- Bitcoin bull run is at high risk of losing momentum to alternative assets as volatility increases.

- Large HODLer support is essential for maintaining a parabolic run.

This post-election cycle is unlike any before it. In the past, when Bitcoin [BTC] entered a high-risk phase, investors tended to shy away.

This time, however, it hasn’t even been a week since the results were announced, and BTC has already posted three all-time highs, with the latest reaching $81K.

This Bitcoin bull run is a clear sign of the shift the crypto community is championing within the financial landscape, advocating for digital assets as a hedge against inflation and centralized control.

However, beyond its appeal as an asset class, the influence of speculative momentum on Bitcoin’s price is undeniable.

While the bulls have held firm over the past week, several key conditions must align to keep this rally going.

If these conditions don’t fall into place, a bearish pullback could not only halt the Bitcoin bull run but potentially erase the gains made so far.

Bitcoin bull run could slow

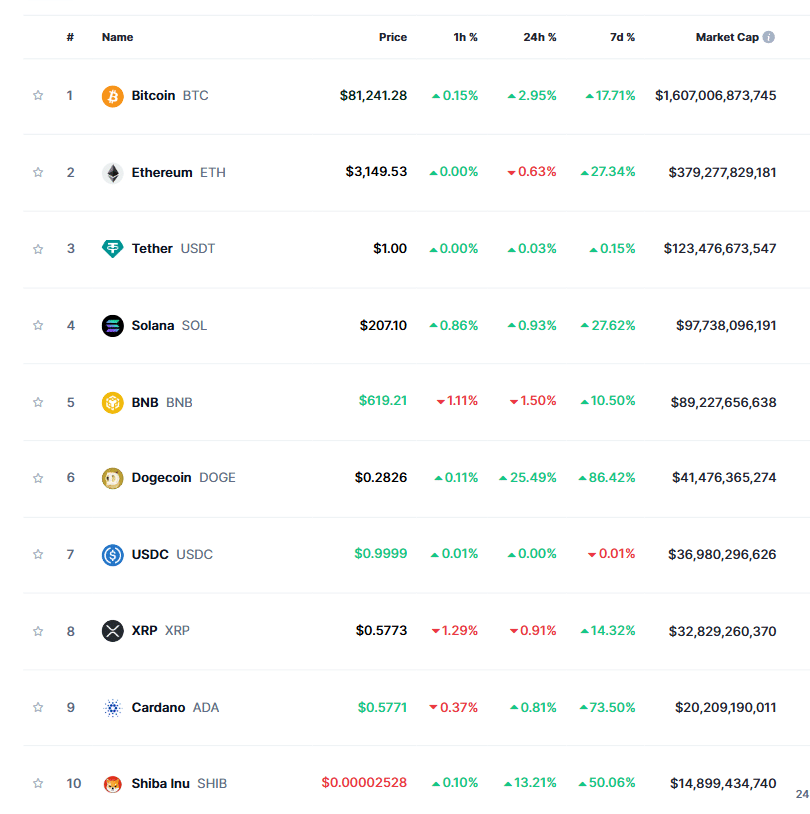

Two days ago, Bitcoin’s market share slipped to 58.5%, with its price seeing a modest 0.19% daily gain. In contrast, Ethereum’s [ETH] dominance rose by 3%, with its price increasing by 5% during the same period.

In the middle of a Bitcoin bull run, this trend suggests that altcoins are gaining a significant leg-up, pulling attention away from BTC.

Typically, this shift happens when traders perceive Bitcoin has reached a market top, turning to altcoins as a more affordable alternative.

Source: CoinMarketCap

As a result, while Bitcoin’s weekly gain has been impressive, pushing it to a new ATH of $81K, the impact on its counterparts cannot be overlooked, with several altcoins even nearing a triple-digit increase.

