- Ethereum’s exchange reserve was dropping, signaling high buying pressure.

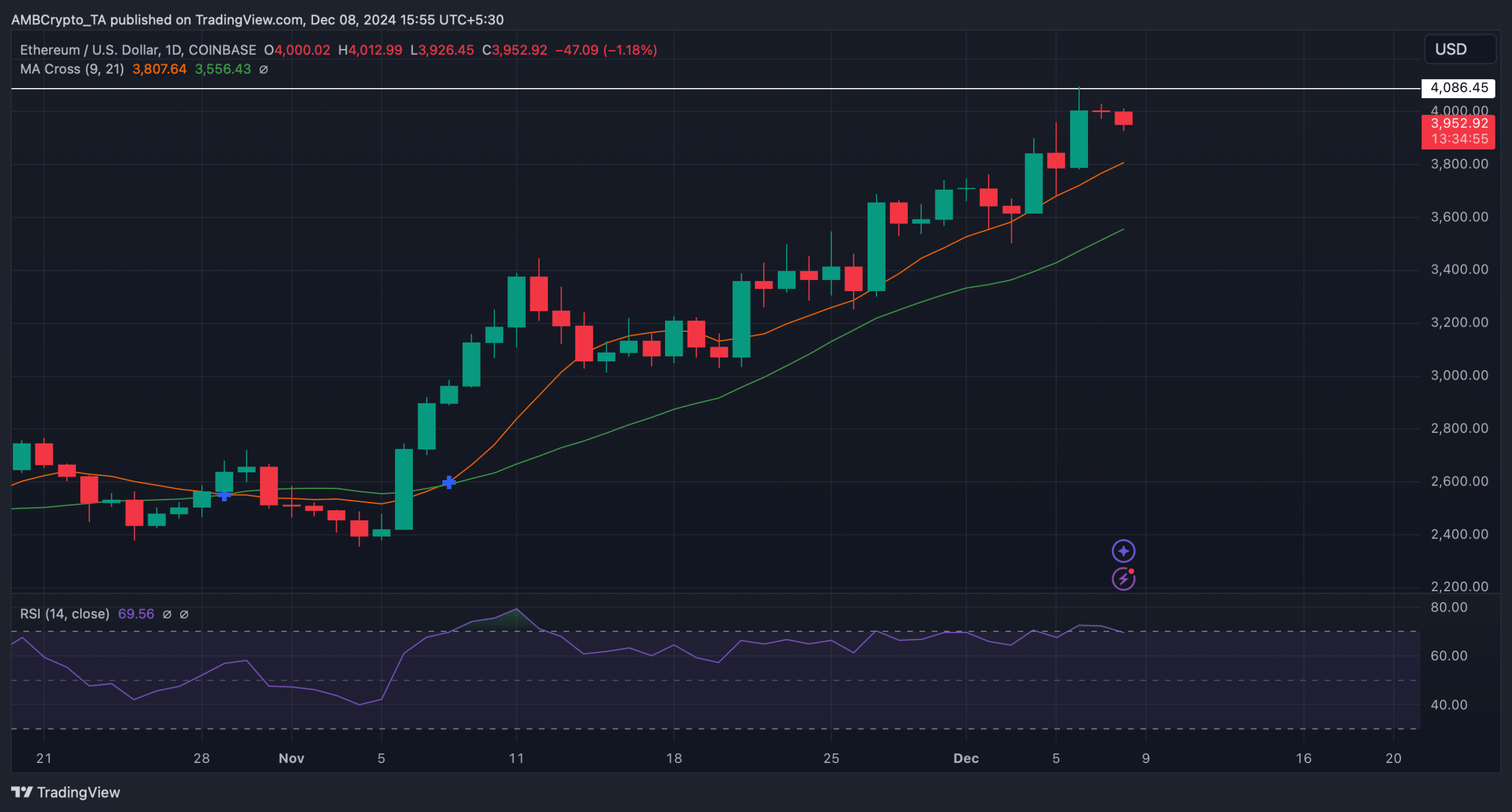

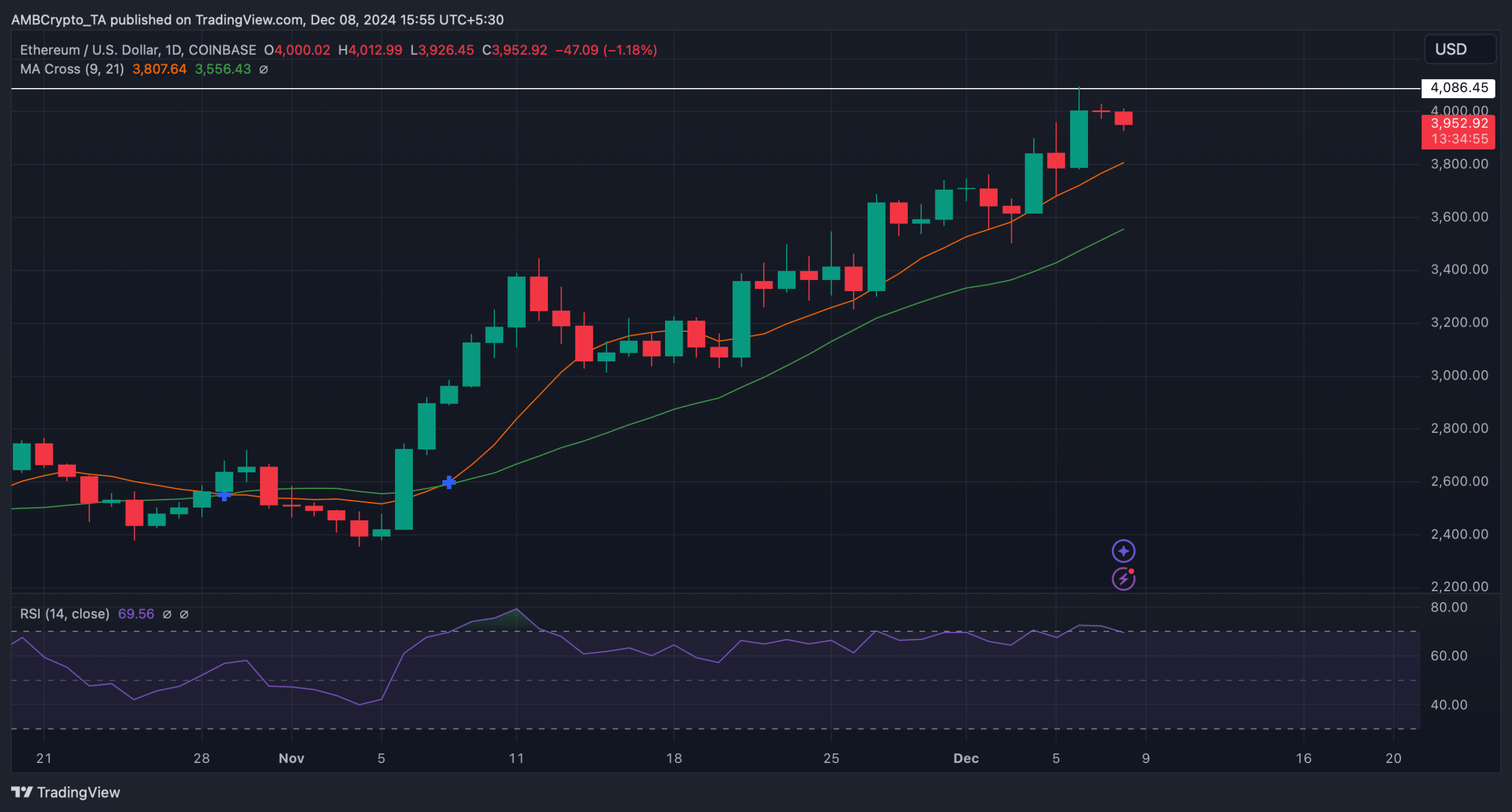

- However, the RSI was resting in the overbought zone.

Ethereum [ETH] has been struggling to breach the $4k barrier for quite some time now, as it is getting rejected near the resistance.

However, latest analysis revealed that the path for ETH moving towards a new all-time high is pretty clear. Therefore, AMBCrypto investigated further to find out whether that’s actually the case.

Ethereum is on the right track

ETH’s price registered a 7% price hike last week, pushing the token’s price near $4k. At the time of writing, ETH was trading at $3.05k with a market capitalization of over $476 billion.

In the meantime, Ali Martinez, a popular crypto analyst, posted a tweet revealing that there was nothing preventing ETH from reaching new all-time highs. The only modest resistance zone ahead was around $4,540.

But as long as the $3,560 demand zone holds, the odds favor the bulls.

Will ETH touch $4.5k soon?

Since Martinez’s tweet revealed the possibility of ETH touching $4.5k, AMBCrypto assessed the token’s on-chain metrics to find the likelihood of that happening in the short term.

