- Cardano’s price, at press time, was hovering around the $0.33 key level

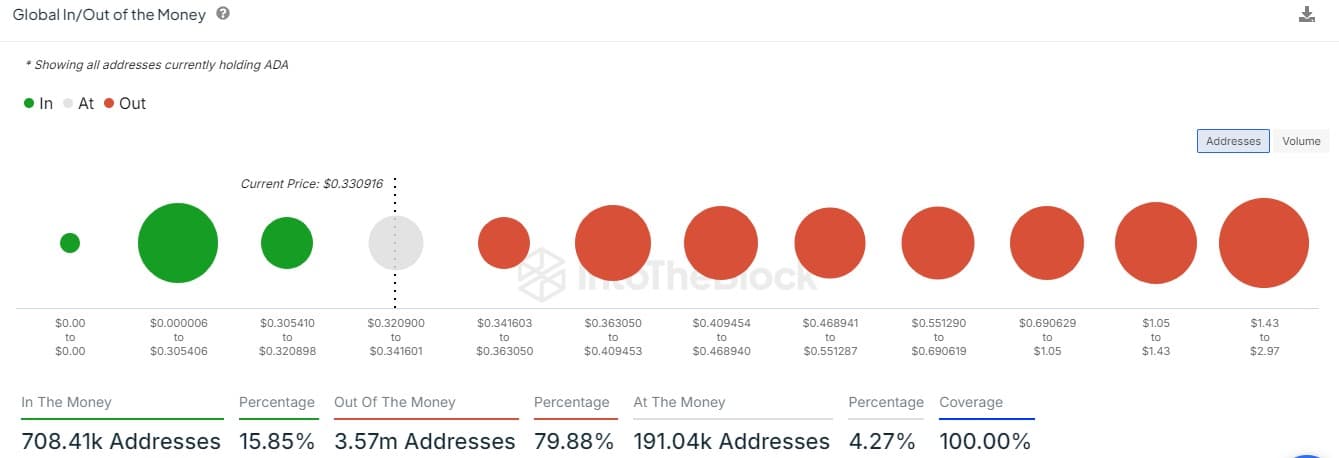

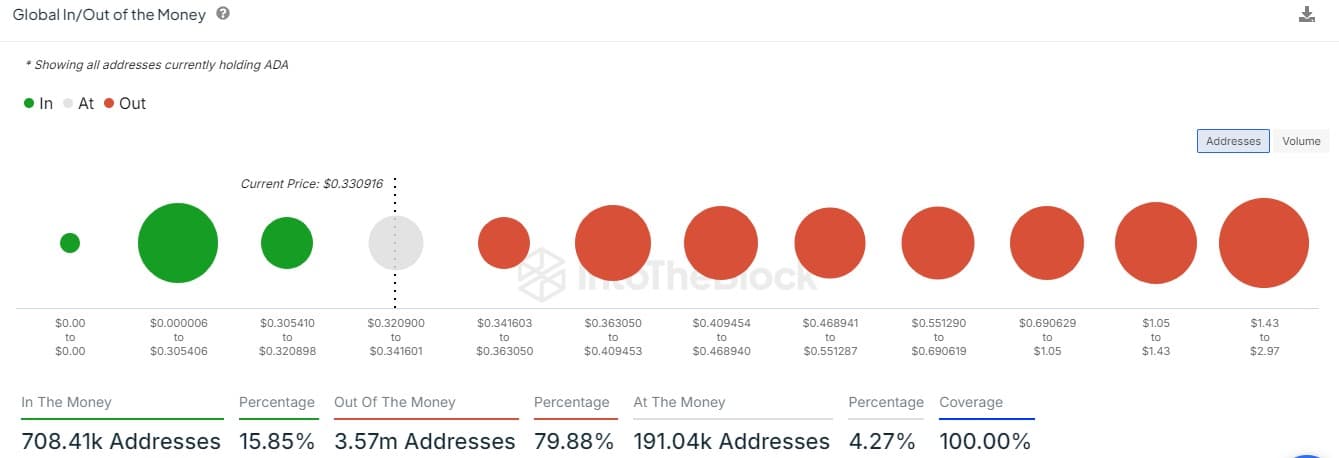

- Only 16% of all addresses seemed to be in profit

Cardano’s (ADA) price might just be at a crossroads, with the altcoin testing key support levels on the charts. At the time of writing, Cardano was trading at $0.33 – A price level that has historically acted as both support and resistance.

Now, although the market appeared to be recovering, Cardano’s price action has remained sluggish. In fact, the altcoin has been stuck in its press time range for a while now, with bulls being unable to muster enough buying pressure either.

