- ARB could rally by 125% – 200% amid key bullish catalysts

- ETH’s price could further aid the token’s prospects from January 2025

According to analysts, Arbitrum [ARB] may be relatively undervalued and could offer extra 125% gains if it soars to its 2024 highs.

In a recent post, Andrew Kang of crypto VC Mechanism Capital noted that ARB has been ‘fundamentally’ undervalued against other altcoins.

“$ARB has had a great rally but is still fundamentally undervalued. Trades at a fraction of Sui, AVAX, Tron, etc, but has them beat on volume and TVL by multiples.”

Source: X

ARB’s key catalysts

Kang added that the altcoin has seen massive institutional interest and Ethereum’s interoperability research. These, according to him, have been bullish catalysts for the price.

For his part, Blockworks Research’s Ryan Connor views Arbitrum’s Timeboost, a new priority transaction ordering system, as another key catalyst. The research firm stated that Timeboost would drive more activity on Arbitrum, claiming that the market has been mis-pricing ARB.

So, how far can ARB’s price go from here?

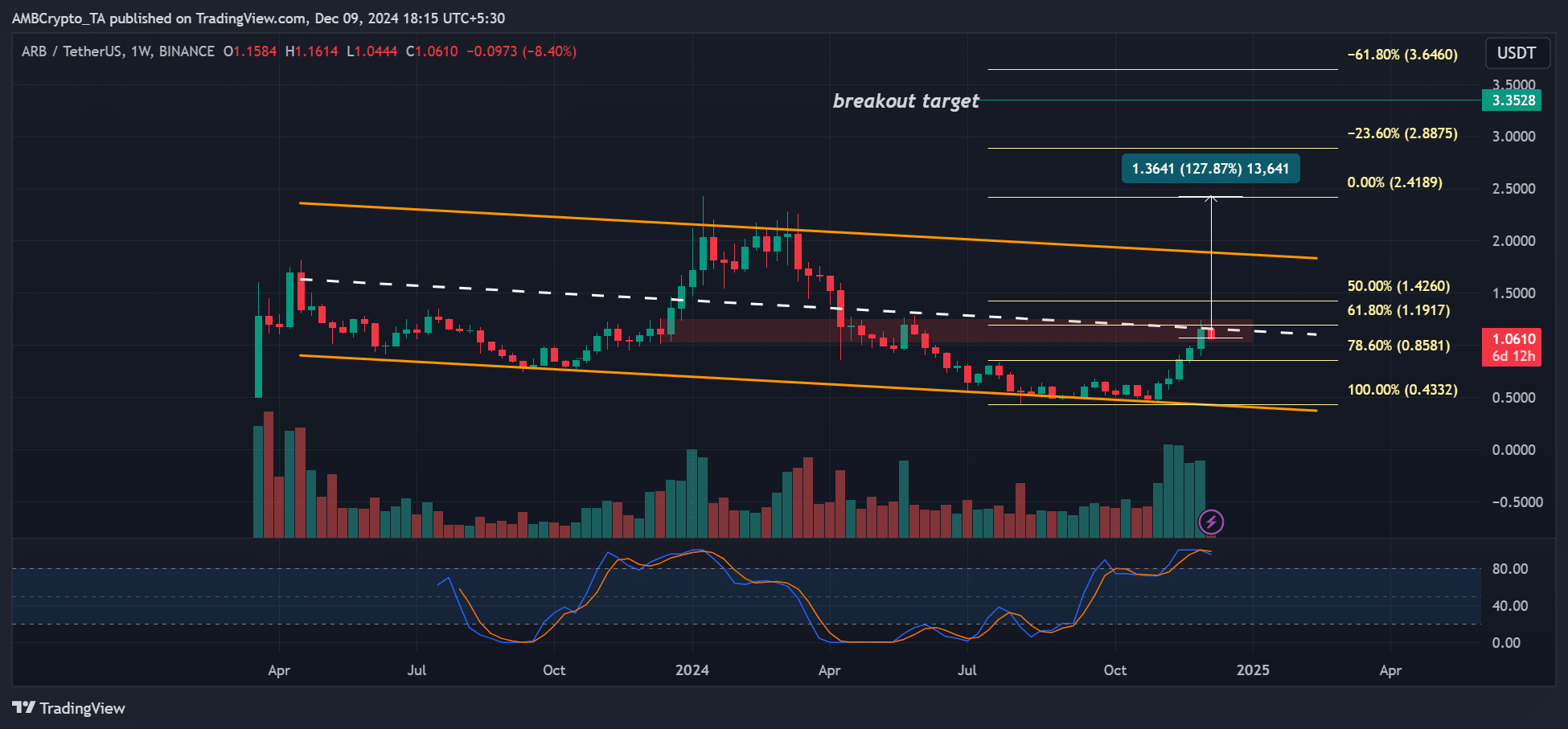

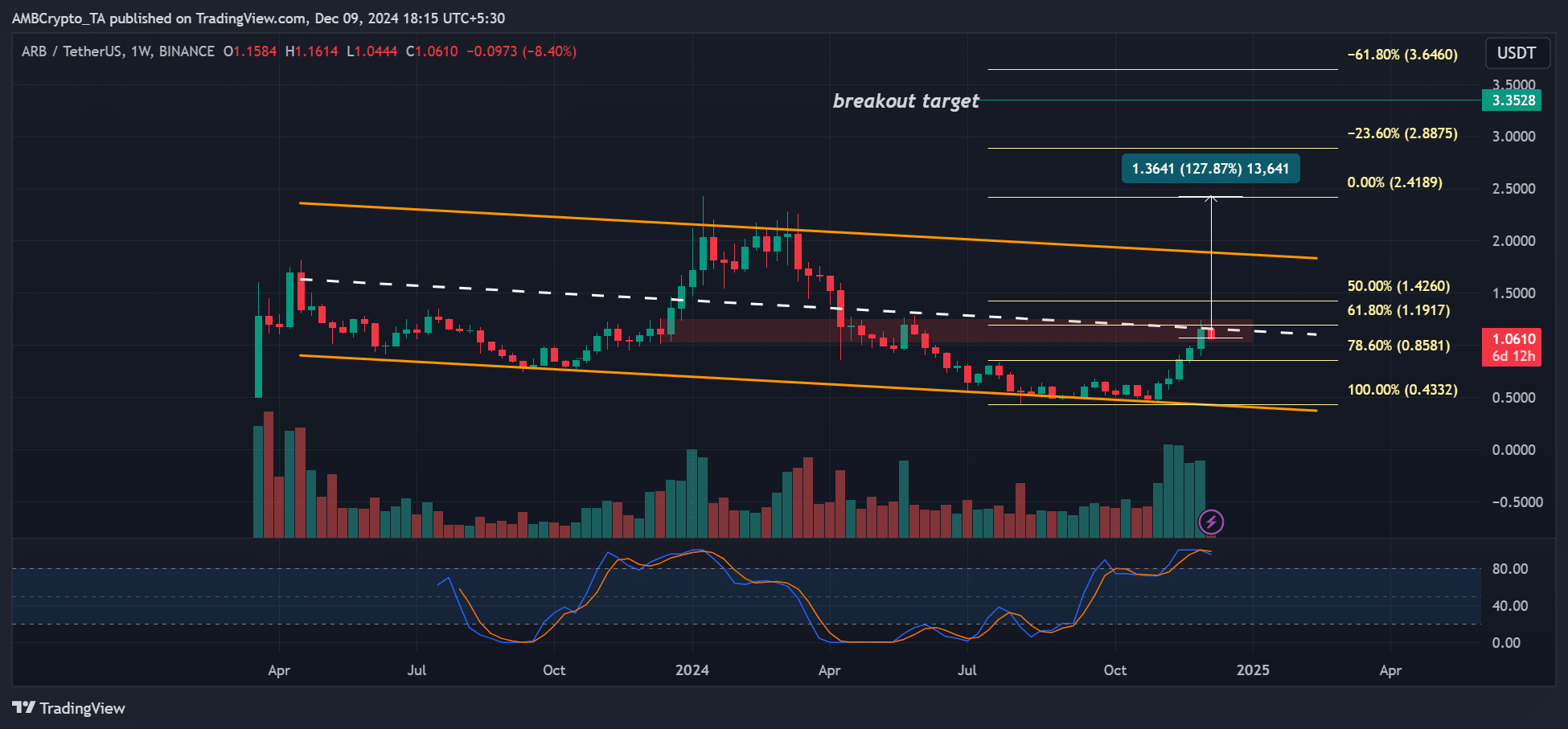

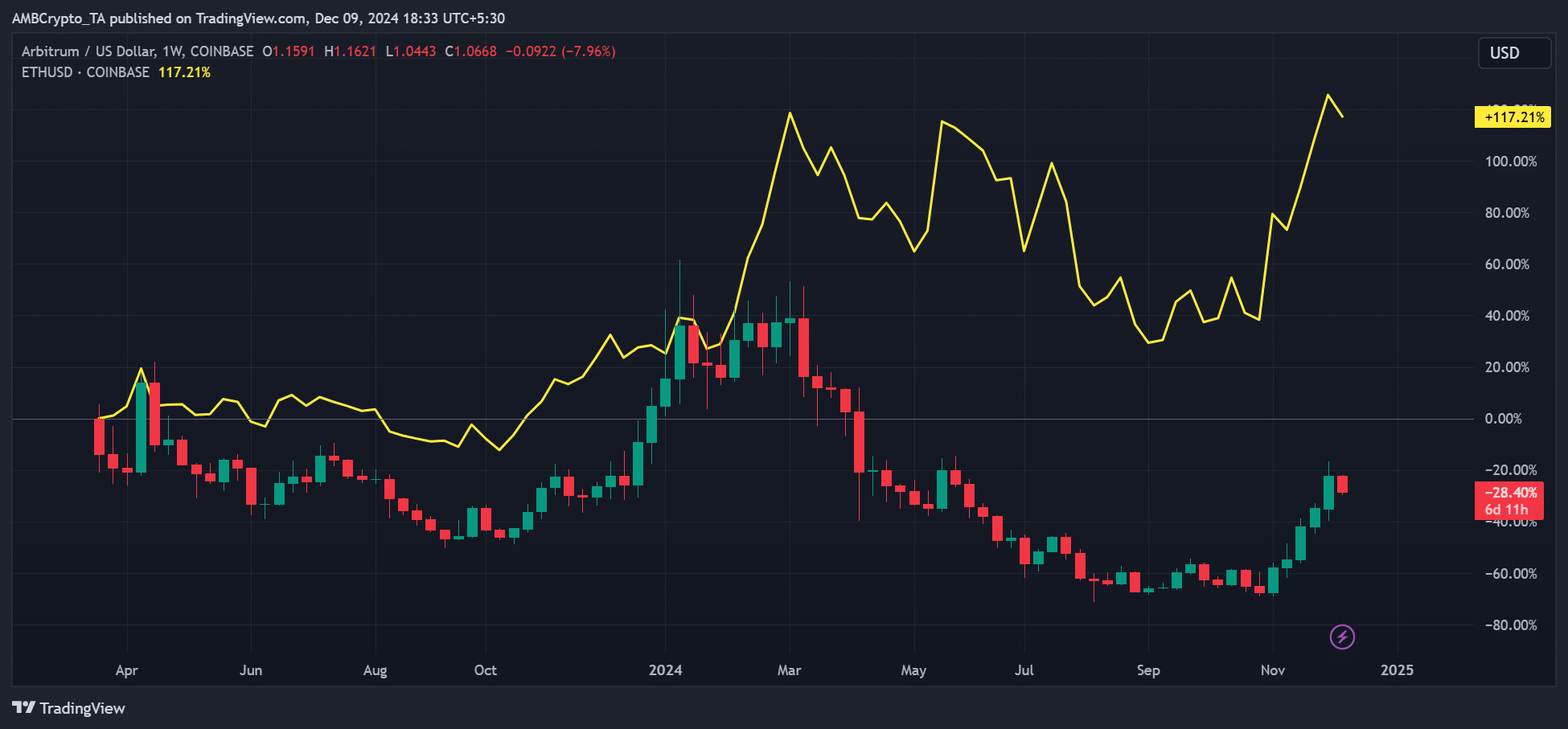

On the weekly charts, the medium-term target would be the upper channel ($1.9) – An 80% potential gain if hit. An extension to its 2024 high of $2.4 would boost the potential rally to 127%.

