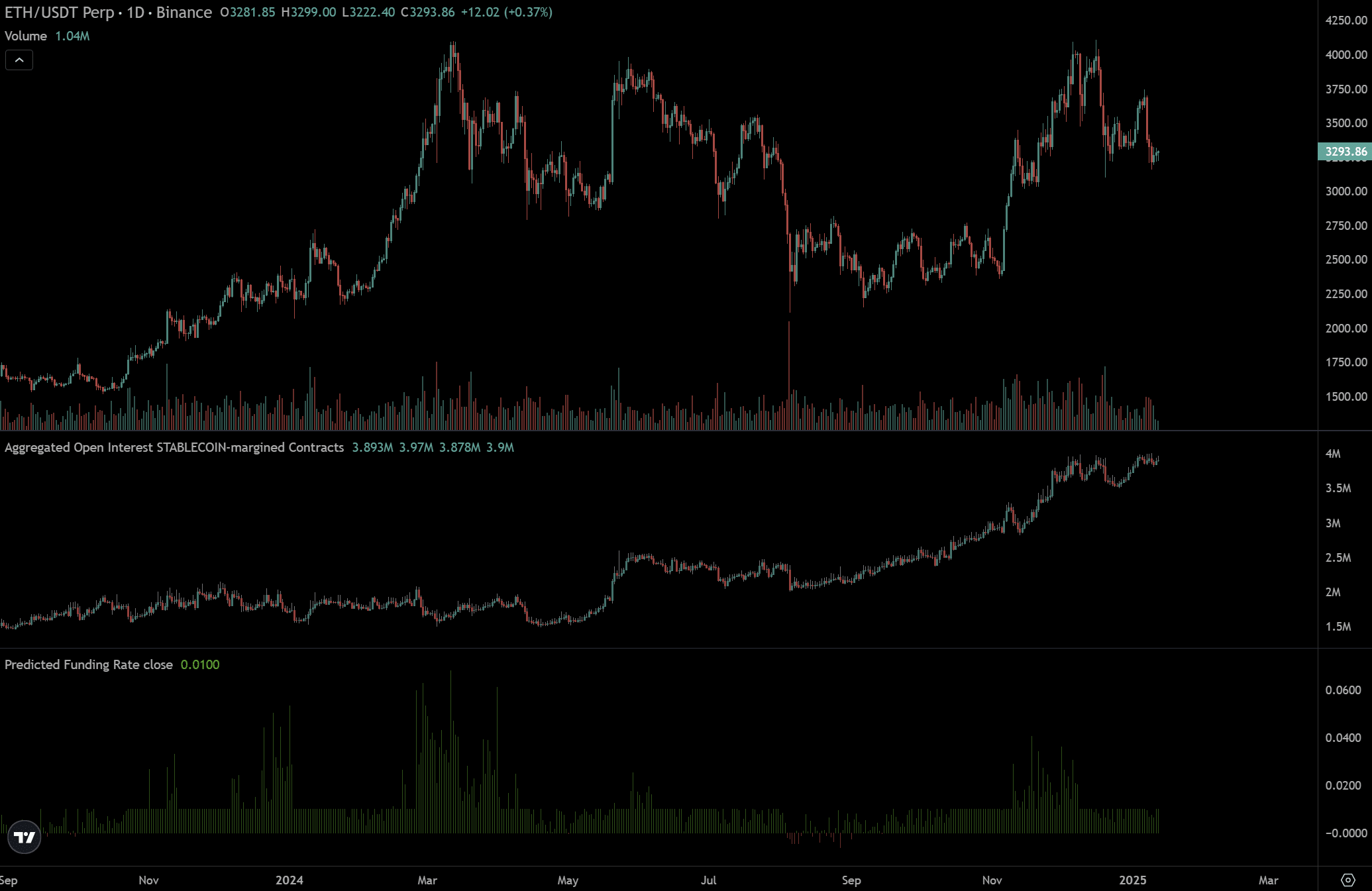

- ETH’s leverage has surged to $10B in two months.

- Historical trends indicated high leverage could negatively impact ETH’s value.

Despite Q1 being historically bullish for Ethereum [ETH], the altcoin’s massive $10B leverage could expose it to liquidation risks and cap upside potential.

