- Grayscale files to convert its multi-crypto fund into spot ETF.

- Analysts warn of challenges because of XRP, SOL, and AVAX inclusion.

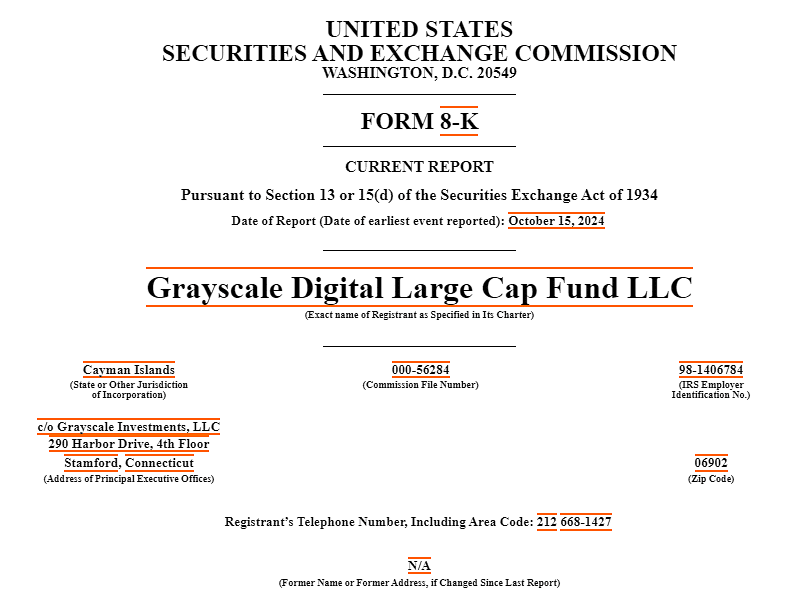

On the 14th of October, crypto asset manager Grayscale applied with the U.S. SEC (Securities and Exchange Commission) to convert its multi-crypto fund into an ETF.

Currently, the firm’s Digital Large Cap (GDLC) fund has $524 million in assets under management and spans Bitcoin [BTC], Ethereum [ETH], Solana [SOL], Ripple [XRP], and Avalanche [AVAX].

BTC and ETH dominated over 90% of the fund.

If approved, the fund will be traded on the NYSE (New York Securities Exchange) per the filing. In a separate filing, the asset manager notified its investors of the proposed rule changes to the fund.

Source: SEC

Crypto index ETF race

Converting a fund into a spot ETF makes buying and selling shares of the fund much easier. Grayscale has converted two funds linked to BTC (GBTC) and ETH (ETHE) into spot ETFs this year.

However, at the moment, only BTC and ETH are deemed commodities by the SEC. In fact, other issuers that have applied similar crypto index ETFs, like Hashdex and Franklin Templeton, only included BTC and ETH in their applications.

But Grayscale has included even XRP, which had no regulatory clarity given its ongoing case with the SEC.

According to Nate Geraci of ETF Store, the move could be a bet on a change in administration after the November U.S. elections. He stated,

“Feels like issuers are piling in on the “change in administration” bet…Basically lining-up in the event of a Trump win w/ the assumption that admin would be much more crypto-friendly.”

For its part, Presto Research, a crypto-focused research firm, viewed the application as a potential pathway to altcoin ETF approval.

“Its approval could potentially pave the way for future altcoin ETFs, such as SOL, XRP, and AVAX, whose outlook for ETF eligibility has remained unclear under the current SEC.”

But Prestor Research analysts also noted that the application’s road could be ‘bumpy’, citing spot SOL ETFs challenges in August.

That said, Grayscale converted ETFs have faced intensified outflows, as seen in GBTC and ETHE. Since its conversion, GBTC has bled over $20 billion in total flows while nearly $3 billion in outflows in ETHE.

It remains to be seen how the application will proceed after the U.S. elections, and whether other altcoins with unclear regulatory status will get approved.