- Fantom’s price surge is supported by strong network growth and key resistance targets near $1.50.

- Technical indicators and market sentiment highlight cautious optimism for sustained upward momentum.

Fantom [FTM] has captured attention with a dramatic 23.13% surge in the last 24 hours, bringing its price to $1.07 at press time.

This impressive growth, fueled by rising network adoption and positive onchain metrics, raises the question: is Fantom on track to lead a broader crypto market rally in the coming weeks?

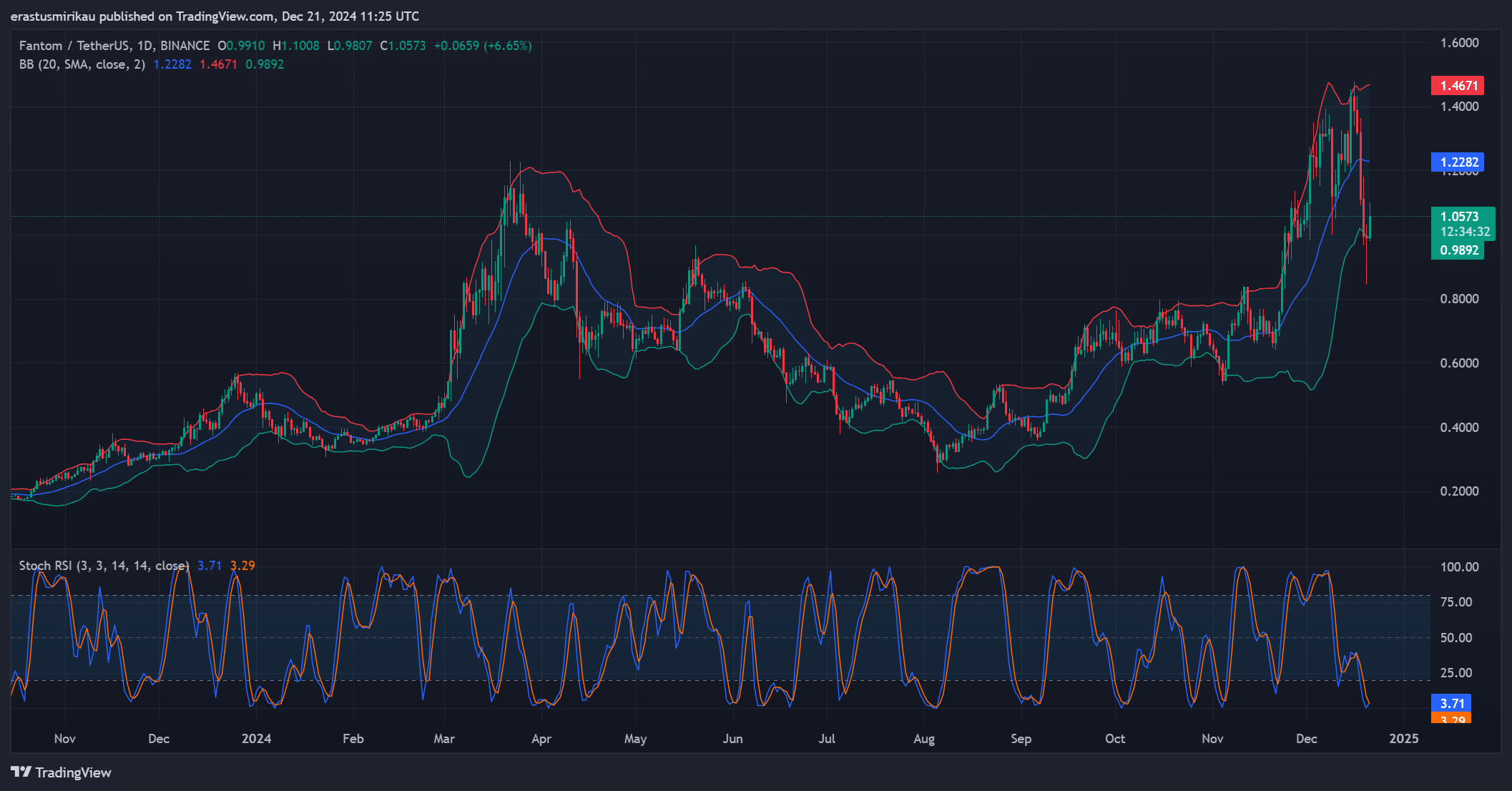

Fantom chart analysis: price movement, key levels, and targets

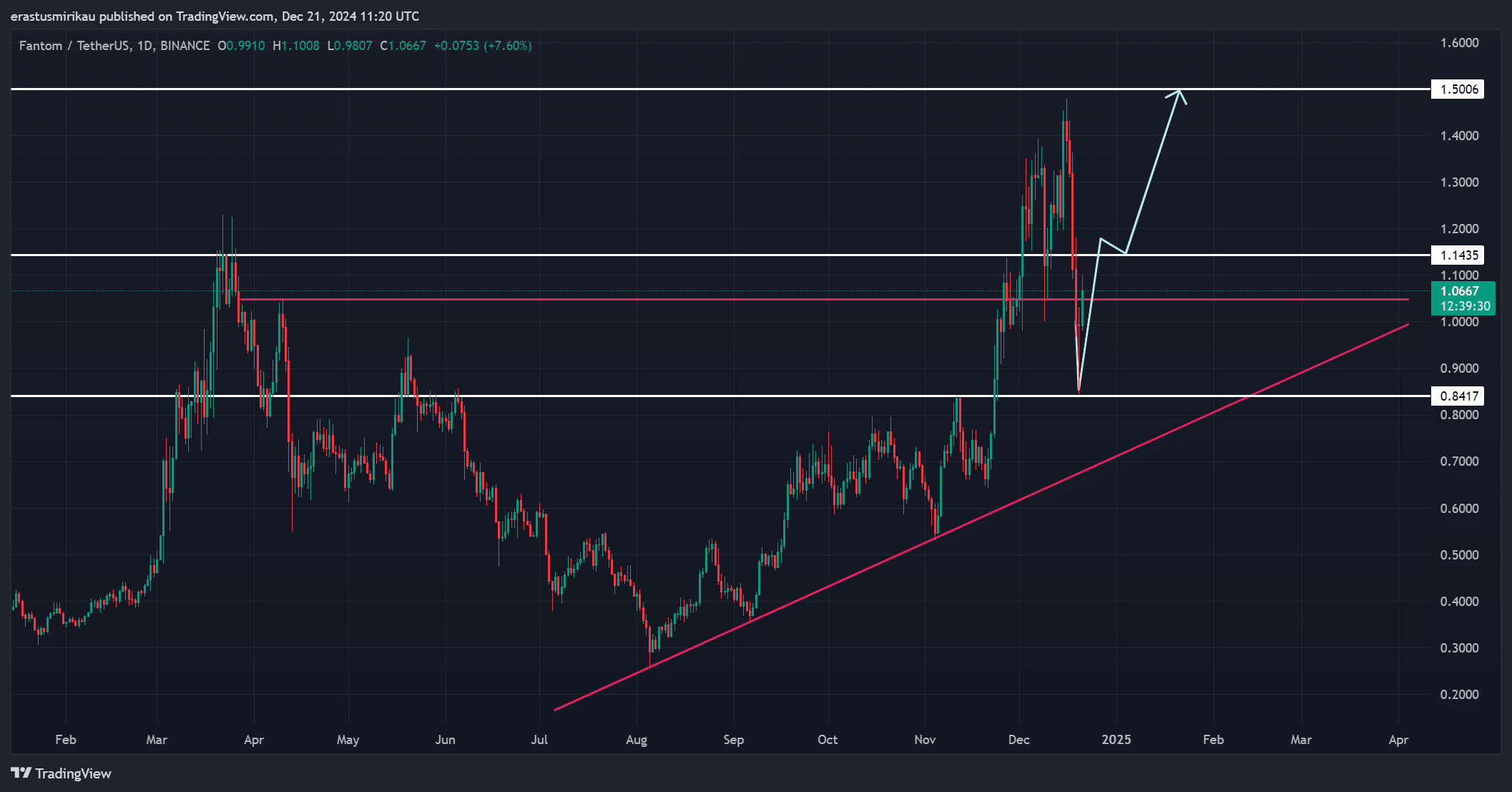

Fantom’s chart reveals a robust bullish structure, with the price breaking past the critical $1.00 level, now acting as strong support. The next resistance lies at $1.14, a key psychological and technical level.