Source: TradingView

This sluggish performance is also evident in the asset’s profitability metrics. According to the IntoTheBlock data, only 15.85% of Cardano addresses own “In The Money.” This implies that there are few strong hands holding the asset, possibly limiting any upward price momentum.

Most Cardano holders are calm…

Similarly, the same data revealed that almost 79.88% of addresses were out of money, meaning they purchased ADA at a loss. As prices went up, this high percentage of underwater positions might result in a sell-off, as holders would want to get out at their break even points.

Source: IntoTheBlock

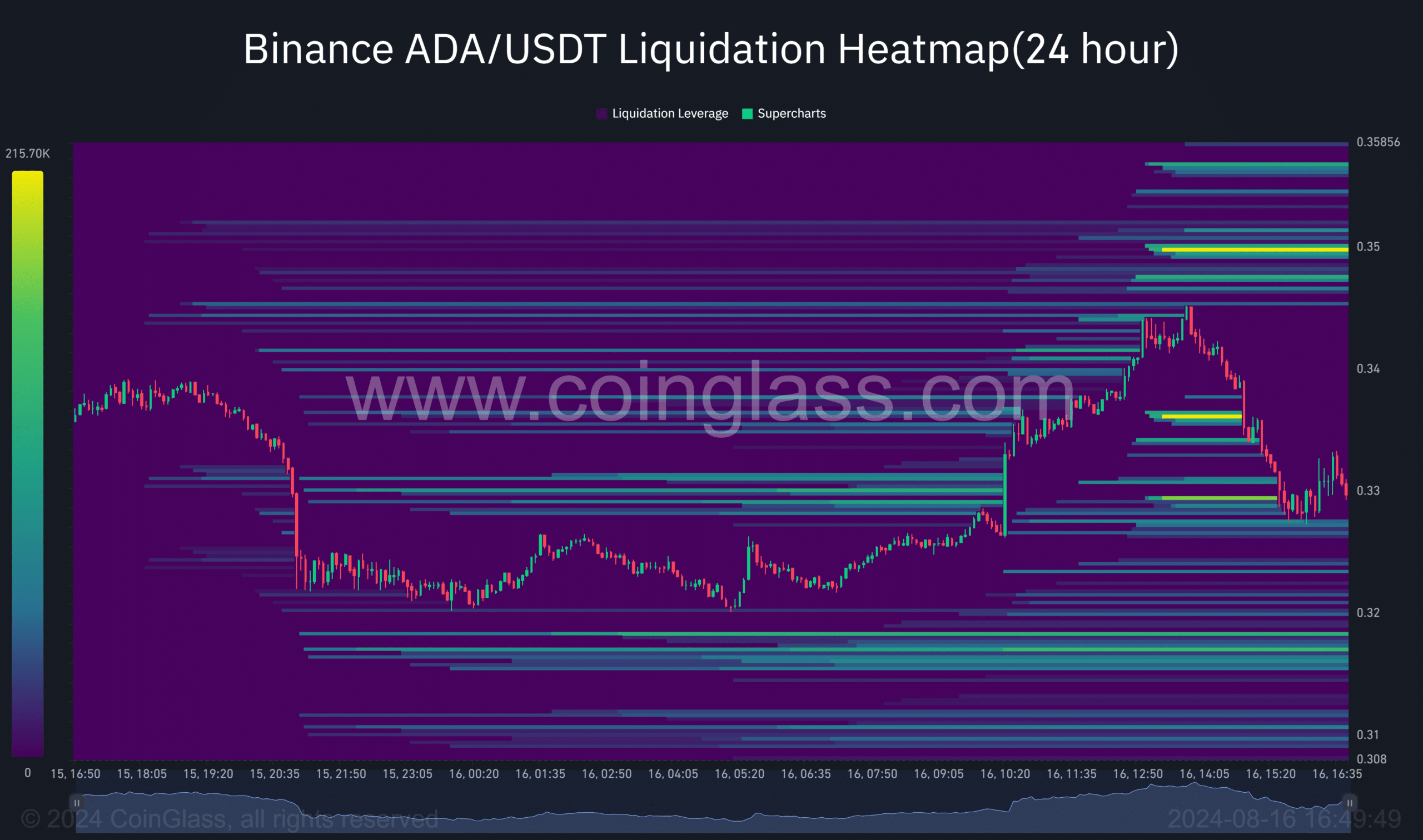

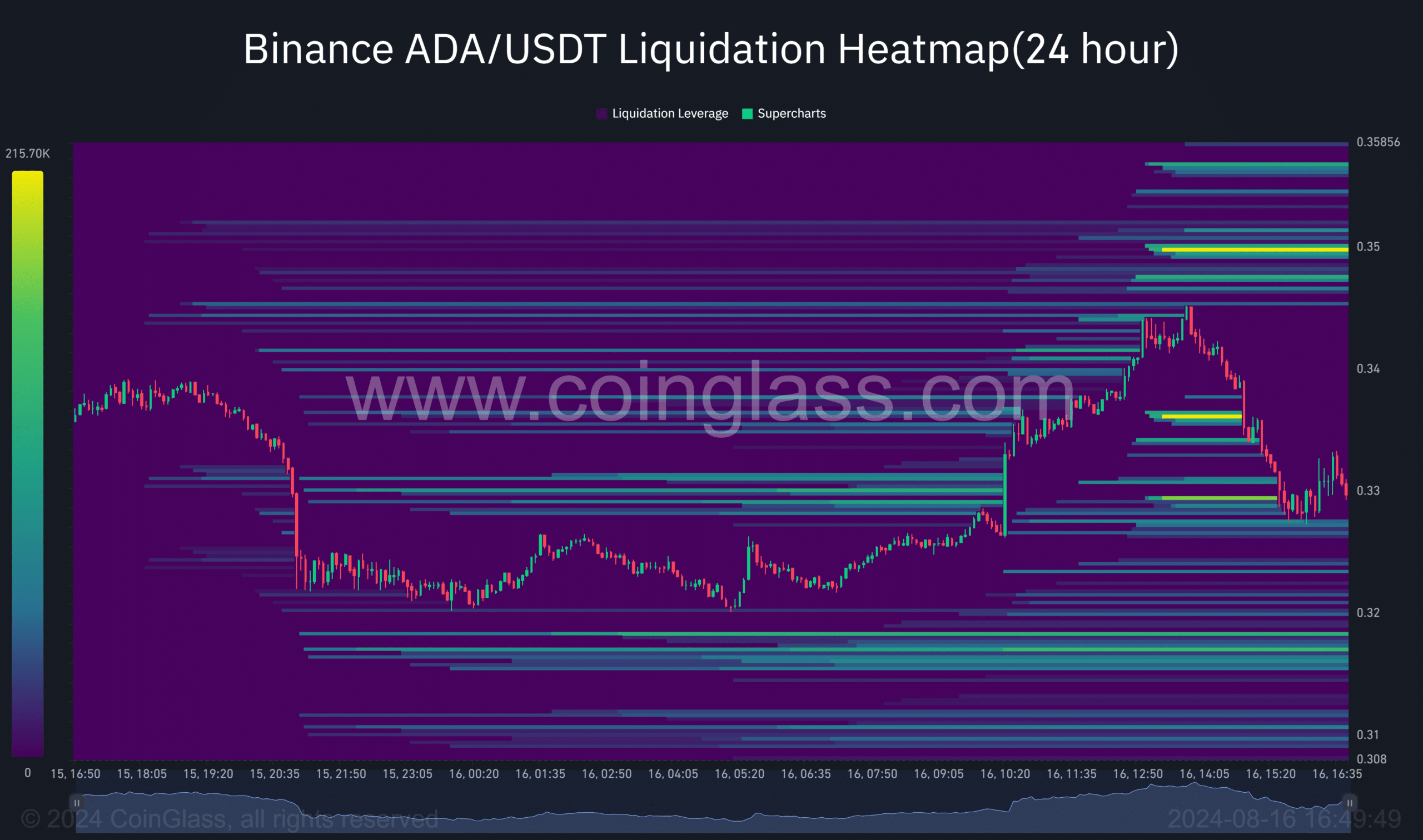

Looking at Cardano liquidation data, it indicated prospective volatility on the cards, even though the market appeared dull. It also revealed several liquidation levels concentrated around the $0.35-level on the charts.

If this level can be decisively conquered, then it would lead to cascades of liquidations, thereby helping fuel a bigger upward move in prices. However, such an occurrence may face hurdles from sellers seeking to recoup their losses. Especially given the low profitable address percentage.

Source: Coinglass

Can the bulls make a comeback?

Hence, the question – Can 16% profitable addresses bring about a significant bull rally? Despite being a minority, this group might have the money and confidence necessary to drive up prices positively.

To have any meaningful recovery for Cardano, it will need to break convincingly above the $0.35 resistance level. This will not only lead to potential liquidations. but also make more addresses profitable, thereby reducing sell-side pressure.