- Aptos broke the $14 resistance, signaling bullish momentum with $20 in sight.

- APT showed strong buyer interest as MACD and RSI confirmed growth.

Aptos [APT] has continued its steady climb, recently surpassing the $14 mark. Analyst Michaël van de Poppe suggests a bullish trend may persist, with a potential upside toward $20 as long as key support levels hold.

Aptos recently broke above the $11.30–$11.50 range, a former resistance zone that now serves as a support area. This shift signals continued bullish momentum.

Analysts suggest that a successful retest of this support would further validate the upward trend.

Source: X

Market activity highlights that buyer interest has remained robust, with strong volume accompanying the breakout. This indicates confidence among market participants and aligns with the current upward trajectory.

Key resistance levels

At press time, Aptos was trading at $14.24, following a 0.99% price increase over the past 24 hours and a 12.85% rise over the past week.

Analysts have identified two key resistance levels to watch: the first near $13.80–$14.00, which corresponds to a previous swing high, and the second around $17.00, a historical resistance zone.

A break above these levels could set the stage for a move toward $20. However, traders are monitoring for potential profit-taking, as exchange inflow data shows increased deposits of APT on trading platforms.

Technical indicators reflect strong momentum

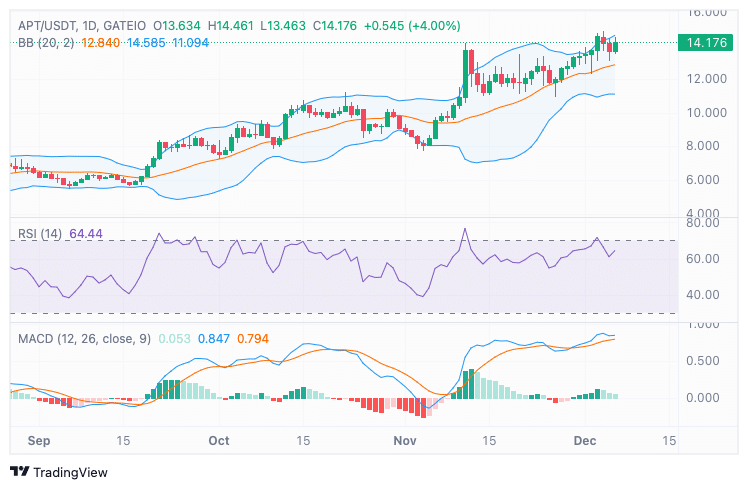

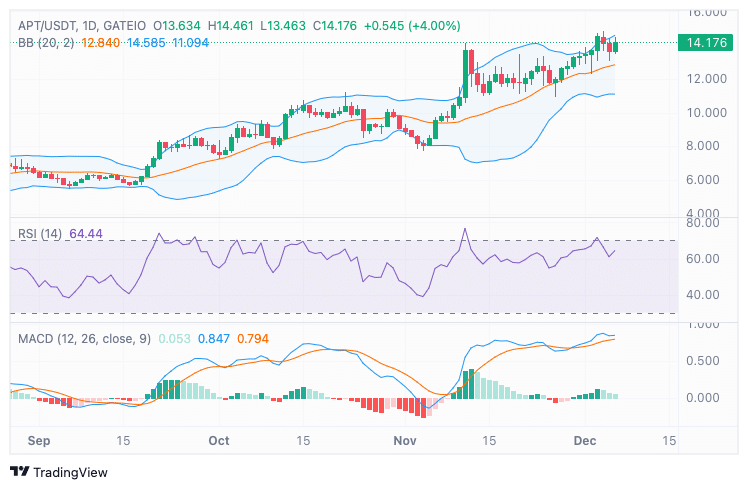

Technical indicators suggest APT’s uptrend may have room to grow. The Relative Strength Index (RSI) stood at 64.44, signaling bullish momentum while remaining below overbought territory. This leaves the asset space to advance further without immediate risk of a reversal.

The Moving Average Convergence Divergence (MACD) indicator also confirmed positive momentum, with the MACD line sitting above the signal line and histogram bars in the green. This reflects growing buying pressure in the market.

