- Cardano’s non-zero addresses declined.

- Dogecoin’s non-zero addresses increased by over 13%.

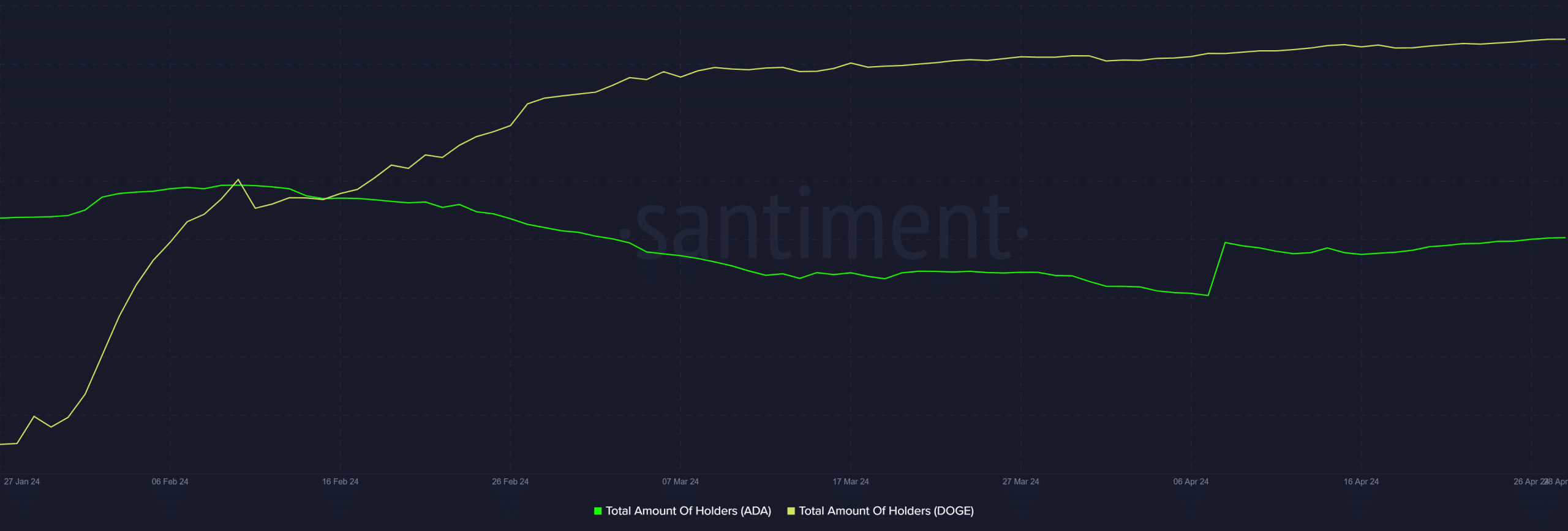

Recent data indicated that Dogecoin [DOGE] and Cardano [ADA] have experienced a slight shift in the number of non-empty wallet addresses.

In addition to this metric moving differently for each asset, their prices and market sentiments have also displayed distinct patterns recently.

Dogecoin and Cardano show varying flat trends

An analysis of the total number of holders metric for Dogecoin indicated a relatively flat trend recently. However, examining its trend over the last three months revealed a growth of over 13%.

At the time of this writing, the total number of holders was 6.62 million. Comparatively, this number was approximately 6.58 million at the beginning of April, suggesting a slight increase over the month.

Source: Trading View

In contrast, Cardano’s total number of holders metric declined, although it also reflected a flat trend recently. However, unlike Dogecoin, no apparent slight increase was observed.

Although there has been an increase compared to the volume at the beginning of the month, the total number of non-zero addresses for Cardano has declined by 0.1% over the last three months.

At the time of this writing, the number of Cardano holders was around 4.7 million.

