- Dogecoin may be poised for another 23.4% price drop

- Downtrend was noticeably strong on the daily timeframe

Dogecoin [DOGE] saw a spike in social sentiment recently, and its social media engagement has been on the rise too. This could help the price action turn bullish. However, at press time, the sellers’ dominance was too high.

The memecoin retested its July low at $0.09136 as support, with technical analysis showing that further losses may be likely.

Fibonacci extension levels mark the next target

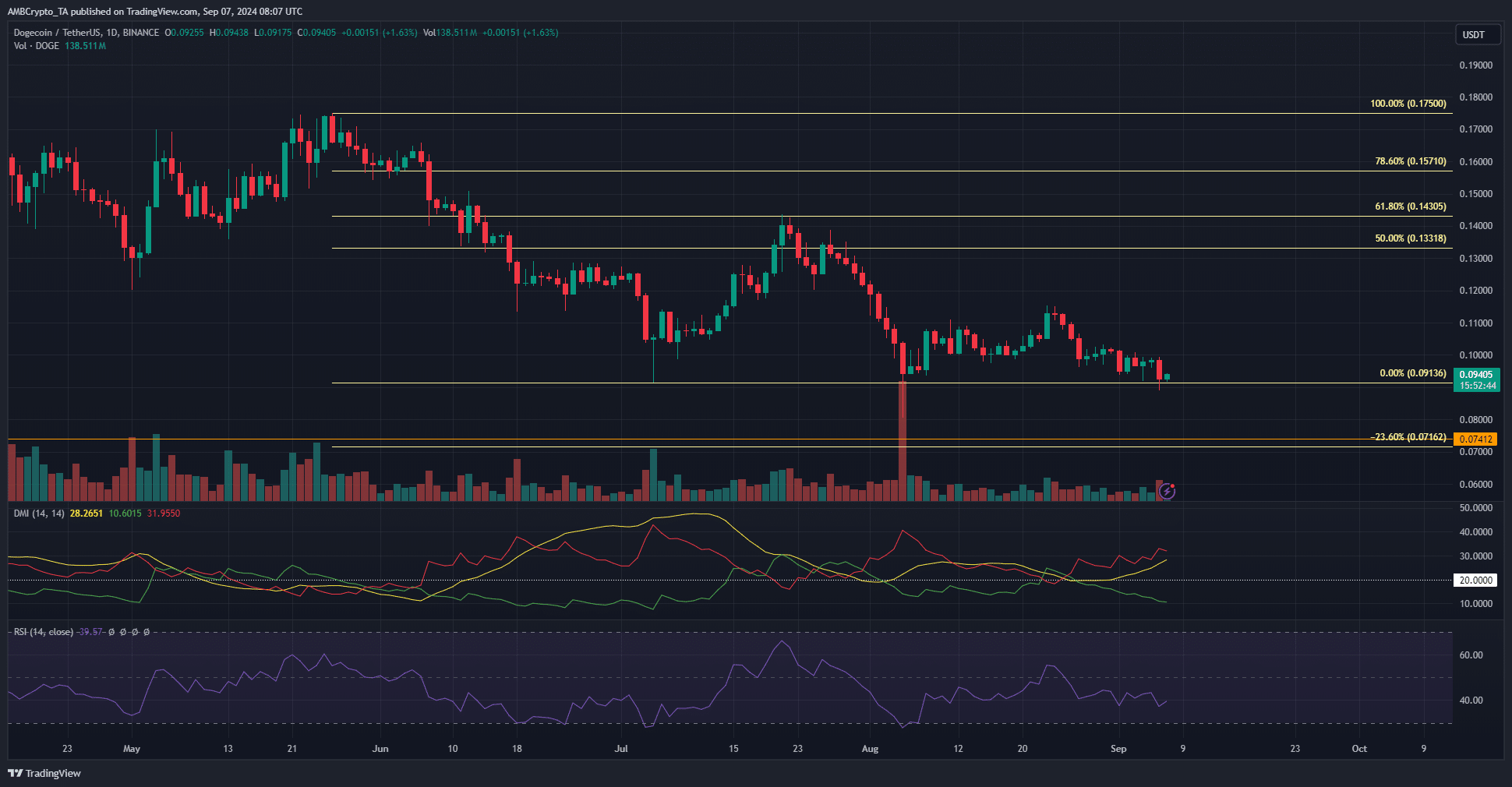

Source: DOGE/USDT on TradingView

The daily chart showed Dogecoin dipping towards the $0.09136 support level once again over the past two weeks. During this time, the downtrend regained its momentum. The RSI, which briefly raised its head above neutral 50, was forced into bearish territory.

The DMI indicator revealed that the -DI (red) and the ADX were both above 20 – Signaling a strong downtrend in progress. The trading volume was low during the attempted price bounce, underlining a lack of conviction in August.

The weekly and the daily structure were starting to align though. And, the Fibonacci extension level at $0.07162 may be the next target for DOGE if $0.09136 gives way.

