- Ethereum whales jumped on the “dip” as prices slid to $2.3K.

- Despite a slight rebound, uncertainty still looms.

Ethereum [ETH] was grappling with its toughest market cycle yet, posting a weekly decline of over 6%. As the worst performer among the top five altcoins, this downturn prompts critical questions about its future.

Faced with increasing competition from Solana [SOL] and evolving market dynamics, Ethereum’s resilience will undergo a significant test in the coming weeks, especially as there is…

Too much leverage in the market

Historically, a spike in the Margin Lending Ratio has triggered forced selling, resulting in a price decline until the ratio returns to normal levels.

Source: Hyblock Capital

In simpler terms, when this ratio rises sharply, it signals that too many traders are borrowing to bet on higher prices, which often leads to a market pullback.

This trend serves as a warning for traders to trade carefully, as it usually precedes a market correction.

Recently, the ratio surged from 38 to 72, indicating heavy borrowing of USDT. While long positions can indicate bullish sentiment, they can also create problems, particularly in a volatile market.

If prices begin to fall, traders who borrowed funds may need to sell their assets quickly to cover their loans, causing further price drops.

This pattern has been observed before, where a sudden rise in borrowing signals potential near-term trouble. Therefore, Ethereum might be poised for further declines if bulls fail to step in and support the price.

