- Long-term holders are trimming BTC positions, while short-term traders ride momentum.

- Despite consolidation near $102K, bullish sentiment holds.

After months of quiet belief, long-term holders are finally starting to trim their positions – just as short-term traders ride a wave of profits sparked by Bitcoin’s [BTC] surge.

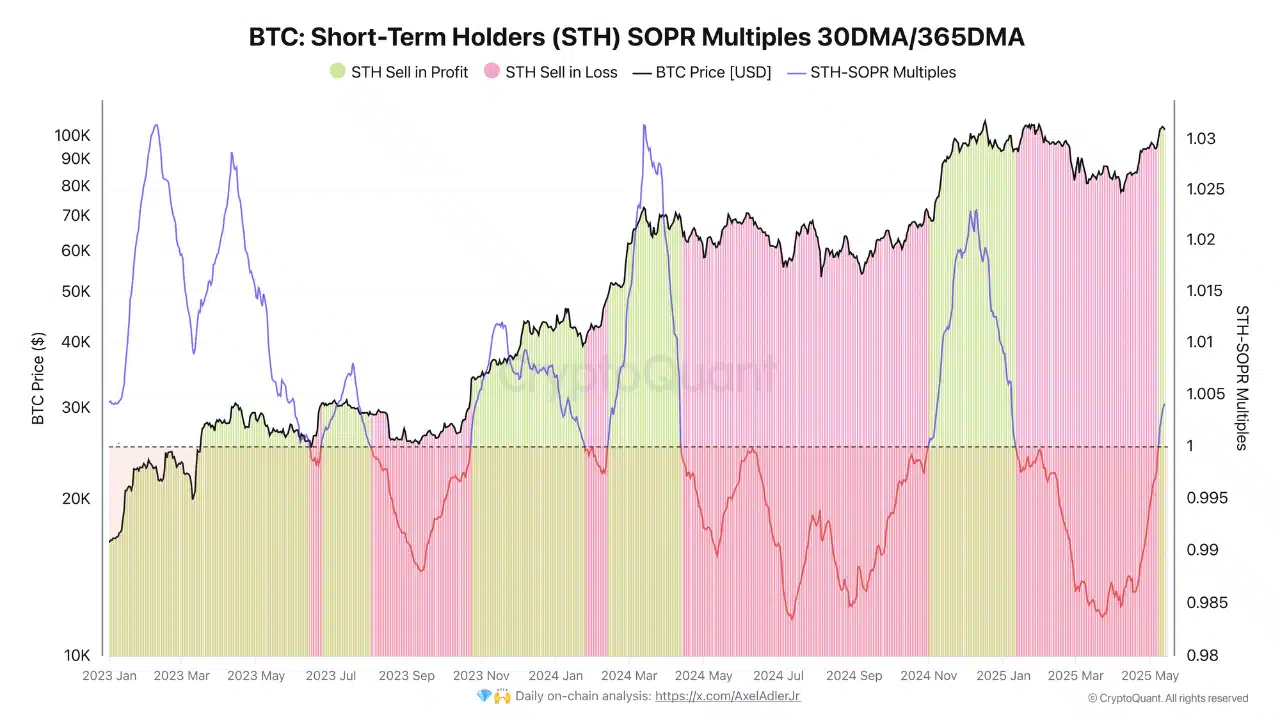

With BTC now well over the $100K mark, market momentum is undeniable. LTH spending is rising, STH SOPR remains above 1, and the broader mood feels bullish. But growing profit-taking could soon test the market’s resilience.

Early signs of distribution

After a steady accumulation phase that saw LTH supply climb from 13.66 million BTC in mid-March to a peak of 14.29 million BTC, the trend has quietly reversed.

Source: Glassnode

May has recorded two consecutive declines in long-term holder (LTH) supply, alongside a rise in LTH spending to 0.43—a significant increase.

These subtle shifts often signal approaching local tops, as seasoned holders start taking profits before broader market movements.

With Bitcoin now trading above $100K, these inflection points warrant close monitoring.