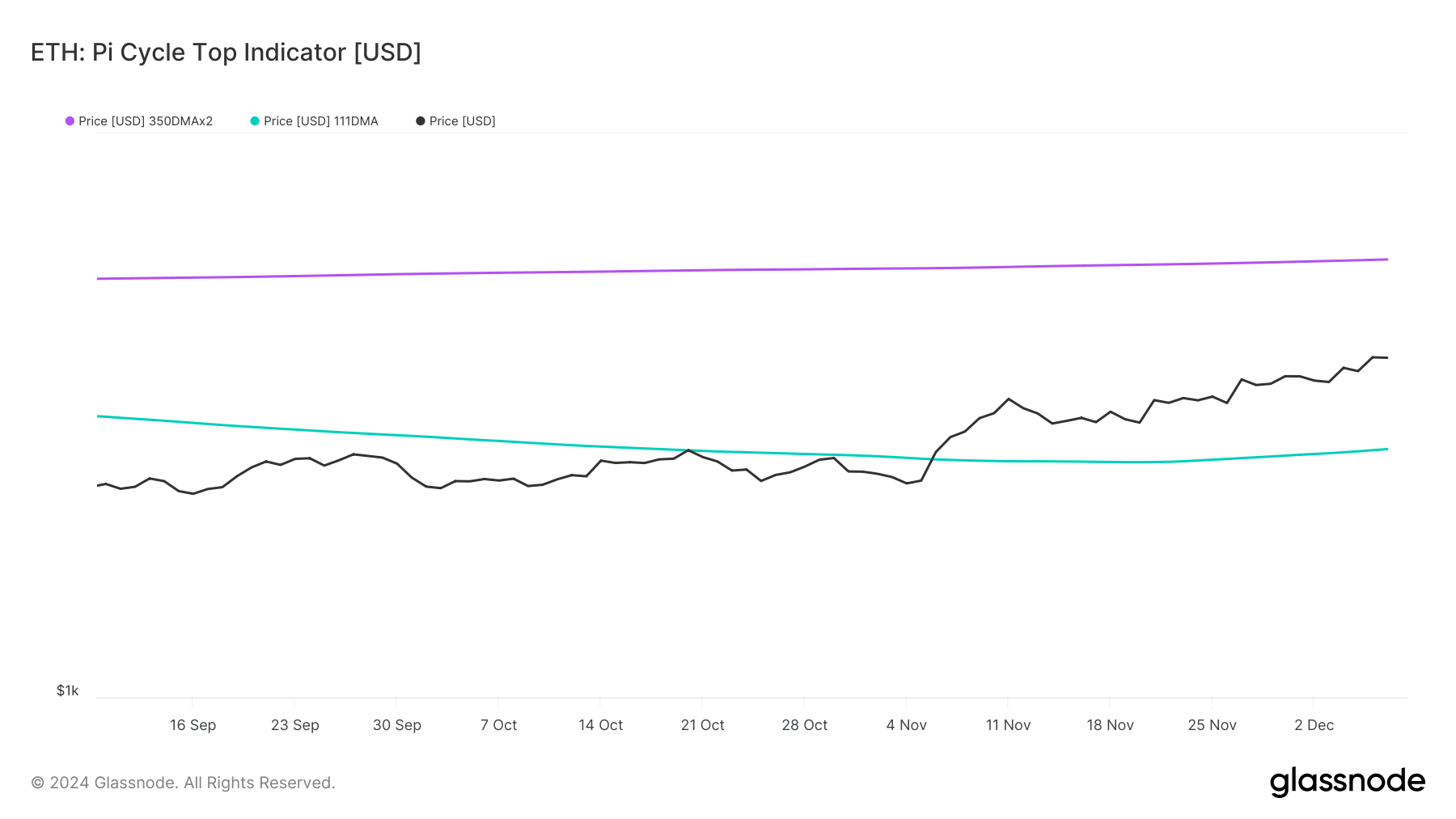

ETH’s Pi Cycle Top indicator revealed that ETH was trading well between its market top and bottom. If the metric is to be believed, ETH’s possible market top was at $5.9k.

Therefore, it seemed likely for ETH top reach $4.5k soon.

Source: Glassnode

CryptoQuant’s data revealed that buying pressure on the token was rising. This was evident from ETH’s declining exchange reserve.

Additionally, Ethereum’s Coinbase premium was green, meaning that buying sentiment among US investors was strong. However, a few metrics also looked bearish.

For instance, ETH’s taker buy/sell ratio turned red. Whenever this happens, it indicates that selling sentiment is dominant in the derivatives market. More sell orders are filled by takers.

