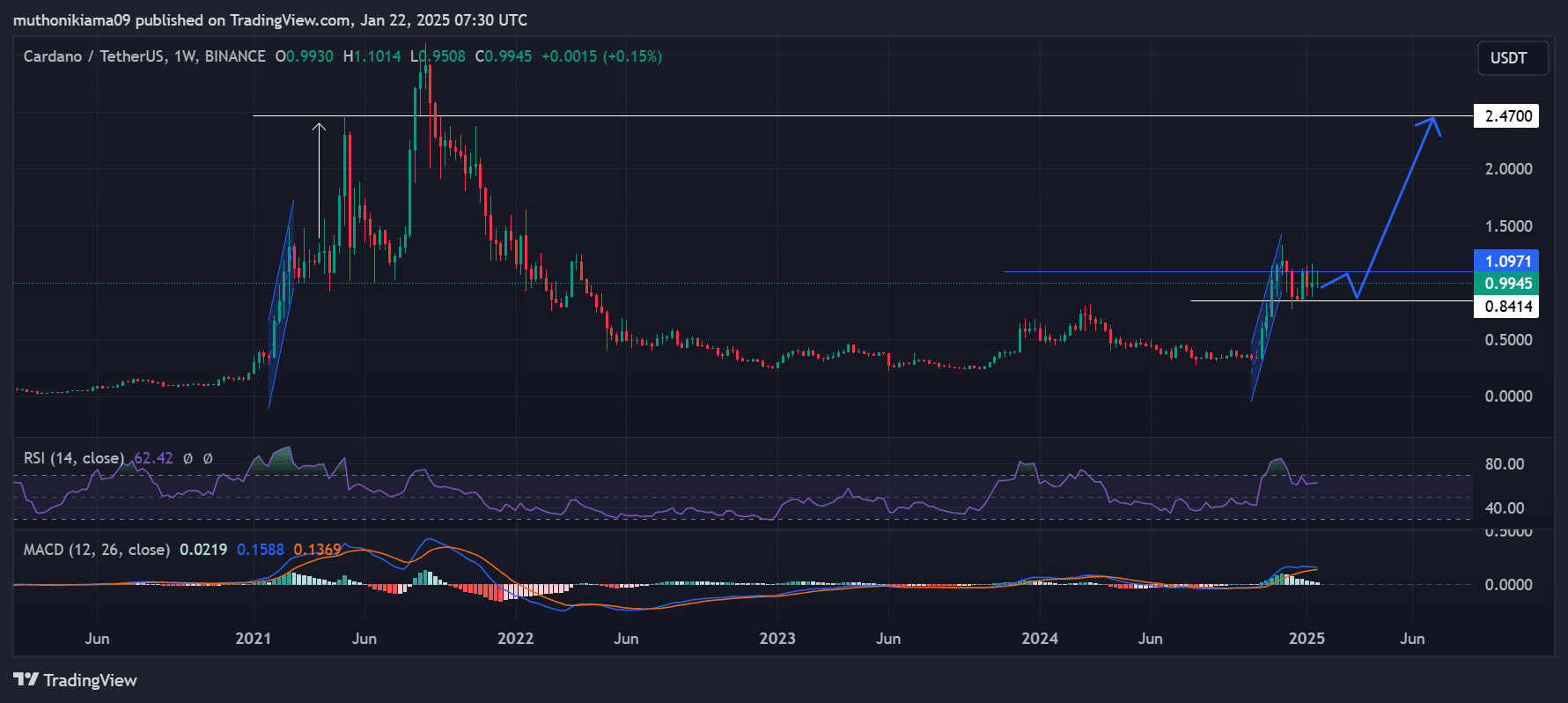

- Cardano could rally to $2.47 if it repeats past patterns and breaks resistance at $1.09.

