- The on-chain metrics showed bulls were eager to go long.

- The age consumed metric signaled caution while other metrics showed.

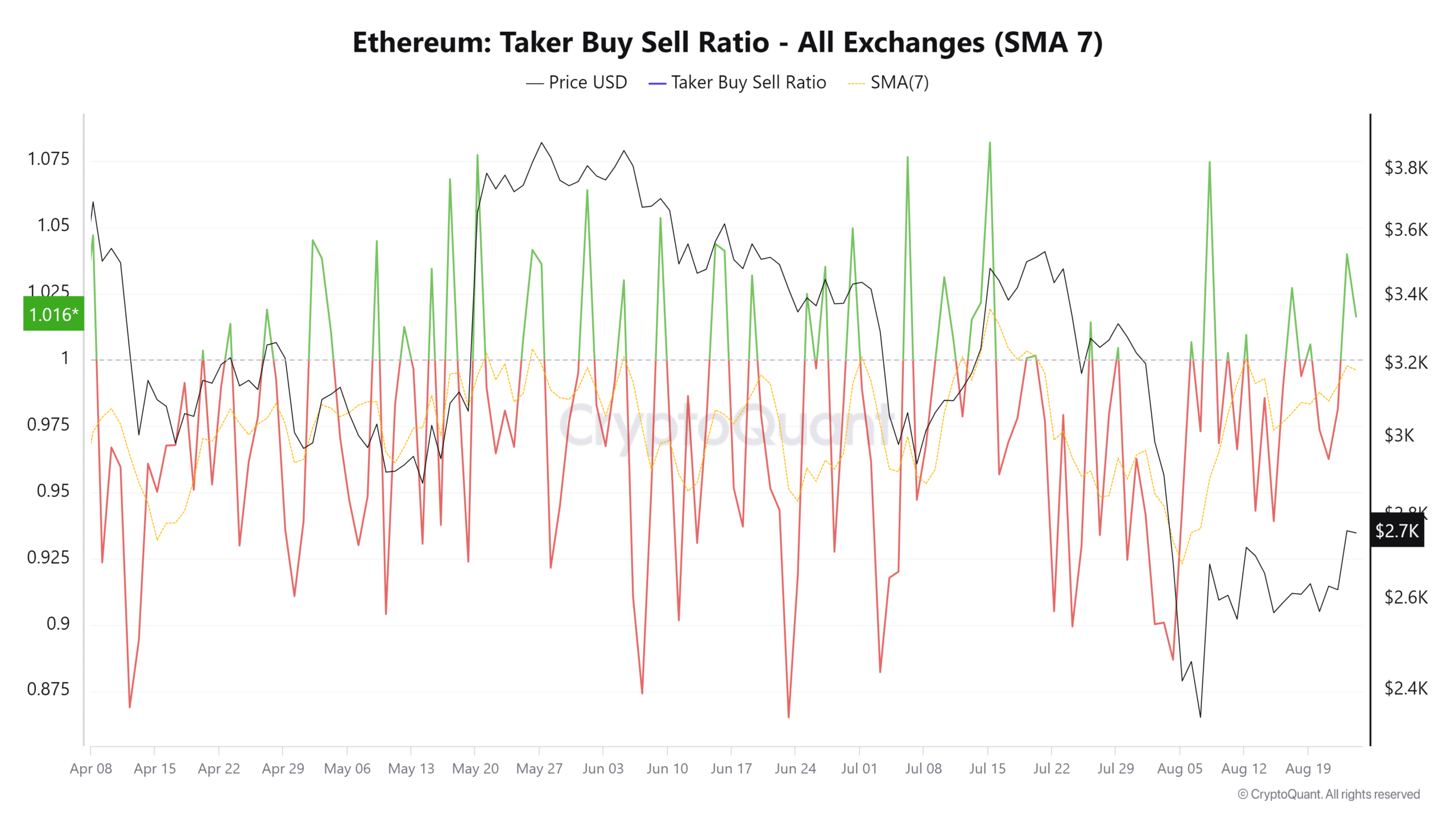

The taker buy/sell ratio shot skyward for Ethereum [ETH] over the past couple of days. This metric tracks the taker buy volume to sell volume ratio. Values below 1 indicate bearish sentiment.

Source: CryptoQuant

Taker refers to the nature of the order placed, being a market order rather than a limit order. This means these traders are willing to pay a slight premium to execute the trade at market prices. Hence, this ratio helps gauge sentiment.

Ethereum on the way to recovery

On the 31st of July, Ethereum was trading at $3.2k. Since the 20th of July, the taker buy/sell ratio has been negative, showing bearish sentiment was dominant. After the dump on the 5th of August, the market bounce encouraged long positions.

The metric’s spikes on the 8th of August and on the 23rd of August, while bullish, might not be indicative of a sustained recovery.