Dogecoin and Cardano in bear trends, but…

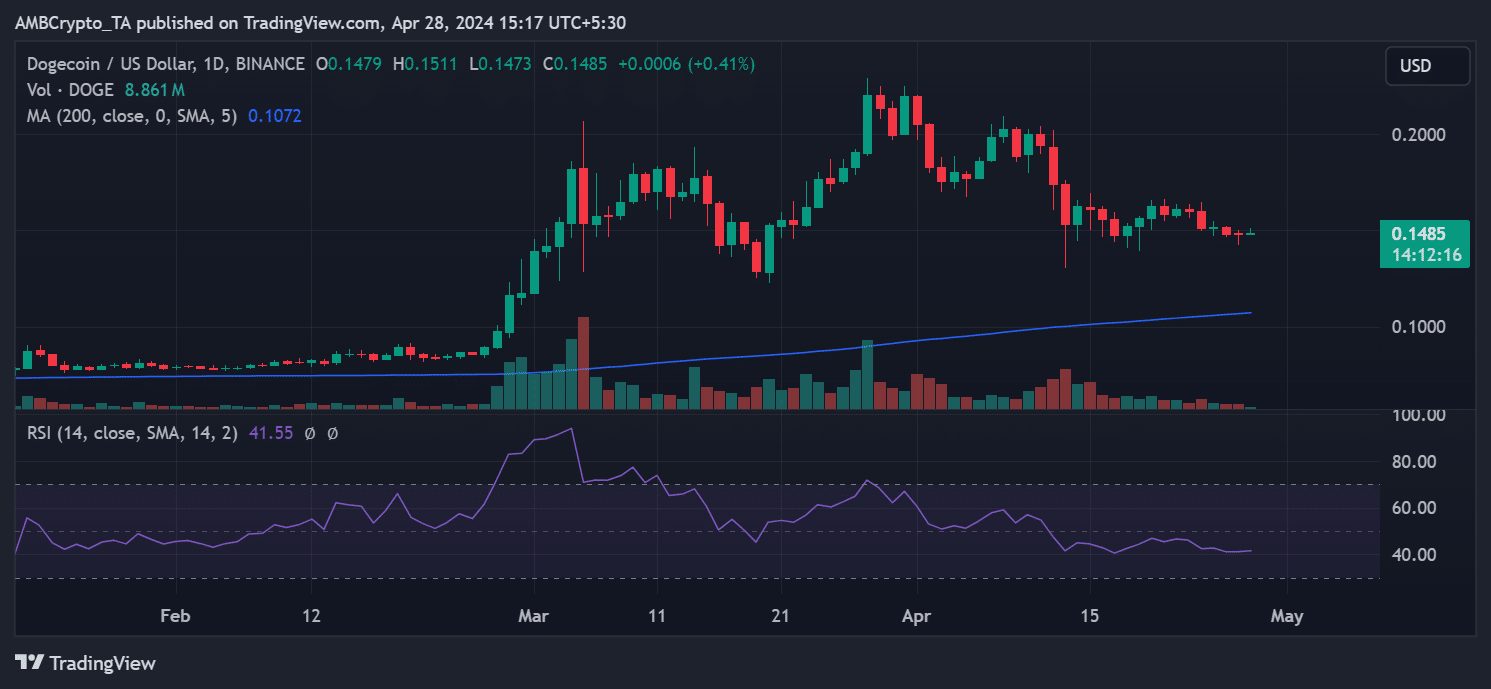

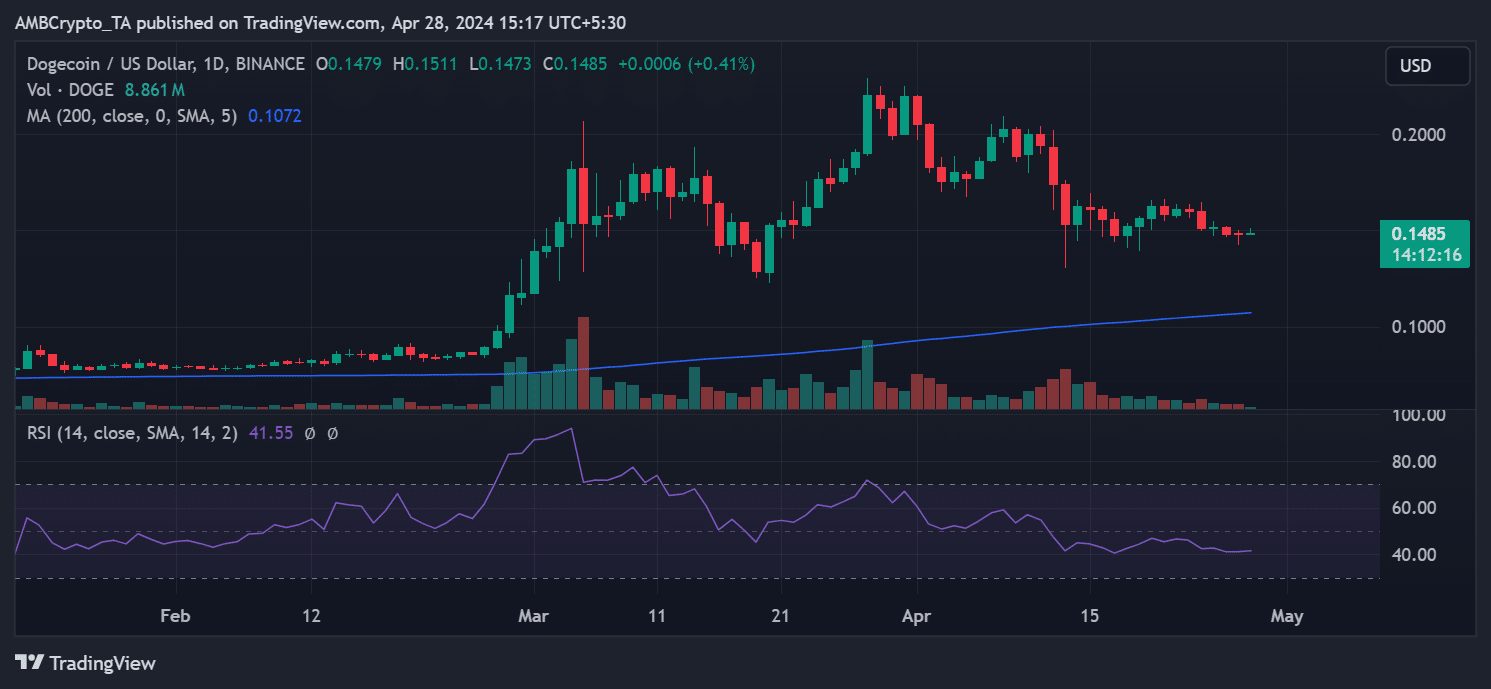

A Dogecoin and Cardano, price charts study, revealed declines in their values over the past few months.

However, Dogecoin (DOGE) has experienced more positive price movements in the last three months than Cardano (ADA).

Analysis of DOGE on a daily timeframe indicated that over the last three months, its price has risen from the $0.08 price range to the $0.1 range.

The chart showed a peak in late March, where it briefly reached the $0.2 range before retracting back to $0.1. At the time of this writing, it was trading at around $0.14, with a marginal increase of less than 1%.

Despite this, DOGE remained in a bearish trend, with its Relative Strength Index (RSI) below 40.

