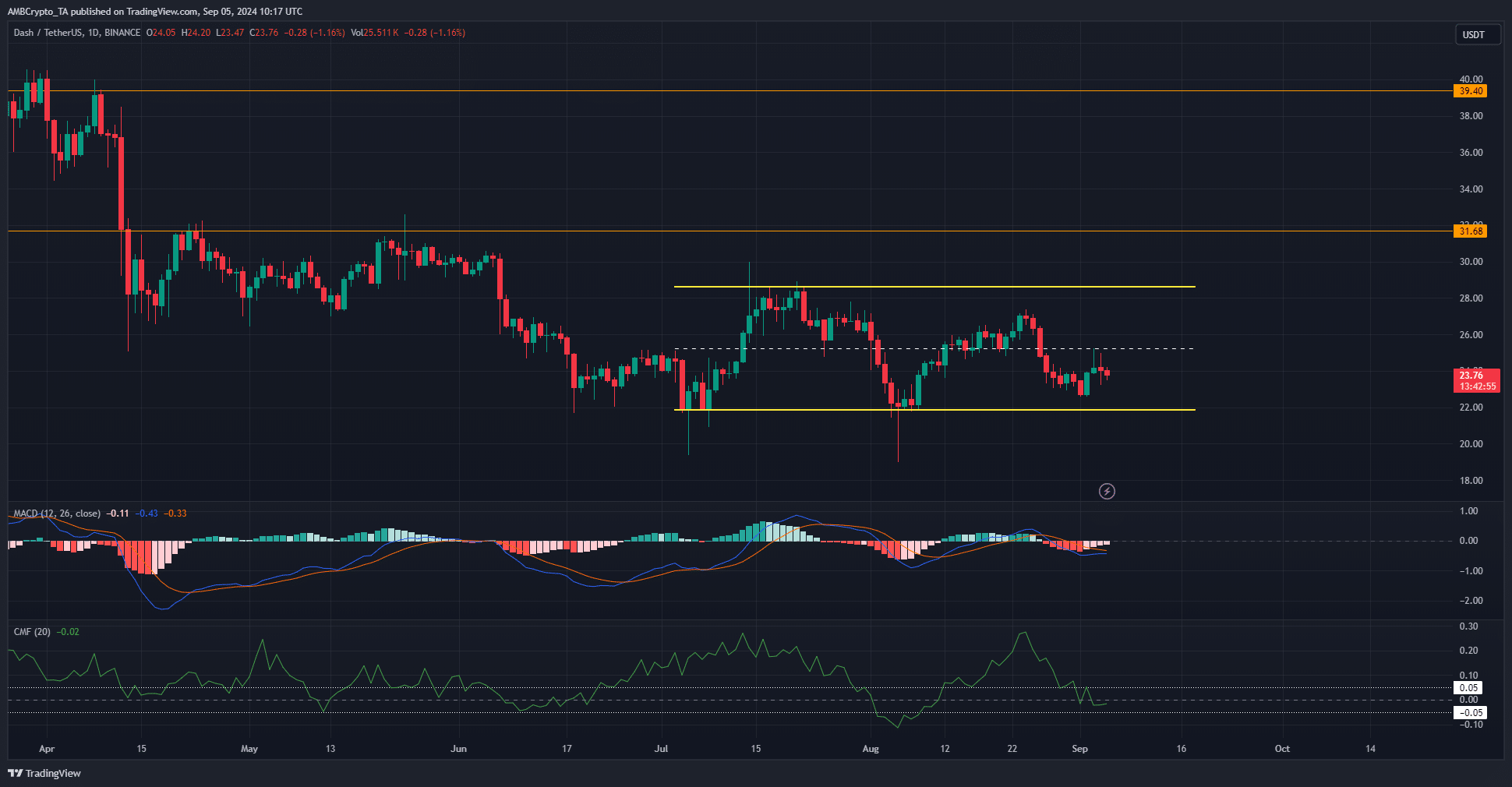

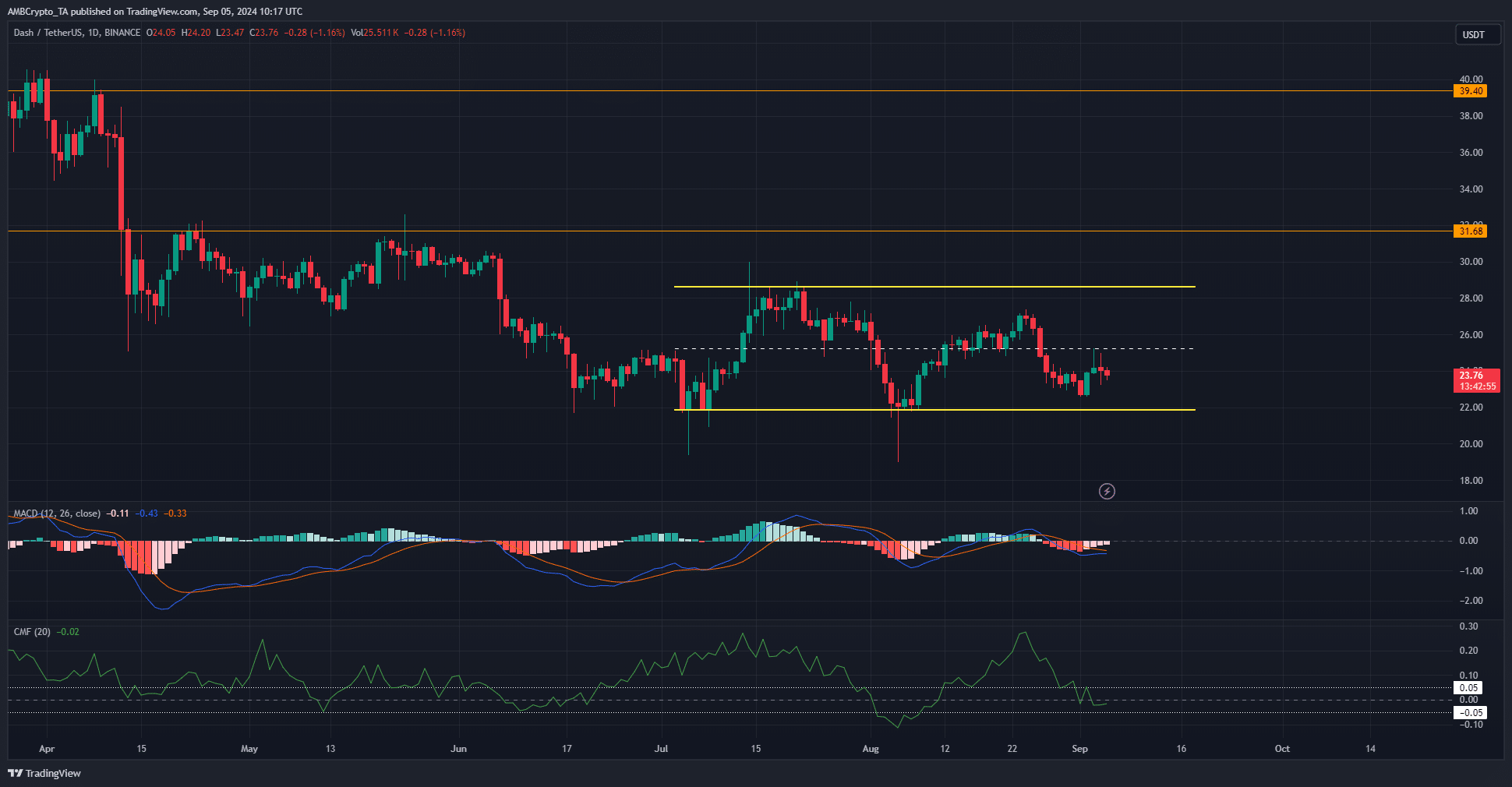

- Dash has stabilized the downtrend from April by forming a range since July.

- DASH was unable to flip the mid-range level to support and hold it.

Over the past two months, Dash [DASH] has traded within a range. It had a 24-hour trading volume of $36 million, according to CoinMarketCap, and the price trend did not signal that a trend shift would be underway soon.

The market-wide sentiment was bearishly poised after Bitcoin [BTC] tumbled below $60k. This short-term bearish momentum could drive DASH downward in the coming days.

The range lows beckon

Source: DASH/USDT on TradingView

Since the first week of August, DASH has traded within a range (yellow) that has extended from $21.85 to $28.64. On the 3rd of September, the mid-range level at $25.26 was tested as resistance and the bulls were rebuffed.

The CMF was at -0.02 and did not show significant capital flow in either direction. On the other hand, the MACD on the daily chart showed the momentum was bearish. This suggested that the range lows could be revisited.

The lower timeframe market structure supports this idea as well, after the rejection from the $25 resistance zone.

In the past two months, each revisit to the range lows has dropped below $20 momentarily. Traders would want to be prepared for that kind of volatility in the event of another price drop.