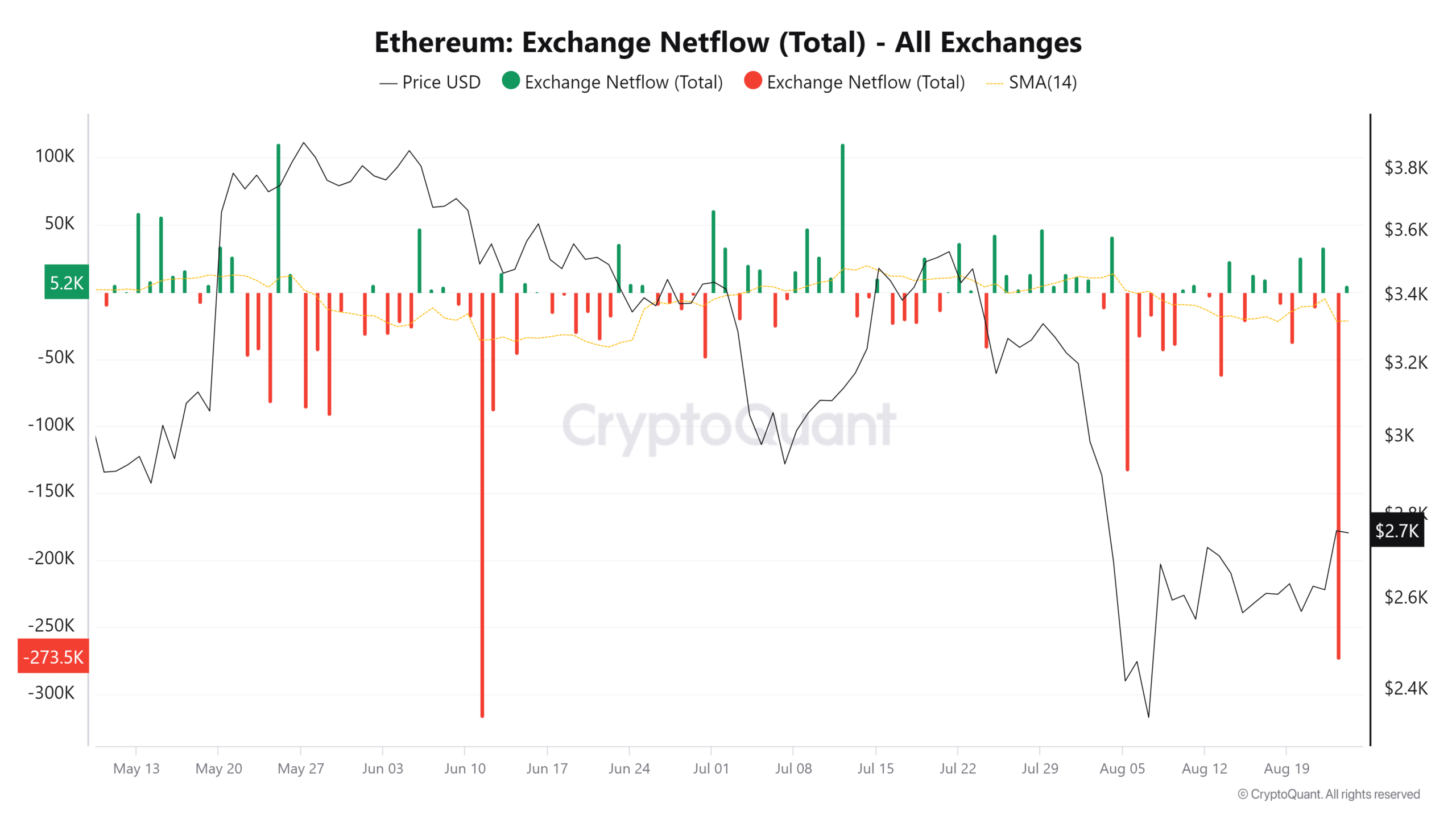

Source: CryptoQuant

The flow of Ethereum from exchanges could shed more light on this. On the 23rd, there was a huge outflow of ETH that indicated accumulation. The 14-day simple moving average has resumed the downtrend it was on after the early August price drop.

This was an encouraging sign and could push prices toward the $3k resistance zone.

Should traders anticipate a breakout past $3k?

