- ETH was facing strong selling pressure as prices retrace from recent high.

- Ethereum whales offloaded 5,677.7 ETH tokens worth $14.03 million.

After market recovery, Ethereum [ETH] prices surged from a low of $1.7k to a local high of $2.6k. However, since hitting these levels, the altcoin has retraced, recording three consecutive days of losses.

In fact, at press time, Ethereum was trading at $2457. This marked a 3.97% decline on daily charts.

With ETH starting to decline, the question is what’s pushing prices down?

Ethereum’s selling activity soars

AMBCrypto’s analysis highlights strong profit realization among Ethereum investors. After being underwater for two months, they are now aggressively taking profits.

The trend is especially noticeable among Ethereum whales, with OnChainLens reporting significant sell-offs.

One whale withdrew 4,677.7 WETH from Aave V3 and sold it for 11.52 million USDC at $2,463 per ETH. This whale originally bought the ETH tokens a month ago for $6.8 million USDC, securing a $4.717 million profit.

Another whale deposited 1,000 ETH worth $2.51 million into Kraken after holding it for four years.

Initially, this whale had withdrawn and received 2,693 ETH worth $5.7 million from Binance US, Coinbase, and a Tornado Cash wallet. After the recent transaction, the whale still holds 1,693 ETH valued at $4.13 million.

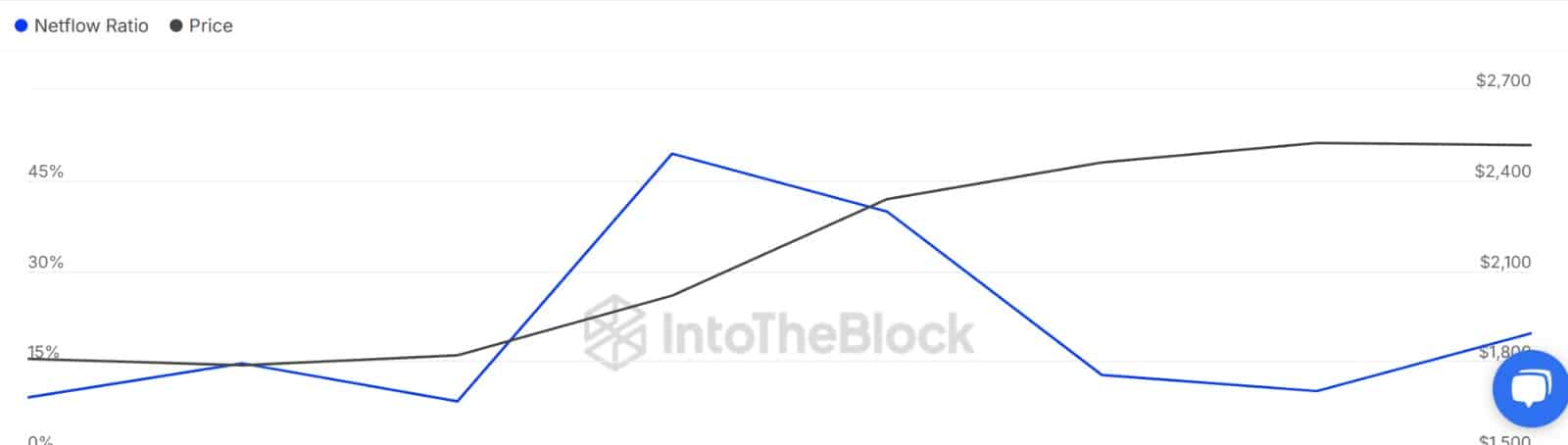

Source: IntoTheBlock

Selling activity appears widespread among Ethereum’s large holders. The Large Holders Netflow to Exchange Netflow Ratio dropped to 10% when ETH reached $2.5K.

As prices declined, large holders resumed selling, pushing whale exchange flow up to 19%. This marks a 9% increase in whale-to-exchange activity in the past day, signaling intensified selling pressure.

Source: CryptoQuant

With whales turning to selling, it seems most market participants, even retailers, and sharks are selling. When we look at Ethereum Exchange Netflow, it has turned positive after four days of consecutive negative netflows.

A positive netflow suggests that exchanges are experiencing more deposits than withdrawals, reflecting higher selling activity.

Source: Santiment

As such, Ethereum’s scarcity has declined as there’s an increase in the amount of ETH available to sell.

Thus, the ETH Stock-to-Flow Ratio has declined from a weekly high of 47 to 18, at the time of writing. This reflects growing supply on exchanges, which is usually a bearish signal as oversupply leads to lower prices.

What’s next for ETH?

Increasing whale sell-offs have negatively impacted ETH markets, as seen in recent trends. Typically, higher selling pressure drives prices lower as investors offload to secure profits or avoid deeper losses.

If the current selling activity persists, ETH may face further declines, potentially finding support around $2,188. However, if buyers seize the retrace as an entry opportunity, ETH still has growth potential.

In that case, it could attempt a rise toward $2,864.