Additionally, if momentum continues, FTM could test the $1.50 resistance, a breakout above which could confirm a sustained rally. However, traders should remain cautious of a potential retracement, as support at $0.84 aligns with a long-standing ascending trendline.

Therefore, maintaining current momentum is crucial for Fantom to achieve these ambitious targets.

Source: TradingView

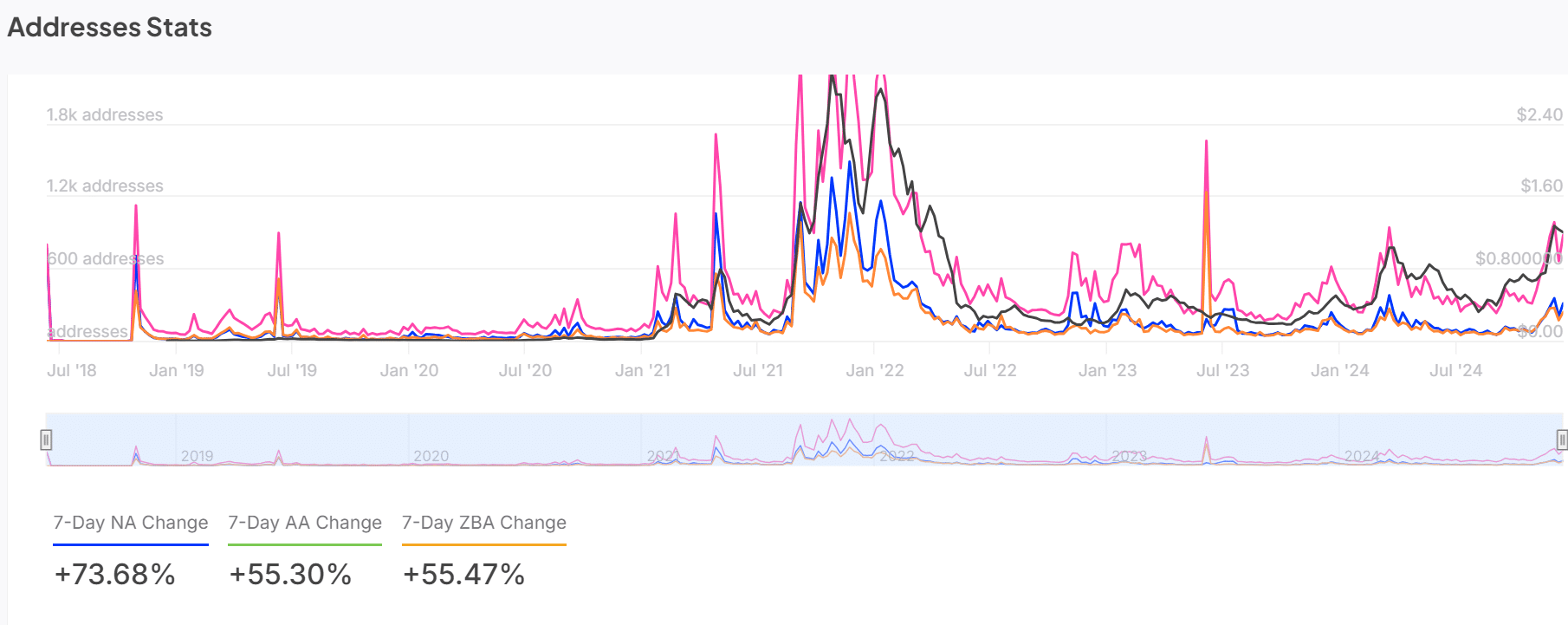

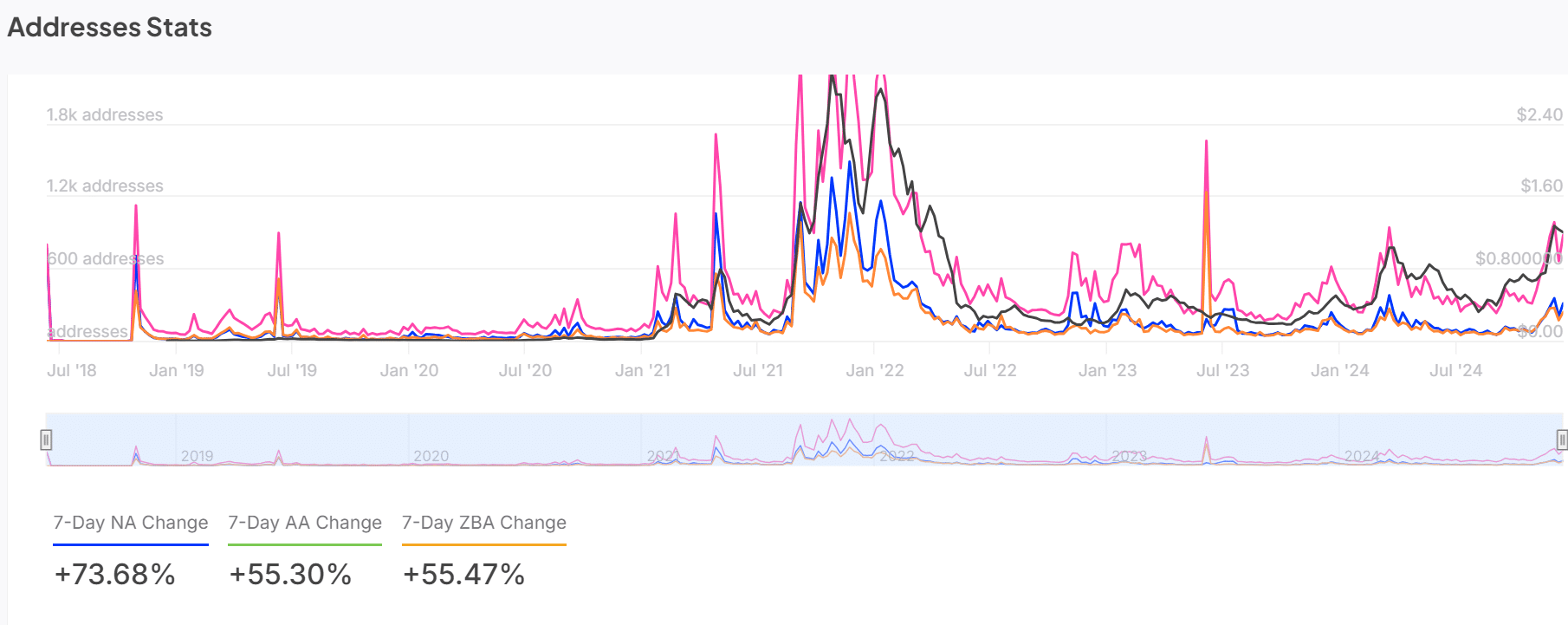

Network growth metrics signal significant user interest. New addresses surged by 73.68% in the past week, while zero-balance accounts rose 55.47%. This demonstrates strong adoption as more users join the ecosystem.

Additionally, the increasing activity reflects growing confidence in FTM, which directly supports the ongoing price rally. As adoption trends remain positive, they could drive sustained growth in the token’s value.

Source: IntoTheBlock

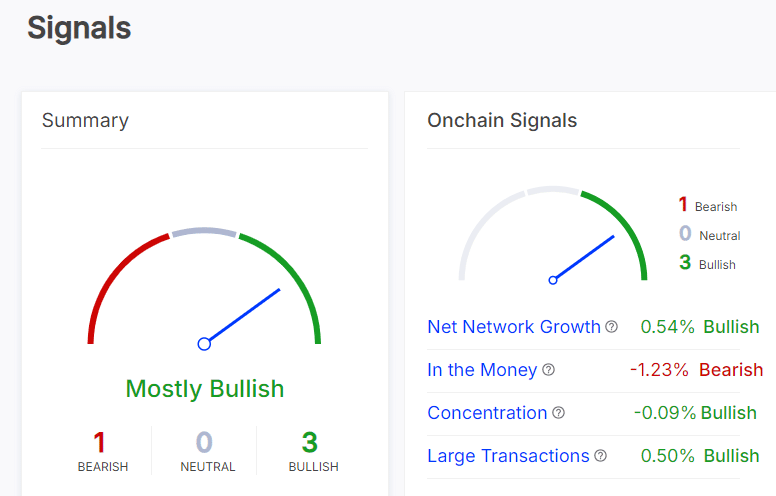

On-chain signals: bullish or cautious?

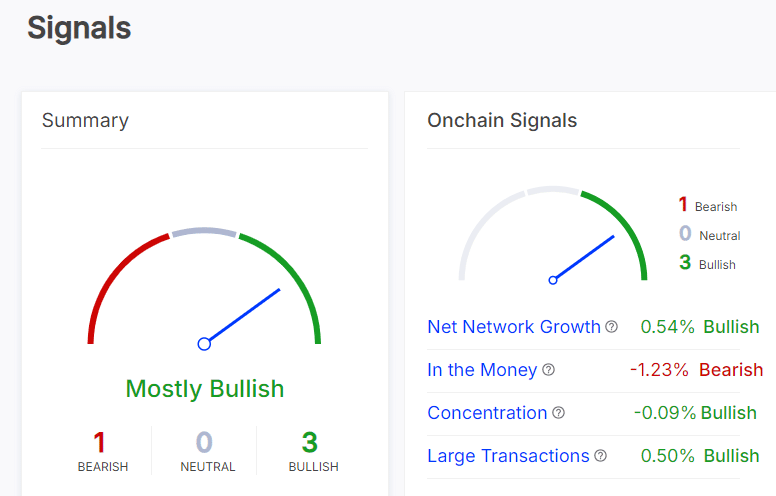

FTM’s onchain signals present a mostly bullish outlook. Net network growth stands at +0.54%, affirming steady expansion. However, the “In the Money” metric dipped by -1.23%, suggesting slight profit-taking among investors.

On the other hand, large transactions rose by 0.50%, indicating that institutional and high-value trades continue to support the bullish trend. Therefore, while short-term caution exists, the overall outlook remains positive.

Source: IntoTheBlock

FTM technical indicators: volatility and momentum

Fantom’s technical indicators suggest growing volatility and momentum. The Stochastic RSI stands at 3.71 and 3.29, signaling oversold conditions with potential for a further upward move.

Additionally, FTM’s price is near the upper Bollinger Band at $1.22, reflecting bullish pressure, while the lower band at $0.98 offers support. However, breaching the $1.14 resistance remains crucial for unlocking higher targets such as $1.50.

