- Elon Musk reacts to Bitcoin’s pullback, highlighting market volatility and investor sentiment.

- Bitcoin’s 46% growth shows bullish sentiment, despite uncertainty around Cramer’s influence on price.

Amidst the whirlwind of headlines surrounding Tesla CEO Elon Musk, whose net worth has surged to a record-breaking $348 billion following Donald Trump’s victory in the U.S. presidential election, another intriguing development has caught the attention of the crypto world.

Jim Cramer’s crypto stance and community reaction

Musk recently expressed amusement over Bitcoin’s [BTC] sudden pullback in value, a shift that came on the heels of financial analyst Jim Cramer’s bullish stance on the cryptocurrency.

In a recent post on X, Musk responded with a laughing face and a “100%” emoji, reacting to a satirical take on the “Inverse Cramer” trend.

Source: Elon Musk/X

For those unfamiliar, the “Inverse Cramer” trend is based on the idea that following the opposite of financial analyst Jim Cramer’s advice could yield positive returns.

This concept gained enough traction that, in 2022, an exchange-traded fund (ETF) was launched, enabling investors to bet against Cramer’s predictions.

However, the ETF was eventually shut down earlier this year due to limited success.

Adding to the fray was a crypto analyst — Ali Martinez, who noted,

“Another sell signal.”

What happened so far?

Recently, Bitcoin experienced an impressive rally, reaching nearly $99,860 on major U.S. exchange Coinbase.

However, the optimism surrounding this surge could be fleeting, especially with financial expert and TV host Jim Cramer expressing a bullish stance on the cryptocurrency.

While the notion of counter-trading Cramer’s predictions has gained attention, there remains no conclusive evidence to suggest it is a consistently profitable strategy.

In fact, as of the latest data, BTC was trading at $98,074.06, reflecting a modest 0.72% increase in the past 24 hours, with a remarkable 46% growth over the past month.

