- LDO is nearing its $1.33 resistance, but low volatility and overbought RSI may limit gains.

- Open interest is rising, but daily active addresses decline, signaling potential hurdles ahead.

Lido DAO [LDO] has been actively driving growth with its Simple DVT Module now supporting over 2,250 validators and securing 72,000 ETH. Additionally, the platform is currently voting on significant upgrades, such as integrating Bolt and enhancing the Distributed Validator Voting (DVV) system.

At press time, LDO was trading at $1.16, up 4.24% in the last 24 hours. However, the question remains: can these upgrades push LDO past its key resistance level of $1.33?

LDO chart analysis: Will resistance at $1.33 continue to hold?

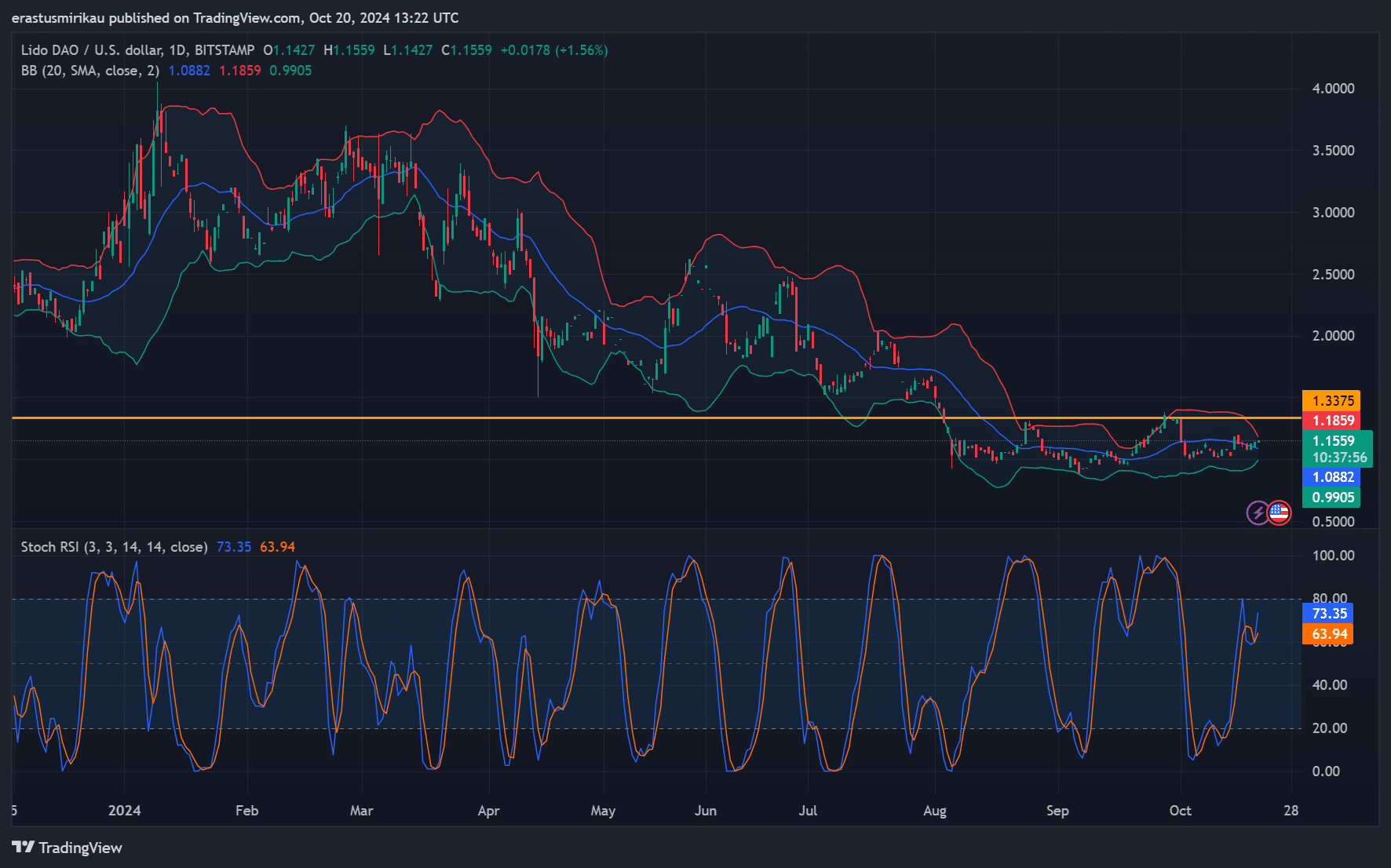

Lido DAO is approaching a critical resistance level at $1.33, and the recent price movements have sparked interest. The Bollinger Bands suggest that volatility remains low, which indicates a consolidation phase.

