- Solana behaved like a more of a volatile version of Ethereum until press time.

- Pump.Fun and institutions impacted price of SOL.

Solana [SOL] is poised to shine in the upcoming bull market, potentially outpacing other altcoins if Bitcoin [BTC] rises.

Solana has gained a reputation as one of the most user-friendly cryptocurrencies, making it a strong contender for growth. However, despite its potential, SOL has faced resistance from its bull market support band.

Technical analyst, Benjamin Cowen, noted on X (formerly Twitter) that Solana’s behavior mirrored that of Ethereum [ETH], suggesting that SOL could drop back into its previous ascending wedge pattern if the current trend continues.

This signals that a critical moment for Solana is approaching. October is expected to be a favorable month for both SOL and the broader crypto market, as it has historically been a strong period since the inception of crypto.

Source: Benjamin Cowen/TradingView

Despite some sideways movement, there is still a bias towards taking long positions in SOL, with the possibility of gains, although this remains a risky trade.

If SOL remains below the retest zone of its ascending triangle for an extended period, the price could decline before any significant surge.

Volatility index of Solana

In addition to these technical insights, the launch of the Solana Volmex Implied Volatility Index (SVIV) adds another layer of analysis. The SVIV, which measures the 14-day expected volatility of SOL, was 87 at press time.

This high volatility index suggested that the market anticipated significant price swings, either upwards or downwards.

While such volatility can attract traders looking to capitalize on these movements, it also increases the risk of unexpected and sharp losses.

Source: Volmex/X

As Bitcoin’s price moves higher, Solana could benefit from these market conditions, but caution is advised.

On-chain data analysis

On-chain data, per Artemis, further complicated the outlook for Solana. Although SOL continues to dominate in daily active addresses, indicating high activity on the network, institutional activity does not appear bullish.

