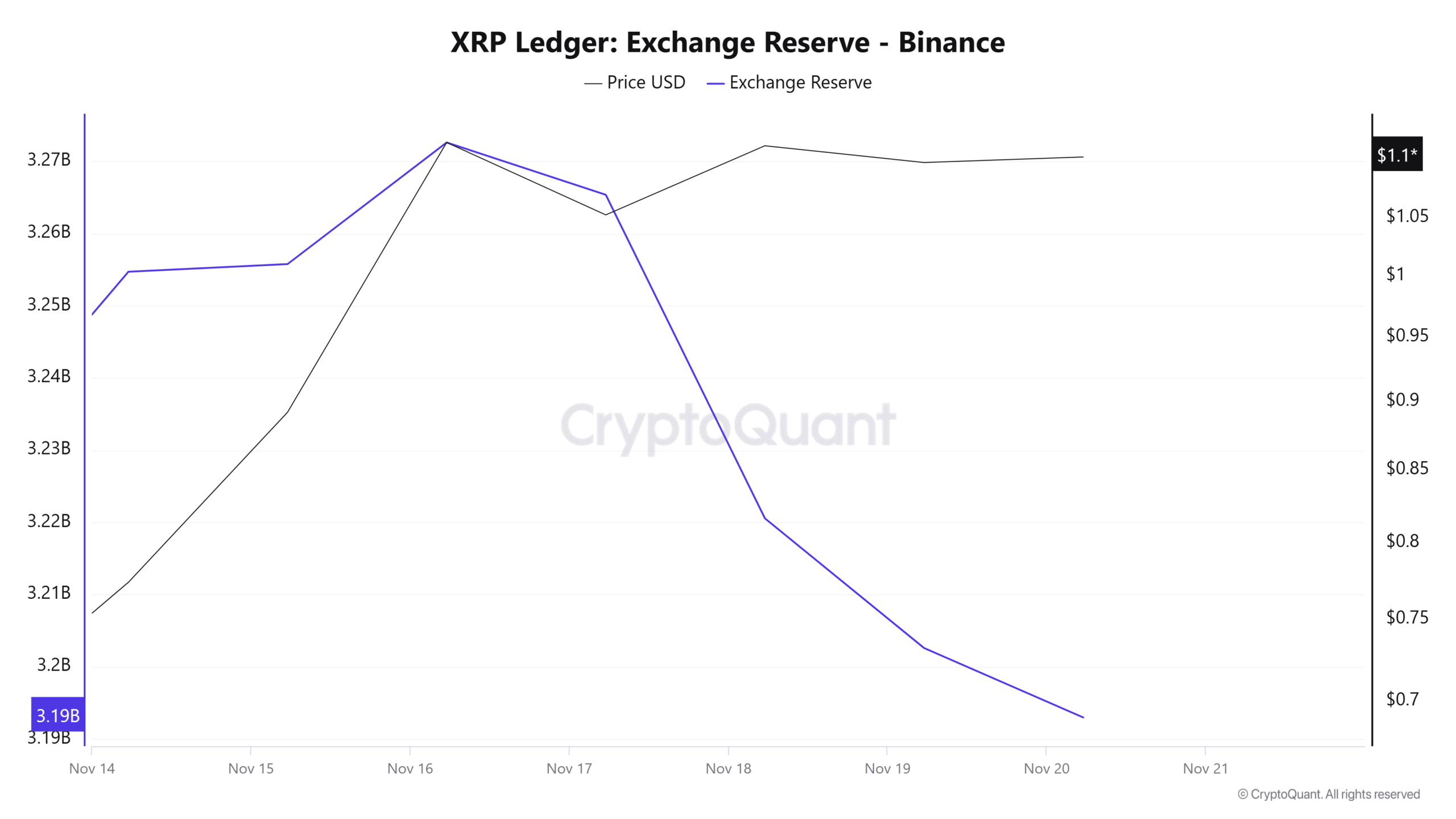

- XRP reserves on exchanges are continuously falling, indicating that whales and institutions were significantly withdrawing tokens.

- XRP could surge by 63% to reach the $1.90 level if it closes a candle above the $1.15 level.

Ripple [XRP] has been gaining significant attention from whales and institutions following the formation of a bullish price action pattern.

Additionally, Bitcoin [BTC] has been driving the overall cryptocurrency market to higher levels. This shifted market sentiment from consolidation to an uptrend as it approached the $100K mark.