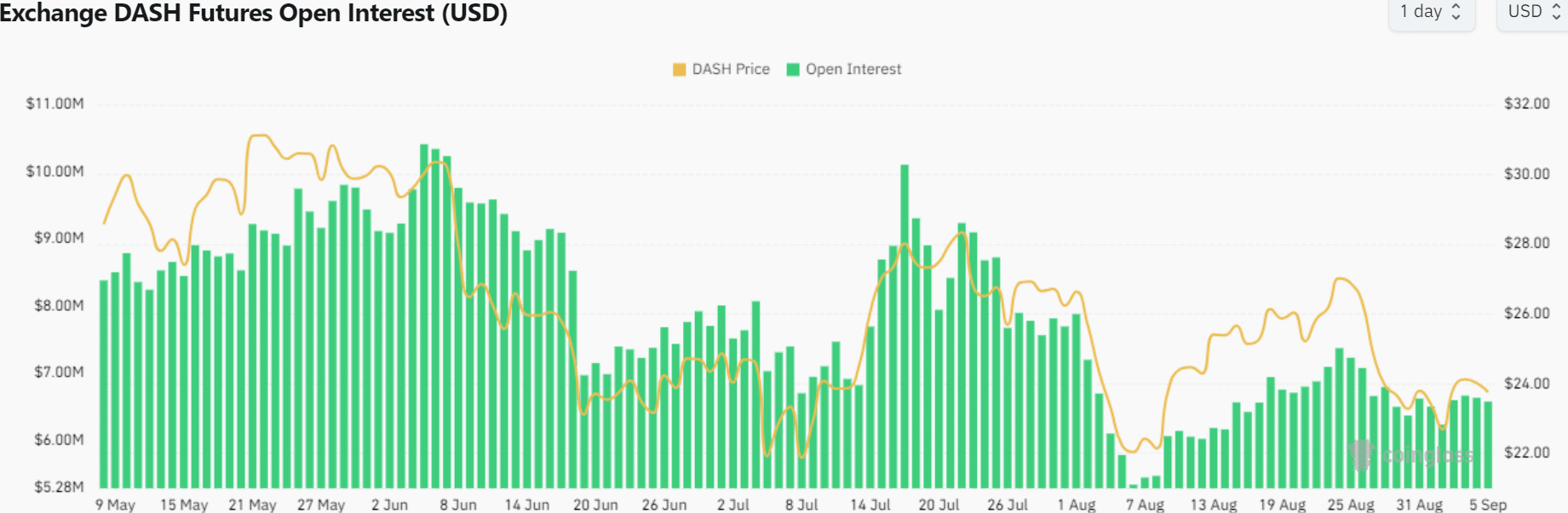

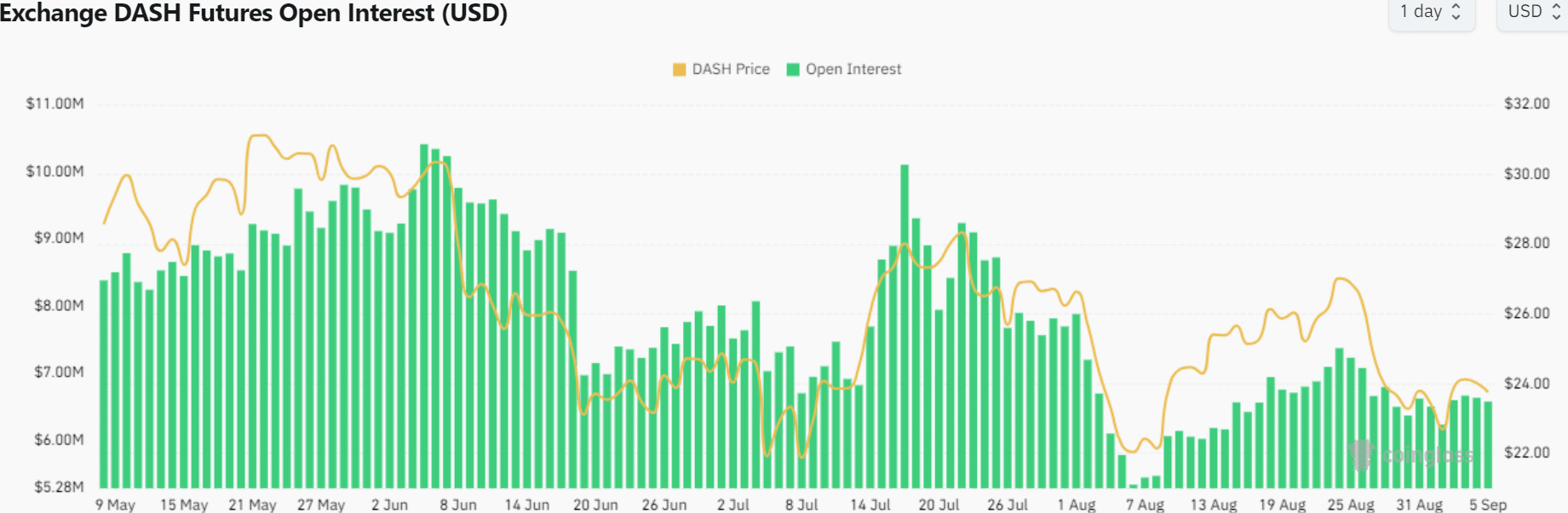

Hopes of a price recovery were dashed

Source: Coinglass

Read Dash’s [DASH] Price Prediction 2024-25

In the final week of August, the upward trend of the Open Interest began to reverse. The price also reversed its short-term uptrend at the $27 level and was quick to fall to $22.

This was a sign that speculators were not confident of sustained gains. Combined with the downtick in the CMF indicator, the market was not ready to bid and DASH is likely to post further losses in the coming days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion