- BONK has formed a key technical pattern on the chart, hinting at a bullish reversal ahead.

- Buying activity and bullish sentiment from the derivatives market currently contribute to BONK’s rally potential.

Bonk [BONK] has remained one of the most impressive tokens in the market over the past month. In the past week alone, the asset gained 44.63%, with a monthly move of 21.22%.

This move suggests there’s growing interest in the memecoin and a tendency for it to record further market gains, as market sentiment shifts largely in favor of buyers.

A bullish pattern could add to rally

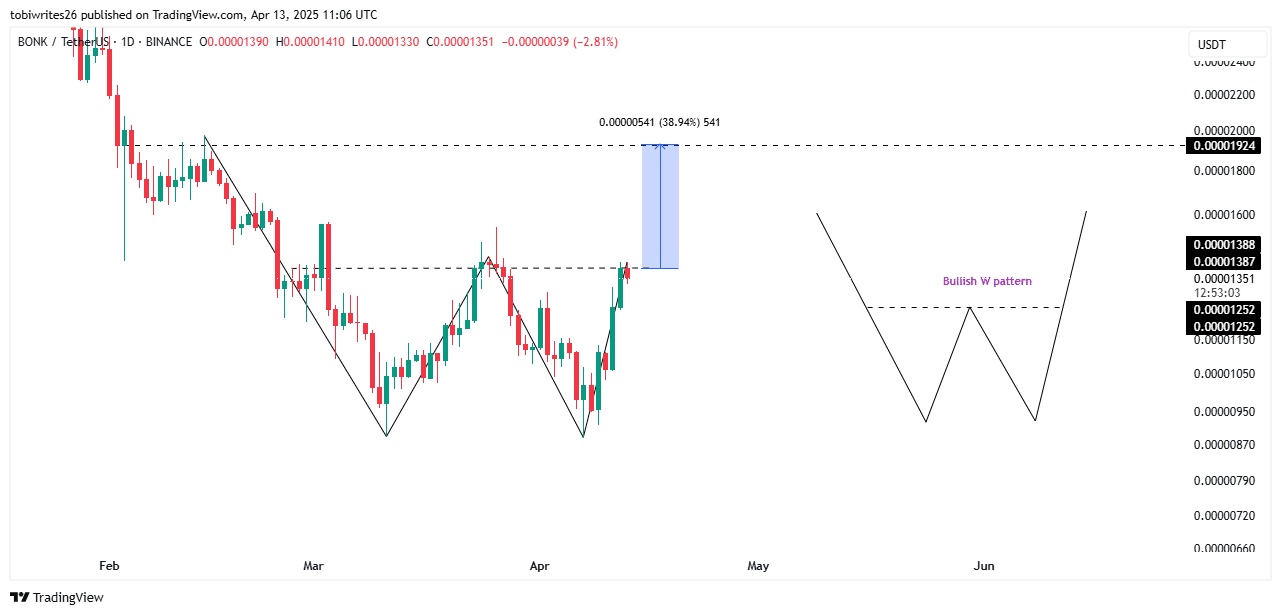

BONK has formed a bullish pattern known as the “W” pattern, known to act as a catalyst for assets to recover and record further market gains following a break of structure.

This break of structure occurs when the asset breaches a resistance line, leading to the start of a rally. In the case of BONK, the extended dotted line marks the level that needs to be breached.

Source: TradingView

Once this breach occurs, BONK could take a major price leap, gaining approximately 38% and rallying to $0.00001924 on the chart.

Above this price target are unmarked fair value gaps, which are known liquidity levels on the chart, suggesting the price could record further gains by trading into those points.

Market indicator and demand adds to bullish sentiment

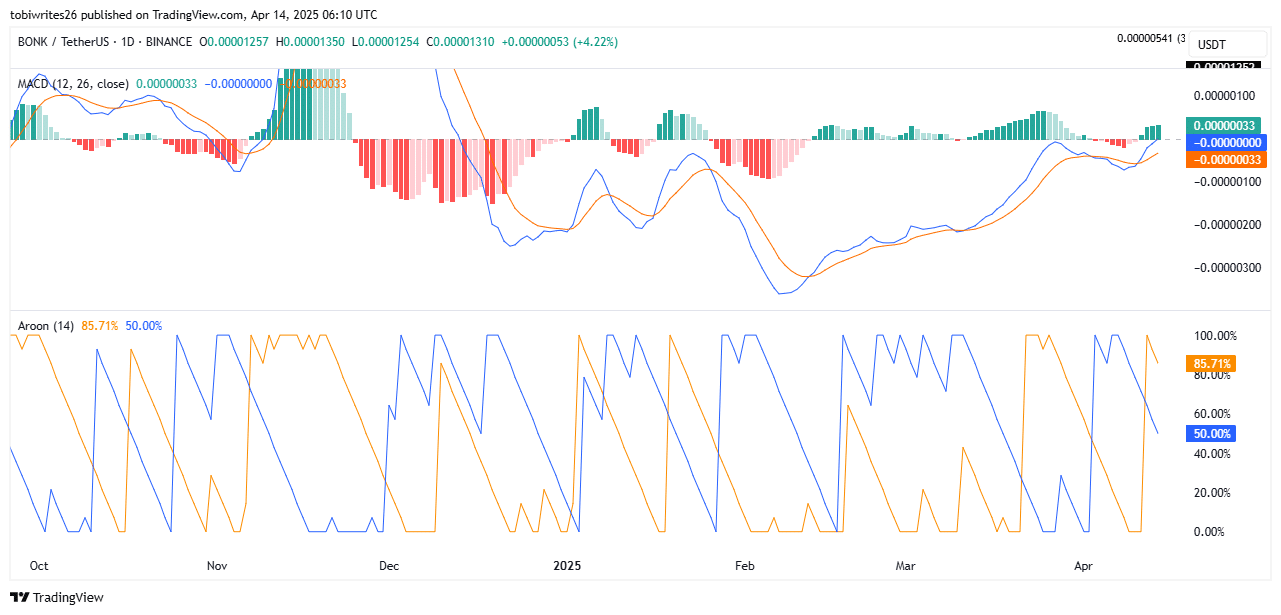

Technical indicators suggest that a breakout of this resistance level is imminent. The Moving Average Convergence and Divergence (MACD) indicates the rally may soon take shape.