XRP whale bags tokens worth $124M

Amid this bullishness, on the 20th of November, a crypto whale transferred nearly 111 million XRP tokens worth $123.59 million from Binance to an unknown wallet.

This significant withdrawal is potentially caused by bullish market sentiment and XRP’s strong price action.

Additionally, XRP reserves on exchanges were continuously falling, indicating that retailers, whales, and institutions were significantly withdrawing tokens.

This is a bullish sign as it reduces the likelihood of a price decline for the asset.

Source: CryptoQuant

XRP’s technical analysis and key levels

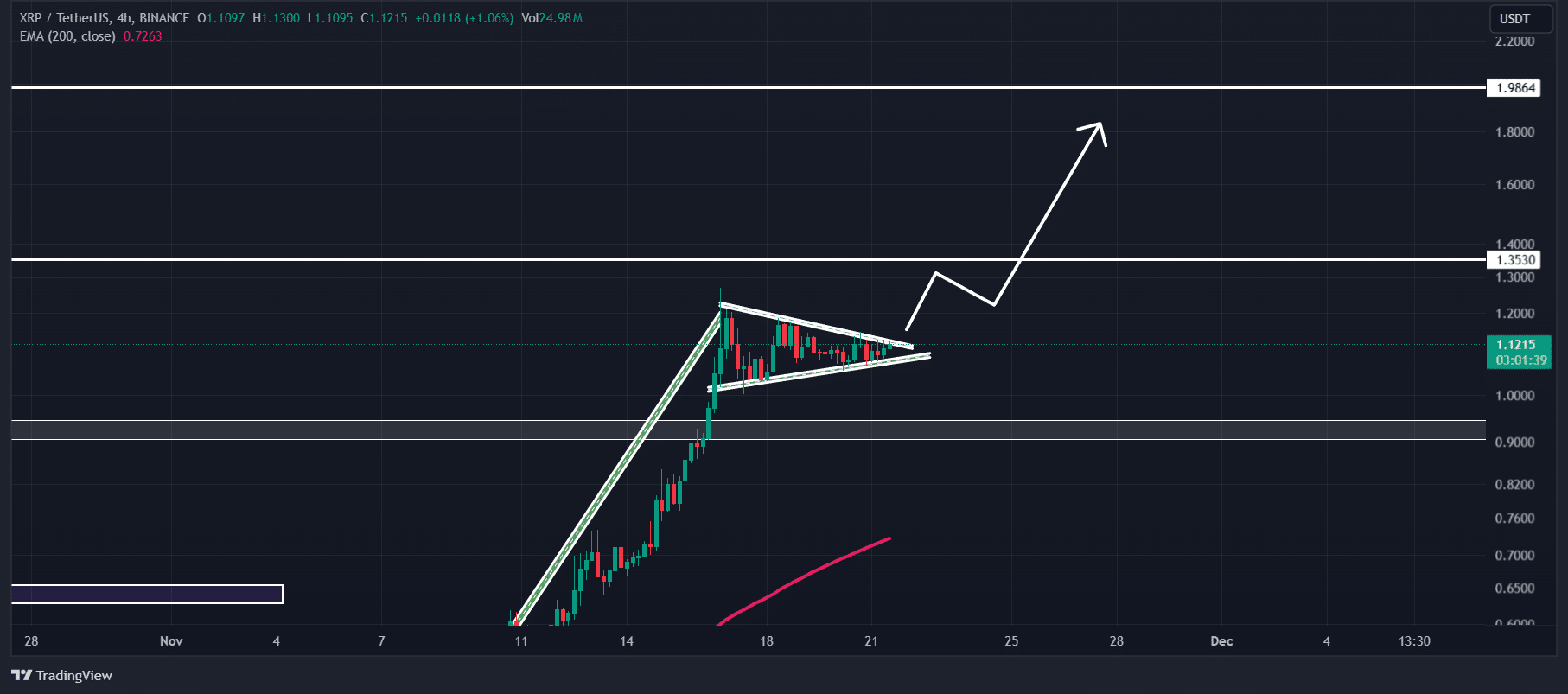

AMBCrypto’s technical analysis showed XRP forming a bullish pennant price action pattern in the four-hour time frame. It was on the verge of a breakout.

If XRP breaks out of this pattern and closes a candle above $1.15, it could surge by 63% to reach $1.90 in the coming days.

