- Dogecoin’s price appreciated by more than 20% in the last seven days

- A few market indicators hinted at a correction in the near term

Dogecoin [DOGE] defied all odds last week with its impressive performance on the charts. That’s not all though as some signs seemed to suggest that this just might be the beginning of yet another massive bull rally.

In fact, the latest analysis revealed a bull pattern, one which can push DOGE’s price much higher.

Dogecoin awaits a major breakout

Dogecoin’s bulls clearly dominated the market last week as the memecoin’s price appreciated by more than 20% in the last seven days. In the last 24 hours alone, DOGE’s price surged by 4%. At press time, the world’s largest memecoin was trading at $0.1622.

AMBCrypto’s look at IntoTheBlock’s data revealed that after the aforementioned hike, 5.34 million DOGE addresses were in profit. This number accounted for 84% of the total number of Dogecoin addresses.

Source: IntoTheBlock

Amidst all this, Ali, a popular crypto analyst, shared a tweet highlighting a bull pattern on Dogecoin’s chart. According to the same, DOGE’s price surged sharply a few days ago. Following the same, DOGE’s price registered a slight correction.

However, this helped in forming a bullish flag pattern. At press time, DOGE was on the right track as it seemed to be approaching the upper limit of the pattern. A breakout above this flag pattern could push DOGE to $0.209 in the coming weeks.

Source: X

Interestingly, Elon Musk also played a major role in DOGE’s latest pump, something that has happened multiple times in the past.

AMBCrypto had previously reported how Musk’s X post included a Dogecoin image. This could have stirred up bullish sentiments, in turn pushing the memecoin’s price up sharply.

Will this uptrend sustain itself?

