- Bitcoin gains traction as U.S. economic uncertainty hits record highs, boosting its safe haven appeal.

- Declining BTC inflows to Binance signal reduced sell pressure and growing long-term investor confidence.

As U.S. economic instability deepens, Bitcoin [BTC] is once again drawing attention as a potential global safe haven.

With investor confidence in traditional markets wavering, the crypto market’s flagship asset is showing signs of resilience.

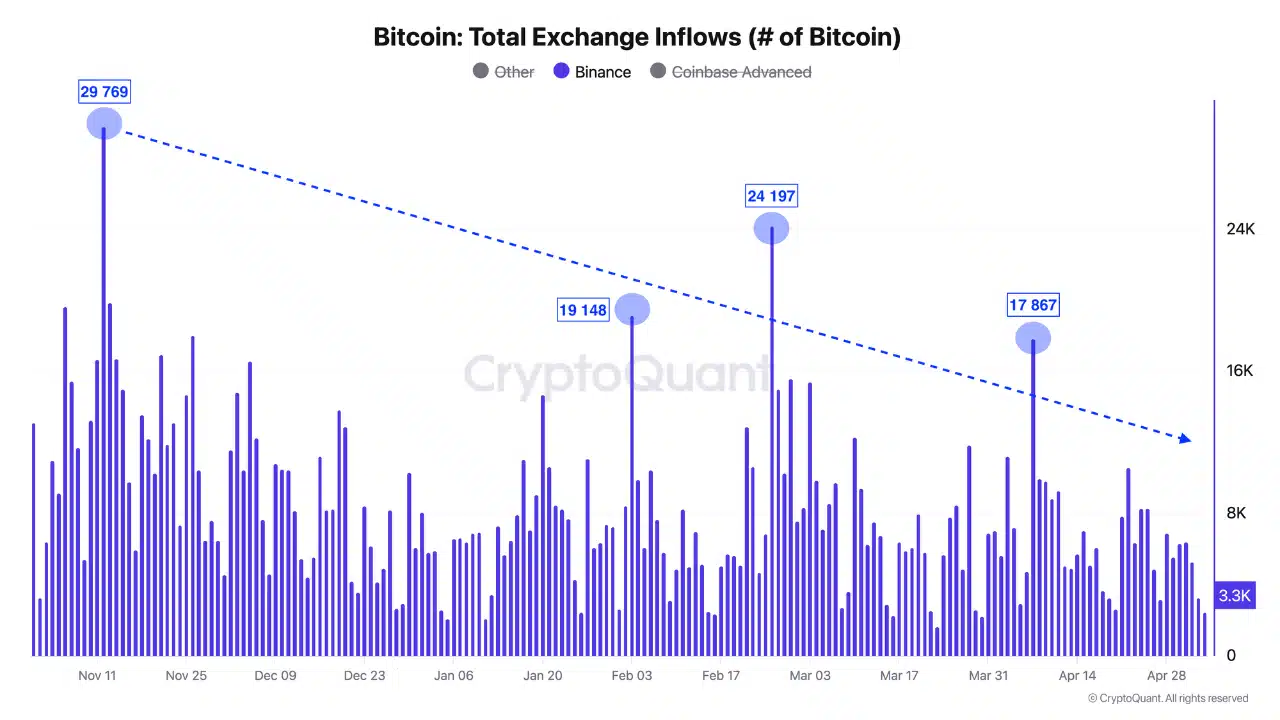

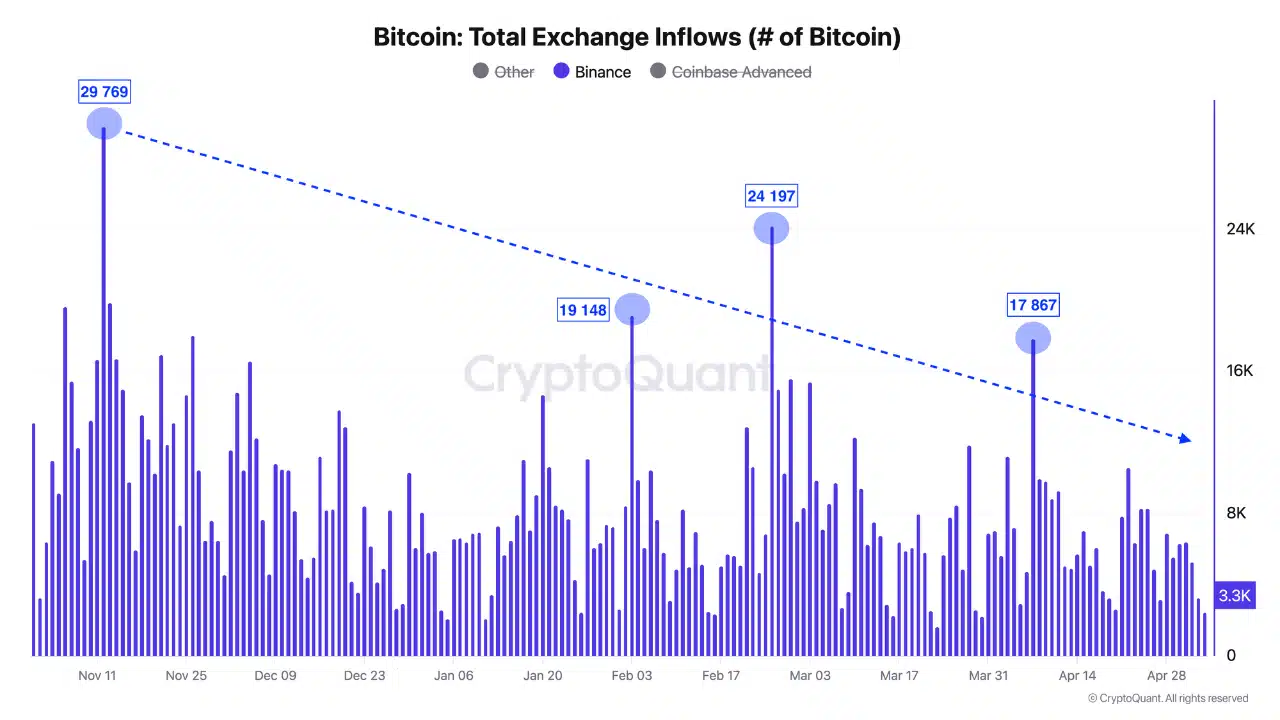

Notably, BTC inflows to Binance have dropped significantly, pointing to reduced sell-side pressure and a shift toward long-term holding.

These quiet but telling signals suggest that Bitcoin may be coiling for its next major breakout, quietly positioning itself not just as a hedge, but as a contender in the flight to safety narrative.

Bitcoin rises amid record-breaking economic turbulence

The U.S. economic policy uncertainty index has surged to an all-time high in 2025.

The chart showed that each spike in uncertainty has historically coincided with bullish momentum for Bitcoin — and the latest surge is the most extreme yet.

Source: Alphractal

The second Trump administration’s tariff hikes, a reinstated debt ceiling, stalled Fed policy, and a credibility crisis for the U.S. dollar have all fueled investor anxiety.

Add to it the geopolitical risks and regulatory whiplash, the result is a highly volatile environment for traditional markets.

Bitcoin, in contrast, appears structurally immune to such chaos.

With trust in fiat waning, BTC is increasingly viewed not as speculative, but as a strategic hedge — one that may quietly be entering its next accumulation phase ahead of a major breakout.

BTC: Easing selling pressure

Bitcoin inflows to Binance have been in steady decline since late 2024, pointing to a reduction in immediate selling pressure.

While there were a few notable spikes above 17,000 BTC, the trend is clear: fewer coins are being moved to the exchange for liquidation.

Source: CryptoQuant

With macro risks rising and investor confidence in fiat systems faltering, this may reflect growing conviction in Bitcoin’s long-term role as a hedge.

Bitcoin’s price outlook

BTC traded near $94,000 at press time, posting a minor pullback after testing the $96,000 mark. The RSI has slipped from overbought territory to around 58, indicating a cooling momentum without indicating overselling.

Source: TradingView

Meanwhile, the MACD was close to a bearish crossover; potential consolidation or short-term weakness. However, price structure remained intact above previous resistance levels, now acting as support.

If the dip finds footing above $91,000-$92,000, bulls could regain control swiftly.