Clues from exchange netflows and spot markets

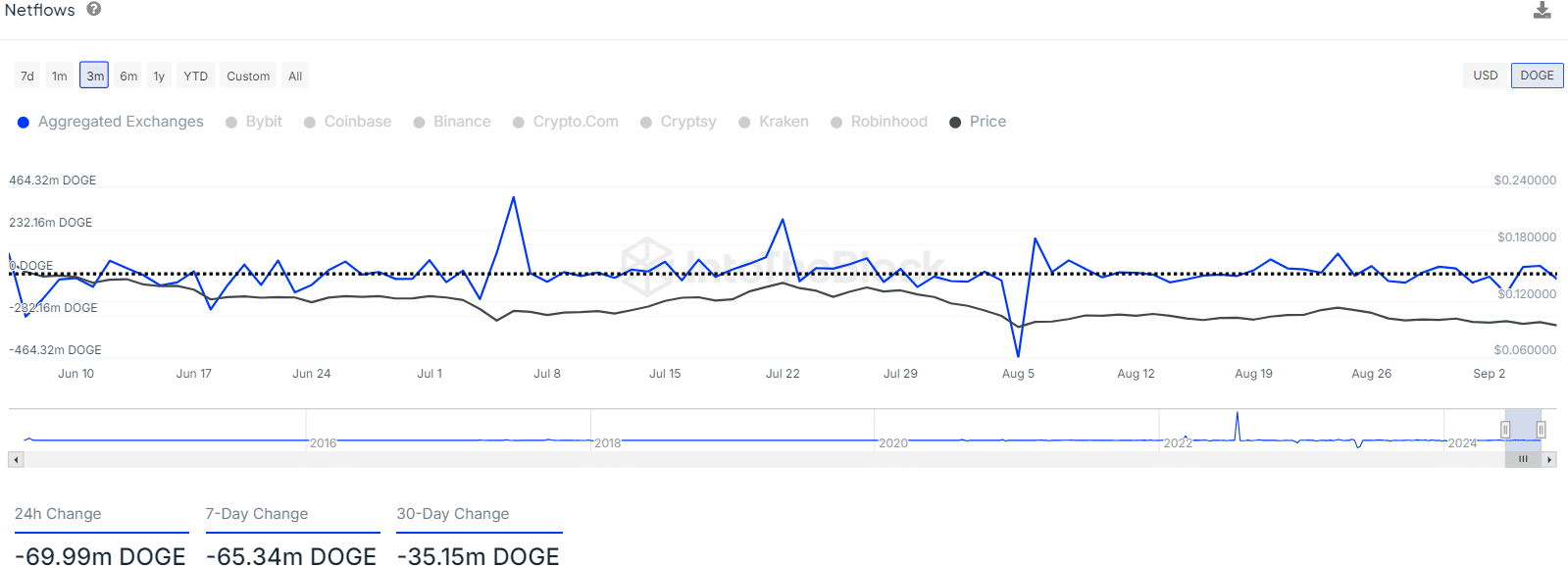

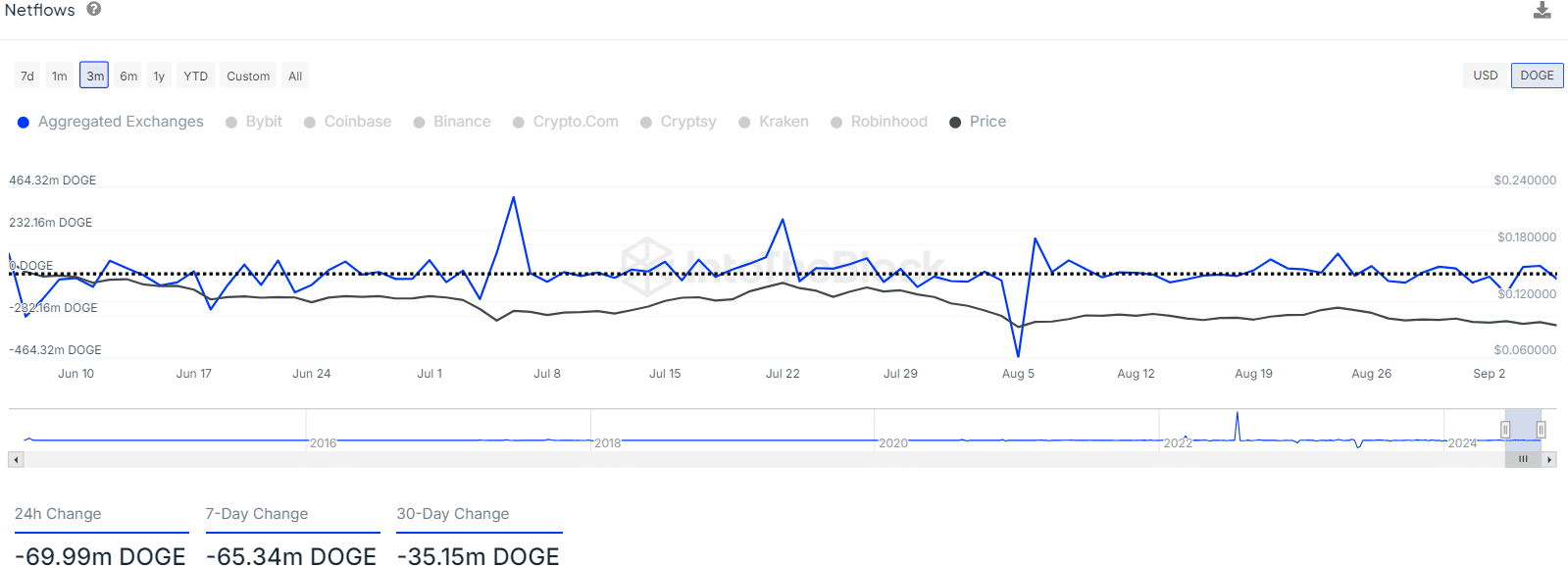

Source: IntoTheBlock

AMBCrypto looked at the exchange netflow data of the past three months too. Overall, the 35.15 million DOGE outflows over the past month were worth $3.211 million of accumulation. In the grand scheme of things, this value isn’t much for a $13.7 billion market cap asset.

And yet, this came at a time of intense selling pressure, and every little bit of accumulation helps the bullish argument.

