While Bitcoin reclaimed its upward trajectory, rising 7.5% to surpass $100,000, Dogecoin’s price action paints a contrasting picture.

Despite reaching a 2024 high of $0.45 on 8th December – a level not seen since 2021 – the meme coin failed to sustain its gains, facing persistent rejection at this resistance. This barrier has proven critical, marking the third major rejection in the current market cycle.

Source: TradingView

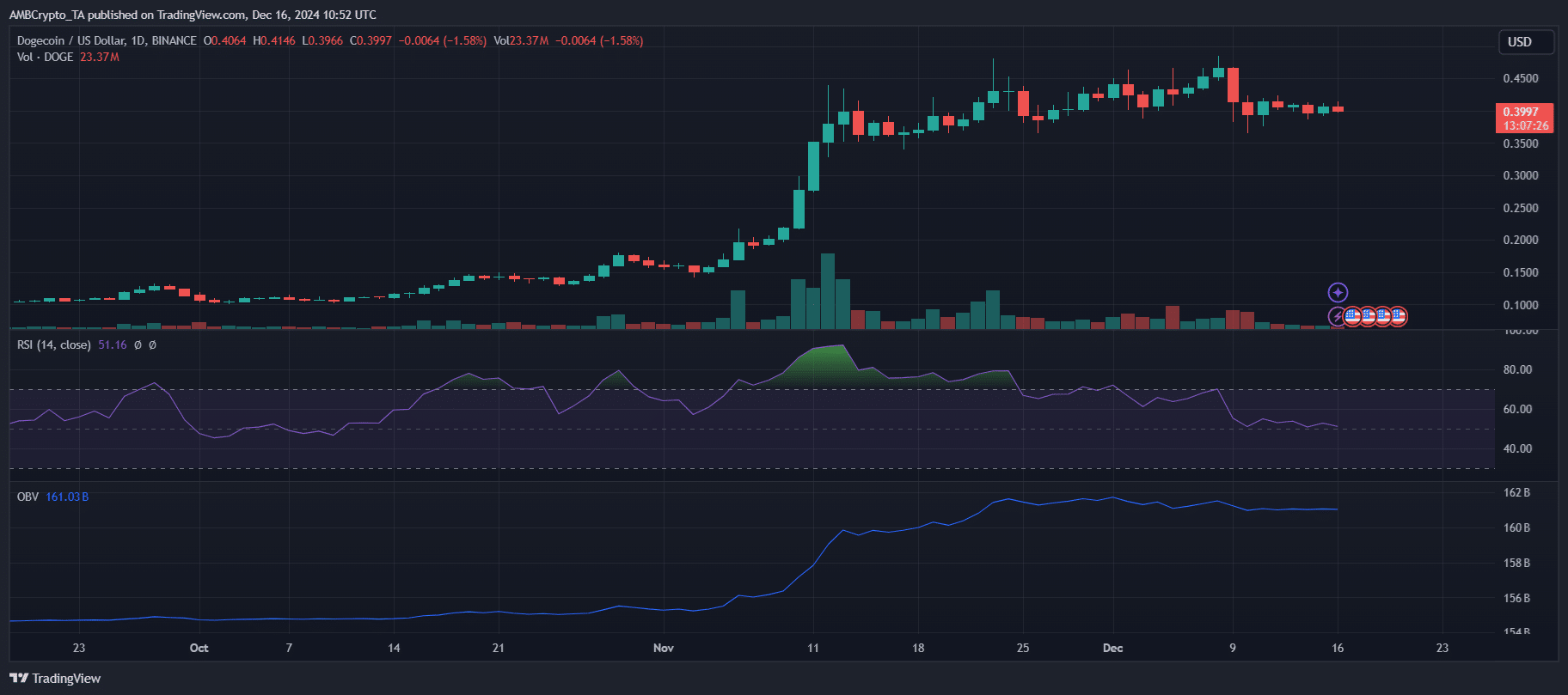

Trading at $0.3997 at press time, Dogecoin’s volume trends indicate weakening momentum, with diminishing buying pressure compared to earlier in December. Meanwhile, the RSI has dipped toward neutral territory at 51.16, reflecting waning bullish strength.

Dogecoin’s lack of correlation with Bitcoin’s rally underscores a concerning divergence for traders. With OBV stalling near 161B, the market suggests stagnating capital inflows, raising doubts about Dogecoin’s ability to reclaim upward momentum.

Is a DOGE ATH possible in this cycle?

Dogecoin’s ATH of $0.73, achieved during the May 2021 crypto bull run, remains a distant target. While the possibility of surpassing this price in the current cycle exists, the path ahead is fraught with challenges, particularly as Dogecoin diverges from Bitcoin’s ongoing rally.

The prevailing sentiment suggests that a Dogecoin resurgence may be possible, but it requires a catalyst. Historically, Dogecoin’s significant price movements have been driven by sudden surges in retail interest, often sparked by social media trends or rumors, such as potential use cases like payments on X.

For Dogecoin to eclipse its 2021 ATH, a similar wave of retail enthusiasm is necessary, accompanied by substantial trading volume and renewed participation from both retail and institutional investors.

A more realistic scenario for an ATH could materialize in early 2025, contingent upon broader macroeconomic shifts. These could include political changes, like the inauguration of Donald Trump, which could reignite optimism in the cryptocurrency sector and provide a potential catalyst for renewed Dogecoin price action.

Possible catalysts for DOGE’s fall

Several key factors could contribute to further price declines. One major risk is its increasing decoupling from Bitcoin’s price movements. As Bitcoin surges above the $100,000 mark, Dogecoin’s failure to maintain similar growth raises concerns about a potential shift in investor sentiment.

In late November, the Federal Reserve’s decisions on interest rates and inflationary pressure continued to weigh on risk assets like cryptos.

A tightening of monetary policy or sustained inflationary fears could lead to reduced investor appetite for speculative assets, impacting Dogecoin and other altcoins.

Furthermore, market sentiment around meme coins and speculative investments is notoriously volatile.