However, the Stochastic RSI points to overbought conditions, raising the possibility of a near-term pullback. Support is evident around $1.08, but Lido DAO will need significant bullish activity to break through $1.33.

Therefore, traders are watching closely to determine whether this resistance will hold or if the token will gain enough momentum to move higher.

Source: TradingView

Daily active addresses decline: A concern for LDO?

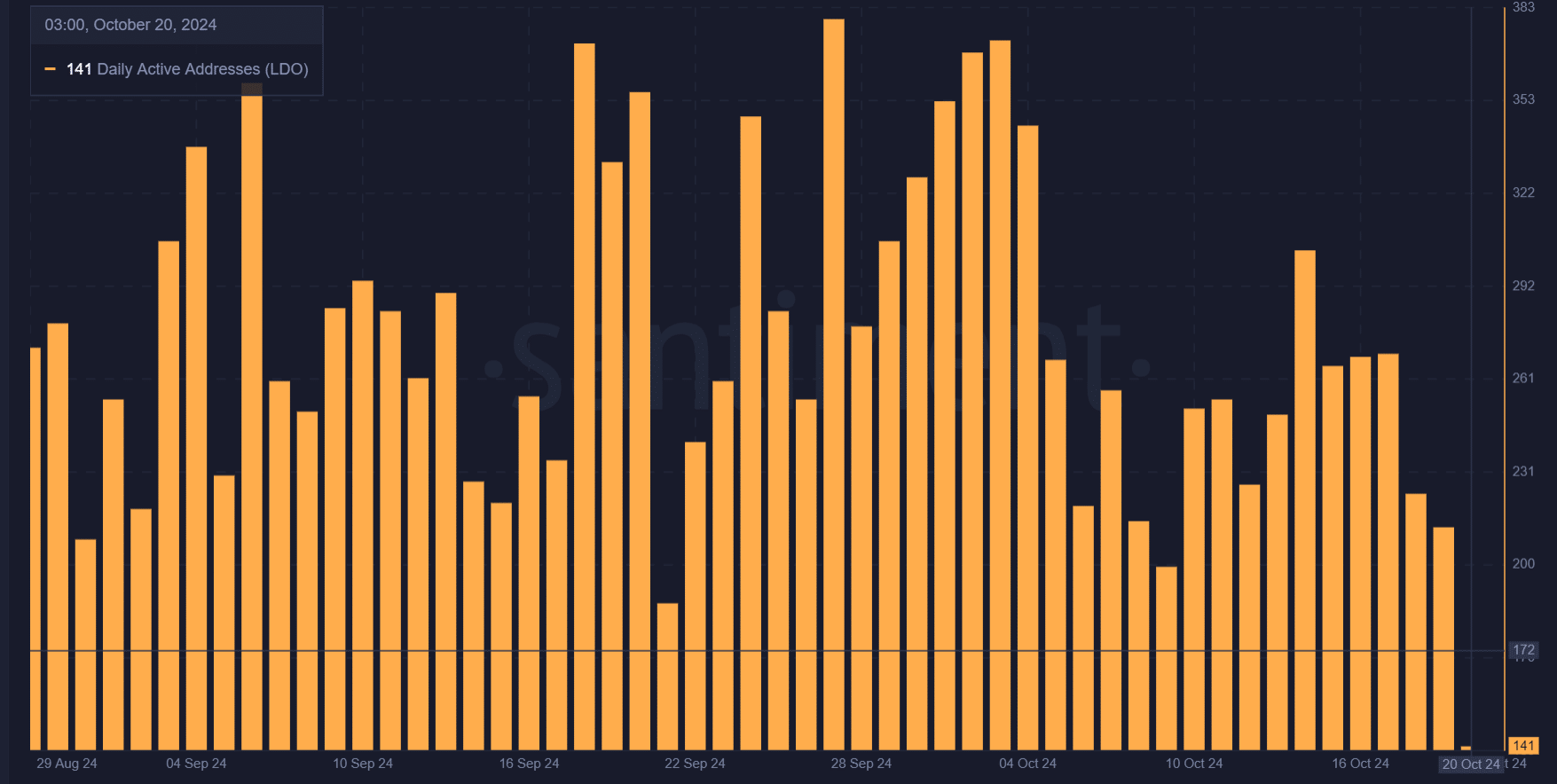