Andrew Kang, Co-Founder of crypto VC firm Mechanism Capital, projected ETH could remain range-bound ($2K-$4K) due to this leverage risk. He stated,

“$ETH has added $10b+ in leverage since the election. This unwind will be painful, but $ETH won’t go to zero. It will simply range from $2k to $4k for a very long time”

Source: X

Before the US elections, ETH leverage (borrowed asset for speculative trading) stood at $9B. It shot up to over $19B in December.

Afterward, the sharp price decline liquidated several positions and dragged ETH to around $3.1K.

Will leverage derail ETH’s upside?

Kang added that the ETH ‘basis trade’ driven by CME Futures had little impact on the massive leverage since it was ‘delta-neutral’—every ETH bought in the spot market is shorted in the Futures market. Instead, he blamed speculative traders for the excessive leverage.

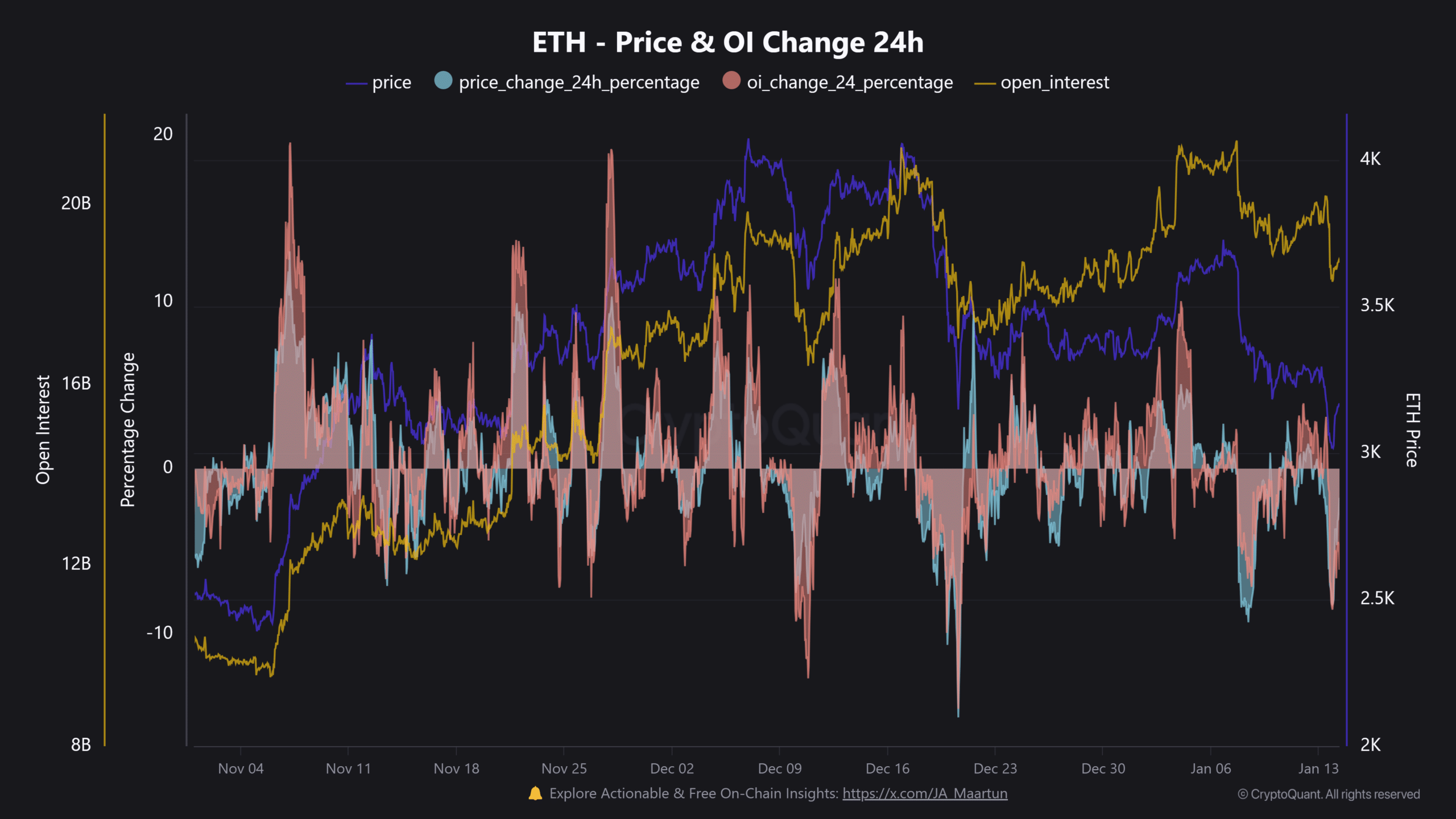

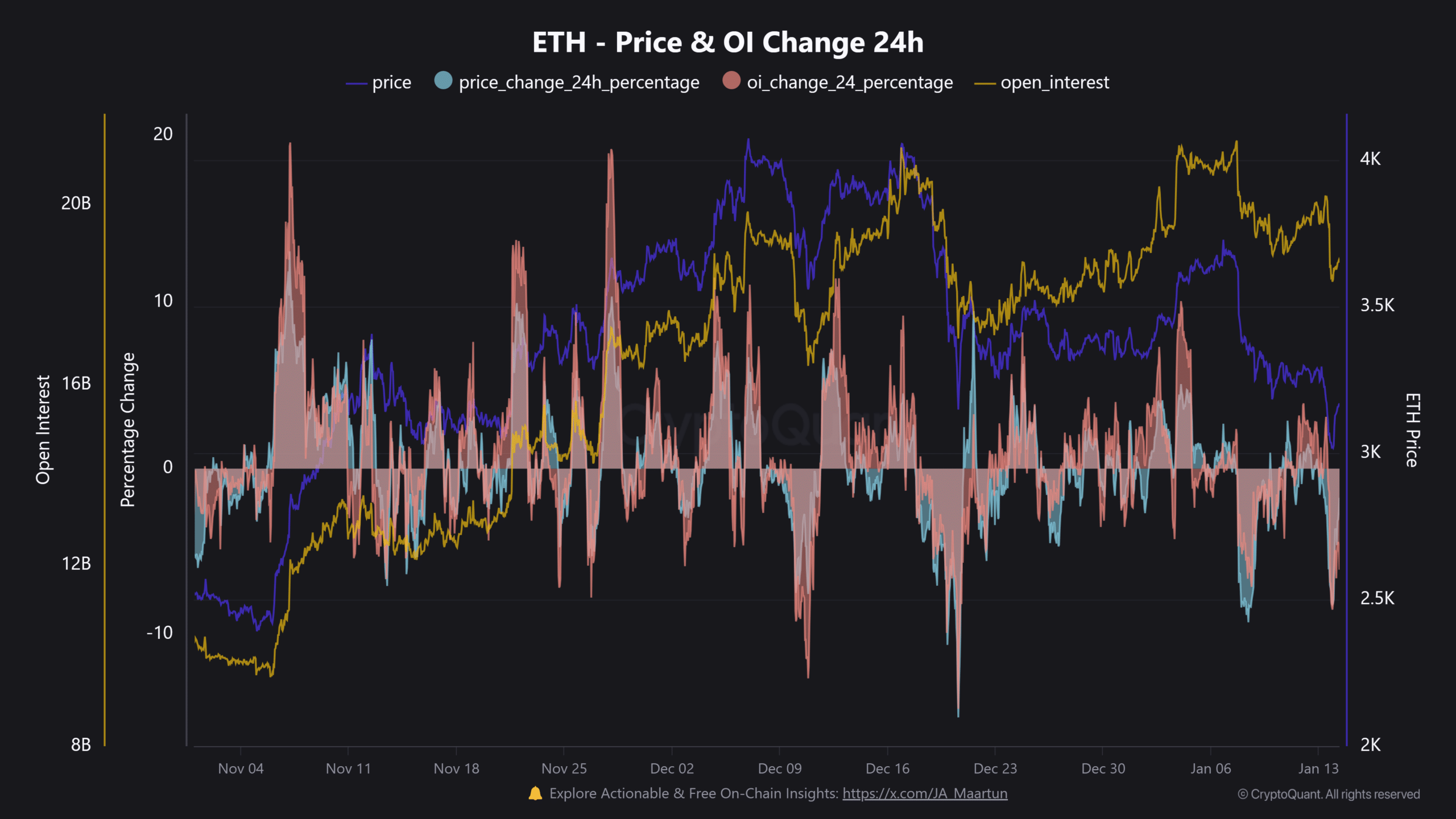

The historical ETH-leverage-driven pump confirmed Kang’s concerns. In most cases, whenever leverage Open Interest increased more than price during the rally, a pullback and local top followed.

Source: CryptoQuant

This was evident in early November and late December. They both escalated ETH liquidations.

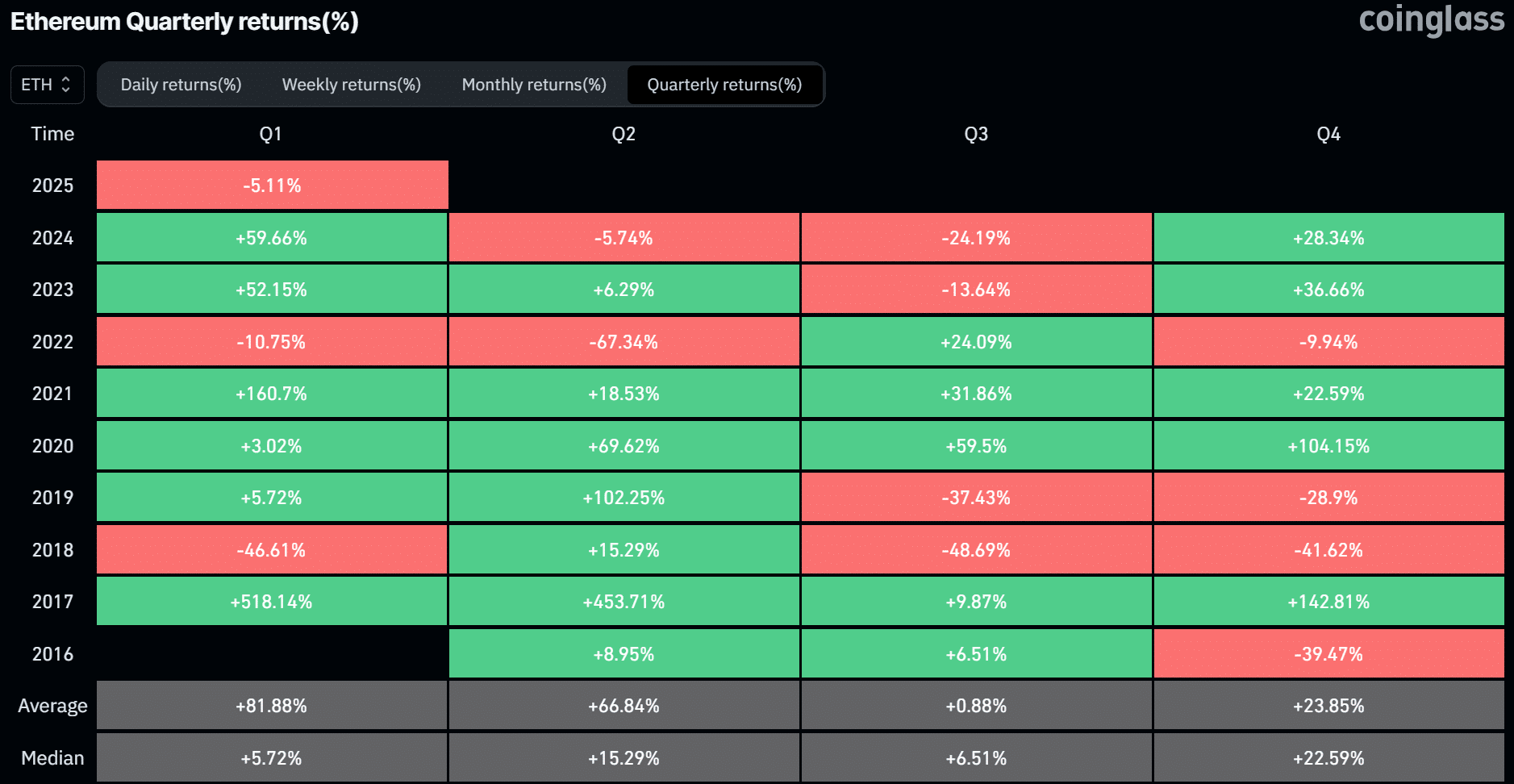

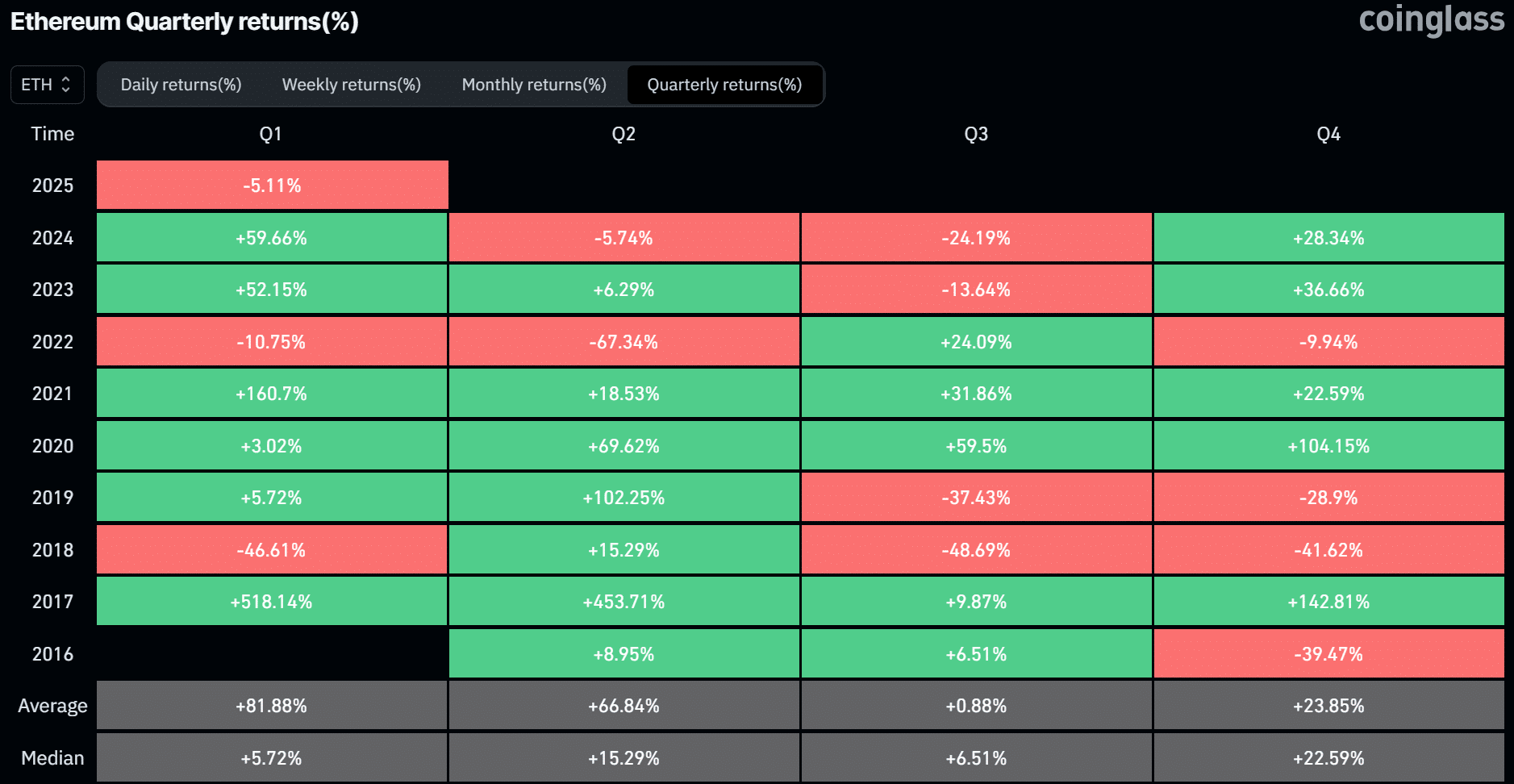

In fact, on the 20th of December, ETH recorded over $300M of liquidations, and long positions dominated the losses. That said, Coinglass data revealed that Q1 has always been ETH’s strongest performer, with an average of 81% gain.

Out of the past seven years, ETH closed only two quarters (Q1s) in the red. Simply put, if historical trends repeat, ETH could record significant gains in Q1 2025.

Source: Coinglass

However, the lurking liquidation risk could cap the upside expectation. At press time, ETH was back above $3K after a sharp drop to $2.9K following Monday’s bearish move.