At press time, the blue MACD line was positioned at the neutral level of 0.00 and was trending upward. The volume histogram displays exponential growth.

If the MACD line moves into the positive region and the histogram continues to increase, it will confirm rising momentum among traders actively buying BONK.

Source: TradingView

The Aroon indicator analyzes market trends and their strength using two lines—Aroon Up (orange) and Aroon Down (blue).

A bullish sentiment is confirmed when the Aroon Up line remains above the Aroon Down line. Current readings show the orange line at 85.71% and the blue line at 50.00%. These readings align with the prevailing market narrative.

In the spot market, buyers have been actively acquiring BONK. They purchased $2.6 million worth of the asset and transferred it to private wallets for holding.

This shift from exchanges to private wallets indicates growing confidence in the asset’s long-term potential.

If the trend continues into the upcoming week, BONK could see further price appreciation. This scenario increases the possibility of a major upward movement in the trading sessions ahead.

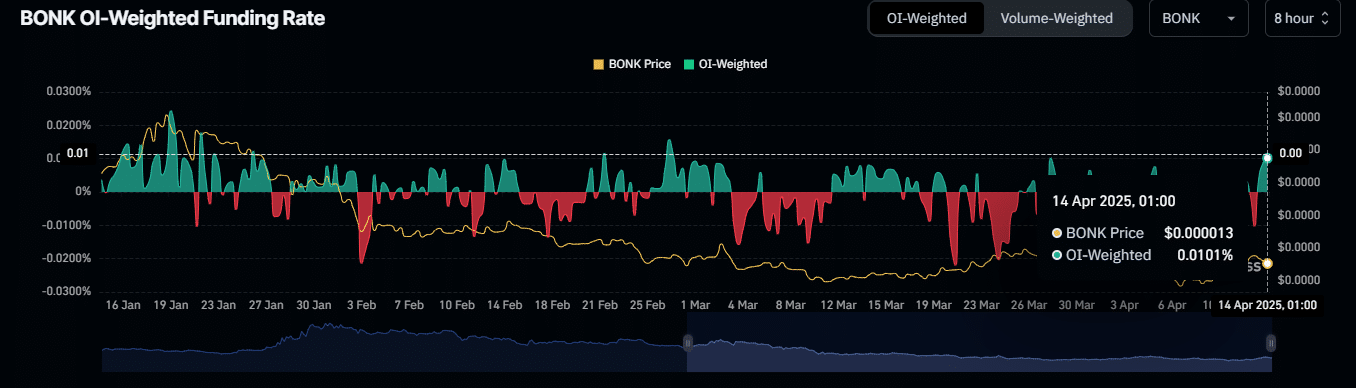

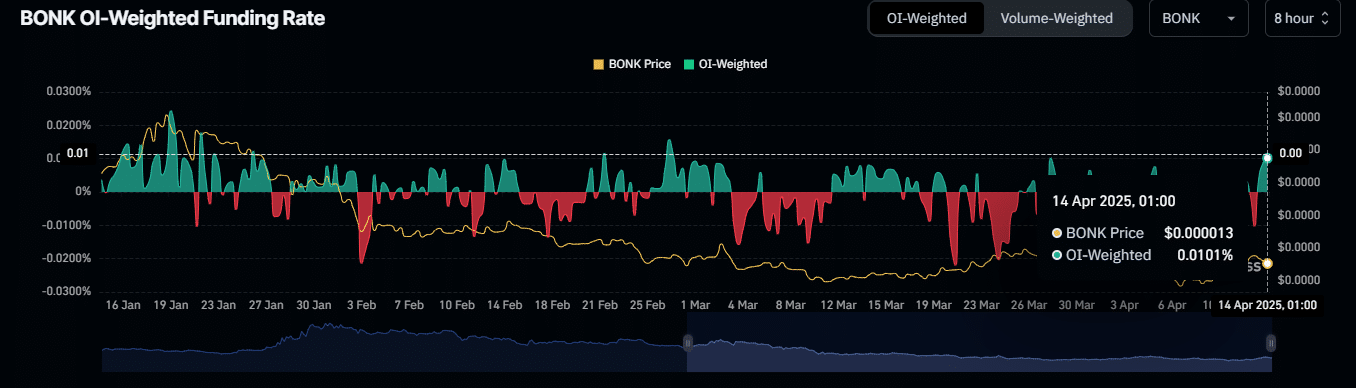

Source: Coinglass

The OI-Weighted Funding Rate combines the Funding Rate and Open Interest to assess potential market direction.

It indicates that the market is favoring long traders. At the time of writing, the OI-Weighted Funding Rate stood at 0.0101%.

This reading confirms high buying activity in the market, which could support a breakout of the resistance level. If the resistance level is breached, it may drive a further rally, potentially leading to new highs for BONK.

Overall, the BONK rally appears likely, with the market expected to rise and the asset surpassing marked targets.