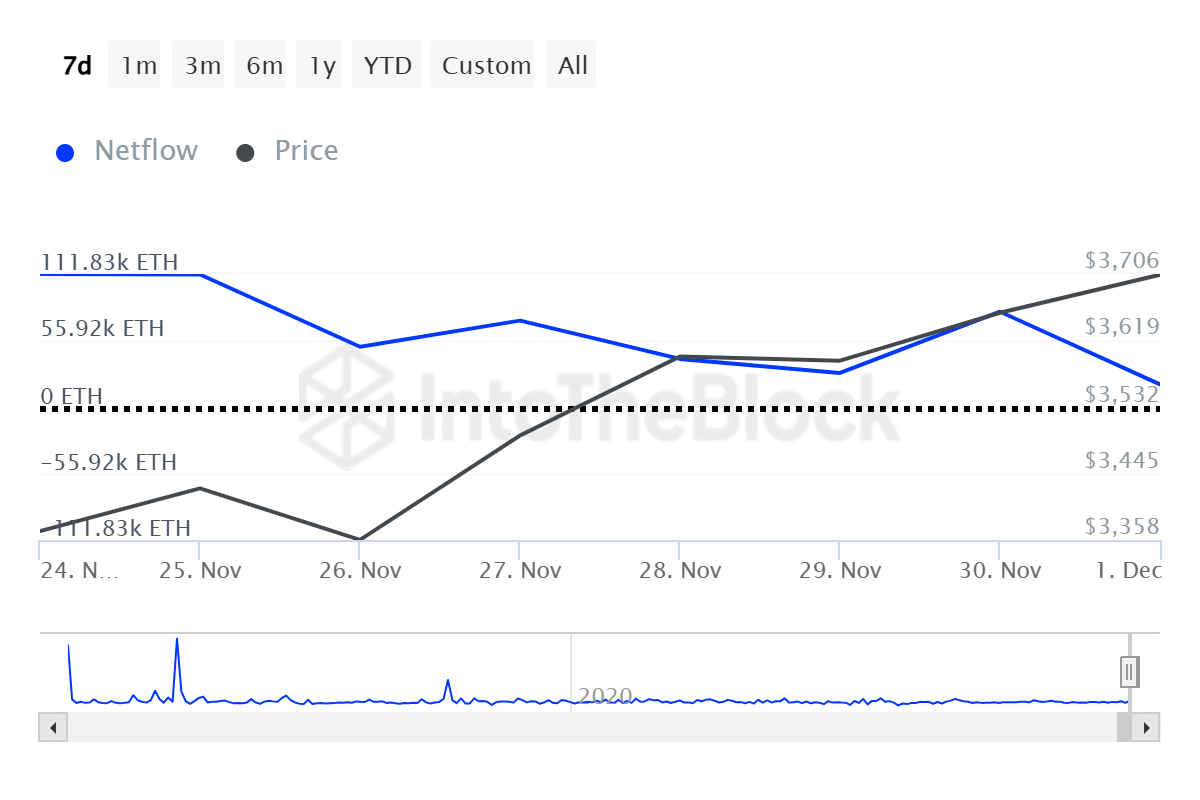

Ethereum whales netflow signals a shift in market behavior

Source: Into The Block

Recent data revealed a significant uptick in Ethereum’s whale netflow, with large holders accumulating over 111,000 ETH ($188 million) in just two days.

The netflow chart showcased a sharp influx on the 24th of November, followed by a gradual decline, reflecting a strategic accumulation phase.

Interestingly, this surge coincides with ETH reclaiming the $3,600 level, suggesting whales are betting on further upside.

Positive netflows typically indicate growing confidence among institutional and high-net-worth investors, often preceding bullish price action.

However, sustained inflows will be critical to maintaining this momentum, particularly as Ethereum approaches the psychologically significant $4,000 resistance.

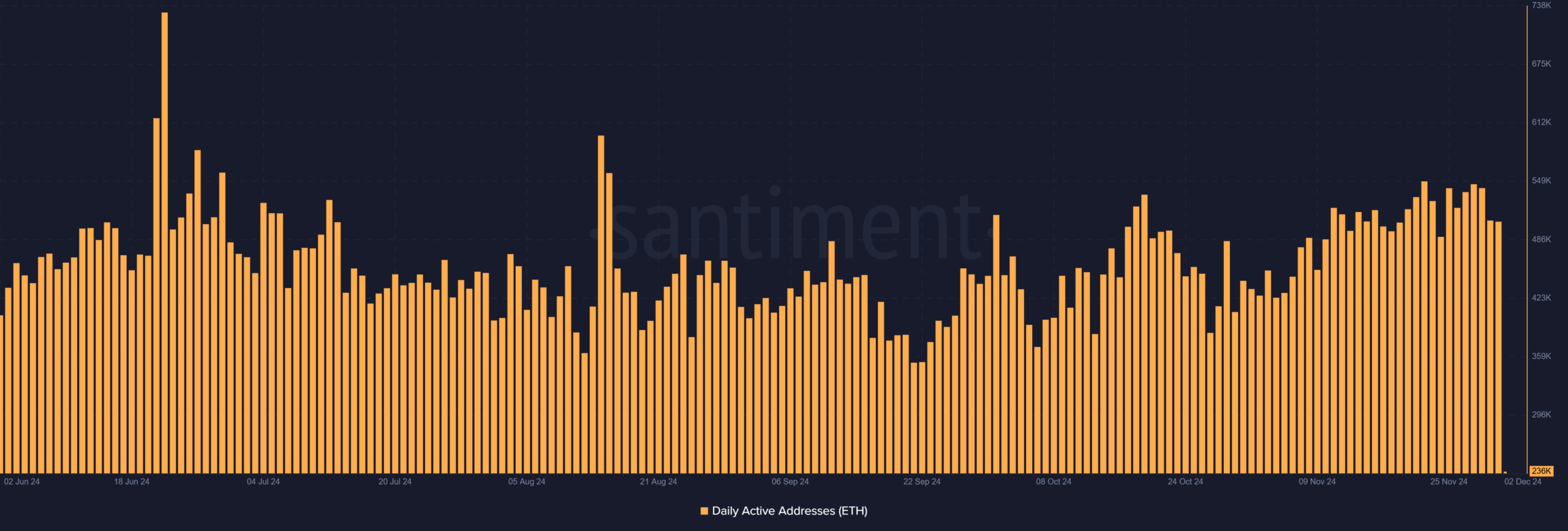

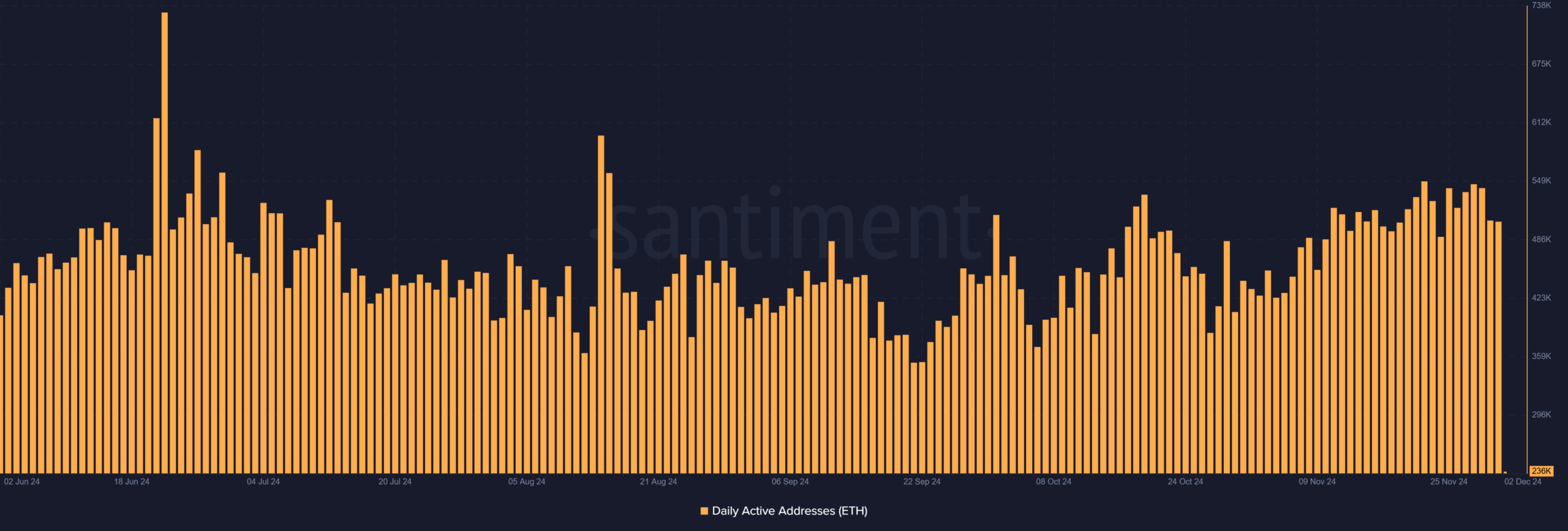

Retail interest in ETH soars

While whale accumulation leads, retail activity in Ethereum was seeing notable growth.

The daily active Ethereum addresses showed consistent engagement, peaking at over 500,000 active users in late November 2024, indicating sustained participation from retail traders.

Source: Santiment

Additionally, Ethereum’s DeFi ecosystem expansion and anticipation surrounding the Shanghai upgrade are further fueling optimism.

However, while retail-driven rallies tend to generate momentum, they also carry the risk of increased volatility, suggesting caution as ETH eyes the $4,000 mark.

What’s next for Ethereum?

Ethereum’s future trajectory will depend on its ability to break through the critical $4,000 resistance level. If it manages this, a rally toward $4,500 could be in the cards, supported by strong whale and retail participation.

Additionally, Ethereum’s growing utility is evident in its expanding DeFi ecosystem and NFT market dominance, where sales on Ethereum-based platforms saw a significant increase recently, despite some market fluctuations.

However, risks remain. A broader crypto market correction, particularly if Bitcoin falls below $94,000, could stall ETH’s momentum.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Also, rising gas fees might discourage retail adoption, limiting potential price growth.

For now, Ethereum’s bullish outlook remains intact, but its ability to maintain buying pressure across institutional and retail segments will be crucial for continued success.