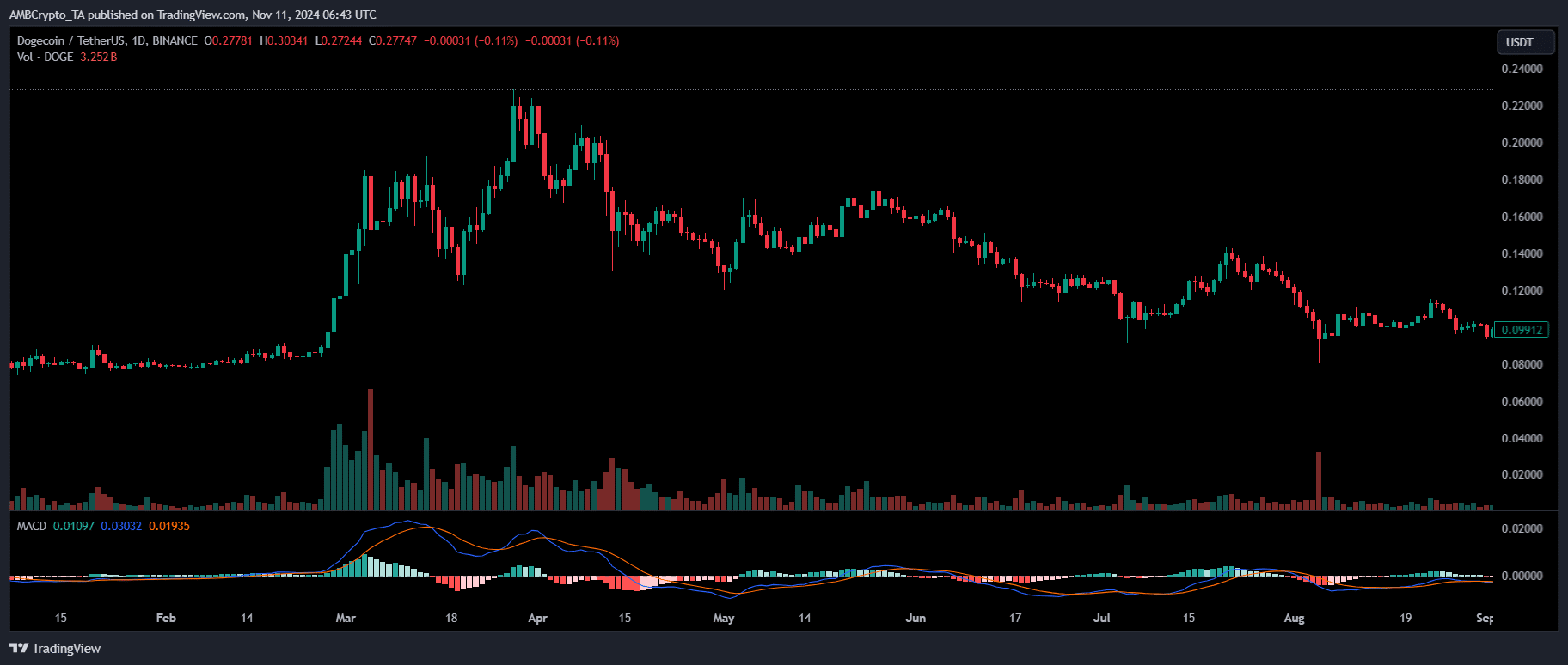

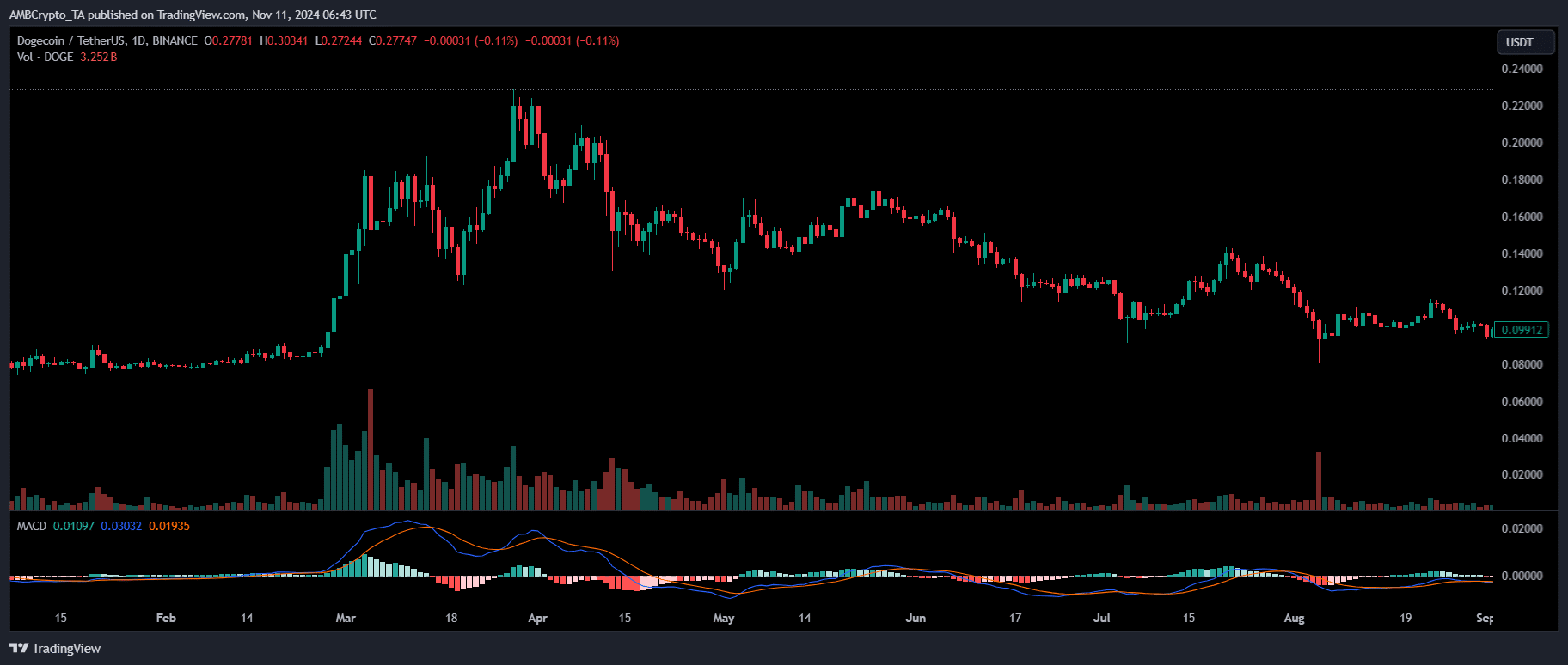

Looking at the daily price chart, AMBCrypto identified another pattern that supports this trend.

