- A looming US recession and BoJ’s rate hike were responsible for the recent market losses.

- US recession outcome presents a conflicting scenario for crypto markets.

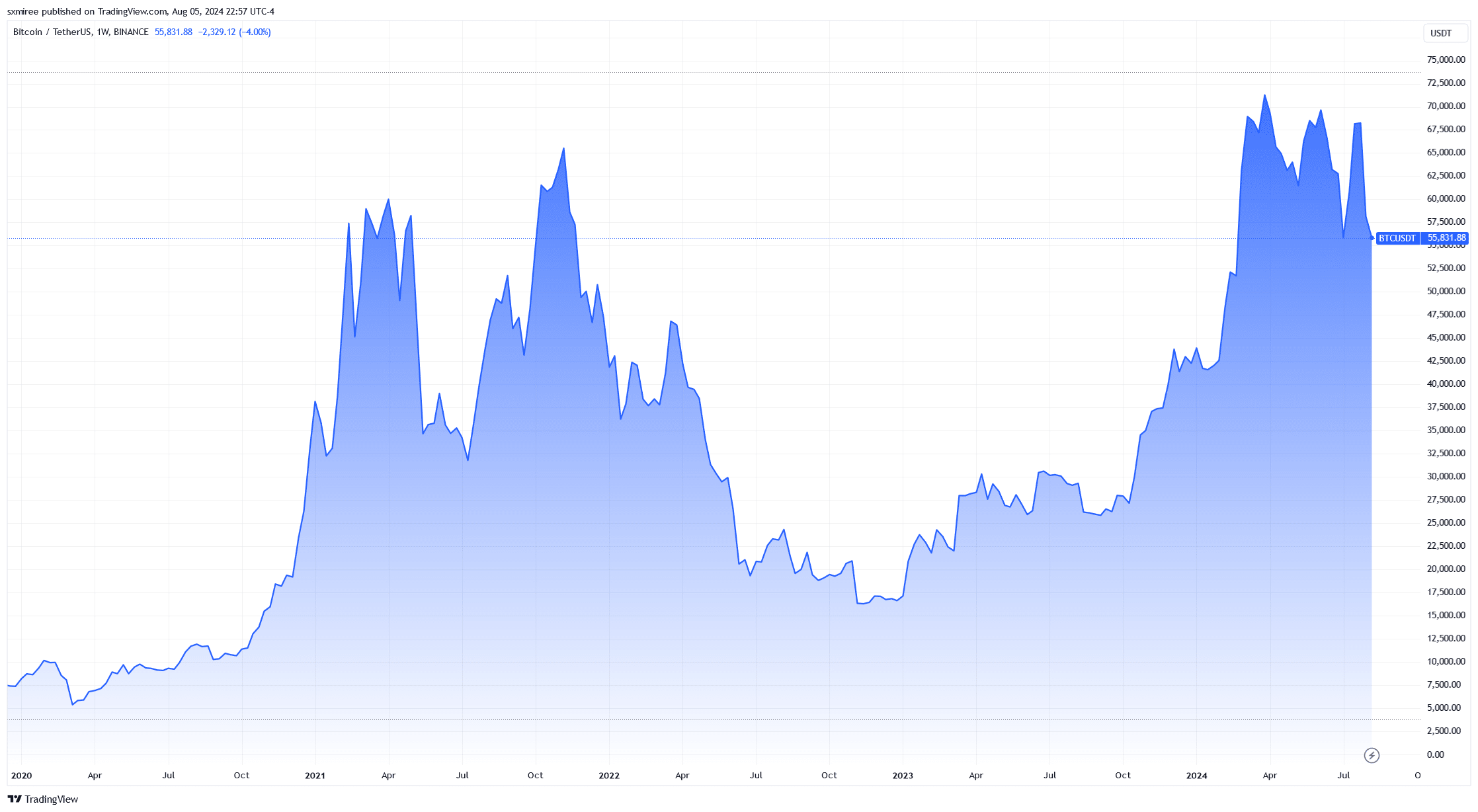

Bitcoin [BTC] and other altcoin prices fell sharply on Friday, the 2nd of August, with the losses extending throughout the weekend. The flagship crypto tumbled through $60,000 over the weekend before nosediving below key support levels on Monday, 5th August.

Source: TradingView

Friday’s market pullback, which cut across global equities, was triggered by a weaker-than-expected US jobs report released after market hours.

Markedly, the three-day heavy sell-off came less than a week since Bitcoin was trading close to its March all-time high on 29th July, highlighting the influence of macroeconomic factors on crypto assets.

Impact of a US recession on Bitcoin price

The narrative of a US recession has been going on over the past year amid mixed opinions on the state of the economy.