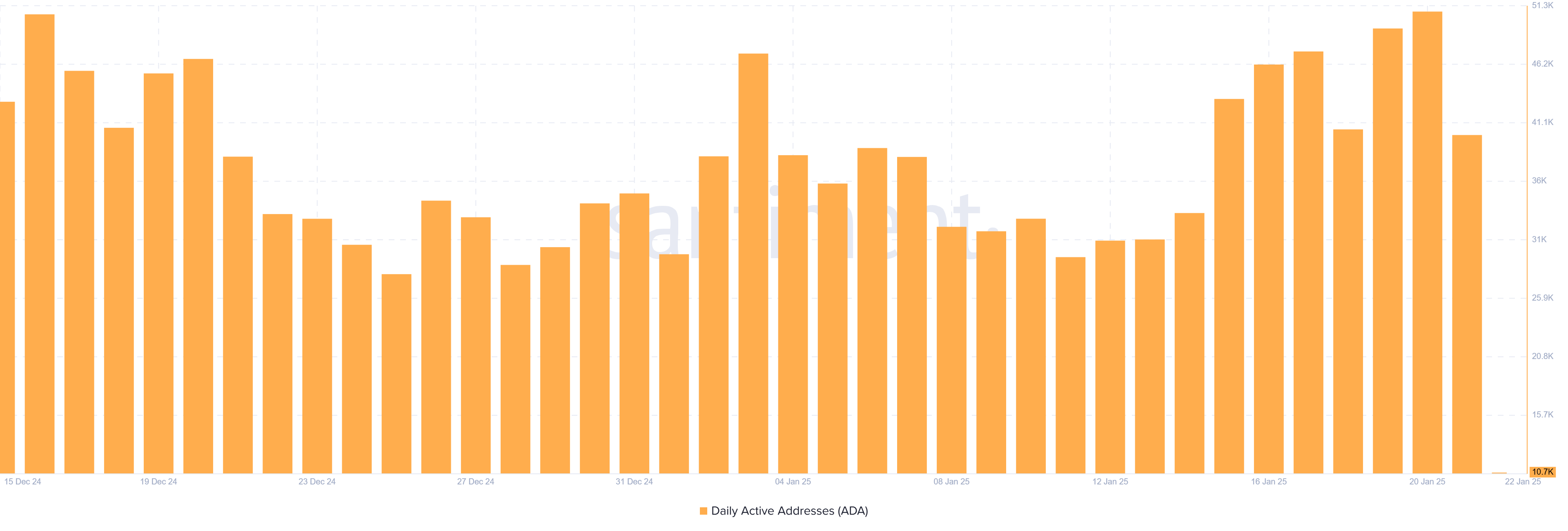

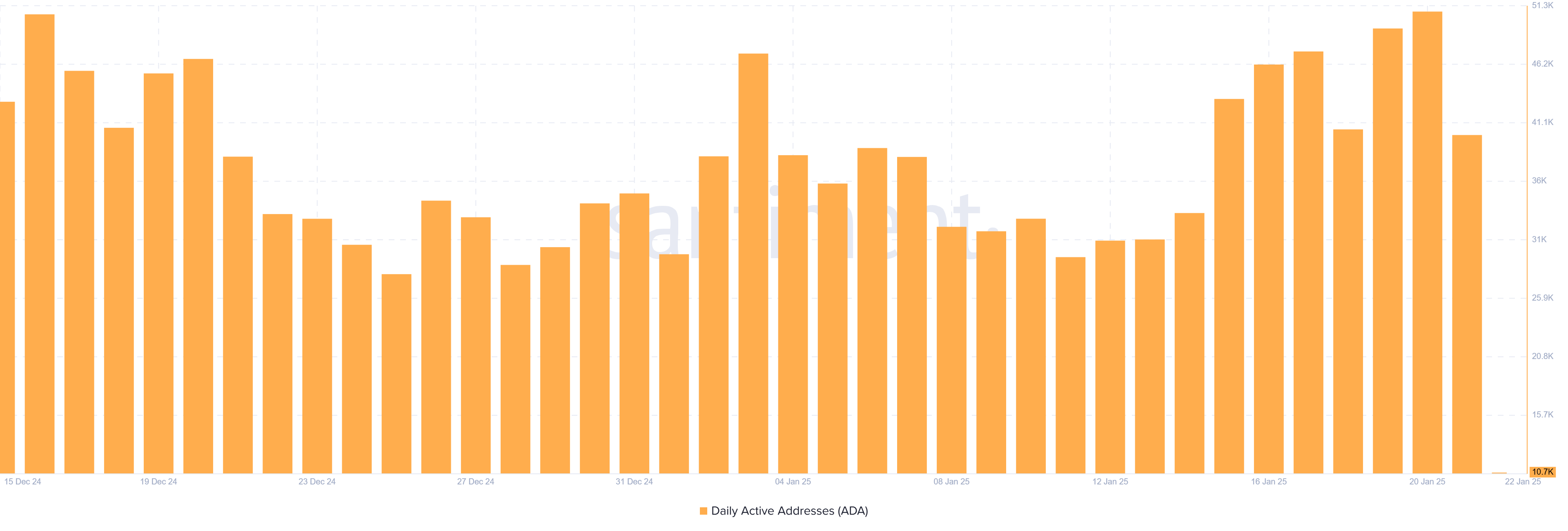

- A spike in the number of daily active addresses suggested rising interest in ADA and the Cardano network.

Cardano [ADA], at press time, traded at 0.996 after a slight 2% gain in 24 hours. However, trading volumes were down by 40% to $1.4 billion, showing reduced market interest.

Despite these gains, Cardano’s market capitalization has dropped by 14% in less than one week to $35 billion. This indicated that buying pressure remained weak, and more volumes are needed to aid a rally.

Nevertheless, on the weekly chart, ADA showed signs of an upcoming rally past $2.

Long-term trend hints at incoming rally

ADA’s weekly chart showed signs of a potential rally to $2.47 if the token follows past price patterns.

After completing an ascending parallel channel late last year, ADA has entered a period of consolidation, with resistance at $1.09 preventing an upward breakout.

The current trend mirrored ADA’s performance in 2021, where its rally cooled off after a sharp rise. After weeks of trading in consolidation, ADA broke out and registered an over 200% gain within two weeks to $2.47.

Source: TradingView

The Relative Strength Index (RSI) at 62 indicated that ADA was cooling off after being overbought. However, sellers are yet to overwhelm buyers, highlighting some level of conviction among traders that the rally could resume.

ADA’s Moving Average Convergence Divergence (MACD) further showed that despite reduced buying volumes, the momentum remained bullish.

Rising network activity could fuel the rally

Activity on the Cardano network has been on the rise following an increase in the number of addresses.

Per Santiment, the daily active addresses on the network reached 50,828 earlier this week, suggesting rising network usage or a spike in trading activity.

Source: Santiment

However, despite the increasing number of addresses, data from DeFiLlama showed a drop in Cardano’s Total Value Locked (TVL) to $518M. A surge in DeFi activity is needed to support ADA’s long-term uptrend.

