- FLOKI’s technical indicators underlined overbought conditions, signaling possible short-term risks

- On-chain data and social dominance reflected greater participation too

Floki [FLOKI] has been making waves in the crypto space, surging by 14.19% in the last 24 hours, pushing its price to $0.0001686 at press time. With trading volume skyrocketing by over 147%, investors wonder – Can FLOKI maintain its bullish momentum, or will a correction follow?

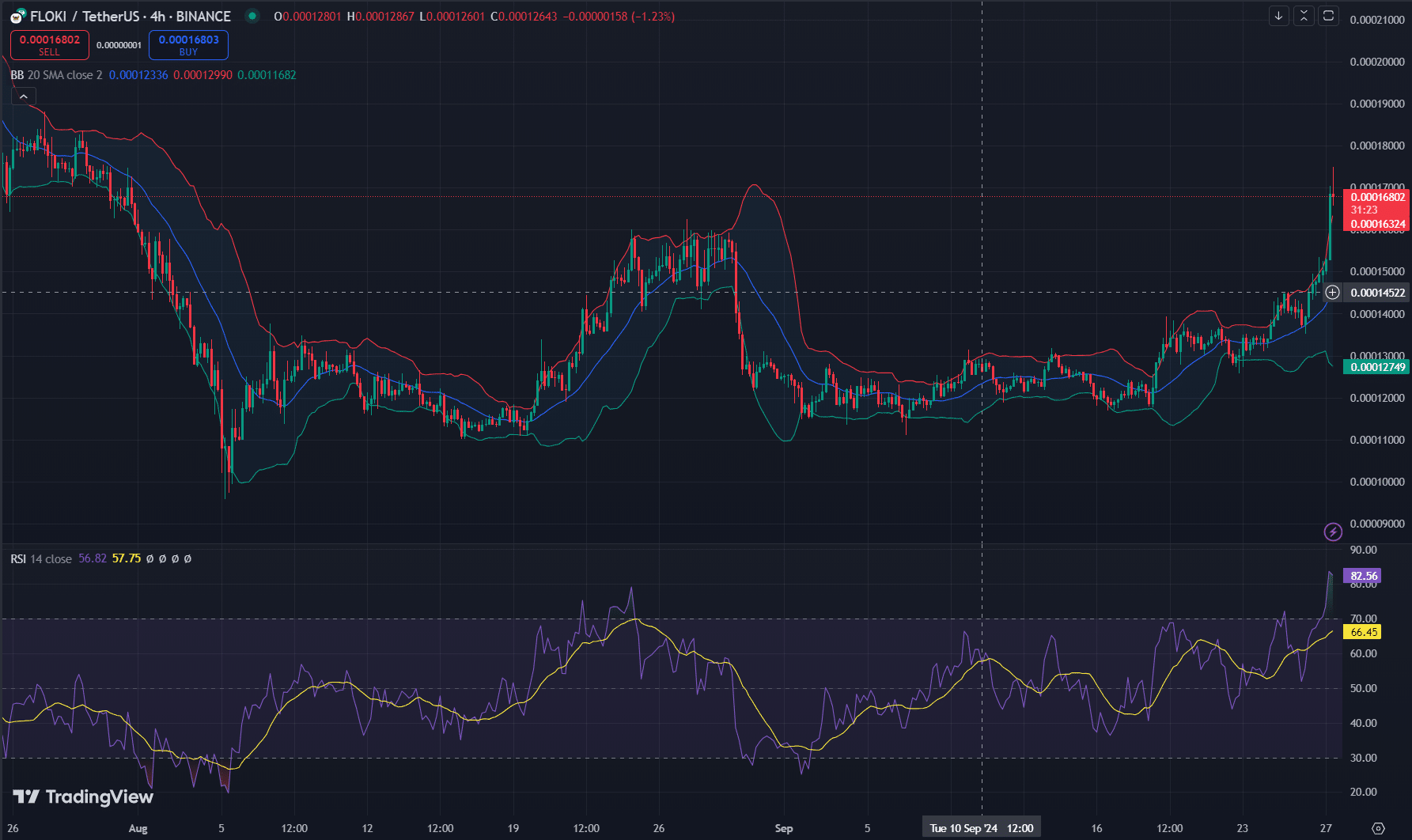

Technical analysis: What do the indicators say?