Bitcoin’s future…

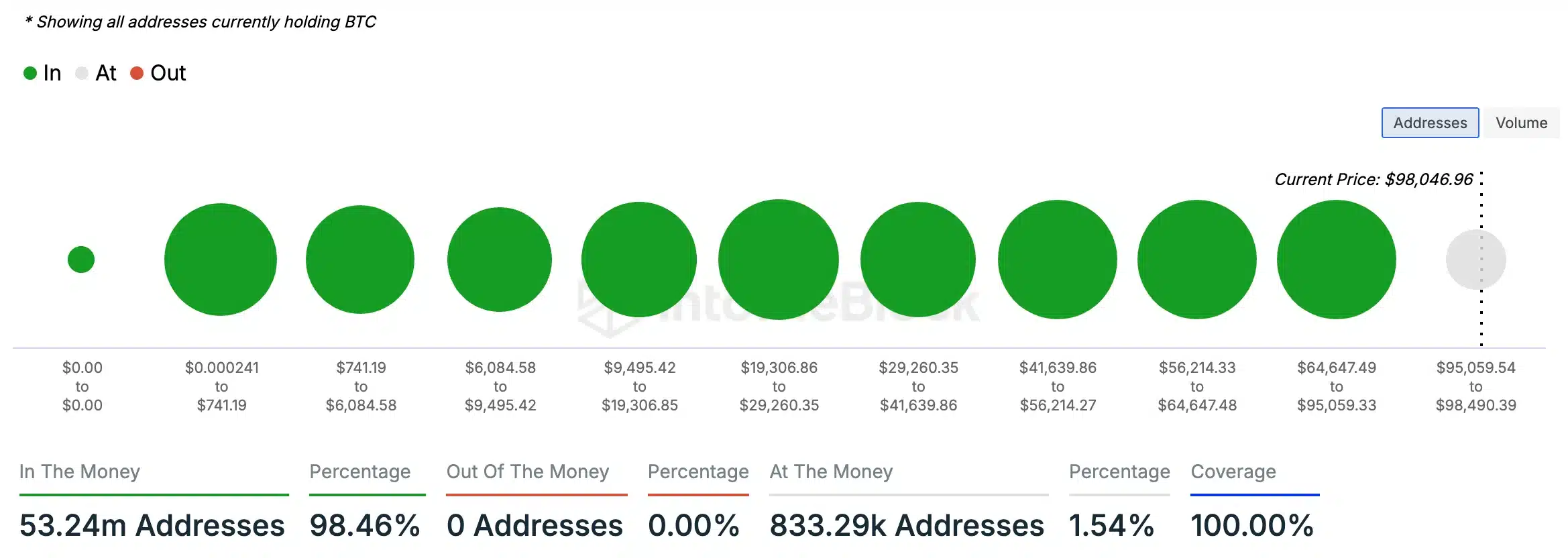

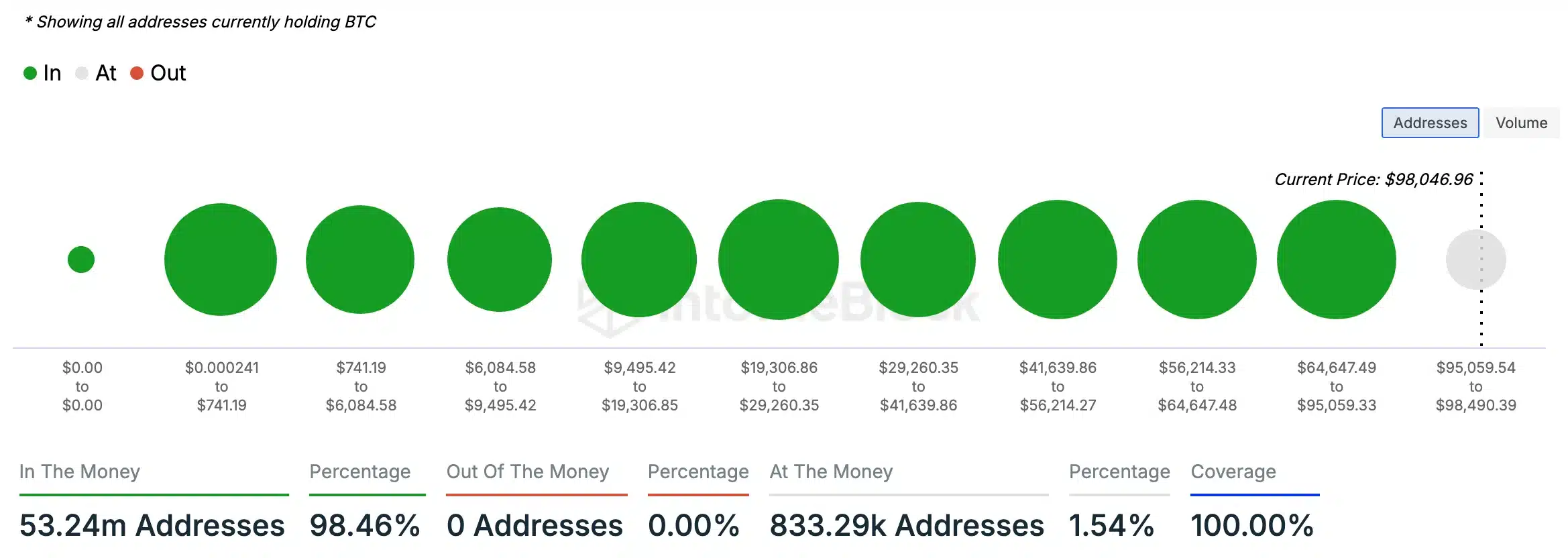

According to IntoTheBlock data analyzed by AMBCrypto, 98.46% of Bitcoin holders are currently in profit, with their tokens valued higher than the purchase price. This suggests a prevailing bullish sentiment.

In contrast, there were no BTC holders “out of the money.”

Source: IntoTheBlock

Thus, while Bitcoin’s future movements remain uncertain, these trends highlight the impact of market sentiment and external factors on its price direction.