Source: ARB/USDT, TradingView

That’s a conservative price target. If the breakout from the descending channel follows textbook scenarios, the bullish target would be $3.35. That’s a whopping 213% gain from its current $1 value – A potential 3x move.

At the time of writing, ARB was at a key roadblock at the channel’s median level. A decisive move above $1.2 could accelerate the odds of hitting the upper channel and a possible breakout.

Perhaps the long-term impact will be ETH’s price direction and regulatory shift. The ETH L2 segment lagged behind other sectors because of unclear DeFi regulation. This can be expected to change under the Trump 2.0 administration.

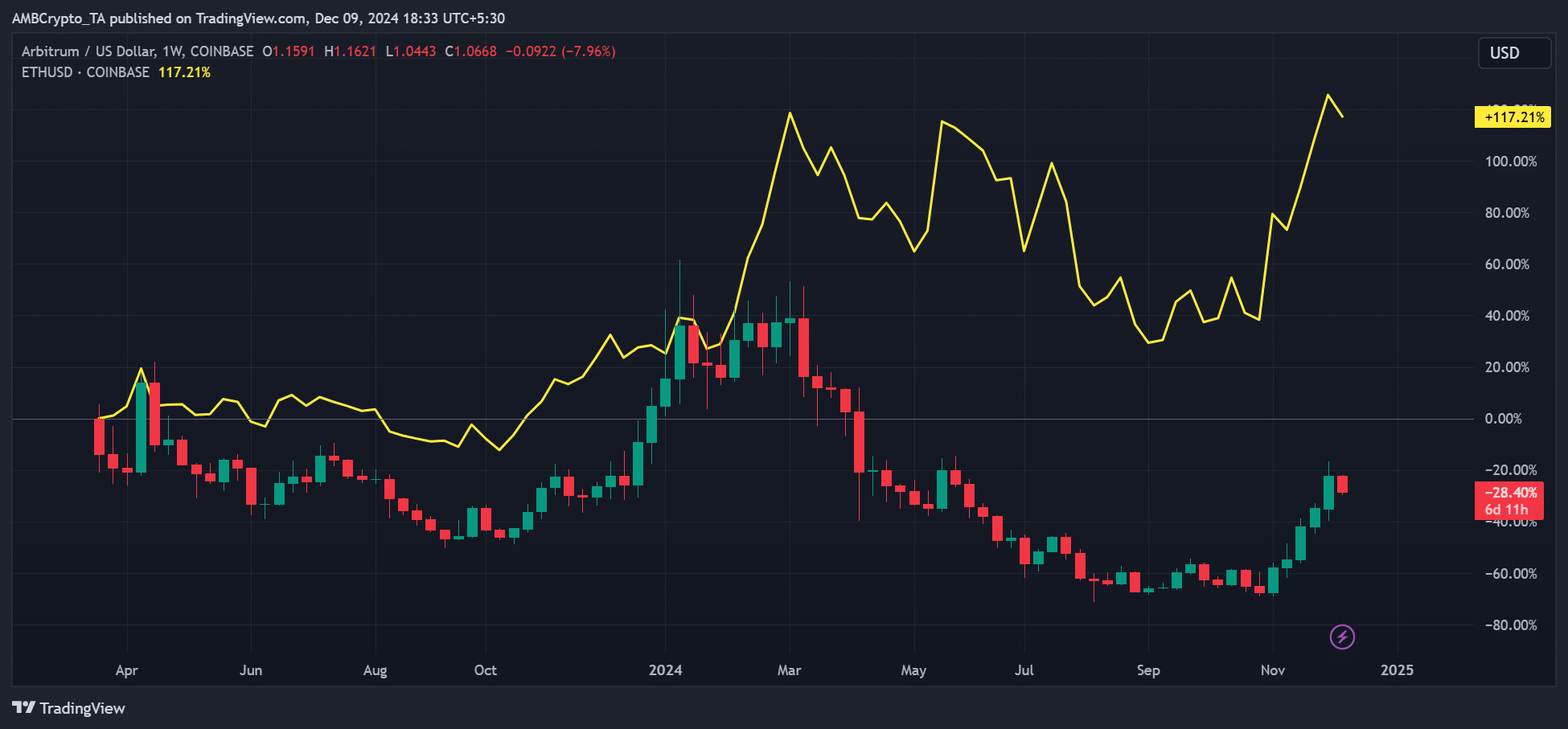

Last week’s nomination of pro-crypto Paul Atkins as SEC Chair tipped ETH to tap $4k. ARB also climbed higher, a positive correlation, underscoring ETH’s influence on ARB and the entire L2 segment.