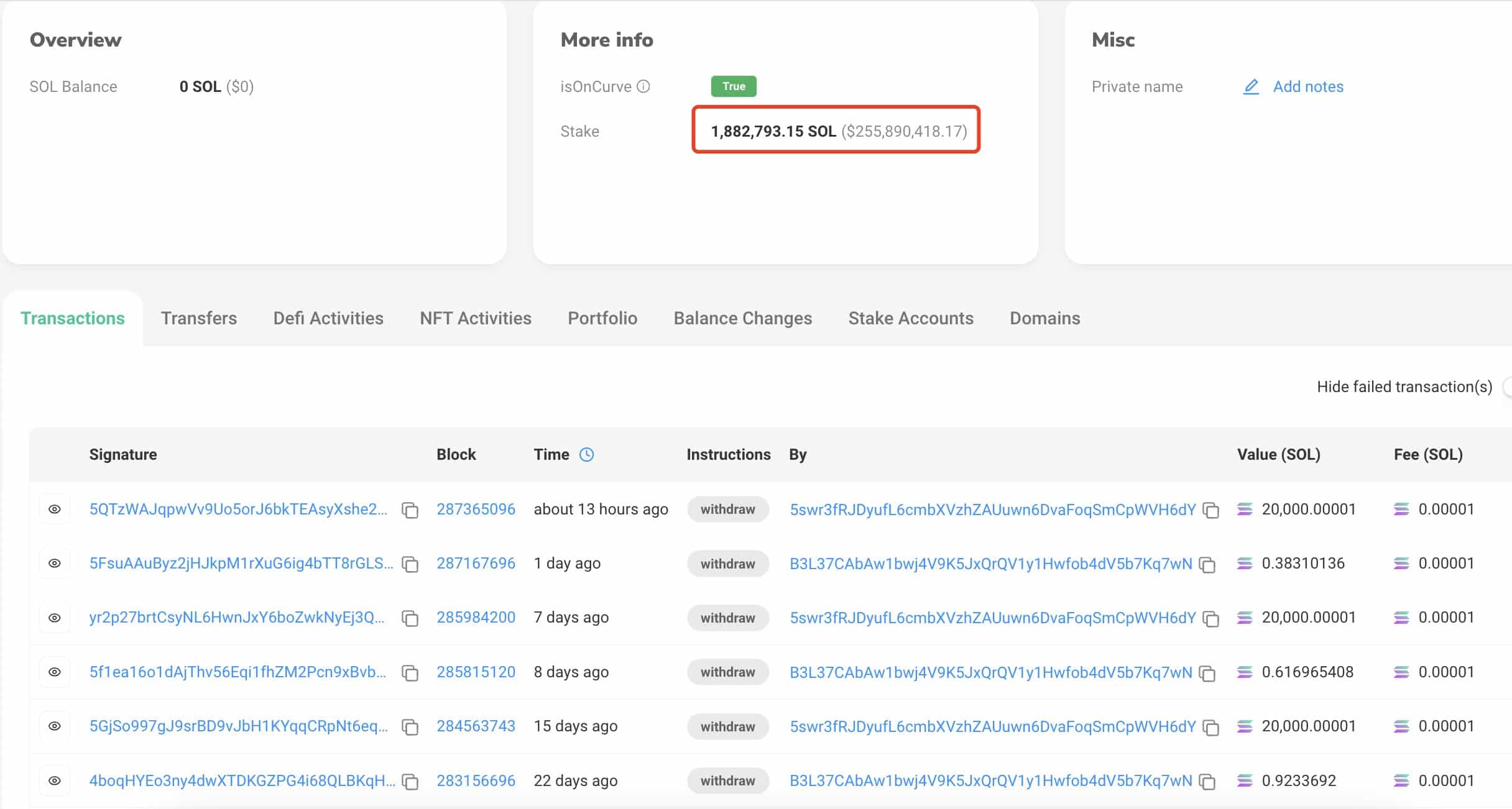

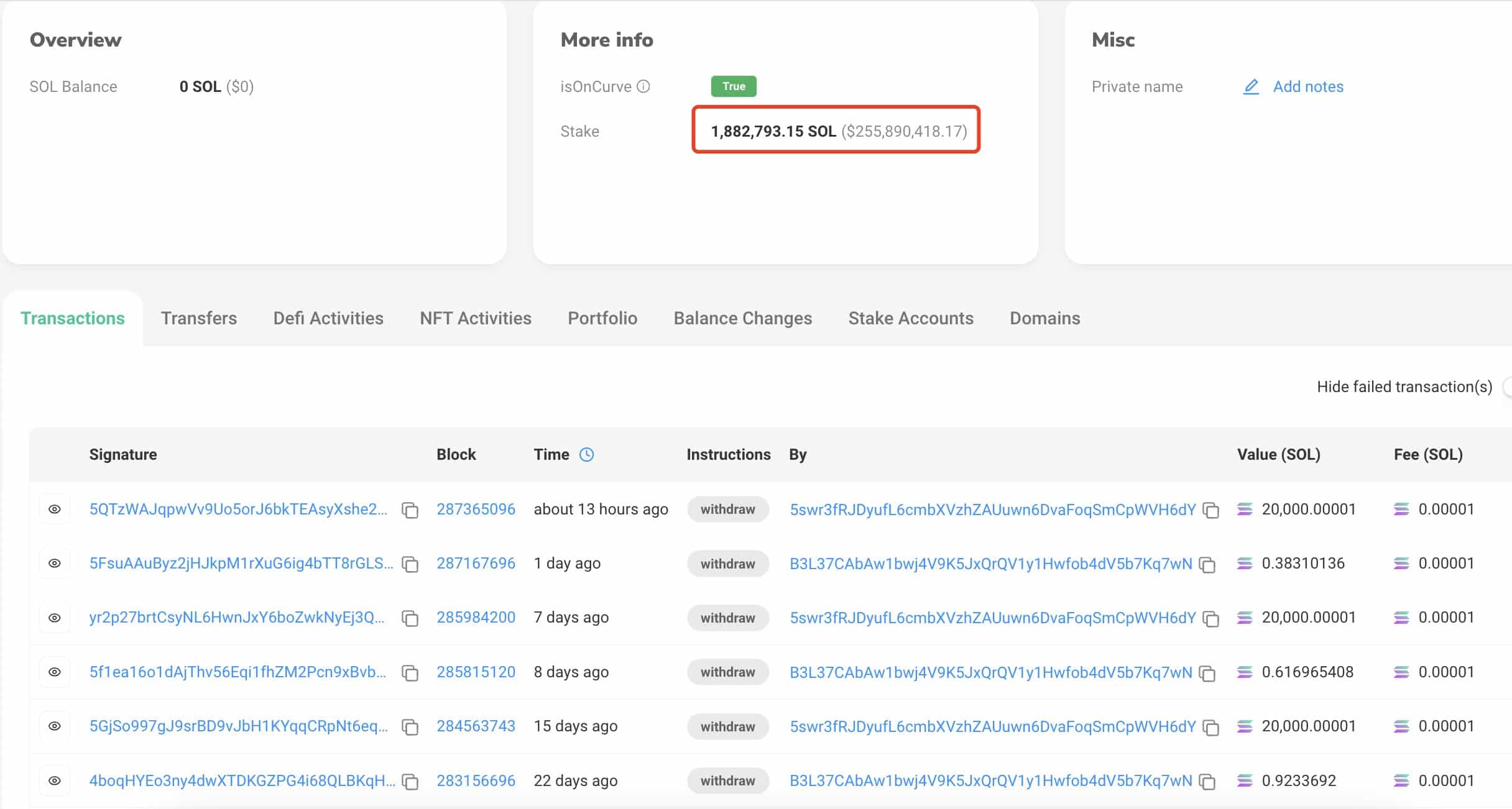

According to Lookonchain, one institution sold 695,000 SOL, worth approximately $99.5 million, this year. This institution has been offloading an average of 19,306 SOL weekly, totaling nearly $100 million in sales.

Despite these sales, the institution still holds 1.88 million SOL, worth around $255.89 million, which is staked. This selling pressure has likely contributed to the recent struggles of Solana’s price.

Source: Lookonchain

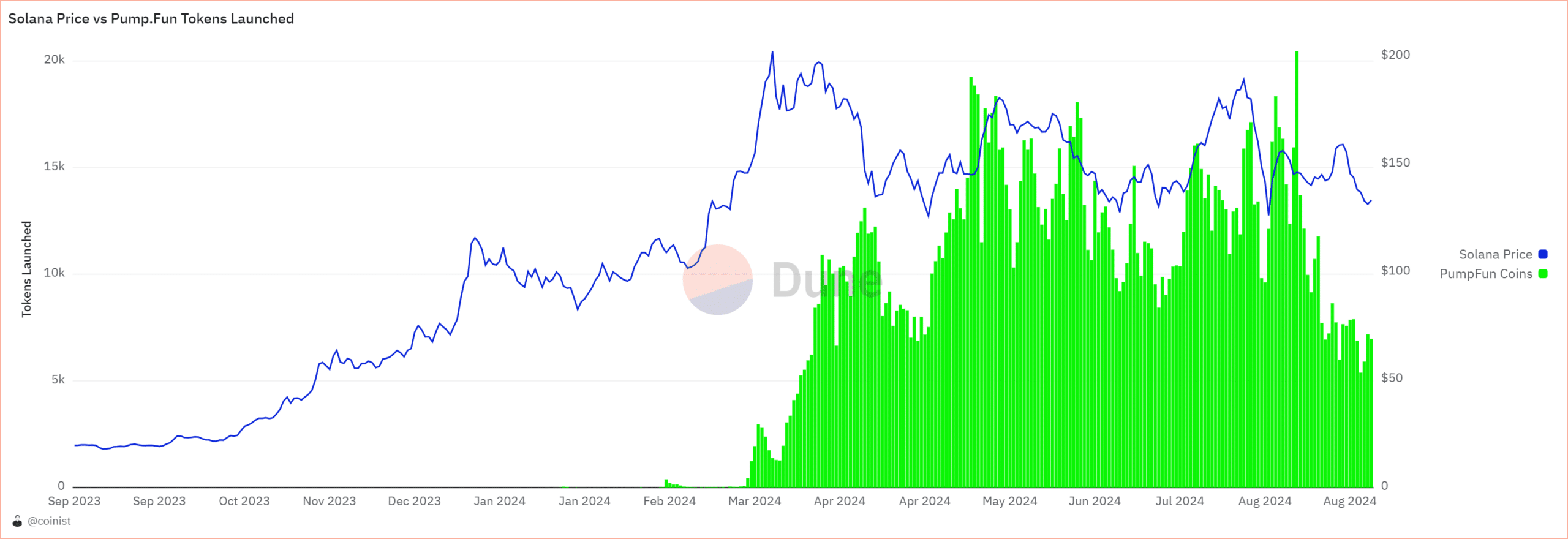

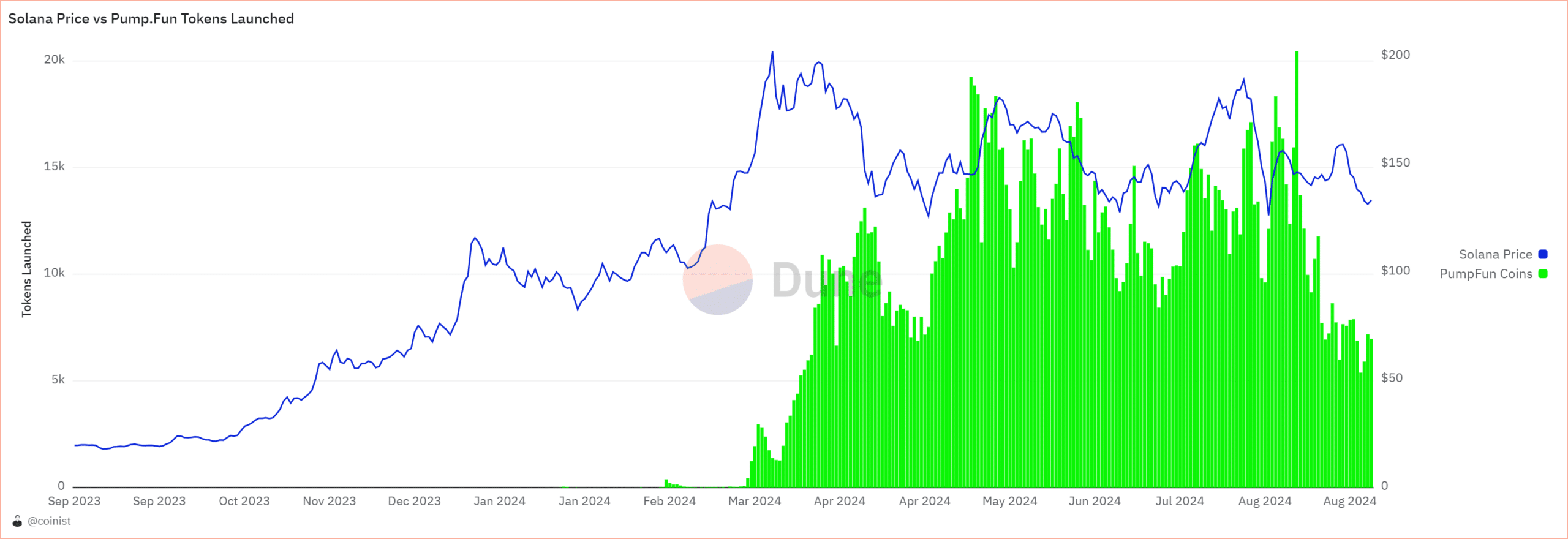

Solana price vs. Pump.Fun tokens launch

Moreover, the launch of Pump.Fun tokens have had a notable impact on SOL’s price. When analyzing the price chart, it becomes evident that SOL’s upward momentum halted around the time these memecoins were launched.

Pump.Fun has sold a significant portion of its revenue, including 264,373 SOL at an average price of $157.5, leading to a substantial decline in Solana’s price.

This has caused concern among investors, as the selling pressure from these tokens has weighed heavily on Solana.

Source: Dune

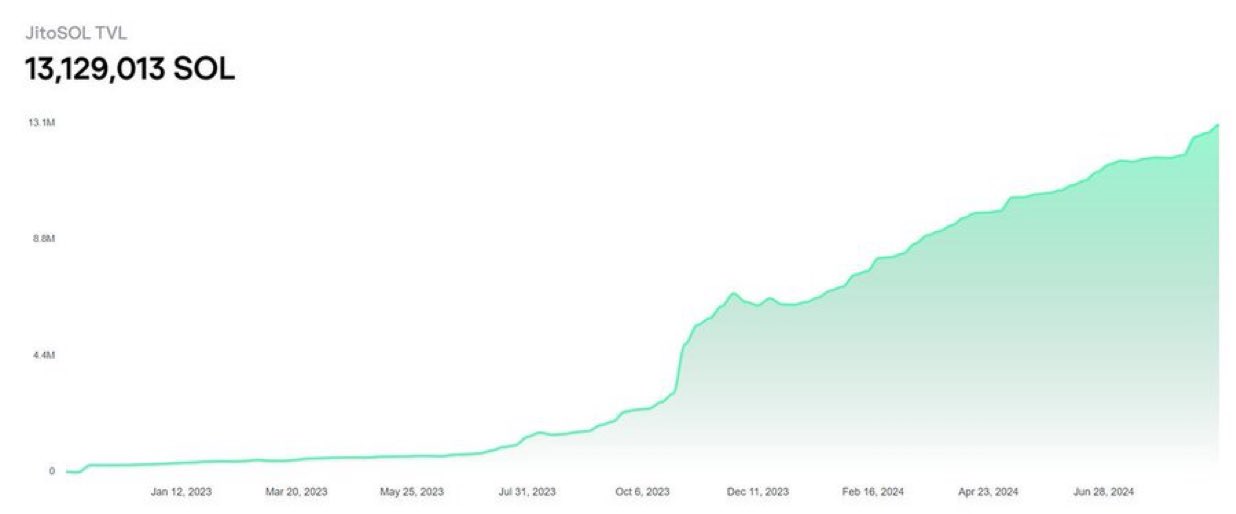

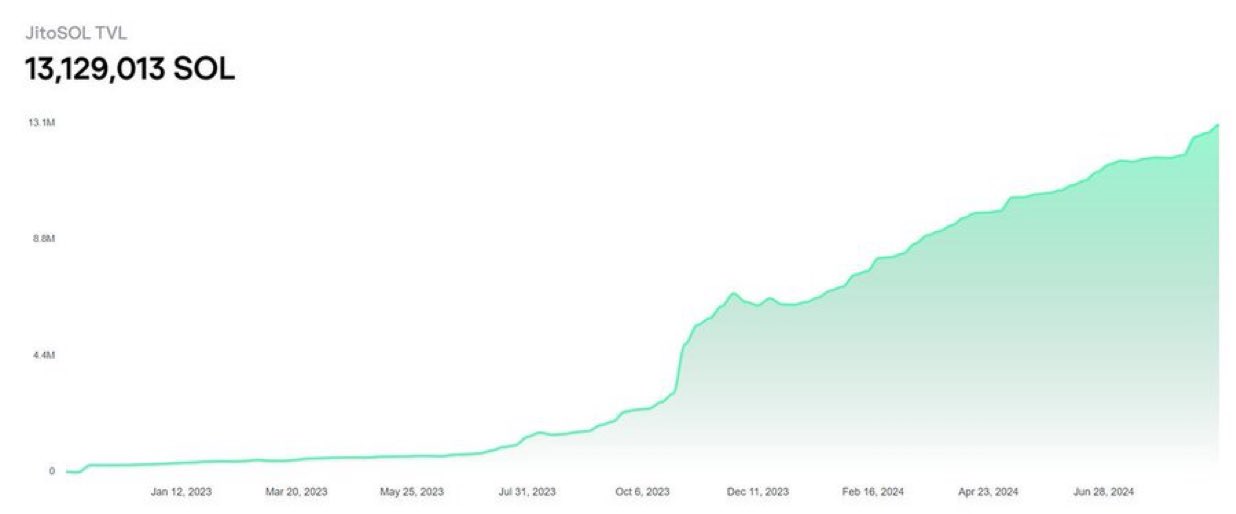

Solana-staking products

However, there is hope for Solana as Binance [BNB] recently announced the launch of its Solana Staking product, BNSOL, set for late September 2024. Also, JitoSOL TVL surpassed 13M SOL for the first time.

Read Solana’s [SOL] Price Prediction 2024–2025

This product will allow users to stake SOL tokens, earn dynamic rewards, and maintain control over their assets, which could positively impact Solana’s future prices.

Source: SolanaFloor/X

Solana might see a resurgence, driven by these new staking opportunities and the potential for a broader market recovery.