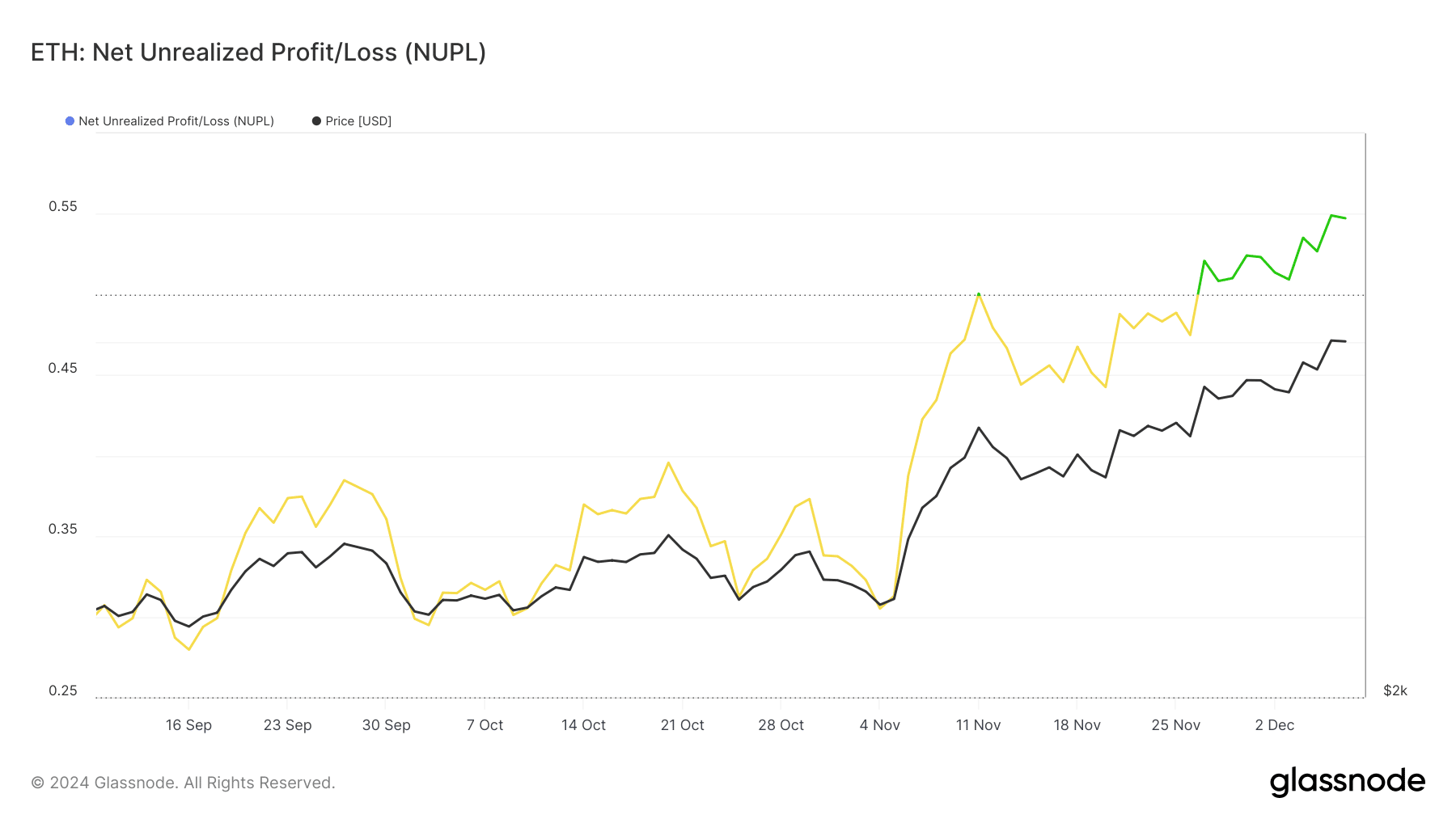

Apart from this, ETH’s Net Unrealized Profit/Loss (NUPL) entered the “belief” phase.

For starters, the NUPL is the difference between Relative Unrealized Profit and Relative Unrealized Loss. Historically, whenever the metric reached this level, it was followed by price corrections.

If history repeats, then ETH might not be able to go above $4k in the short-term.

Source: Glassnode

Trouble for ETH was far from over. The token’s Relative Strength Index (RSI) was resting in the overbought territory.

Read Ethereum’s [ETH] Price Prediction 2024–2025

This might motivate investors to sell their holdings, which has the potential to push ETH’s price down in the coming days.

Nonetheless, the MA Cross indicator supported the bulls, as the 9-day MA was well above the 21-day MA.

Source: TradingView