In every Bitcoin bull run, while the initial momentum is fueled by Bitcoin itself, as the cycle nears its end, a huge capital influx is typically redirected into altcoins.

Source : TradingView

For instance, during the March bull rally, after BTC hit an ATH of $73K, it consolidated below that price range. However, altcoins like DOGE spiked, reaching $0.20 in under 10 trading days.

This brings us to an important question: Is Bitcoin’s bull run nearing its end, as altcoins post higher highs? Or, given that this cycle is unlike previous ones, does BTC still have room for growth?

Key conditions needed for BTC to reach $100K

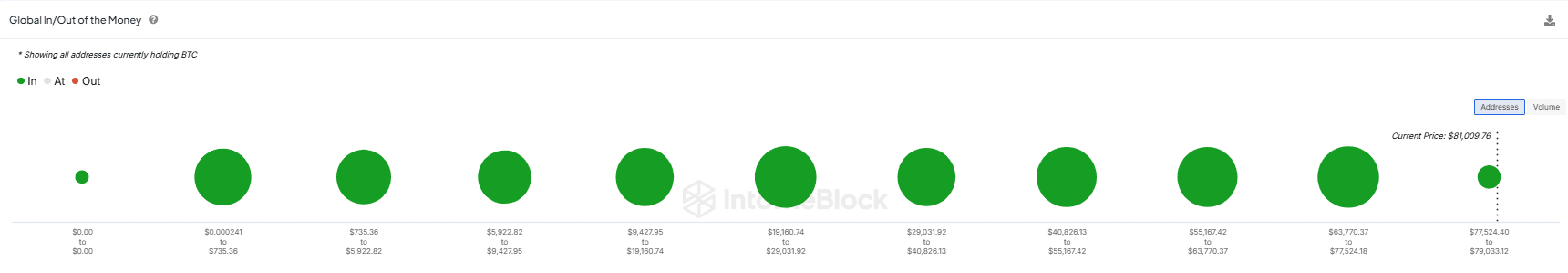

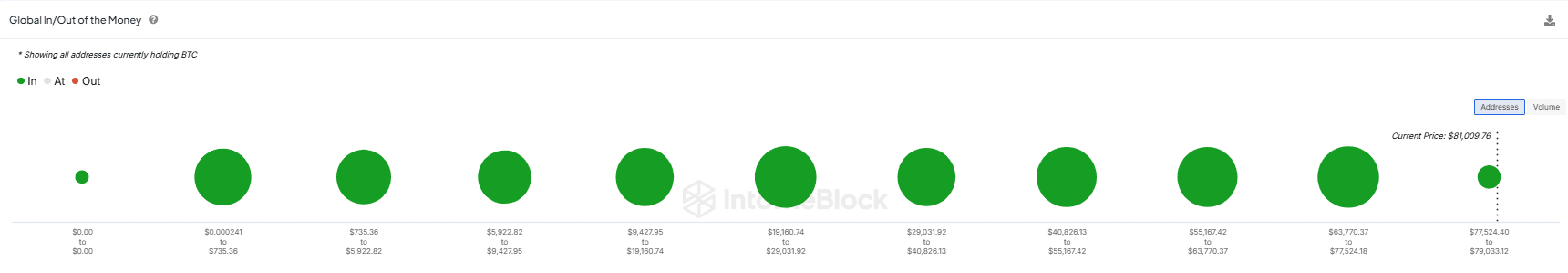

As noted in another report, in order to keep BTC unchallenged above $80K, large HODLers need to perceive the current price as an attractive entry point. If they do, it will be hard for bears to push for a correction.

The reason is simple: Bitcoin’s bull run has driven it to a new ATH, leaving all stakeholders in net profit, with their average purchase prices well below the current market level.

Source : IntoTheBlock

This makes BTC more vulnerable to price swings as weak hands begin to sell. Therefore, in the event of a pullback, the bulls will likely rely on whales for support.

Currently, the market is experiencing strong bullish sentiment, fueled by the prevailing macroeconomic and political environment, which is expected to keep BTC within the $79K-$81K range.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, to sustain the Bitcoin bull run and reach $100K, it will be crucial for the aforementioned conditions to align.

If they don’t, a pullback could be closer than expected, with bears regaining dominance across various metrics.