Friday’s disappointing employment data further spooked investors in the US equity markets and rekindled concerns of an economic downtrend.

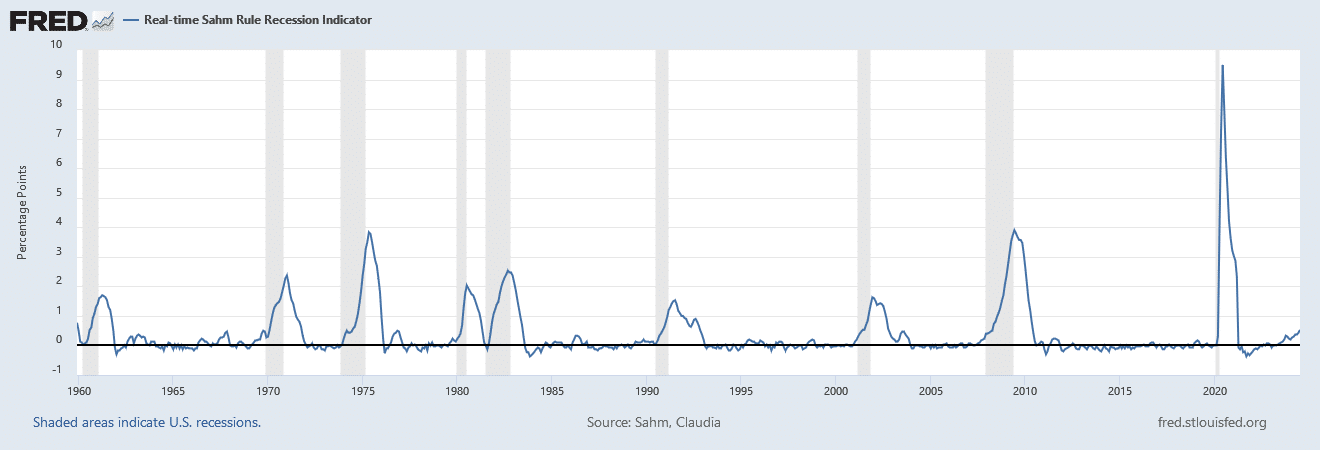

Source: Sahm, St Louis Fed

It hasn’t helped that geopolitical tensions have stirred economic uncertainty on the global stage. The ongoing conflicts in the Middle East and Ukraine have contributed to the delicate economic landscape for the US, which is looped in both.

Here is how a possible recession would affect Bitcoin price in the current cycle.

Investor sentiment

Investor sentiment typically shifts towards risk aversion in recessionary environments. Risk-averse market participants mainly adopt conservative asset allocation, favoring low-risk instruments over volatile assets like cryptocurrencies.

Shifting sentiment by investors choosing to retreat to traditional safe assets would likely mount pressure on Bitcoin price, notwithstanding its fixed supply appeal.

Some market commentators have also opined that a recessionary environment would set the stage for Bitcoin to decouple from equities in the current cycle.

Recessions typically constrict liquidity, birthing tighter conditions as market participants prioritize capital preservation. A recessionary environment would result in curtailed inflows into crypto assets, thus exerting downward pressure on their prices.

Governments and financial regulators may resolve to tighten controls and implement new policies in response to economic contractions. In the past, the crypto market has shown sensitivity to regulatory developments, and any new restrictions would likely introduce more volatility.

Conversely, a recession can also prompt monetary easing and fiscal stimulus measures like reduced interest rates. Market confidence is growing that the Fed will now cut its benchmark interest rate by a warranted 0.5% in September instead of the initial 0.25% projection.

Given the current market dynamics, a rate cut would inject more liquidity, with Bitcoin poised to benefit from such a supportive macroeconomic condition that would result in a weaker US dollar.

Historical context

Past data indicates mixed Bitcoin market performance during periods of an economic downtrend, reflecting its simultaneous speculative and store-of-value attributes.

Source: TradingView

When the Fed last cut interest rates in March 2020, Bitcoin traded below $7,000, rising to $60,000 over the following year.

In contrast to the 31st July Fed decision to leave interest rates unchanged at their 23-year high, Japan’s central bank tightened its monetary policy on 5th August.

The Bank of Japan (BoJ) raised its benchmark interest rate from near-zero to 0.25%.

Trajectory ahead

While the immediate reaction to recession fears has been bearish, it doesn’t indicate any long-term negative trend. Most economic releases this week are light, drawing the attention of market watchers to next week’s July CPI inflation report.

The biggest question is whether the US can muddle through prevailing economic challenges without regression into a severe depression. That said, market participants should closely monitor economic indicators and policy responses in the coming weeks.