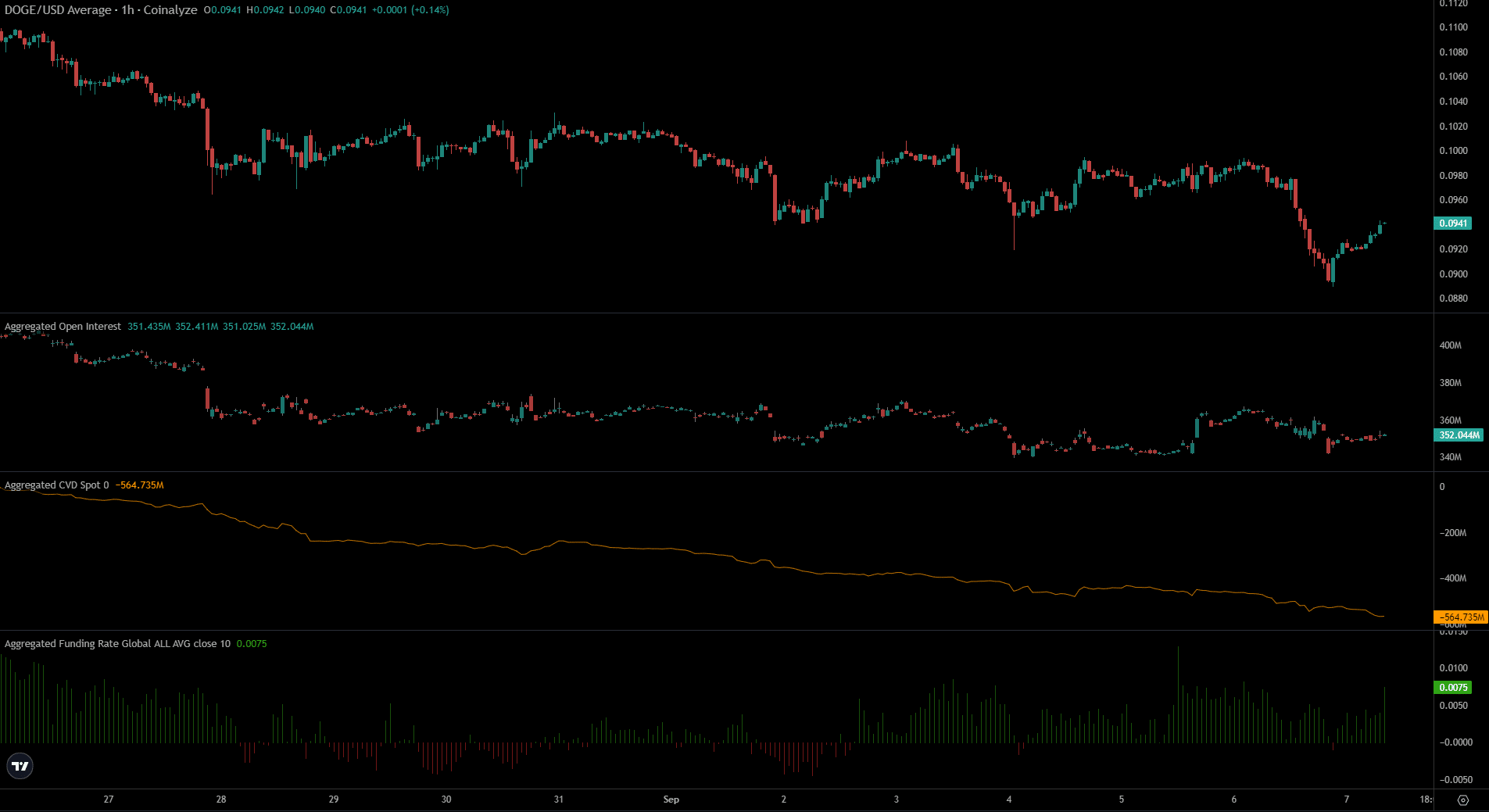

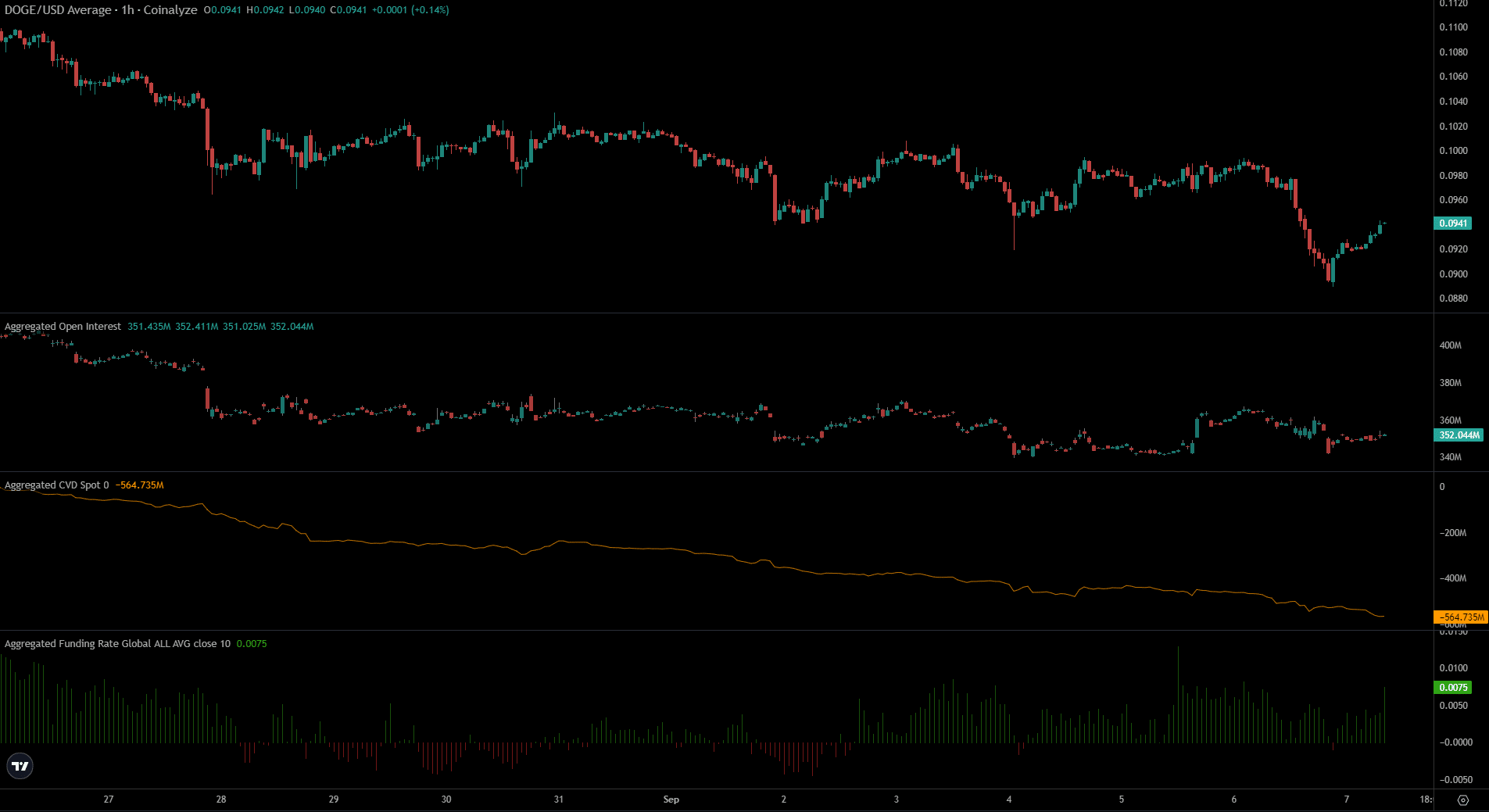

Source: Coinalyze

While some market participants moved their tokens out of exchange wallets, others remained eager to sell. Also, the spot CVD seemed to be in a continual downtrend over the past two weeks as prices steadily slumped.

Is your portfolio green? Check the Dogecoin Profit Calculator

The Open Interest flatlined between the $340 million to $360 million range. The most recent price drop on Friday, 6 August saw the Open Interest rise – A sign of short-selling and bearish sentiment.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion