- Vitalik Buterin warned of AI-driven data centralization and urged for stronger privacy protections for human autonomy.

- As whales sell ETH, one wallet buys $6.87M amid ETF delays and rising market uncertainty.

As AI tightens its grip on personal data, Ethereum [ETH] co-founder Vitalik Buterin is calling for stronger privacy safeguards — warning of a future where centralization is a societal issue.

His remarks come at a turbulent moment for Ethereum: whales are offloading millions, volatility is surging, and regulatory uncertainty hangs in the air following the SEC’s delay on Grayscale’s Ethereum ETF.

Yet, amid the sell-off, one deep-pocketed investor is swimming against the tide – with a bold $6.87 million ETH buy.

Buterin warns of centralized AI threats

Buterin has reiterated his commitment to privacy, emphasizing its importance as a fundamental human right in a world increasingly shaped by AI and data collection.

In his blog post,“Why I Support Privacy,” he argues that control over personal data equates to control over individuals. He asserts that privacy is essential for freedom, innovation, and social stability.

He cautions that centralized data systems pose a threat to decentralization. To counter this, he urges developers to adopt privacy-enhancing technologies such as ZK-SNARKs, Fully Homomorphic Encryption (FHE), and emerging obfuscation tools. These solutions allow for secure systems without compromising functionality.

Buterin expands the discussion beyond cryptocurrency, linking privacy to broader human autonomy. Without privacy, people self-censor, and society drifts toward surveillance-driven conformity.

He even highlights brain-computer interfaces as a growing risk, stressing the need to integrate privacy into future technologies—not just to safeguard data, but also to protect individual thoughts.

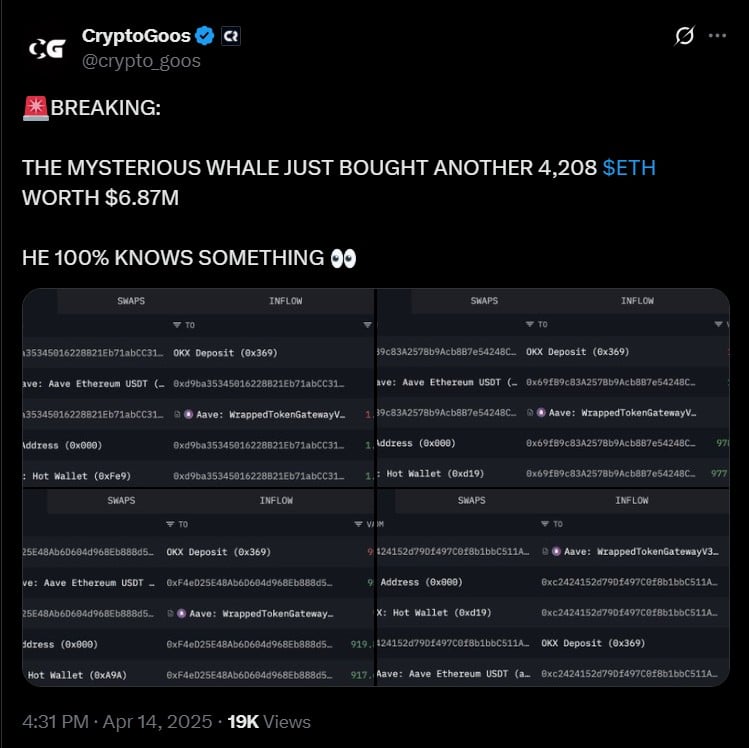

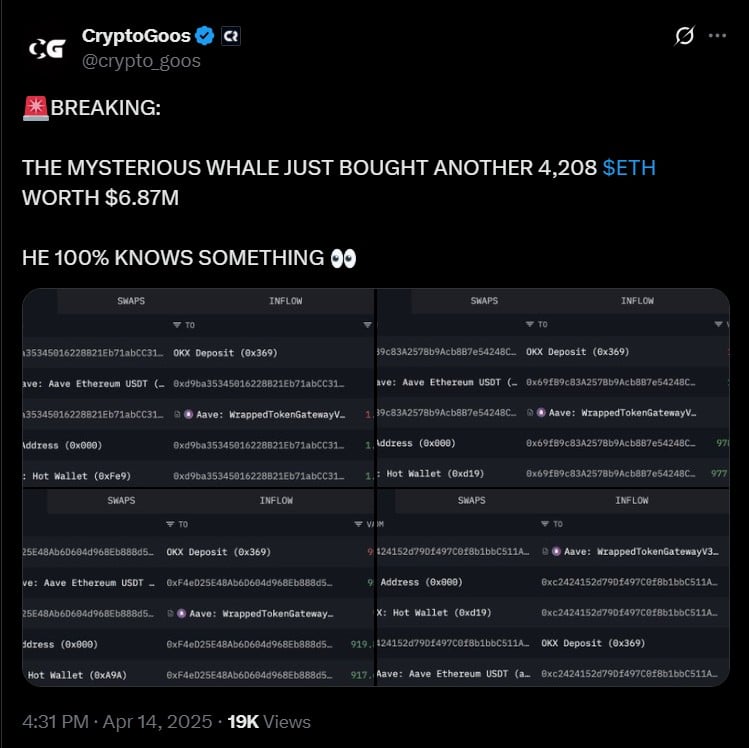

As whales dump ETH, one wallet makes a bold bet

Source: X

In the hours leading up to Buterin’s latest blog post on privacy, Ethereum markets were anything but quiet.

Two major whales offloaded a combined 16,923 ETH, worth nearly $28 million, onto Kraken and at-market, fueling fresh volatility and dragging ETH below $1,640.

The synchronized exits hinted at rising uncertainty, possibly tied to regulatory jitters.

Source: X

While many investors sold, one mysterious investor took the opposite approach. In a surprising move, an unknown wallet acquired 4,208 ETH—valued at $6.87 million—just as selling pressure peaked.

The timing of this accumulation, so close to Buterin’s privacy declaration, raises questions. Could there be more to Ethereum’s current trajectory than what’s immediately visible?

Buterin emphasizes the importance of embedding privacy into future technologies. He argues that safeguarding privacy is not only about protecting data, but also about preserving individual thoughts.