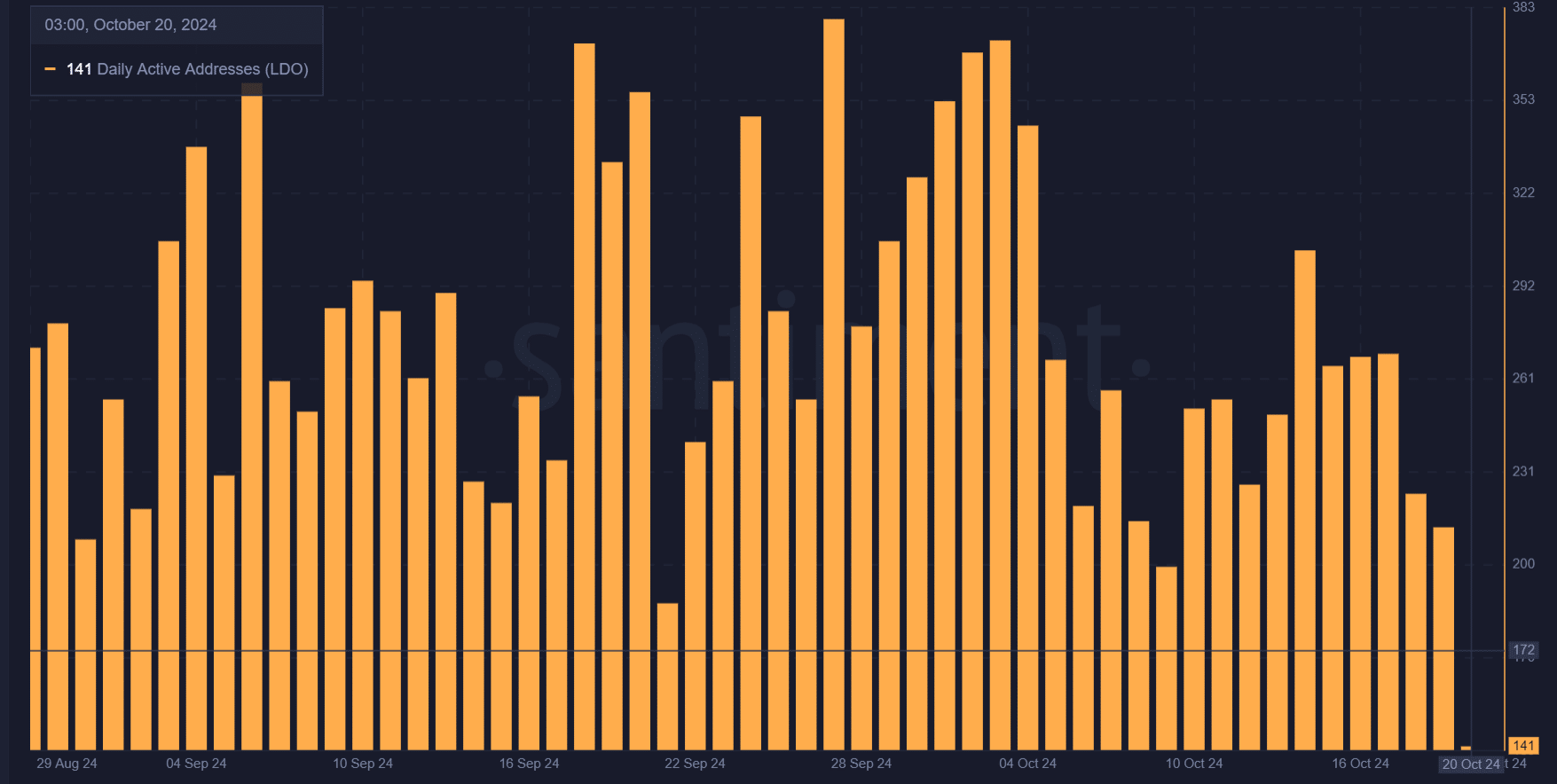

While Lido’s technical advancements are promising, the recent decline in daily active addresses is a cause for concern. The number of active addresses has dropped from 213 to 141, which indicates reduced user engagement.

Consequently, this could limit Lido DAO’s ability to break through the $1.33 resistance as on-chain activity slows. This decline could signal that Lido’s upgrades have not yet fully captured the attention of the broader market.