Looking closely at the technical indicators, the 4-hour Relative Strength Index (RSI) revealed a reading of 82.56, clearly indicating overbought conditions. Consequently, this can be interpreted as a sign of strong buying pressure, which often hints at potential market corrections.

However, it’s important to note that FLOKI’s price has continuously held above key support levels while riding the upper Bollinger Bands (BB).

This reflects sustained bullish sentiment. However, the overextended price outside the BB also means greater volatility, which traders should approach with caution.

Source: TradingView

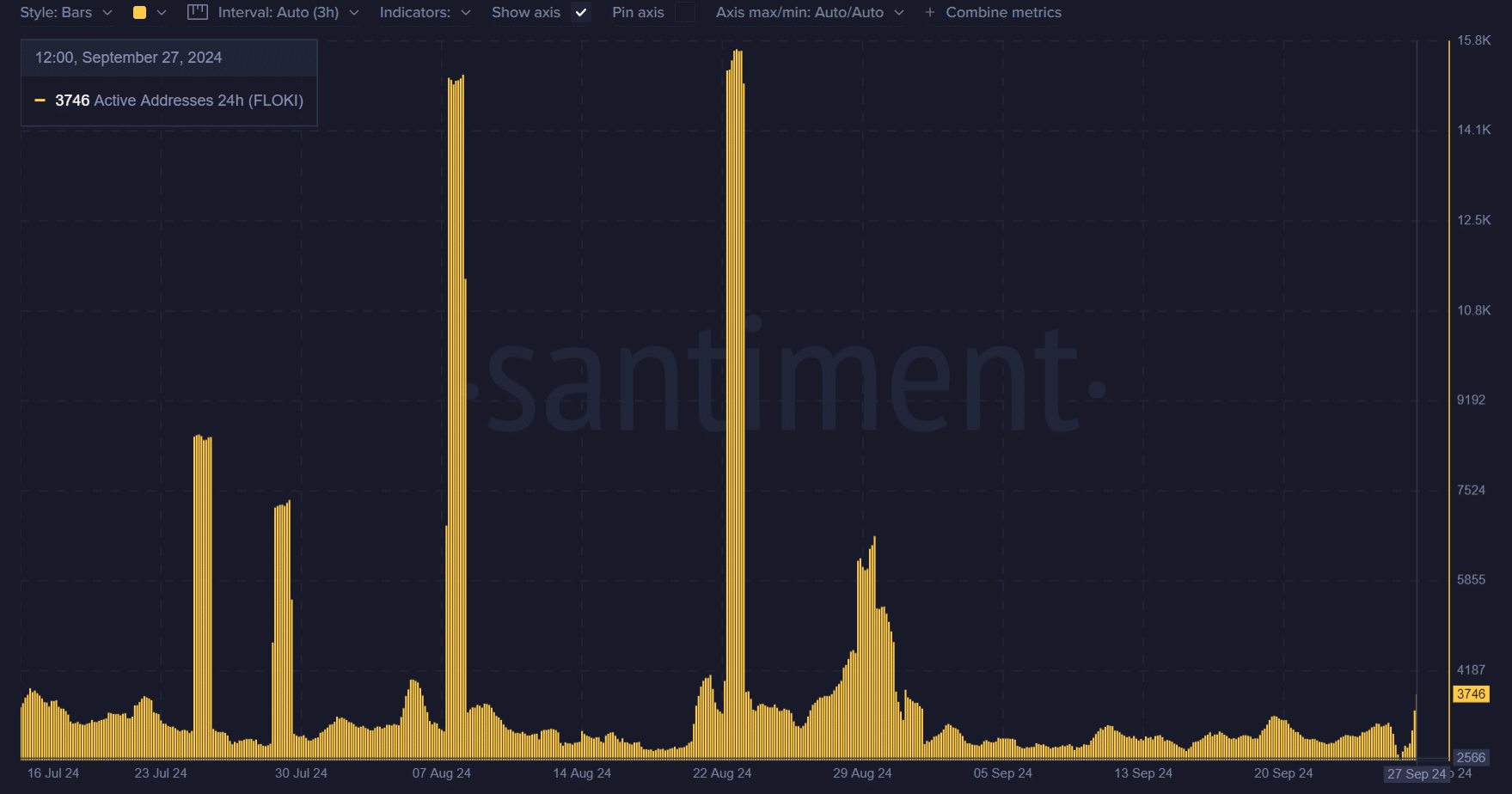