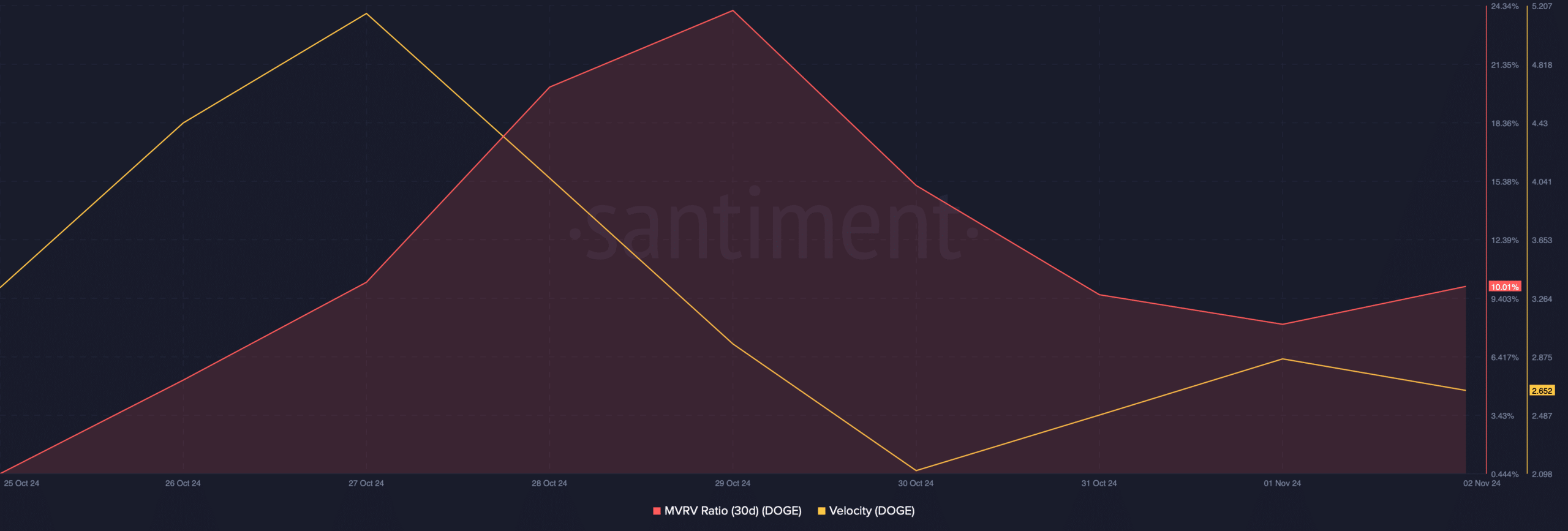

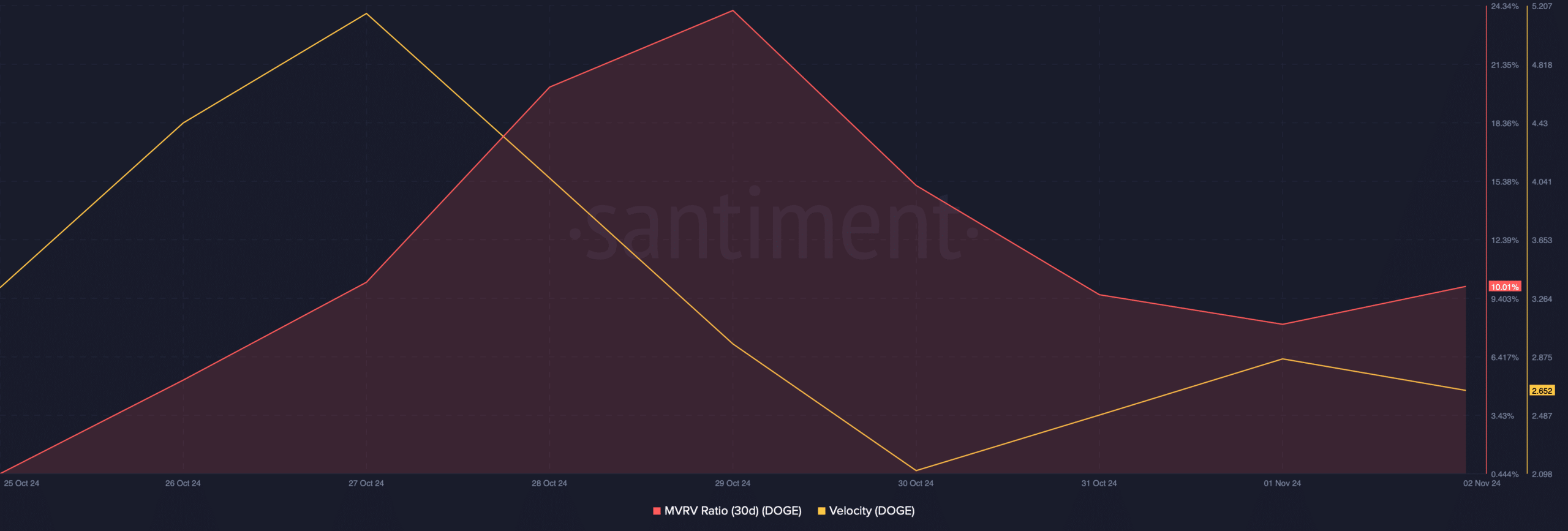

Since DOGE’s recent performance was bullish, AMBCrypto checked the memecoin’s on-chain data to find out the odds of Dogecoin sustaining its rally. According to Santiment, DOGE’s MVRV ratio dropped after spiking on 29 October.

Similarly, DOGE’s velocity also dropped, meaning that Dogecoin was used less often in transactions within a set timeframe. Both of these metrics suggested that DOGE might see a correction while consolidating inside a bullish flag pattern.

Source: Santiment

Finally, we assessed the memecoin’s daily chart to better understand whether a price correction is around the corner or if it will continue to climb.

Is your portfolio green? Check out the Dogecoin Profit Calculator

We found that Dogecoin’s Money Flow Index (MFI) registered a sharp downtick, hinting at a price decline. In case of a correction, DOGE might drop to its support near its 20-day SMA, from where the bulls will have an opportunity to regain control.

Source: TradingView