Ethereum is near a crucial support line

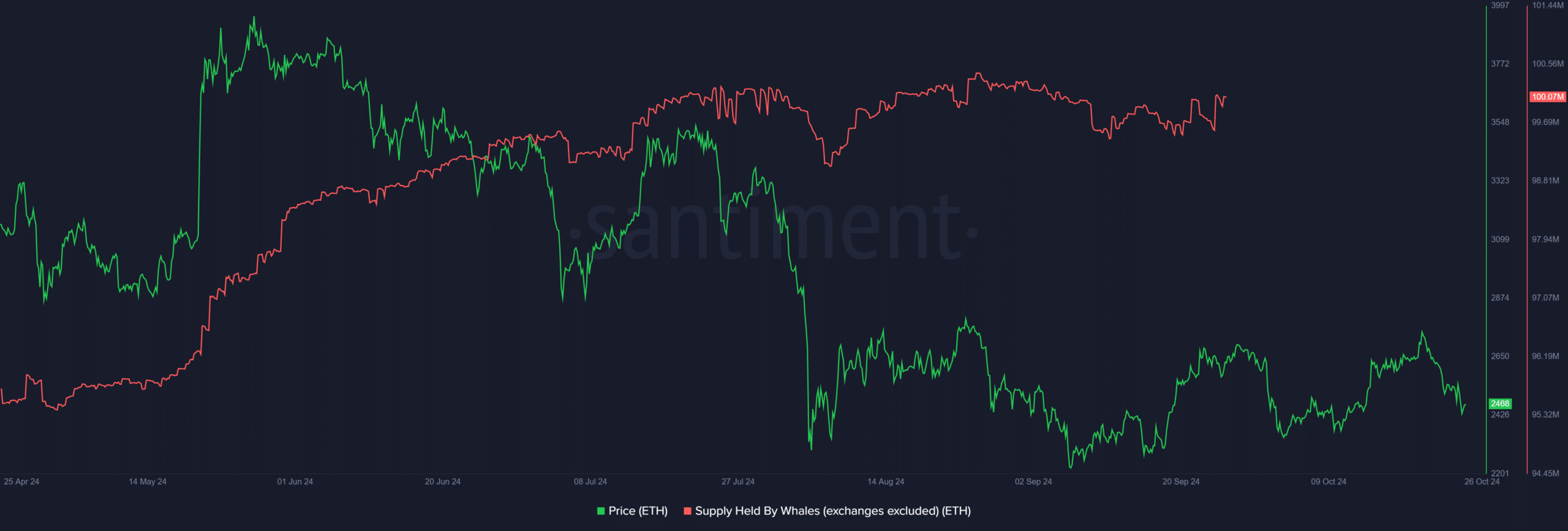

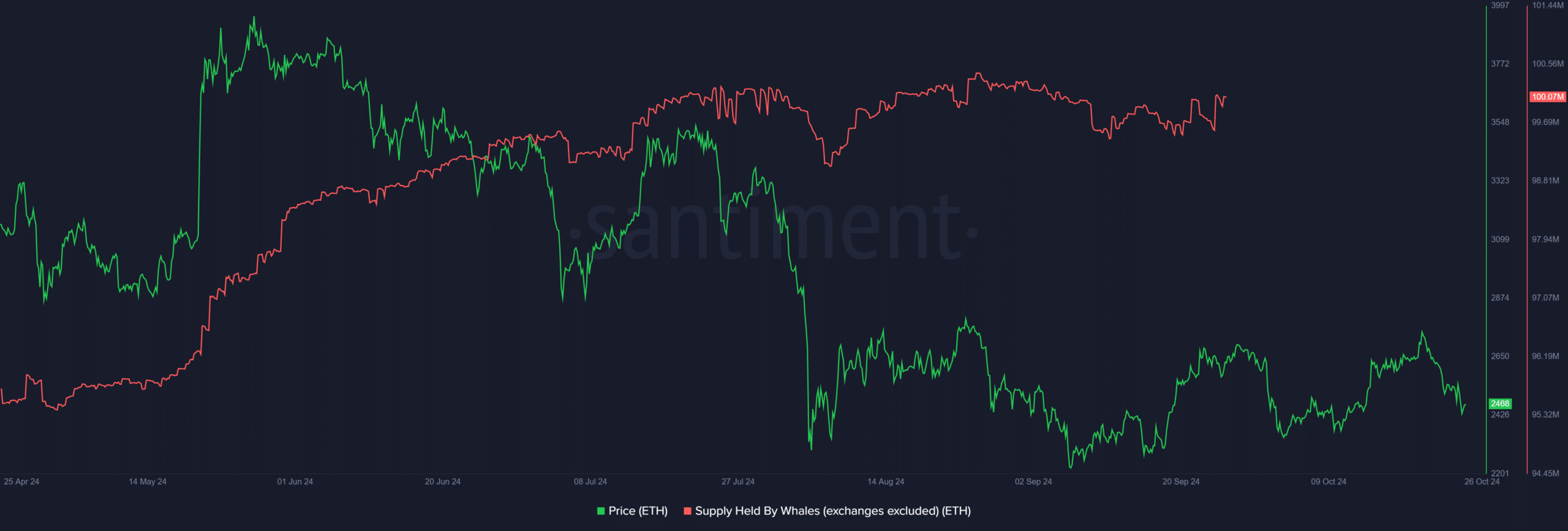

In a recent post on X (formerly Twitter), Santiment pointed out a vital development that could help Ethereum avoid a retracement.

Trading at $2,468 at press time, ETH has hit a significant support line that has been tested four times in less than two months.

This repeated testing reinforces the idea that the current price may present a solid dip-buying opportunity.

Additionally, Ethereum’s whale activity has surged to a six-week high as its price fell to $2,380 on the 25th of October. This uptick in whale transactions indicates accumulation by major stakeholders with significant capital.

Source: Santiment

While the current price level may attract investors, it doesn’t guarantee an immediate bounce. Nevertheless, this trend is certainly encouraging.

However, uncertainty lingers due to the excessive volatility resulting from a spike in open interest (OI) to $13 billion, which makes ETH more susceptible to sudden price swings.

A large influx of long positions could be triggered, especially if Bitcoin continues its downward trend.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Keeping that in mind, closely monitoring the $2.4K support level will be essential. A likely divergence could push ETH closer to $2.3K, potentially setting the stage for a reversal.

With Futures traders currently holding significant influence, Ethereum’s next move may ultimately rest on how this support level holds in the coming sessions.