Source: ARB vs ETH performance, TradingView

So, how could ETH’s price outlook aid ARB? Most analysts foresee ETH hitting a new all-time high (ATH) by January 2025. In fact, in its latest market update, QCP Capital noted,

“Historically, ETH does not usually put in a new all-time high until January of the post-halving year. This sentiment is also reflected in the options market, where ETH risk reversals are skewed toward calls only from January onwards.”

In short, strong ETH momentum from January 2025 could lift ARB even higher.

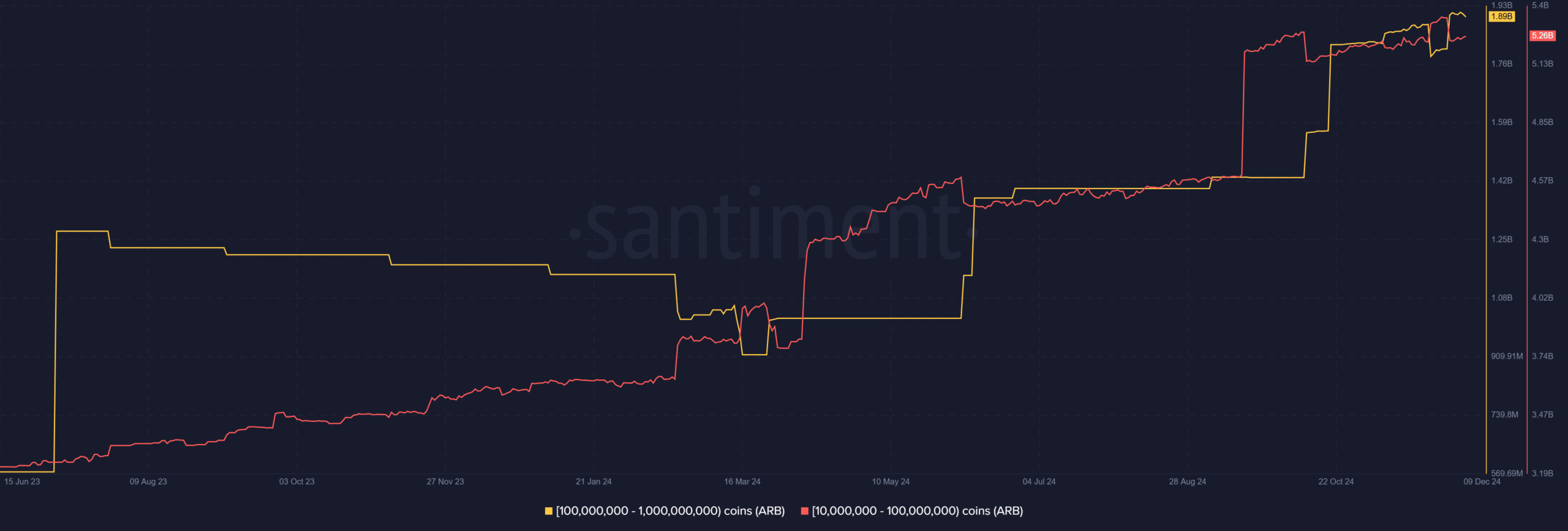

Interestingly, the movement of top whale wallets also expected an extra rally for ARB. Since September, top whales have increased ARB holdings from 6 billion to 7.15 billion tokens (worth $7.15B).

Source: Santiment

The aforementioned observations, together, pointed towards a bullish outcome for ARB with potential +200% gains from January 2025.

However, ETH could determine the altcoin’s direction. So, any weak sentiment on the king altcoin could affect ARB’s bullish projections.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion