- ORDI’s trading volume soared by 200%, indicating interest among traders and investors amid a potential breakout.

- Assets’ bullish thesis will only hold if it closes a daily candle above the $44.45 level, otherwise, it may fail.

Following the election results, the sentiment across the cryptocurrency landscape has shifted from a downtrend to an uptrend. Amid this bullish outlook, the native token of the Ordinals Protocol [ORDI] is poised for a notable upside rally in the coming days.

This bullish outlook is potentially driven by positive price action, heightened interest from investors and traders, and the overall bullish market sentiment.

ORDI technical analysis and key analysis

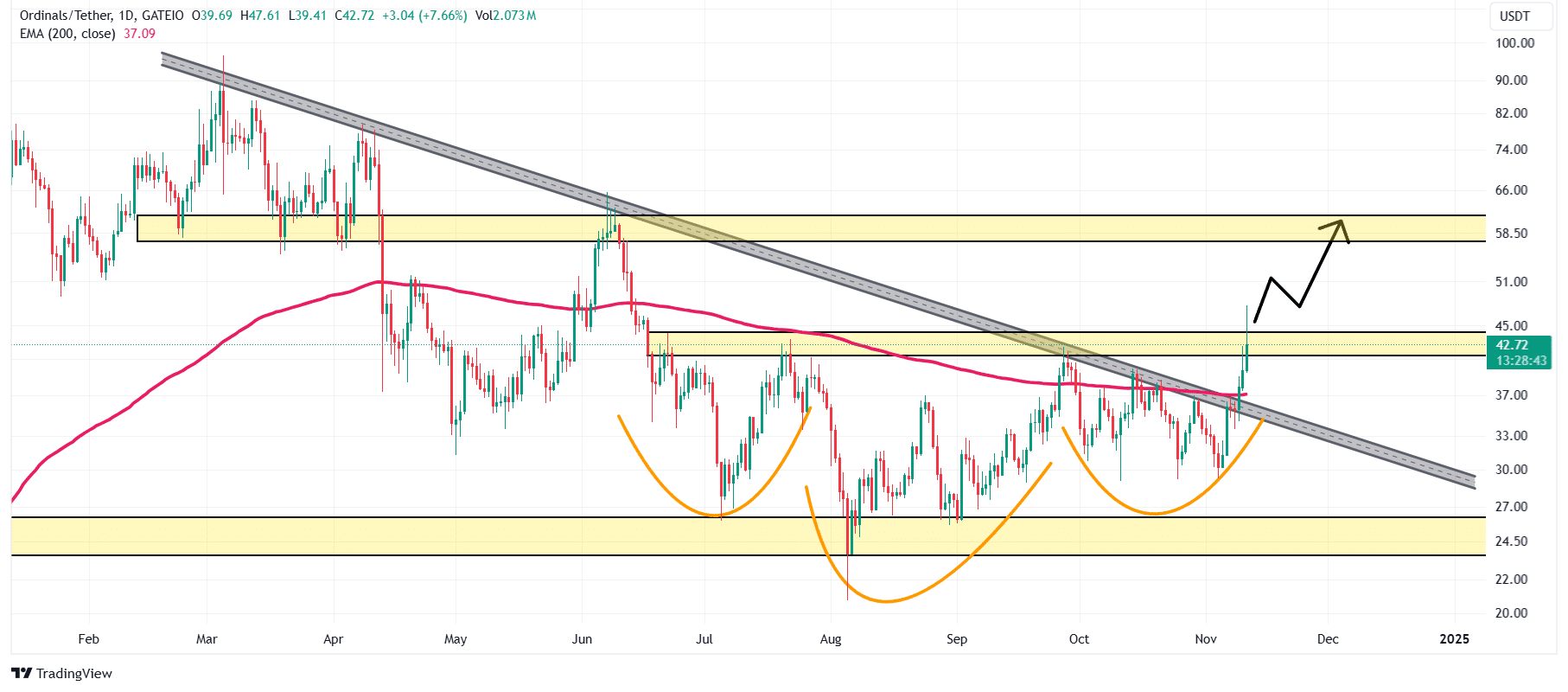

According to AMBCrypto’s technical analysis, ORDI is currently struggling to breach a crucial resistance level of $44.40. This level also appears to act as the neckline of a bullish inverted head and shoulders pattern.

Source: TradingView

Based on recent price action and historical momentum, if ORDI successfully breaches this level and closes a daily candle above $44.45, there is a strong possibility that it could soar by nearly 40% to reach the $62 level in the coming days.

Currently, ORDI is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend. Additionally, its recent breakout from a declining trendline suggests the same.

Besides all this analysis, ORDI’s bullish thesis will only hold if it closes a daily candle above the $44.45 level, otherwise, it may fail.

Bullish on-chain metrics

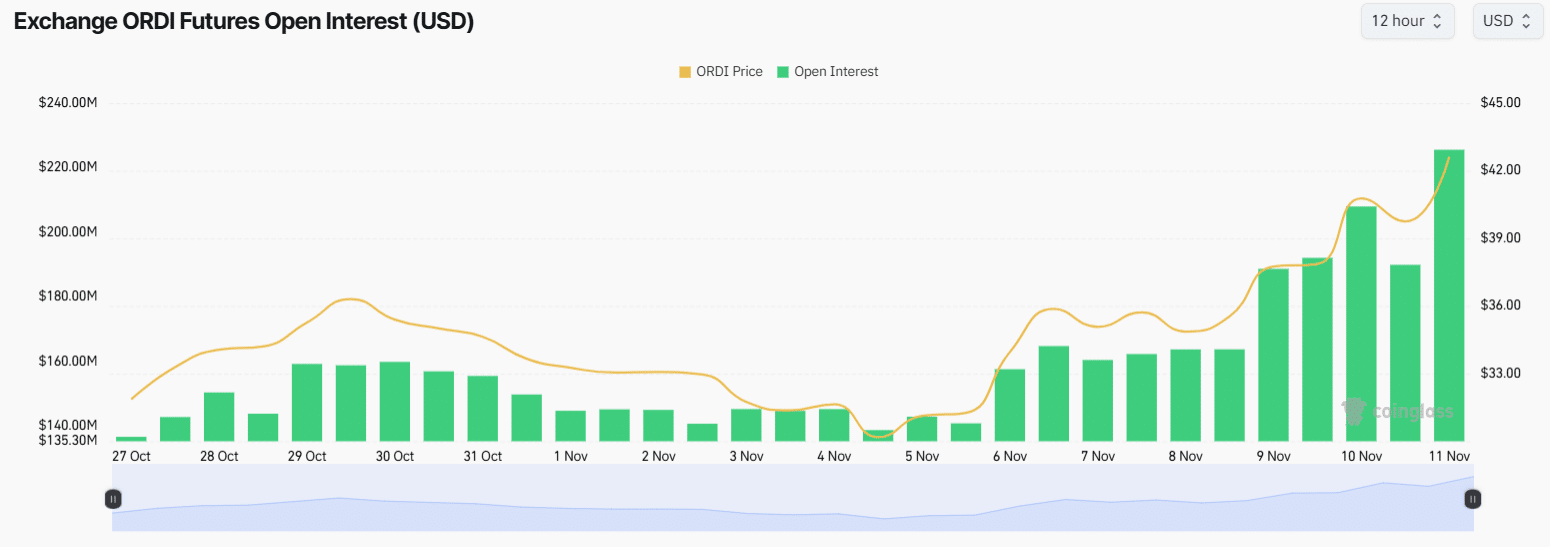

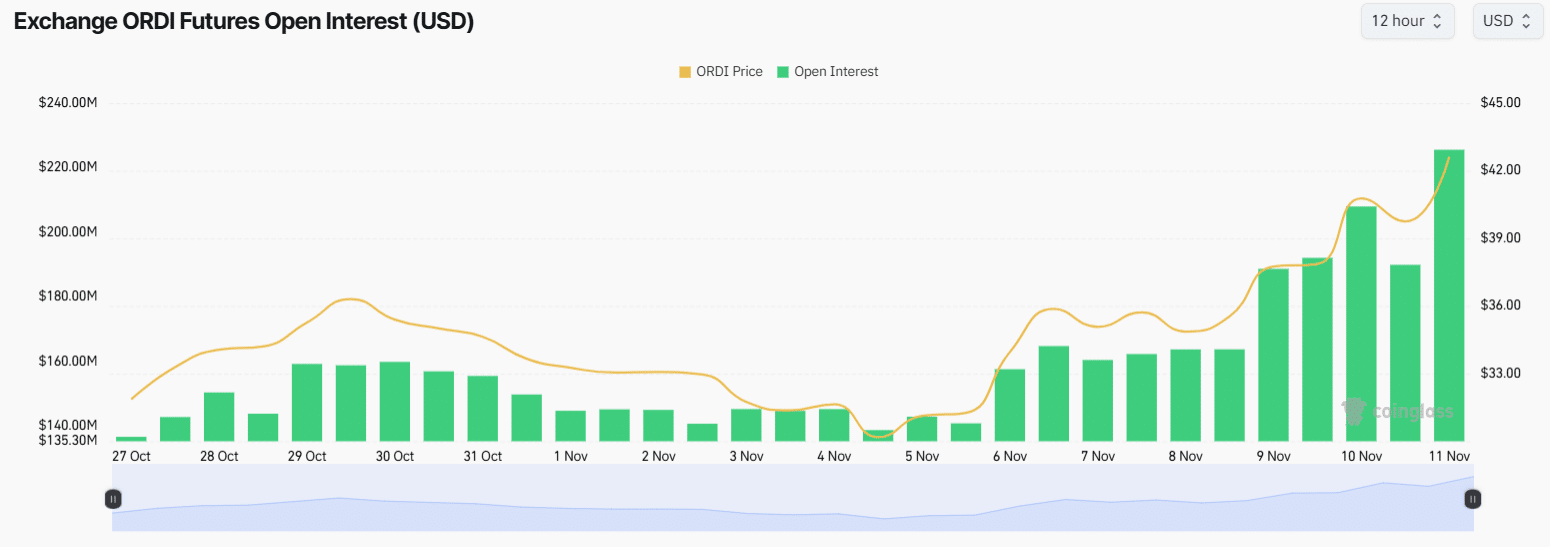

Additionally, on-chain metrics further support the asset’s bullish outlook. According to the on-chain analytics firm Coinglass, ORDI’s long/short ratio currently stands at 1.003, indicating strong bullish market sentiment among traders.

Meanwhile, it appears that trader interest has significantly increased as the asset’s price approaches the breakout level. According to the data, ORDI’s open interest has surged by 8.9% in the past 24 hours and 4.3% over the past four hours.

Source: Coinglass

Is your portfolio green? Check out the ORDI Profit Calculator

The combination of these on-chain metrics and technical analysis suggests that whales and traders are currently dominating the asset and could support its move to breach the resistance level.

At press time, ORDI was trading near $43.15 and has gained over 7.3% in the past 24 hours. During the same period, its trading volume surged by 200%, suggesting heightened participation from traders and investors amid the potential breakout.