Source: TradingView

XRP’s Relative Strength Index (RSI) and the 200 Exponential Moving Average (EMA) indicated bullish momentum. This highlighted a potential upward rally in the coming days.

Rising Open Interest

However, on-chain metrics further supported the altcoin’s bullish outlook.

According to the on-chain analytics firm Coinglass, traders are actively participating in trading activity, leading to a significant rise in Open Interest (OI).

Over the past 24 hours, XRP’s OI has increased by 4.5%, with a 2.78% rise in the past four hours. This growing interest in the altcoin signals a bullish trend.

Key liquidation levels and market sentiment

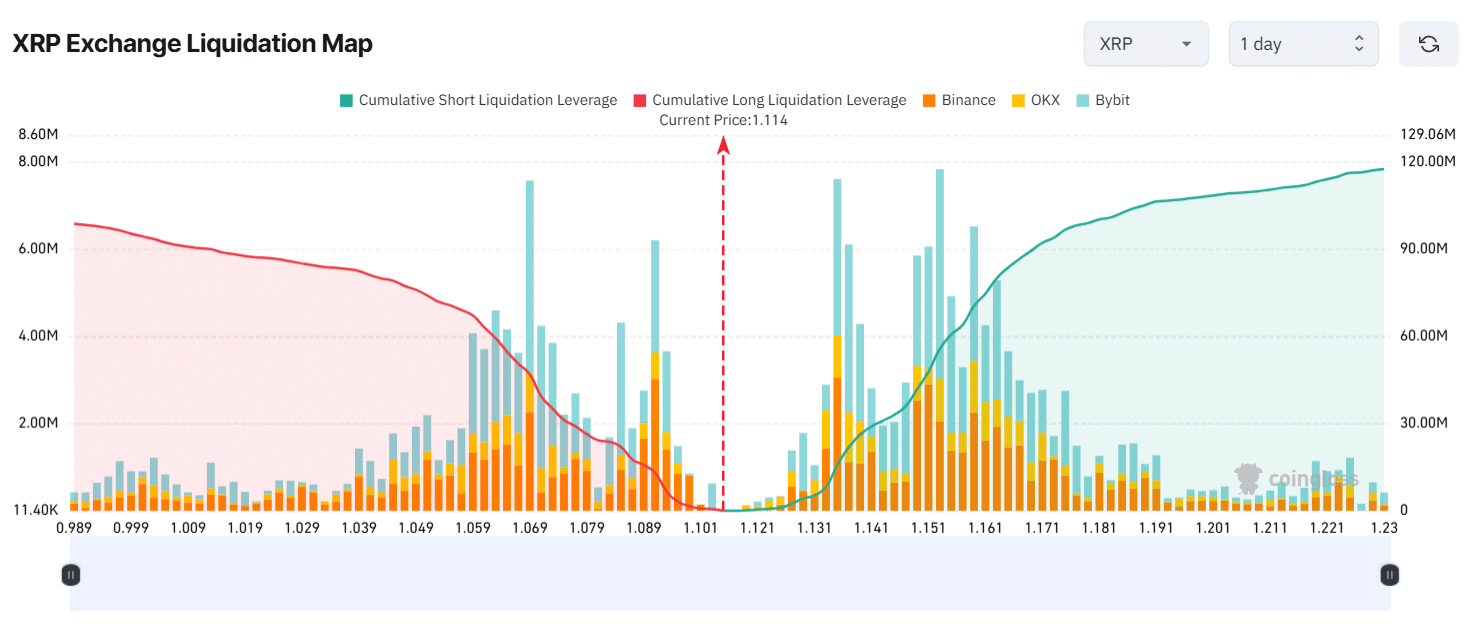

Examining where traders are currently placing bets on XRP, the data reveals that the key liquidation levels are at $1.069 on the lower side and $1.135 on the upper side.

According to Coinglass, traders are over-leveraged at these levels.

Source: Coinglass

If the market sentiment remains bullish and the price rises to $1.135, nearly $15.76 million worth of short positions will be liquidated.

Conversely, if the sentiment shifts and the price drops to $1.069, nearly $49 million worth of long positions will be liquidated.

This liquidation data indicates that bulls holding long positions have strongly dominated the asset compared to short sellers over the past 24 hours.

Realistic or not, here’s XRP market cap in BTC’s terms

At press time, XRP was trading near $1.13 and has registered a price surge of over 3.2% in the past 24 hours.

During the same period, its trading volume has increased by 25%, indicating heightened participation from traders and investors amid a bullish outlook.