Source: TradingView

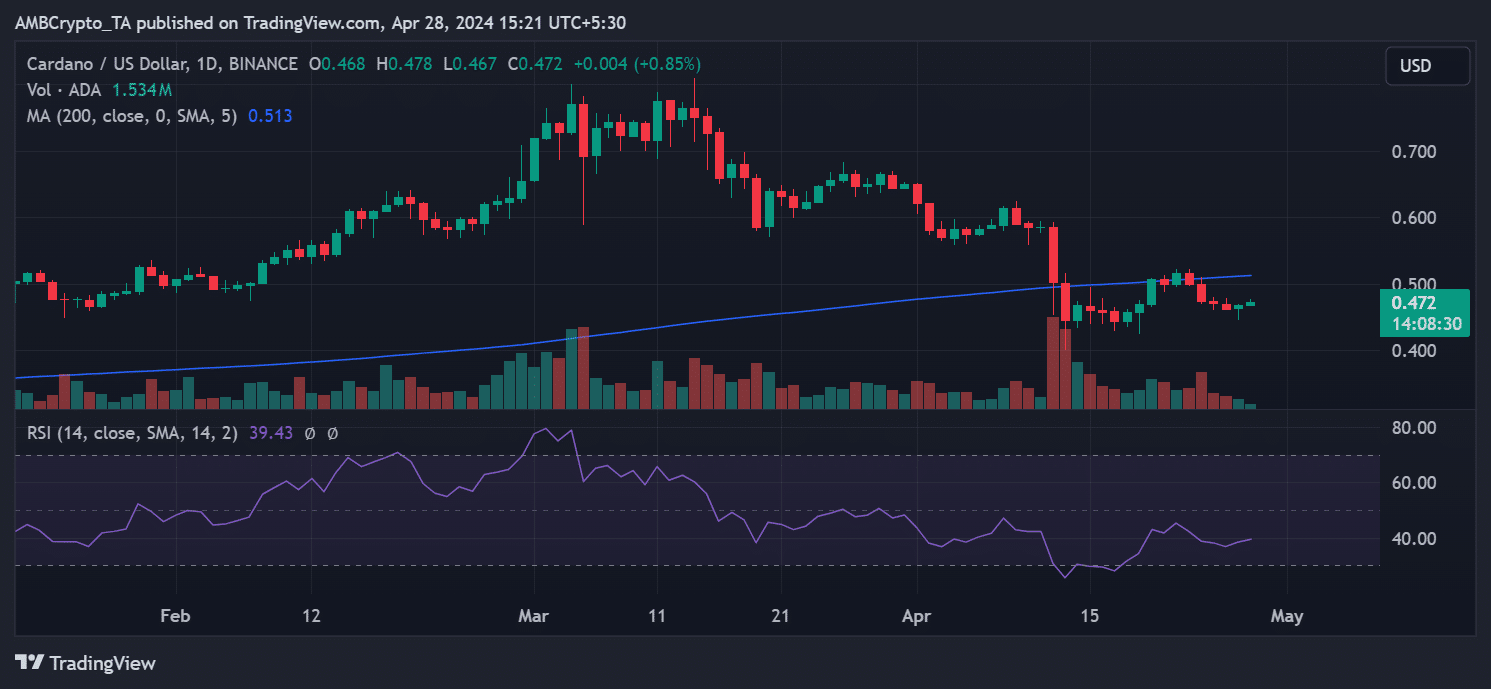

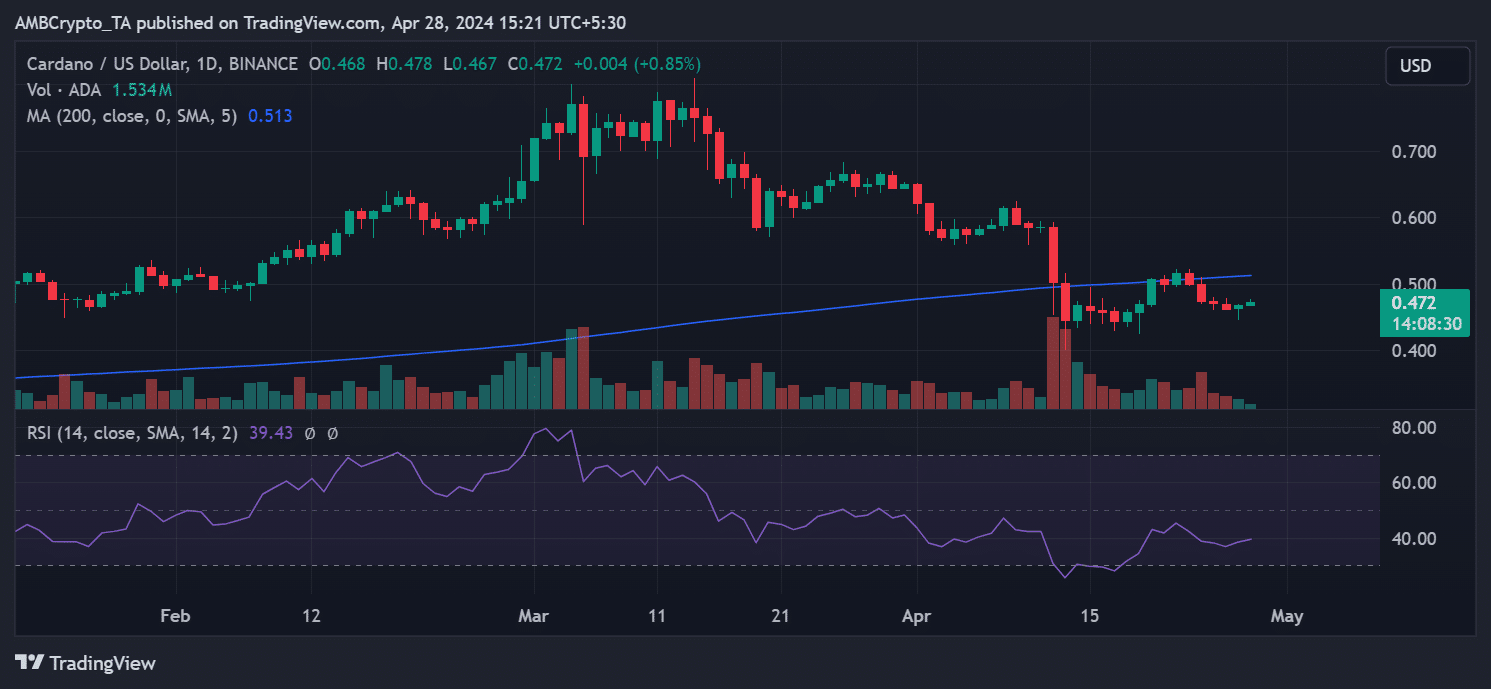

On the other hand, ADA’s analysis showed a decline in its value compared to three months ago. Approximately three months ago, ADA was trading around $0.5.

Although it briefly surged to the $0.7 range, it was unable to sustain this level, and by the end of March, it had dropped back to the $0.6 range.

At the time of this writing, ADA was trading at around $0.47, with a marginal increase of less than 1%. Similar to DOGE, ADA also remained in a bearish trend, with its RSI below 40.

Source: TradingView

Cardano goes negative, Dogecoin stays positive

The analysis of Cardano’s Funding Rate on Coinglass revealed a recent shift below zero after attempting to maintain levels above it for the past few days. At the time of this writing, the funding rate was at -0.0010%.

This indicated that sellers now dominate the ADA trade, suggesting an anticipated price decline. Additionally, it’s notable that trader activities remained low despite the positive sentiment it previously saw.

Read Cardano’s [ADA] Price Prediction 2024-25

In contrast, Dogecoin has sustained a positive sentiment, as its Funding Rate indicated. At the time of this writing, the DOGE funding rate was 0.011%, signifying that buyers are prevailing in the market.

This suggested an expected rise in Dogecoin’s price.