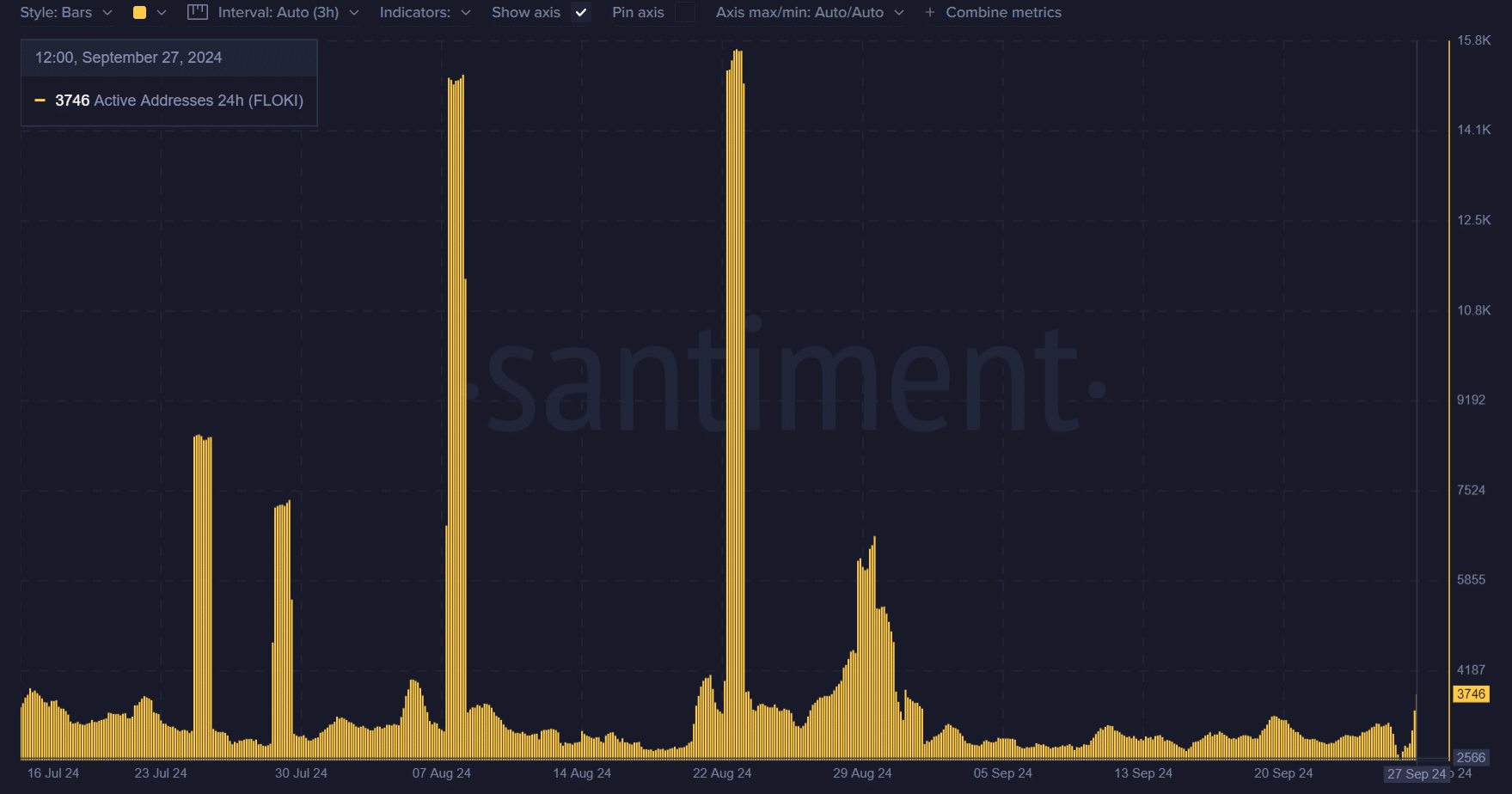

On-chain data: Volume and active addresses spike

Additionally, on-chain data highlighted significant growth in activity. Daily active addresses rose from 2,796 to 3,746, showing heightened interest in the token. Moreover, volume surged by 147% to $143.67 million, according to Coinglass, demonstrating robust participation in FLOKI’s market movement.

Therefore, both metrics seemed to reinforce the idea that FLOKI’s price gains may be well-supported by strong fundamentals and user engagement. This hike in activity strongly suggests that FLOKI may have more room to grow.

