- CYBRO crypto has raised $2 million in a pre-sale, marking a record with 86 million tokens purchased.

- The developers have strategically leveraged a “plan” to advance their goals.

CYBRO crypto promises to reshape the DeFi landscape with its innovative approach to investment.

It does it by leveraging cutting-edge AI technology. Moreover, the platform operates on Blast, a special Layer-2 blockchain.

A prominent trader has recently predicted CYBRO as a potential 5000% ROI sensation, sparking significant interest among CYBRO crypto enthusiasts.

However, with fierce competition in the DeFi world, can CYBRO stand by its promise over the long term, or is it just a fleeting trend?

Historic milestone locked-in

In just over a few days, CYBRO crypto has raised nearly $2 million in a pre-sale, marking a record with 86 million of 215 million tokens purchased. This impressive figure reflected a growing community of over 7,000 active holders.

To assess CYBRO’s potential, AMBCrypto compared it with AAVE, another competitive DeFi platform.

Four years ago, AAVE raised $600K at $1 per token following its event. Today, its price has surged over tenfold, approaching $140.

Contrary to this, CYBRO crypto tokens were launched at a 50% discounted rate, priced at just $0.03 per token.

It is not just the low price that has contributed to CYBRO’s remarkable start in its pre-sale event. AMBCrypto uncovered a few key insights that may have played a crucial role in this early success.

CYBRO crypto taps volatility advantage

By adopting a multi-chain strategy, CYBRO developers have tapped into a vast user base across different blockchains.

For starters, the platform utilizes SOL as a conventional payment option for trading CYBRO crypto, reflecting a strategic move to tap into Solana’s efficient transaction capabilities.

Aside from this, the developers have tapped into the extensive user bases of both Ethereum and Polygon networks.

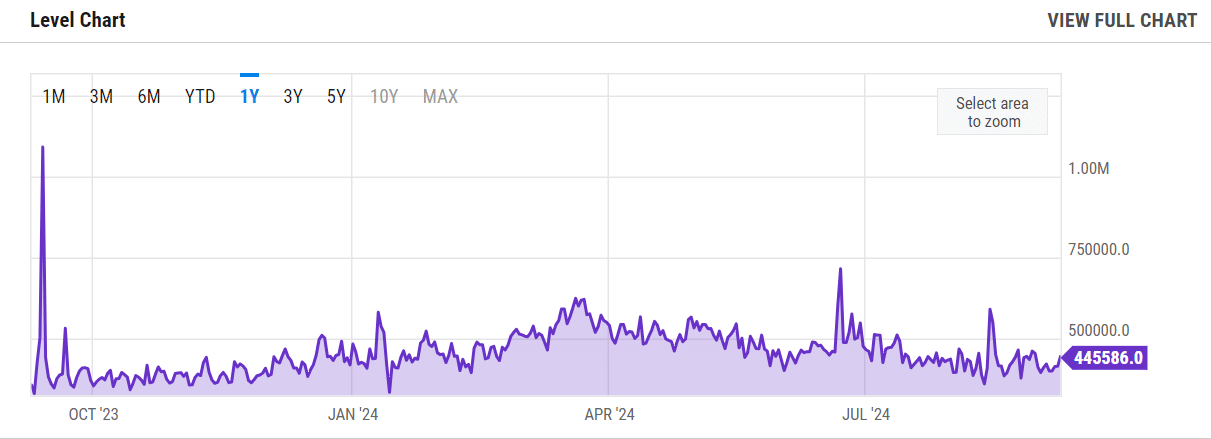

Source : YCharts

Currently, daily active addresses on the Ethereum network are at 445K, marking a 56% drop from over 1 million a year ago.

That being said, AMBCrypto notes that the decreasing number of active holders reflects the ongoing volatility – a factor CYBRO might be capitalizing on.

Coincidentally, the pre-sale event aligned with a downward trend in the crypto market.