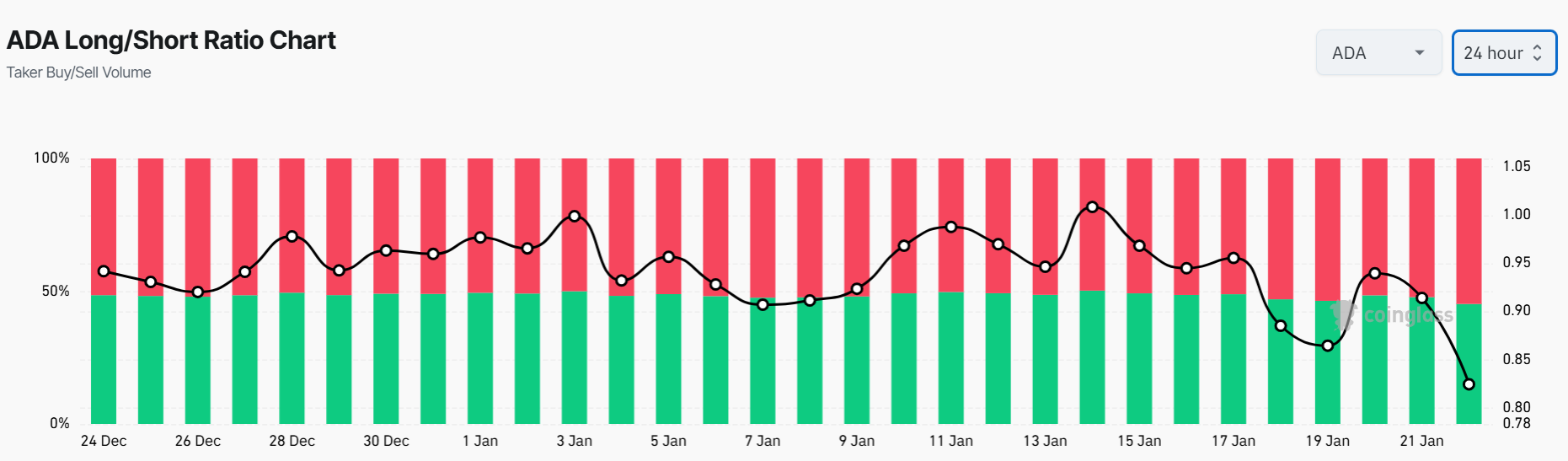

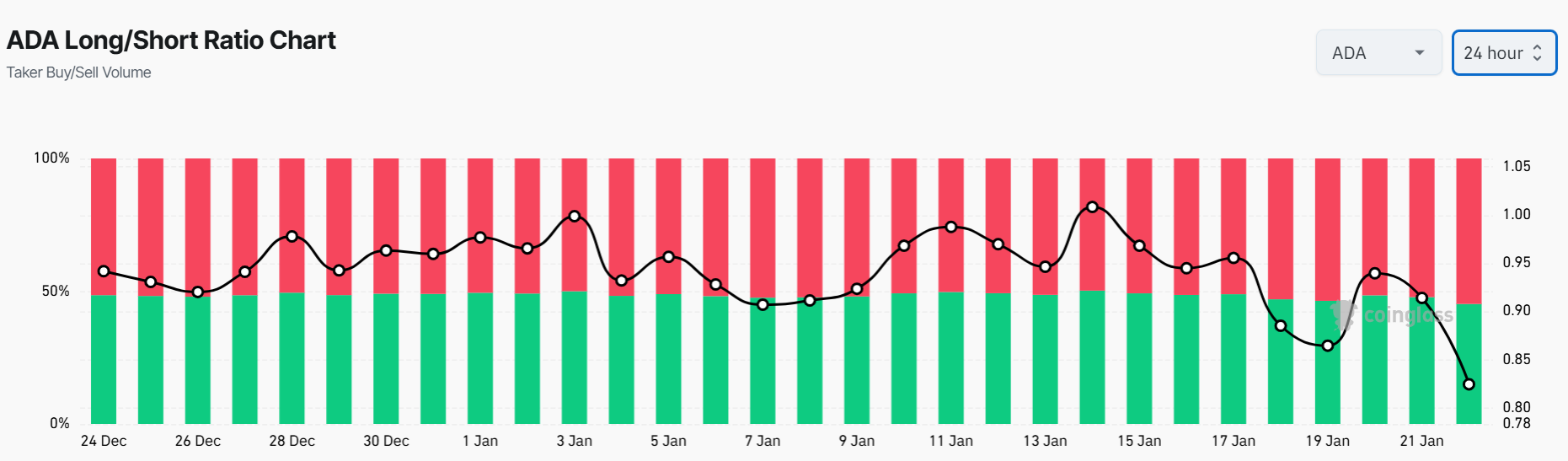

Short traders dominate the market

Data from Coinglass showed a surge in the number of ADA short positions in the market. In fact, the coin’s Long/Short Ratio has dropped to 0.824, marking its lowest level in over a month.

Source: Coinglass

Read Cardano’s [ADA] Price Prediction 2025–2026

When many traders are taking short positions, it shows a bearish market sentiment.

However, an influx of short positions could also aid recovery if there is a short squeeze that forces traders to buy to close their positions.