Source: Santiment

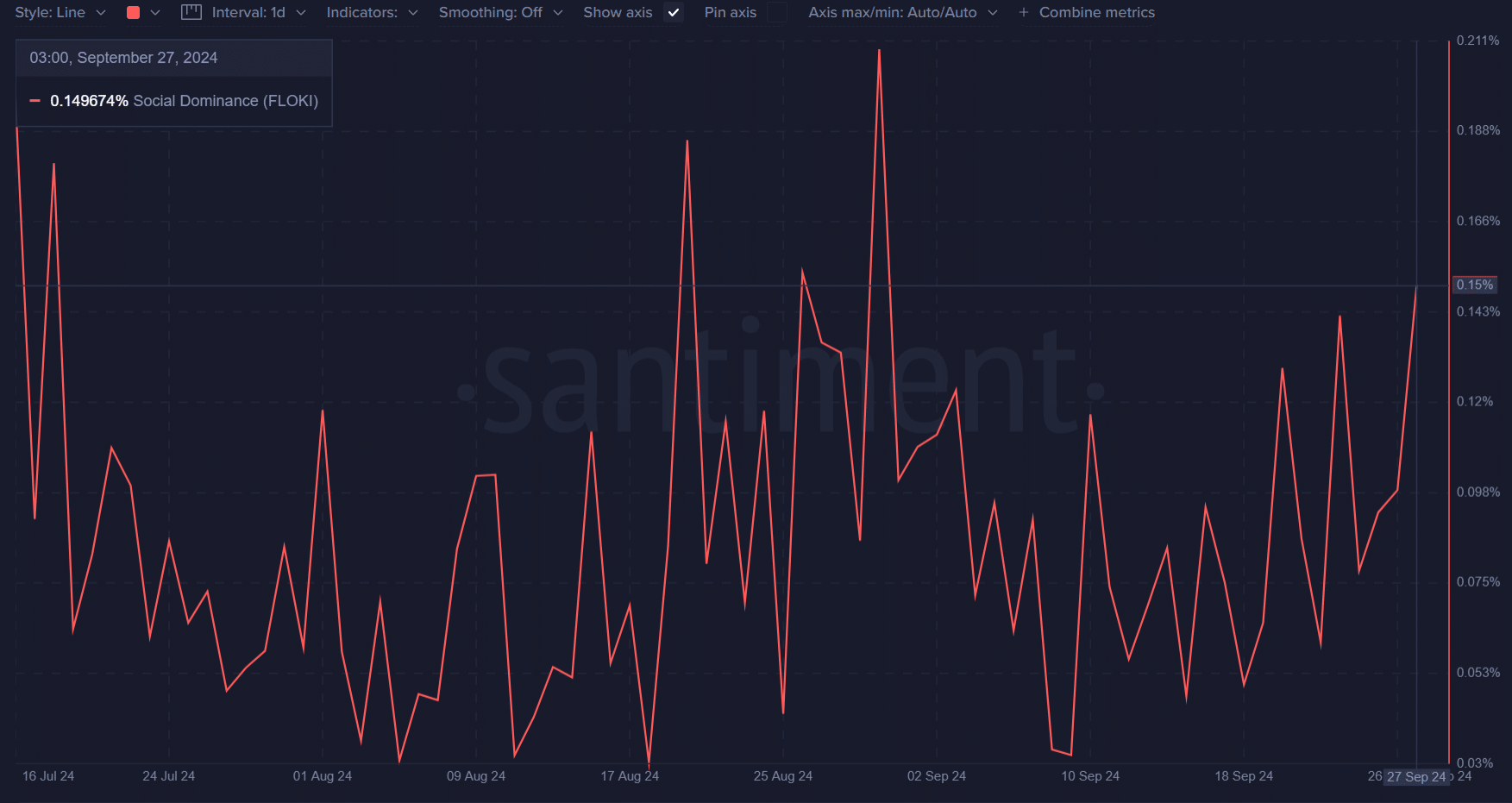

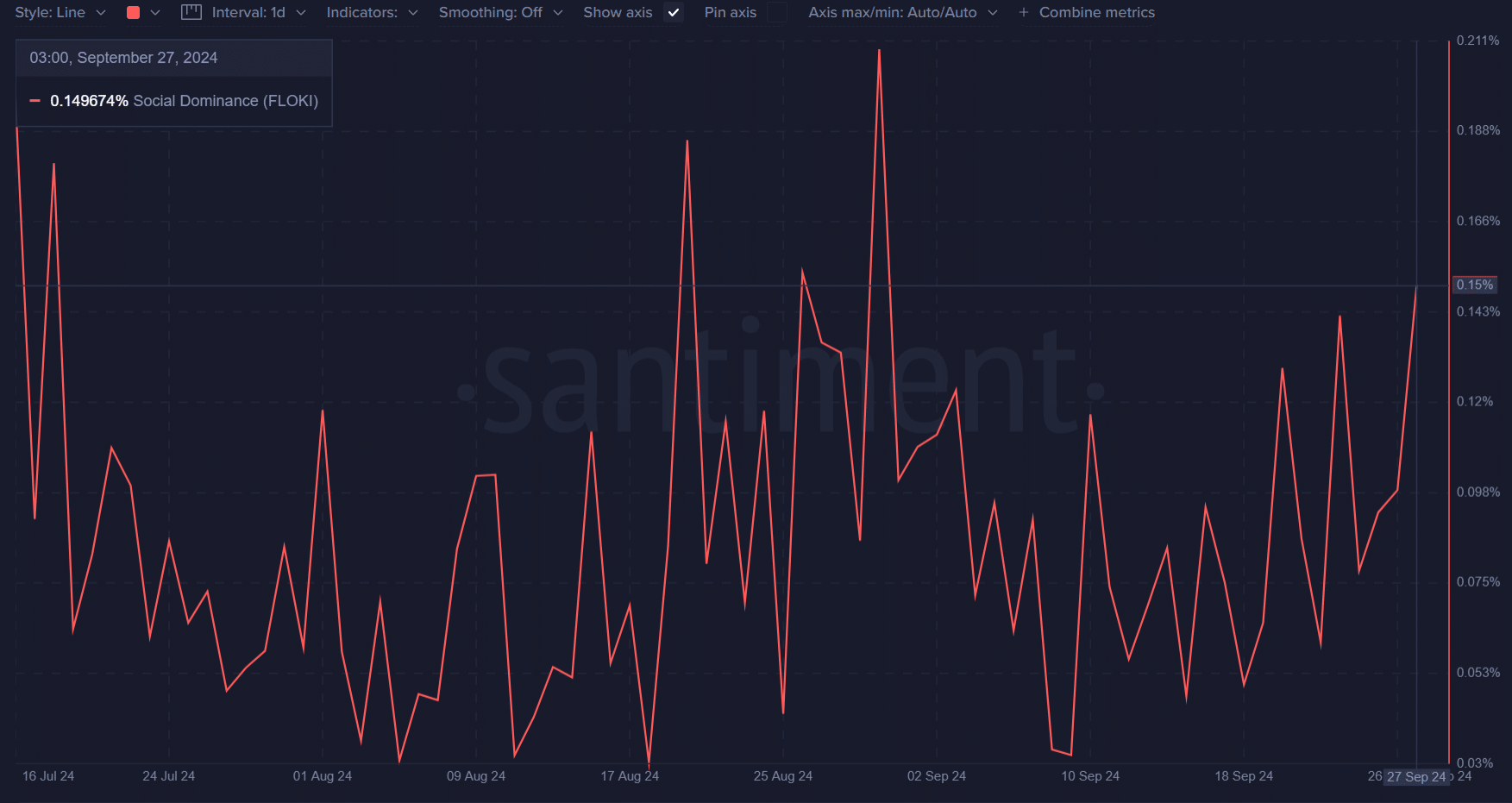

Social dominance: FLOKI’s growing community presence

Social dominance has also played a vital role in FLOKI’s current performance. FLOKI’s share of social conversations rose to 0.149%, reflecting growing community buzz around the token. This uptick in social sentiment often correlates with greater retail interest, something that has historically fueled price rallies.

However, it’s critical to monitor social sentiment closely, as rapid shifts could introduce volatility if traders start taking profits.