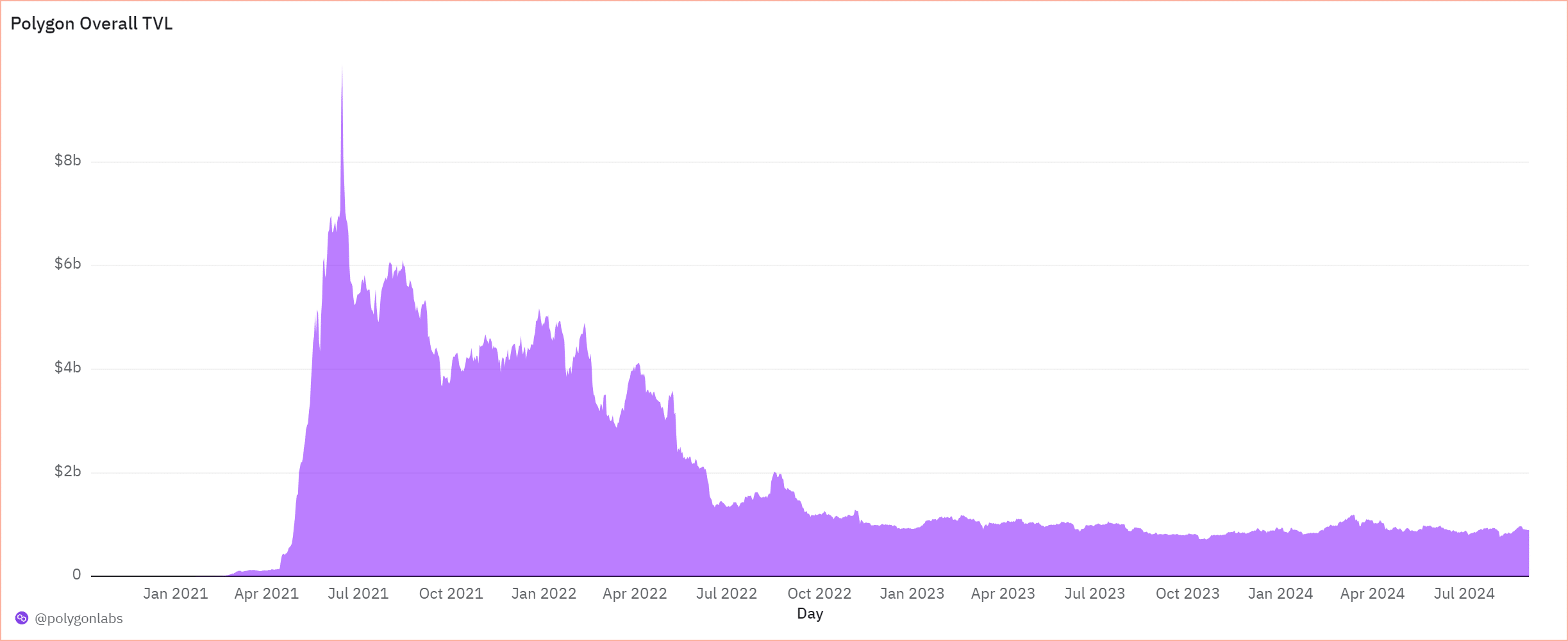

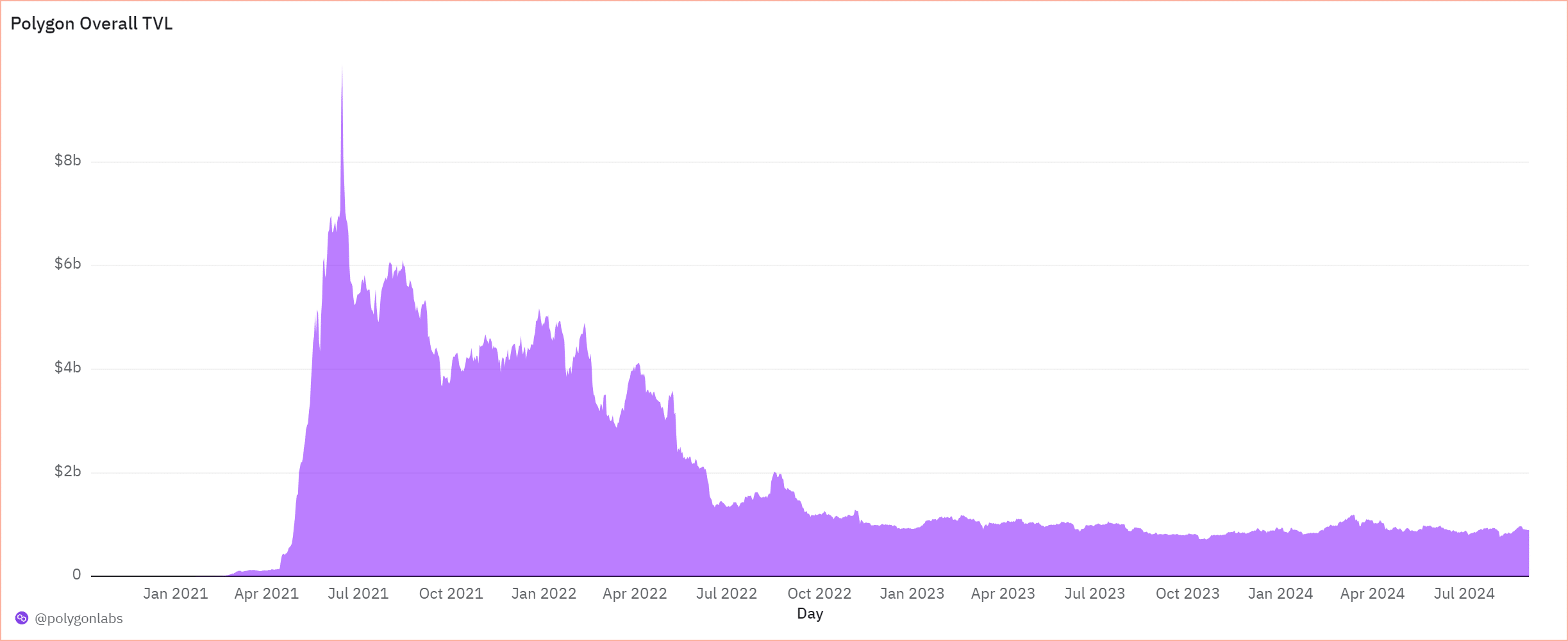

As a result, the DeFi performance on some networks has been impacted, as evidenced in the chart below.

Source : Dune

The chart revealed a dramatic shift in total value locked (TVL) on the Polygon [MATIC] blockchain, from $9.2 billion in mid-June three years ago to just $905 million by the last week of August.

This hinted at a major contraction in DeFi activity on the blockchain, which CYBRO crypto might leverage by offering compelling rewards to attract users from the shrinking TVL pools.

Overall, the strategy is a strong start to CYBRO’s 5000% ROI potential, as highlighted by the trader.

Amid market fluctuations, AMBCrypto praises CYBRO’s strategic roadmap, designed to address blockchains with declining DeFi activity.

If the trend persists, CYBRO could soon claim the top DeFi position, thanks to its innovative AI-driven approach.