Source: TradingView

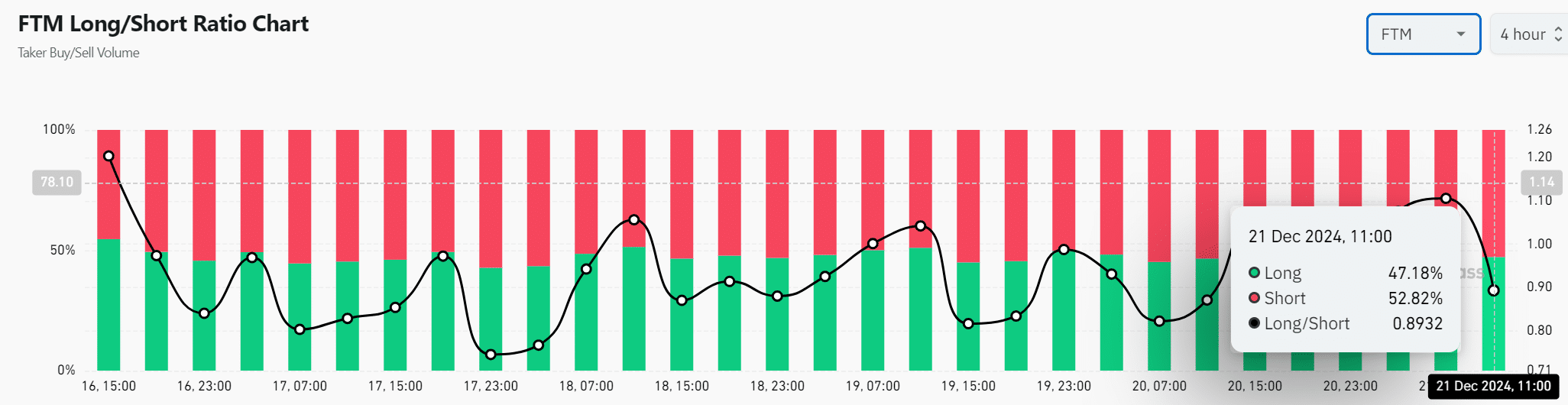

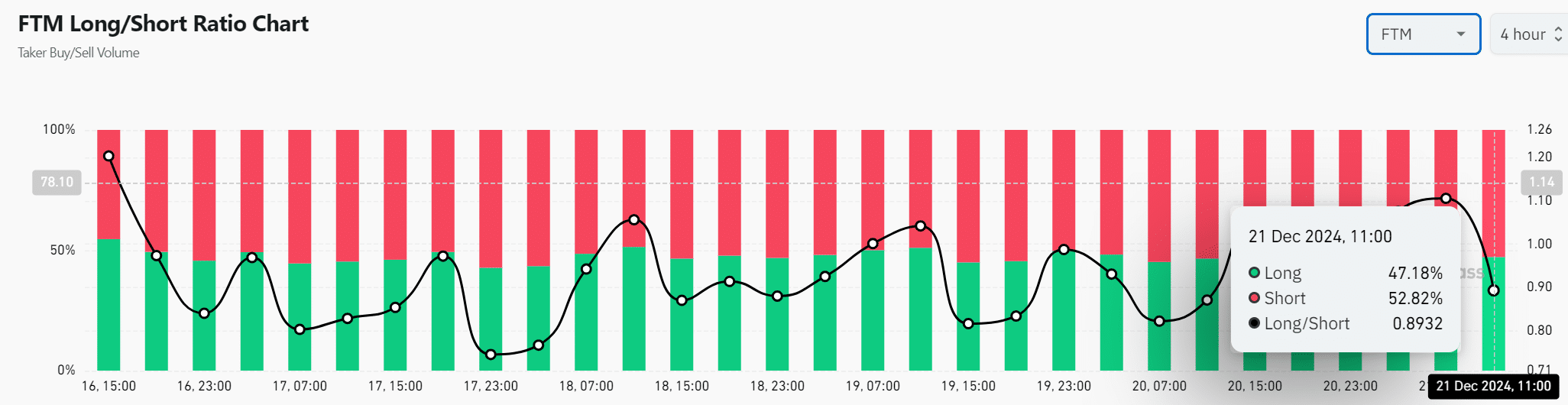

The long/short ratio for FTM reveals cautious optimism. While 52.82% of traders are short, 47.18% remain long, showing a balance between bullish and bearish expectations.

This ratio reflects mixed sentiment, as traders weigh the possibility of continued gains against the risk of short-term corrections.

Source: Coinglass

Read Fantom’s [FTM] Price Prediction 2024-25

Fantom appears poised to lead the next market rally. Its strong price momentum, network adoption, and bullish signals collectively suggest that FTM is well-positioned for further growth, provided key resistance levels are breached.