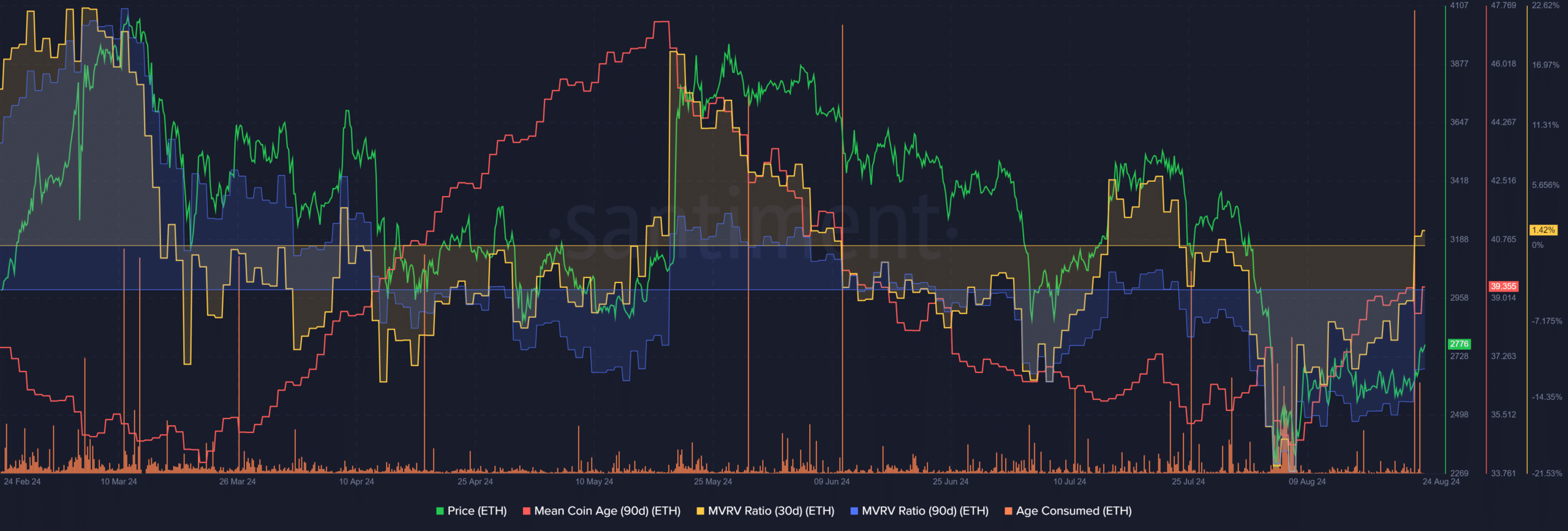

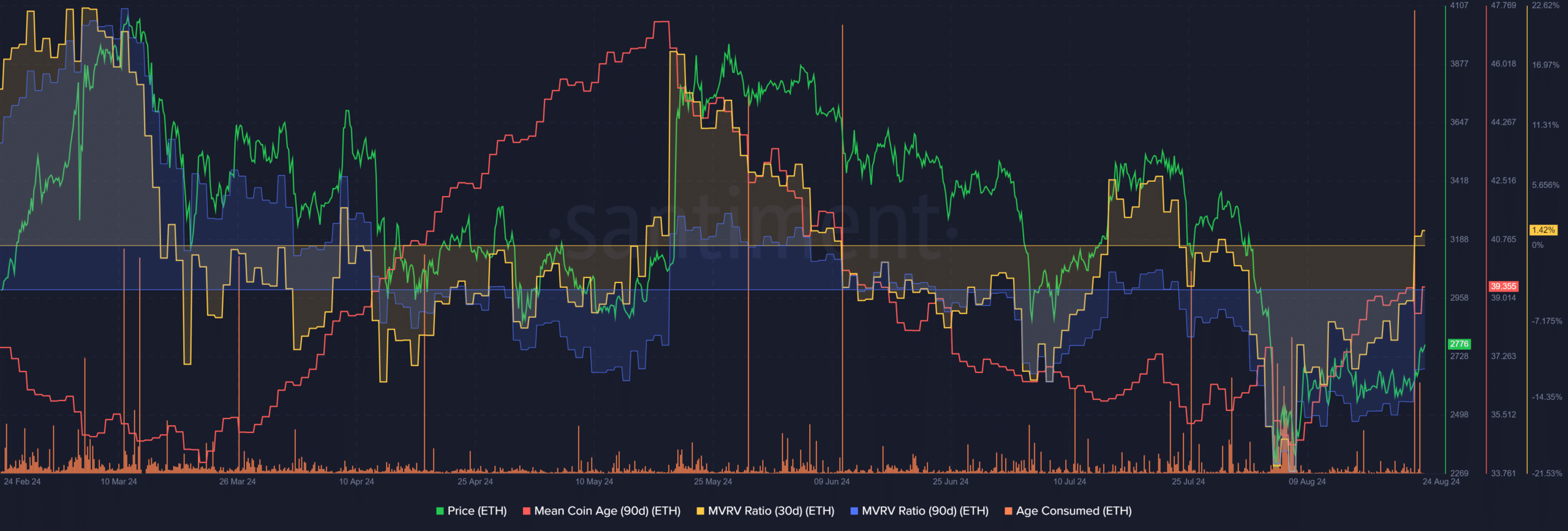

Source: Santiment

The 30-day MVRV stepped into the positive territory to indicate short-term holders at a marginal profit. The 90-day MVRV was still deeply negative. Meanwhile, the mean coin age has trended higher over the past three weeks.

This signaled network-wide accumulation, reinforcing the bullish idea from the netflows metric. However, the age-consumed metric saw a massive spike to show increased token movement.

Is your portfolio green? Check the Ethereum Profit Calculator

The drop in the network gas fee meant the ETH supply could turn inflationary over time, and could negatively impact ETH over the long term.

Such movements generally signal a wave of selling. Traders should be wary of selling pressure over the weekend and exercise caution during Monday’s trading session.