- Cardano (ADA) is leading the upcoming token unlocks, with an expected release of 37.06 million tokens

- Solana (SOL) and Worldcoin (WLD) are also set for linear unlocks

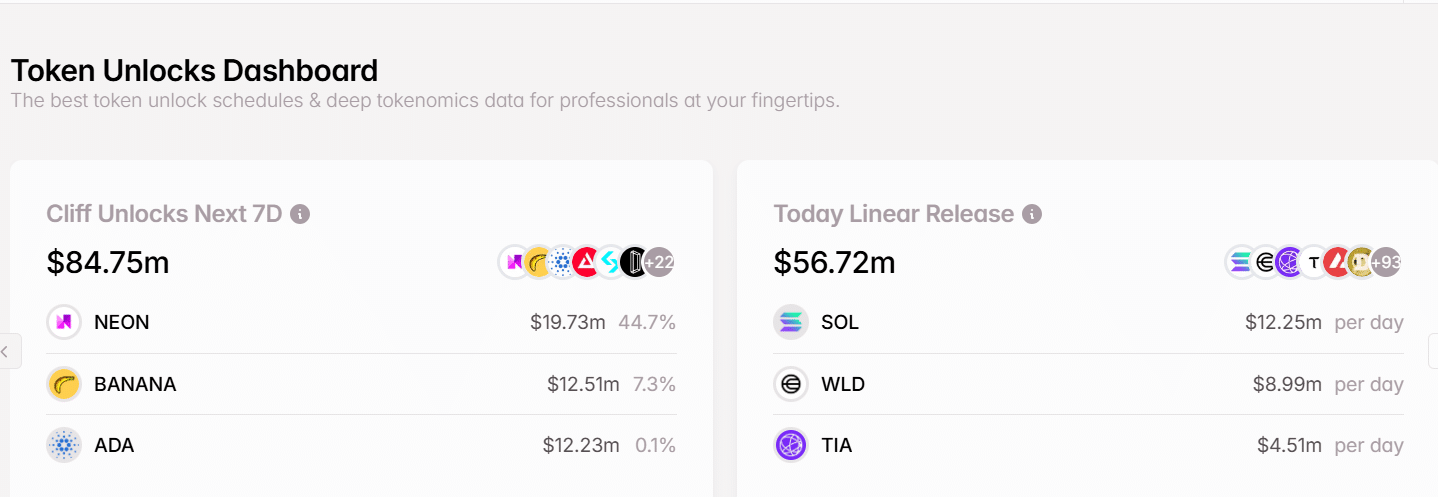

The cryptocurrency market is set to witness another significant round of token unlocks during the first week of November. Following October’s release of over $1 billion worth of tokens, the trend will continue with a fresh batch of unlocks. The upcoming event includes high-profile tokens such as Cardano, Solana, and Worldcoin.

While each token release will introduce varying amounts of circulating supply, market participants will watch closely to assess the potential impacts.

Major cliff unlocks – Cardano (ADA) takes the lead

Cardano (ADA) has the highest cliff unlocks, with an anticipated release of 37.06 million tokens, valued at approximately $12.44 million. Although this unlock represents only 0.10% of ADA’s circulating supply, it could still affect ADA’s short-term price.

If demand does not keep pace with the higher supply, the sell pressure could rise. This hike in supply could drive slight price fluctuations, especially in a market as active as ADA’s.

Source: Tokenunlocks

Another significant unlock is NEON, releasing 53.91 million tokens worth $20.18 million – Representing 44.92% of its circulating supply. Given the size of the unlock relative to NEON’s supply, this event may create considerable price volatility.

Nearly half of NEON’s circulating tokens will become available on the market with the event.

Other projects with smaller unlocks, including BANANA, XAI, BGB, and AGI, will likely feel the effects within their respective ecosystems. However, these releases may have less impact on the broader market.

Linear unlocks for Solana (SOL), Worldcoin (WLD), and Dogecoin (DOGE)

In addition to cliff unlocks, several tokens are set for linear unlocks, where tokens are released steadily rather than all at once. Solana (SOL) leads this list, releasing 524,030 tokens valued at $85.86 million, accounting for about 0.11% of its circulating supply.

Given the relatively low percentage, SOL’s price may not see immediate, dramatic shifts. However, the steady release could contribute to minor price adjustments or stabilization over time.

Worldcoin (WLD) and Dogecoin (DOGE) will also see linear unlocks, with respective releases valued at $65.15 million and $14.48 million, respectively. Notably, WLD’s release will account for 6.16% of its circulating supply, which could lead to selling pressure and price fluctuations if market demand doesn’t keep pace.

DOGE, on the other hand, with a smaller release amount, may see low price volatility, though it remains to be seen how the community will react.

Market impact – Are these token unlocks enough to move prices?

Although the combined value of the November unlocks doesn’t match the $1 billion threshold reached in October, the release of these high-value tokens could still influence market dynamics. Especially for tokens with a significant percentage of circulating supply being released.

For example, NEON and WLD, each expecting releases, representing large portions of their respective circulating supplies, could face increased volatility due to possible selling pressure. Meanwhile, tokens with smaller percentage unlocks, such as ADA and SOL, may see only minor fluctuations, as these increases are more likely to be absorbed without drastically affecting prices.

In general, the impact of these unlocks will largely depend on prevailing market conditions and investor sentiment. If market demand remains strong, the added liquidity from these unlocked tokens may be absorbed relatively smoothly.

Conversely, if demand dips, the increased supply could lead to downward price pressure on certain tokens as they enter circulation.

As the first week of November unfolds, market participants will be closely watching these token unlock events to assess the effects on both individual assets and the cryptocurrency market as a whole. Whether these releases will drive major price changes remains uncertain, but they do provide valuable insights into each project’s liquidity dynamics and the market’s response to changes in supply.