Source: TradingView

Additionally, the price was testing the upper Bollinger Band, suggesting strong bullish momentum. The middle band, which sits near $13.00, is viewed as a key support level if a short-term pullback occurs.

Market activity and on-chain data signal increased interest

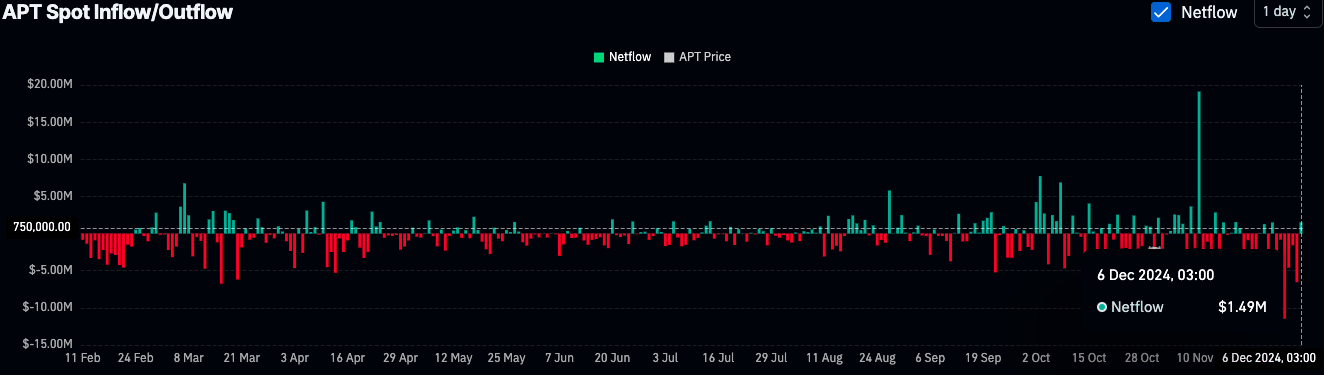

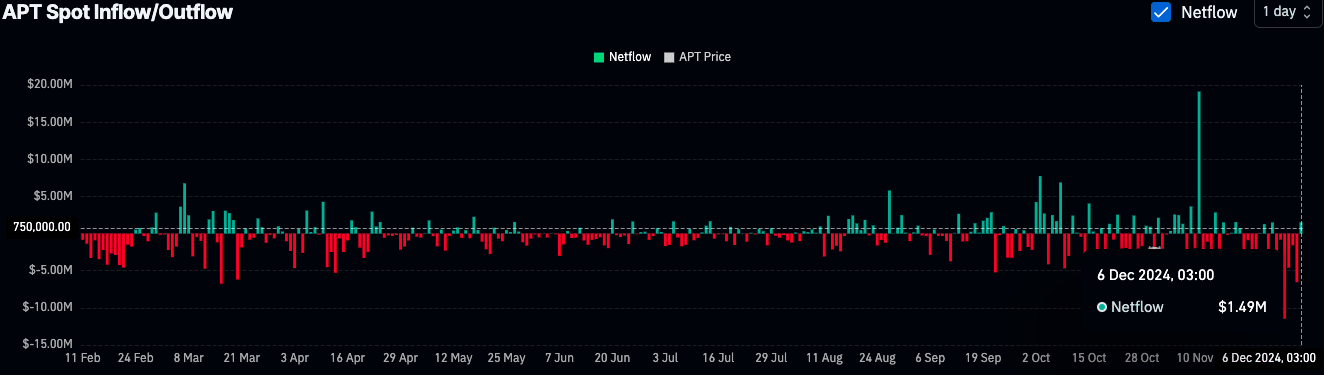

On-chain data from Coinglass shows a mixed picture for APT. While trading volume has decreased by 28.50% to $746.39 million, Open Interest remained stable with a slight increase of 0.08%, reflecting ongoing market engagement.

A net inflow of $1.49 million into exchanges points out possible selling pressure, as traders may move tokens to exchanges for profit-taking.

Source: Coinglass

Read Aptos’ [APT] Price Prediction 2024–2025

Despite these fluctuations, the overall sentiment remains optimistic as the asset shows a clear bullish structure.

Analysts continue to watch for key retests and resistance levels as APT moves closer to its next targets.