- Algorand’s recent price action revealed a strong bearish edge.

- Derivatives data on Binance reignited some hopes for buyers in the near term.

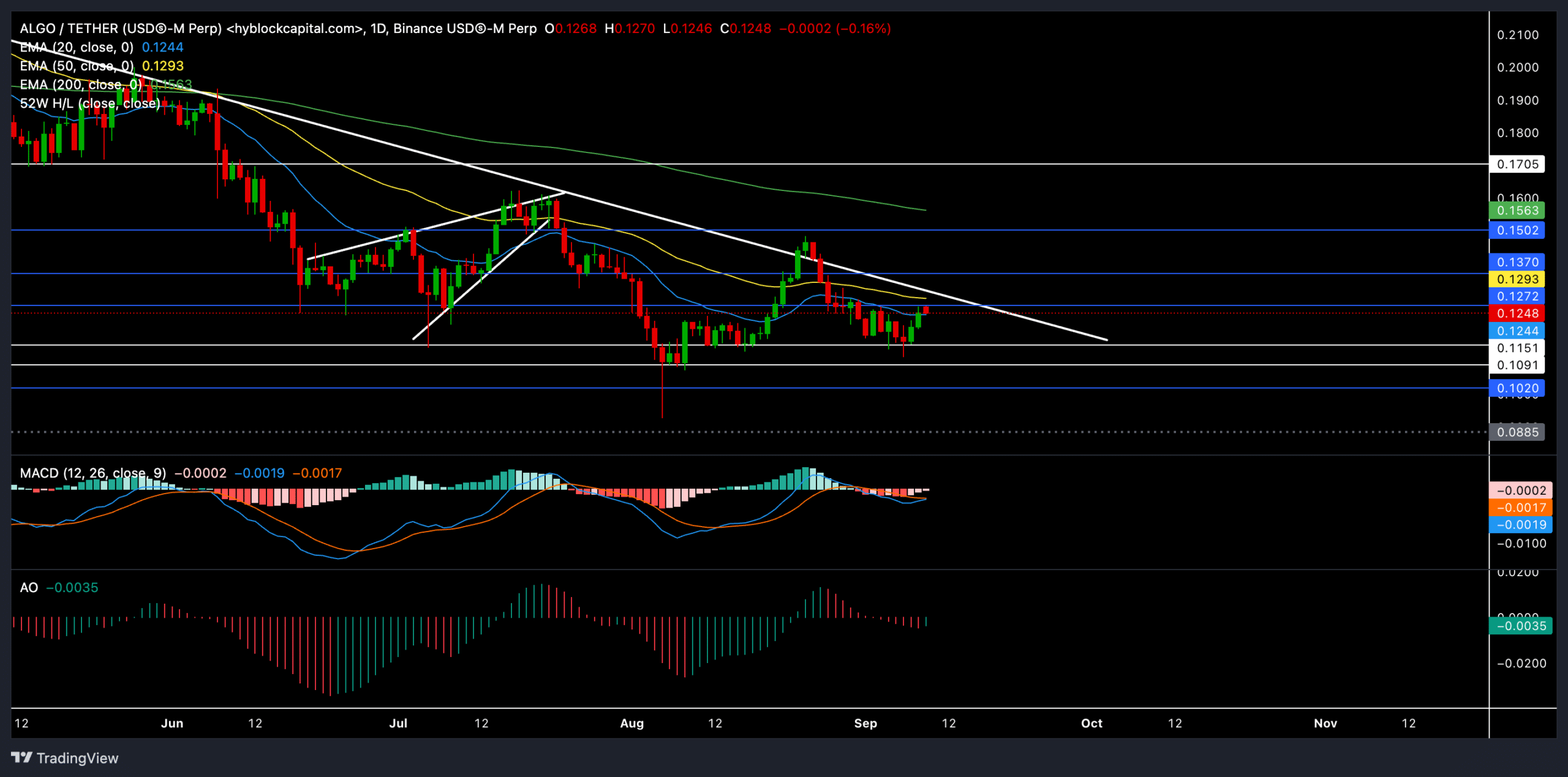

Algorand [ALGO] has been navigating an uncertain market lately. At the time of writing, its price action struggled to stay above the 50 EMA and 200 EMA levels, showing that bears were firmly in control.

Despite a recent bounce from the $0.1 support level, ALGO failed to reclaim key resistance zones.

As the Crypto Fear & Greed Index slipped into the ‘Fear’ zone, the near-term recovery prospects for the altcoin seem questionable. At press time, ALGO traded at $0.12, showing signs of some short-term consolidation.

ALGO bears prevent a break above trendline resistance

Source: TradingView, ALGO/USDT

ALGO’s price recently formed a descending triangle-like structure on its daily chart—with lower highs indicating persistent selling pressure. Over the past month, the $0.1 support zone has been critical for ALGO’s defense.

If this support breaks, we could see a sharp decline toward $0.0885, the next major support level.

On the upside, the 50 EMA ($0.12) could be a significant barrier, coinciding with the long-term descending trendline. A break above this confluence of resistance could trigger a bullish reversal toward the $0.13 and $0.15 levels.

However, bulls will need huge volumes to make this happen.

The MACD indicator showed rather flat momentum, with the signal line slightly above the MACD line. This suggests a slight edge for the bears in the near term.

If the MACD crosses into positive territory, it could indicate the beginning of a bullish phase. Buyers should wait for a close above the zero mark to confirm this bullish revival.

The Awesome Oscillator (AO) has been hovering around the zero line, reflecting weak momentum and a lack of strong directional bias. A decisive move up or down from the equilibrium could indicate the likely price trend early.

Here’s what the derivatives data revealed

Source: Coinglass

The derivatives data also reaffirmed a cautious sentiment surrounding ALGO. Open interest dropped by 2.59% to $23.93M, suggesting traders are reducing exposure in anticipation of further downside.

However, the long/short ratio on Binance was skewed in favor of long positions, with a ratio of over 2.4 for top traders by accounts.

Volume decreased by 3.37%, with a total of $25.44M traded—further reinforcing that traders are waiting for a clear directional move before committing to new positions.

Traders should remain cautious and watch for a break of key levels before making directional bets. Additionally, ALGO’s price is closely correlated with Bitcoin’s movements and any sudden market-wide shifts could heavily impact its trajectory.