- HBAR market interest and trading volume hit all-time highs

- Will 2021’s HBAR pattern reveal itself amid higher buyer exhaustion at the $0.4 level?

Hedera Hashgraph [HBAR] has been a major highlight of this cycle’s altcoin season.

In fact, it rallied by 9x over the past month, surging by $0.04 to $0.35 while outperforming Bitcoin [BTC]. What was behind this remarkable pump though?

What’s driving HBAR?

The key driver behind HBAR’s 9x pump has been massive market interest, which quickly pushed trading volumes beyond its 2021 peak.

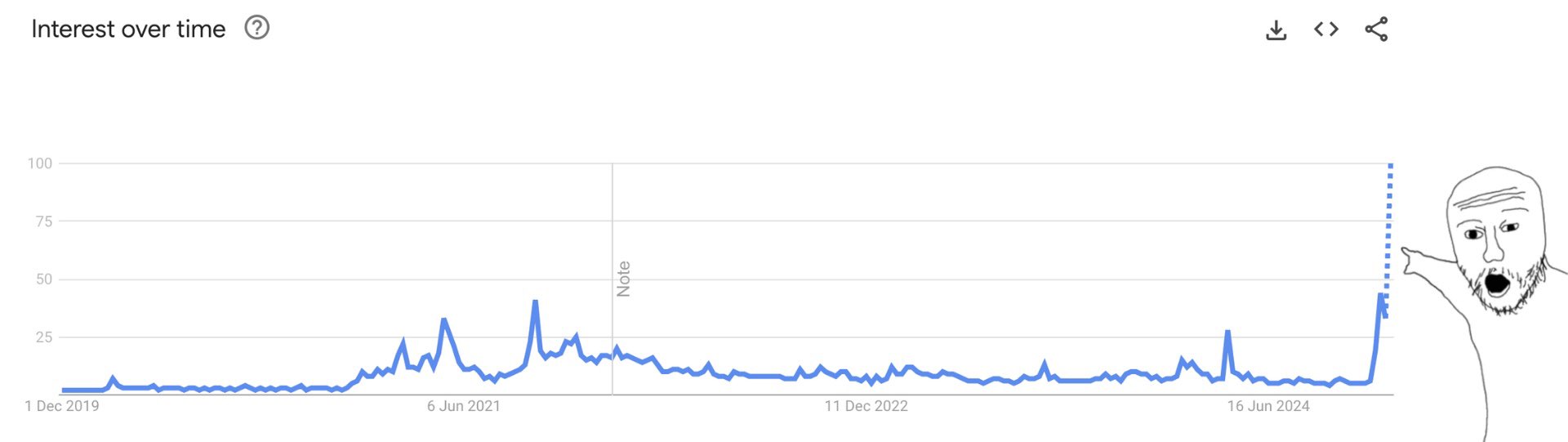

According to Google Trends, search interest in Hedera increased in November and hit an all-time high in early December.

