- ADA’s price surged by over 60% in the last seven days.

- Market indicators suggested a price correction soon.

Cardano [ADA] has showcased impressive performance in the last few days. Though this surge was meteoric, ADA’s latest data suggested a pullback. Will this be the end of Cardano’s bull rally?

Cardano’s massive price hike

CoinMarketCap’s data revealed that ADA bulls outshone the bears last week as the token’s price surged by more than 60%. In fact, in the last 24 hours alone, the token’s price increased by more than 36%.

Cardano investors, who were mostly in losses, enjoyed profits because of this latest uptrend.

To be precise, 2.35 million ADA addresses were in profit because of the latest uptrend, which accounted for over 52% of the total number of ADA addresses.

Source: IntoTheBlock

World of Chats, a popular crypto analyst, recently posted a tweet highlighting that after the emergence of a bullish breakout, ADA managed a successful breakout.

The pattern emerged in December 2023, and since then, Cardano’s price has been consolidating inside it.

Since the breakout, ADA has already registered over 40% gains.

AMBCrypto then checked other datasets to find out whether this bull run would last, as there were a few metrics that looked bearish.

Source: X

Will ADA’s bull run end?

Our analysis of Coinglass’ data revealed that Cardano’s Long/Short Ratio registered a decline in the last 24 hours.

This suggested that there are more short positions in the market than long positions, which can be inferred as a bearish development.

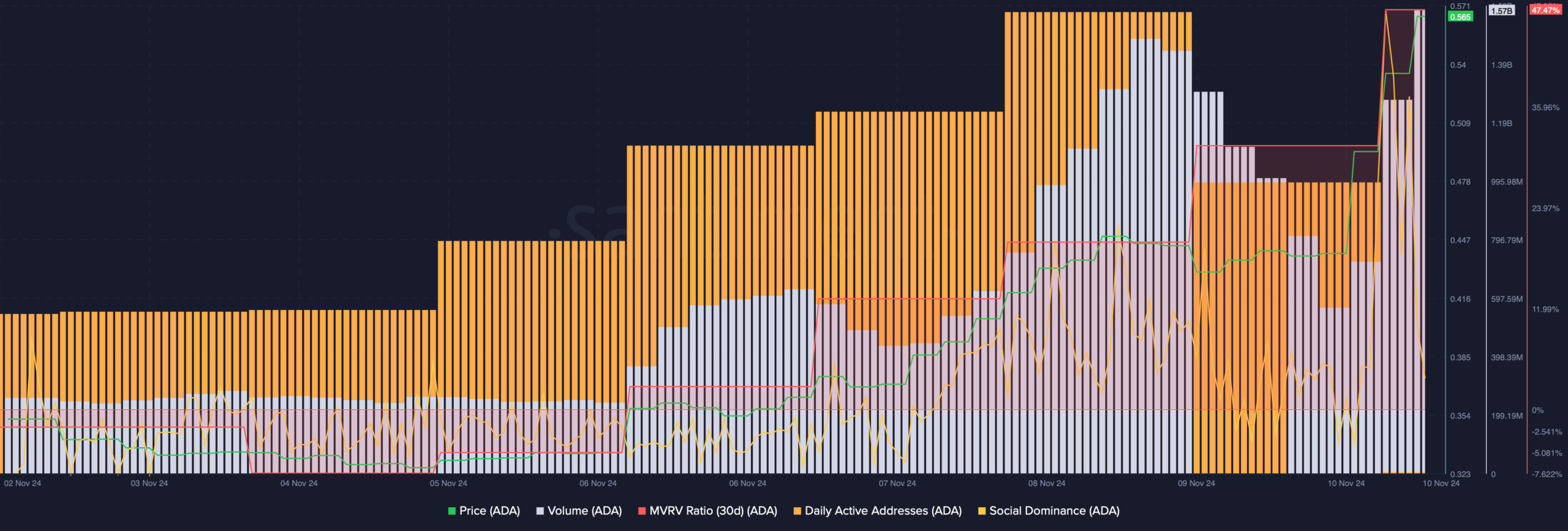

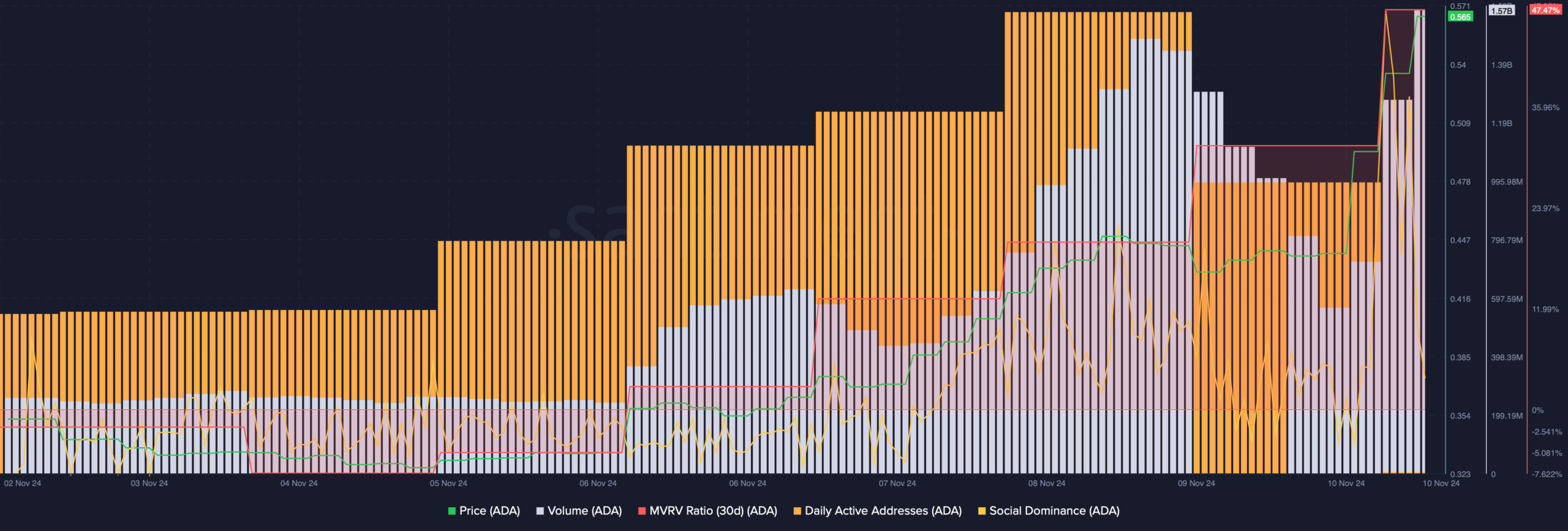

We then took a look at Santiment’s data to better understand Cardano’s path ahead. As per our analysis of Santiment’s data, Cardano’s daily active addresses dropped slightly over the last few days.

However, the rest of the metrics looked pretty bullish.

Source: Sentiment

For instance, the token’s trading volume increased along with its price. Whenever the trading volume rises with price, it acts as a foundation for a bull rally. Likewise, the token’s MVRV ratio spiked.

Apart from that, Cardano’s social dominance increased sharply, hinting that the token’s popularity rose in the last few days.

Realistic or not, here’s ADA’s market cap in BTC terms

Keeping these factors in mind, AMBCrypto took a look at ADA’s daily chart. We found that the token’s price had gone way above the upper limit of the Bollinger Bands.

This means that the chances of a price correction are high. Additionally, its Relative Strength Index (RSI) was also in the overbought zone, which could trigger a price drop.

Source: TradingView