The United States Securities and Exchange Commission (SEC) has been consistently scrutinizing the cryptocurrency sector. This led experts to argue that the lack of regulatory clarity is stifling the industry’s growth.

Coinbase has also found itself targeted by the SEC in its ongoing crackdown on cryptocurrency exchanges.

Coinbase against crypto crackdown

In response to this uncertainty, Coinbase has taken proactive steps by filing two new Freedom of Information Act (FOIA) requests.

Through these filings, the exchange aims to gain insight into the SEC’s stance on crypto regulation and clarify the regulatory framework surrounding crypto assets, which continues to be a point of contention for industry participants.

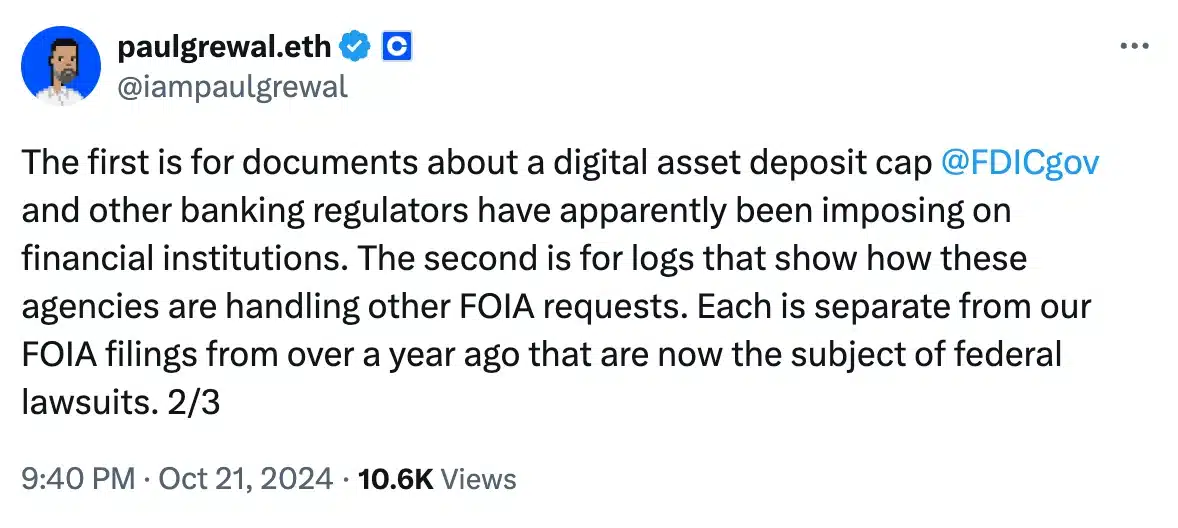

Offering further clarity on the matter, Coinbase’s Chief Legal Officer (CLO), Paul Grewal, disclosed key details of the filings and emphasized,

“We filed two new sets of FOIA requests in our continued effort to get any sort of clarity on how regulatory agencies are approaching digital assets. In short, so long as the government will not relent, neither will @coinbase.”

Grewal explained that the first FOIA request focuses on obtaining documents related to a digital asset deposit cap that banking regulators, including the Federal Deposit Insurance Corporation (FDIC), imposed on financial institutions.

What’s more?

The second request seeks access to records detailing how these agencies manage other FOIA submissions.

He also clarified that these filings are distinct from the FOIA requests Coinbase submitted over a year ago, which have since escalated into federal lawsuits.

Source: Paul Grewal/X

Reports indicate that the Federal Deposit Insurance Corporation (FDIC), the U.S. agency responsible for insuring bank deposits, has allegedly instructed banks to limit deposits from cryptocurrency companies to 15% of their total deposits.

What makes this move controversial is that the FDIC reportedly implemented the cap without seeking public input, a step that is typically required by U.S. law for banking regulators before making such decisions.

SEC against the crypto industry?

As expected, Coinbase isn’t the only crypto company under fire from the SEC.

Ripple Labs has also come under renewed scrutiny as the SEC recently filed a ‘Civil Appeal Pre-Argument Statement’ (Form C), signaling its intent to challenge a prior court ruling in the ongoing legal battle.

The case between Ripple Labs and the SEC, which dates back to 2020, has been a prolonged and highly publicized conflict over the regulatory treatment of XRP and digital assets.

Despite the ongoing regulatory crackdown, Bitwise’s CIO, Matt Hougan, recently stated that Coinbase appears to be the primary beneficiary amid the intensified U.S. enforcement actions in the crypto sector.

He had put it best when he said,

“The hostile regulatory environment is creating an artificial “moat” for Coinbase’s business, helping sustain extremely high margins and allowing them to over-earn in the short-term.”