Source: Google Trends

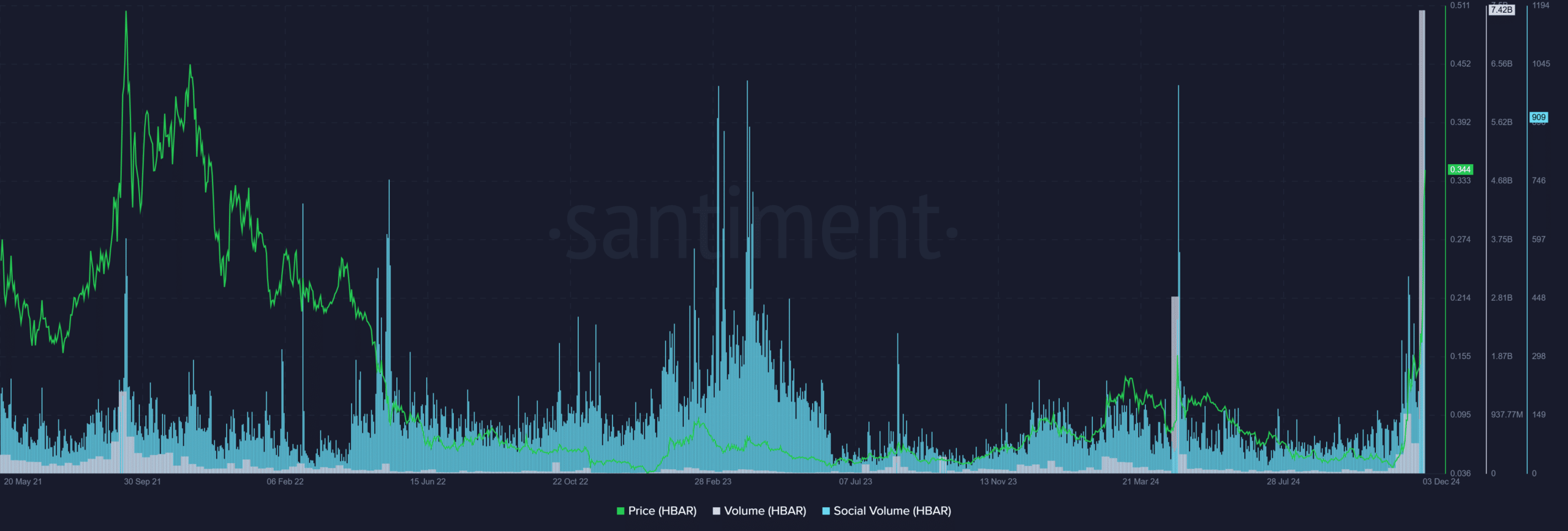

The hike in market interest also spurred social volume, with the same reflected in the trading volume. HBAR’s trading volume hit an ATH of $7.42B, eclipsing March 2024 and 2021 peaks.

In 2021, the trading volume peaked at $1.31B, while March 2024 hit a record of $2.84B. That’s nearly 3x in trading volume.

Source: Santiment

Here, it’s also worth noting that rumors of President-elect Donald Trump picking Brian Brooks, a Hedera board member, as SEC chair also fueled the rally.

Now, although prediction markets are favoring Paul Atkins for the job, Brooks’ name has tipped the scale for the altcoin. HBAR soared by 63% this week after his name was floated as a potential successor to Gary Gensler.

So, despite incredible partnerships and fundamentals, HBAR’s massive rally appeared driven by greater market interest.