Source: Santiment

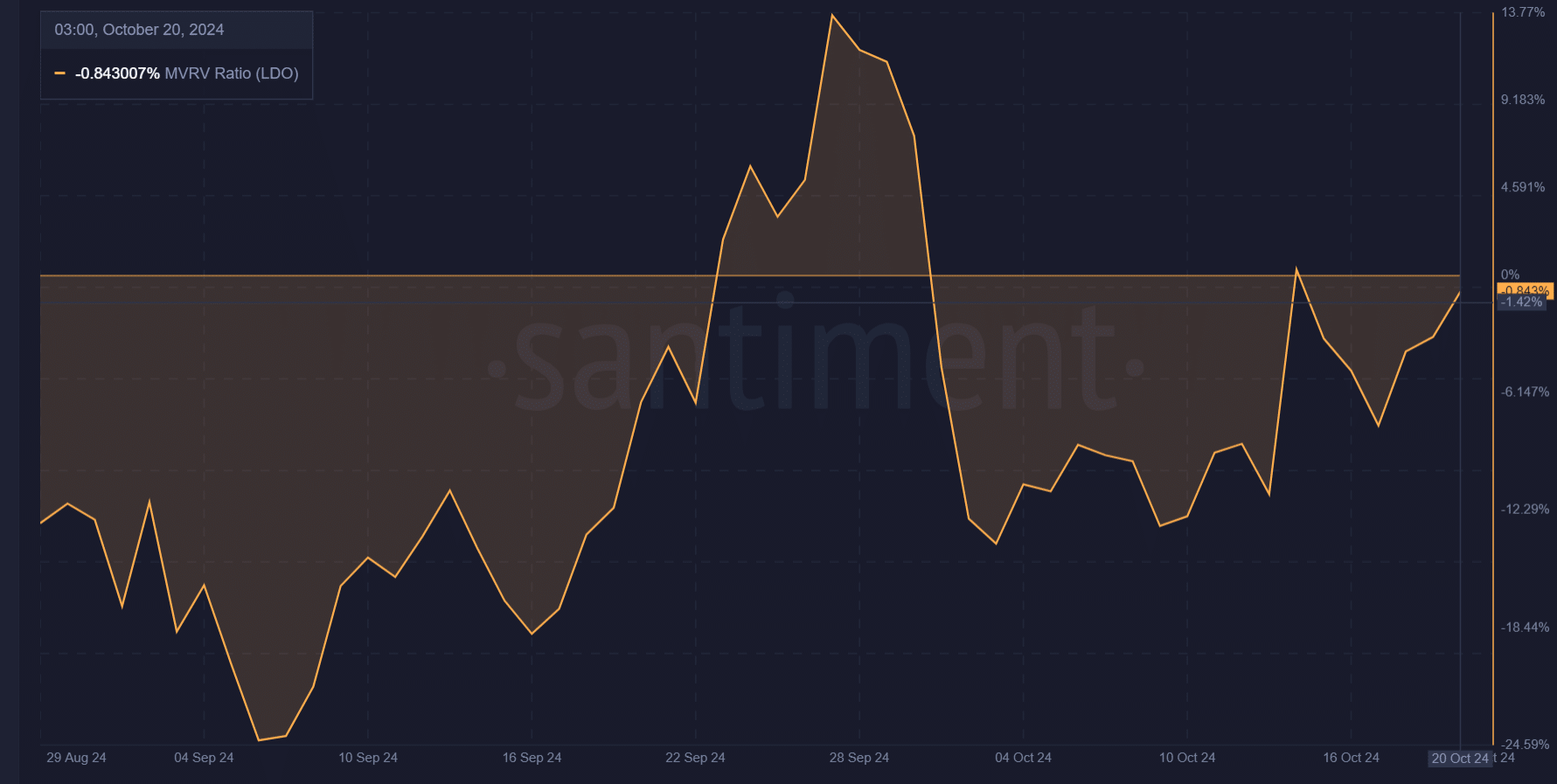

MVRV ratio: What does it mean for LDO‘s price action?

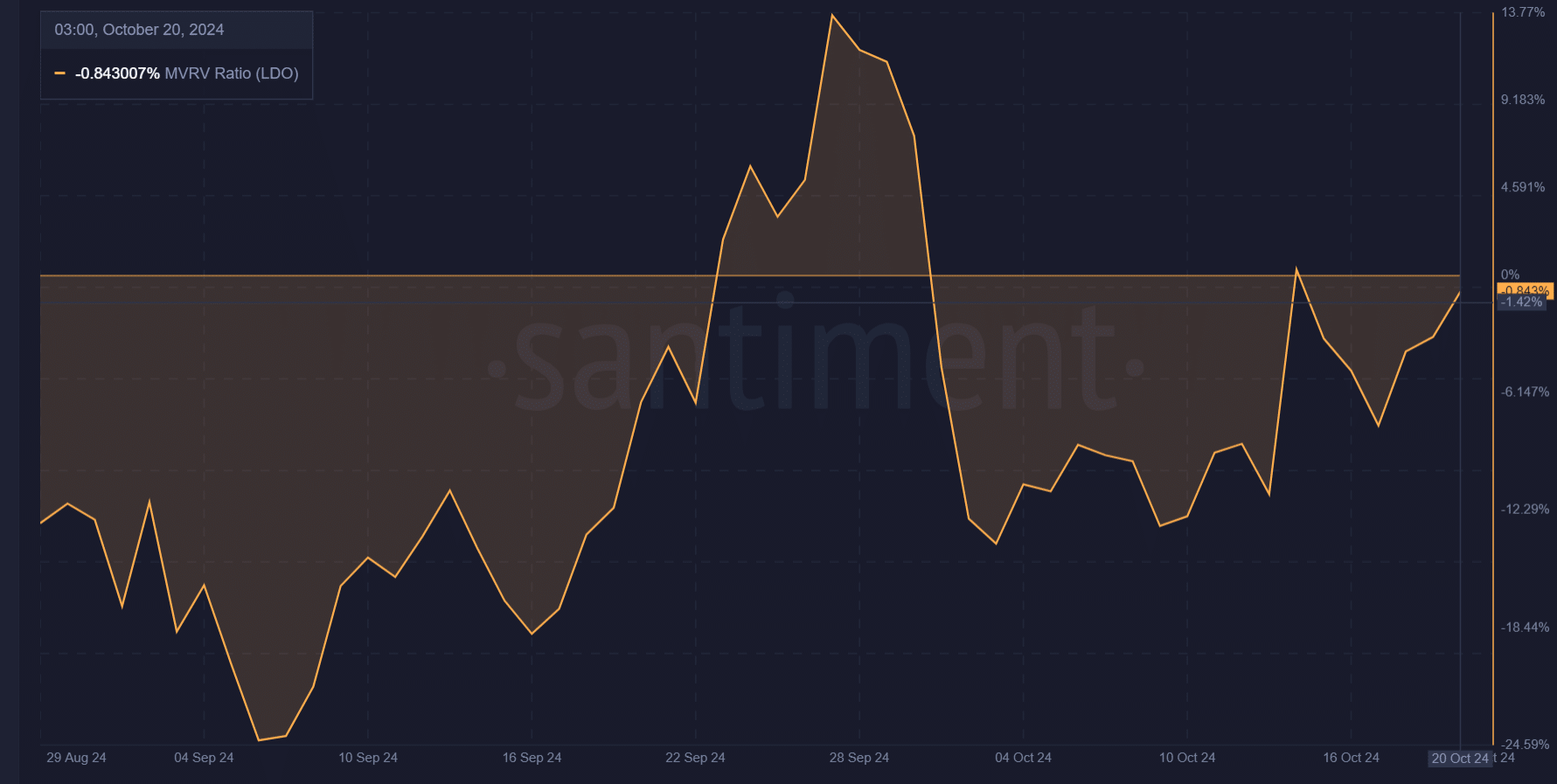

The MVRV ratio, which currently stands at -0.84%, reveals that most investors are holding LDO at a loss. Therefore, there may be less incentive for holders to sell, potentially supporting the price in the short term.

However, if the MVRV ratio turns positive, profit-taking could increase, putting downward pressure on the token. This dynamic makes the MVRV ratio a critical factor in determining whether LDO can sustain its upward momentum and challenge the $1.33 resistance.

Source: Santiment

Open interest rises: Growing trader confidence

Open interest for Lido DAO has risen by 1.98% to $64.9 million. This increase signals growing confidence among traders, as more positions are being opened.

However, for this to translate into a bullish breakout, volume will need to follow. Consequently, this rise in open interest will be closely monitored to see if it drives LDO toward a breakout or another rejection at $1.33.

Source: Coinglass

Read Lido DAO’s [LDO] Price Prediction 2023-24

Lido DAO’s developments are promising, but the declining daily active addresses and overbought Stochastic RSI present challenges.

Although the increasing open interest and MVRV ratio offer some optimism, breaking through the $1.33 resistance will require sustained engagement and volume.