- ApeCoin’s recent recovery chalked out a classic rising broadening wedge on the daily chart.

- The derivates data showed a slight bullish edge, but a patterned breakdown could delay the recovery.

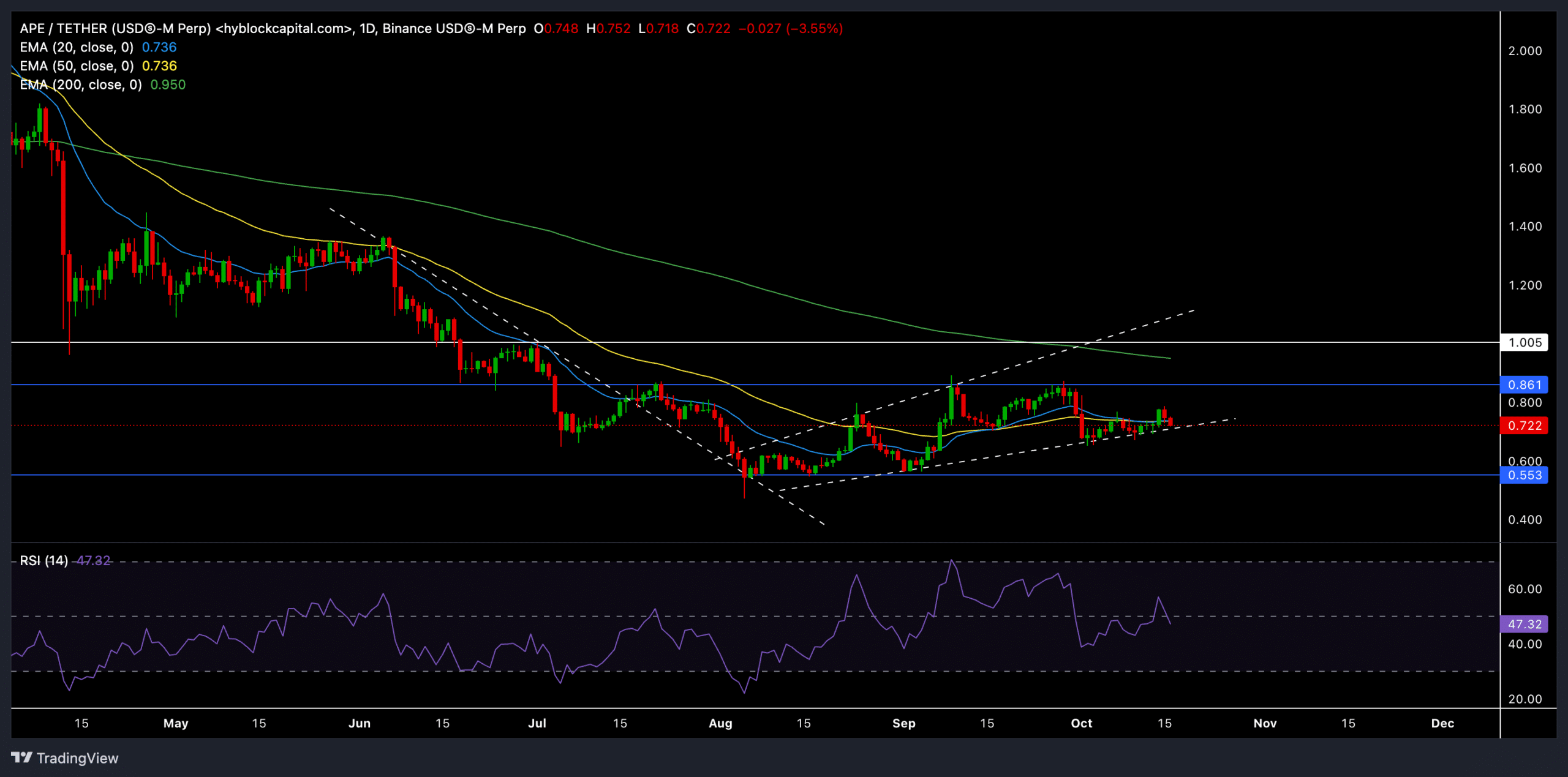

ApeCoin [APE] recently bounced back from the $0.553 support, giving bulls renewed hope. APE was trading at $0.722 at press time, facing immediate resistance at $0.8. However, the question remains: Can buyers sustain the momentum to break key resistance levels?

Buyers regained momentum

Source: TradingView, APE/USDT

ApeCoin’s daily chart recently saw a rising broadening wedge, indicating a gradual increase in buying pressure. This pattern often indicates more volatility, with both upside and downside potential.

The 20-day and 50-day EMAs (both currently around $0.736) continued to act as major resistance points, keeping ApeCoin’s price from breaking into a sustained uptrend.

A close above these levels could fuel a strong rally, potentially targeting the $0.86 resistance before a test of the 200-day EMA at $0.95.

APE’s 20-day EMA and 50-day EMA are moving downward but are close to being tested, suggesting a rather crucial moment for the coin. A breakout above these moving averages could confirm a trend reversal and give the bulls the much-needed strength to challenge the higher resistance zones.

Meanwhile, the RSI hovered at 47, suggesting a relatively neutral position at the time of writing. An immediate move above the 50-mark could indicate a shift in sentiment toward bullish momentum.

On the other hand, a dip toward the 30 level would reaffirm the existing bearish pressure.

Key levels to watch

The $0.553 level remained crucial as primary support. If sellers manage to drive the price below this baseline, APE could face further downside risks.

A breakdown from the rising broadening wedge structure could potentially trigger a drop back to the $0.553 mark or even lower.

On the upside, the $0.8 resistance aligned with the upper line of the wedge pattern, and a strong rebound from this point would likely hint at a patterned uptrend in the coming sessions.

Derivatives data and market sentiment

Source: Coinglass

According to derivatives data, APE’s open interest has dropped by 3.04% to $29.94 million, indicating reduced trader activity. However, the volume increased by 8.49% to $68.65 million, suggesting renewed interest in APE.

The long/short ratio on Binance (2.9017) and OKX (3.56) also indicated a predominantly bullish sentiment among traders.

Read ApeCoin’s [APE] Price Prediction 2024–2025

Interestingly, top traders on Binance have a significant long bias, with a long/short ratio of 3.095 (accounts) and 1.3669 (positions). This suggests that while overall market sentiment might be cautious, leading traders were optimistic about APE’s recovery.

Investors should watch the rising broadening wedge structure, which may dictate the next major move.