Source: X

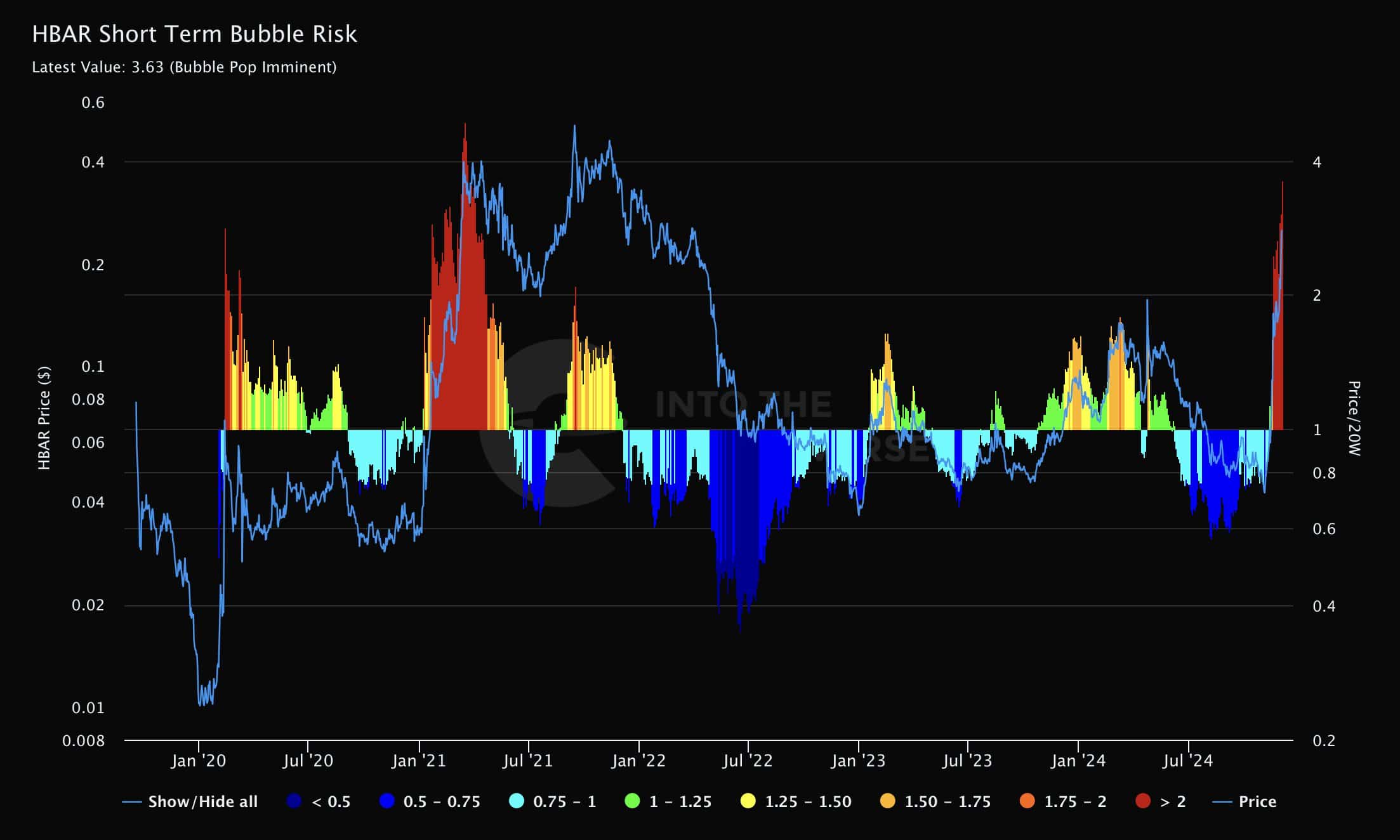

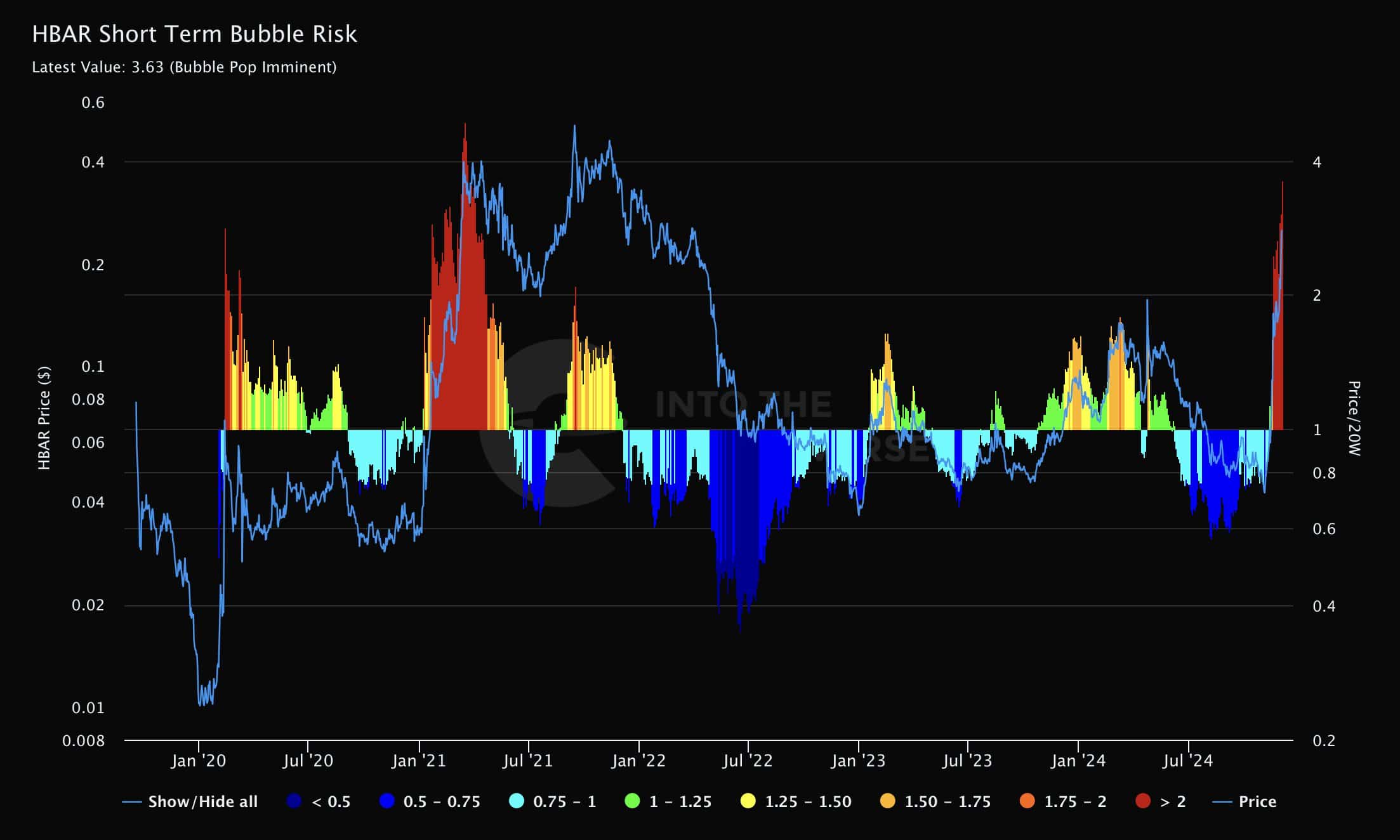

That being said, crypto analyst Benjamin Cowen cautioned that the rally flagged a short-term bubble risk – A sign that the altcoin could stall or retrace soon.

Read Hedera Hashgraph [HBAR] Price Prediction 2024-2025

In the meantime, HBAR seemed to be facing buyer exhaustion near the $0.4-level on the price charts, as shown by the long upper wick on the weekly candlestick.

In 2021, HBAR stalled at the level and retraced to $0.2 before climbing higher to $0.57. Hence, the question – Will this trend repeat itself?

Source: HBAR/USDT, TradingView