Source: Santiment

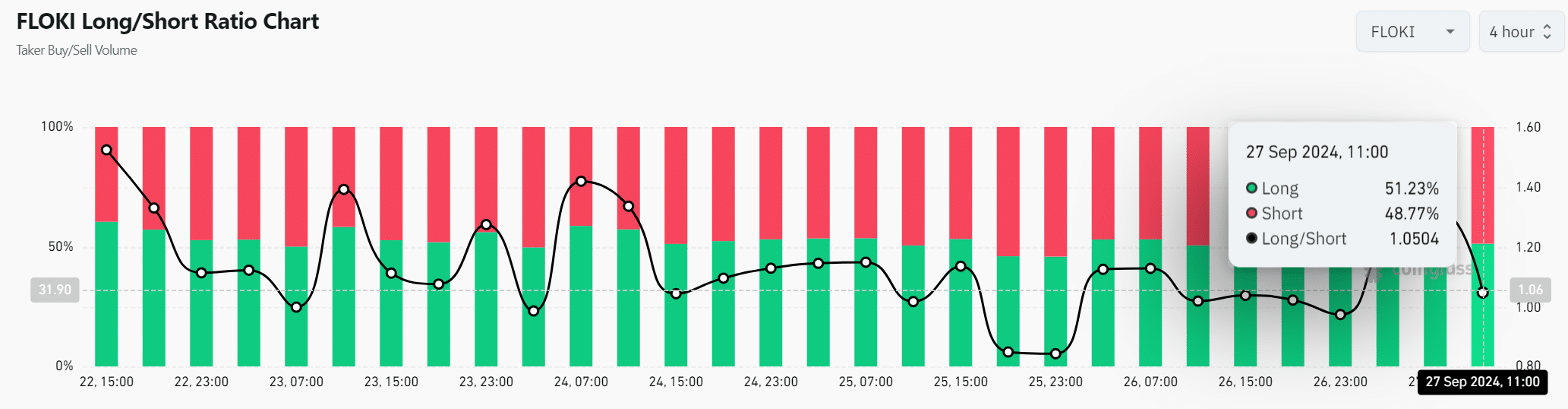

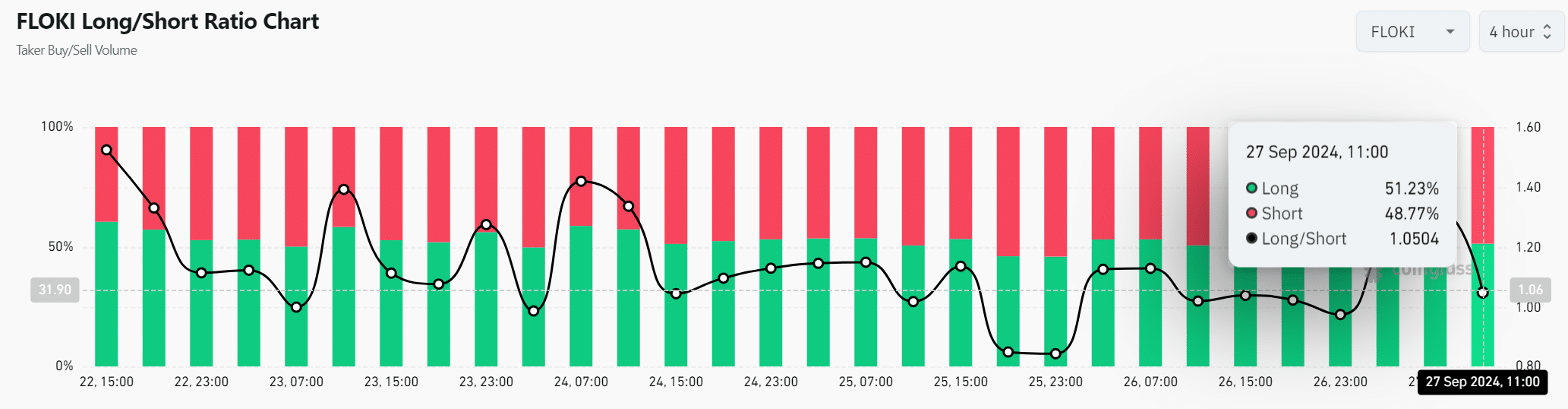

Long/short ratio: A potential market sentiment shift?

Finally, examining the long/short ratio revealed a 51.23% long versus 48.77% short positioning, indicating optimism among traders. Consequently, the market seemed to lean bullish, although near-parity alluded to the need for close monitoring for any sudden shifts.

Source: Coinglass

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

At the time of writing, FLOKI appeared likely to continue its bullish momentum in the short term. Strong on-chain data, rising social dominance, and robust volume are signs of further growth.

However, traders should remain cautious due to overbought technical indicators, which could prompt short-term corrections.