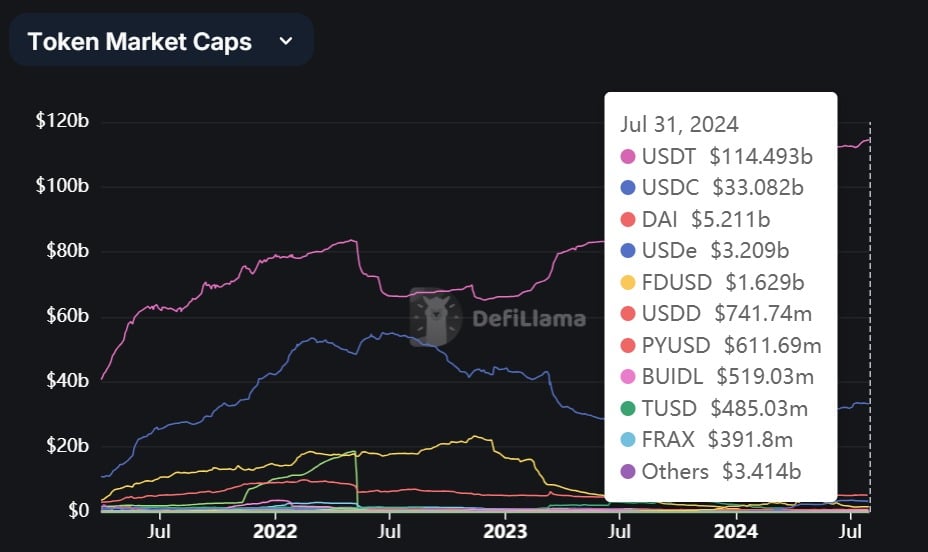

- Tether continued to dominate, hitting a market cap of $114B at press time.

- USDC recovered strongly post SVB’s collapse, with a 37% gain in its market share since.

With increased crypto adoption, especially among institutional users, Tether [USDT] was reaping big. Over the past year, USDT has experienced growth in market cap and active addresses.

The rise stems from the acceptability of stablecoins to avoid constant fiat debase, inflation, and weakening local currencies.

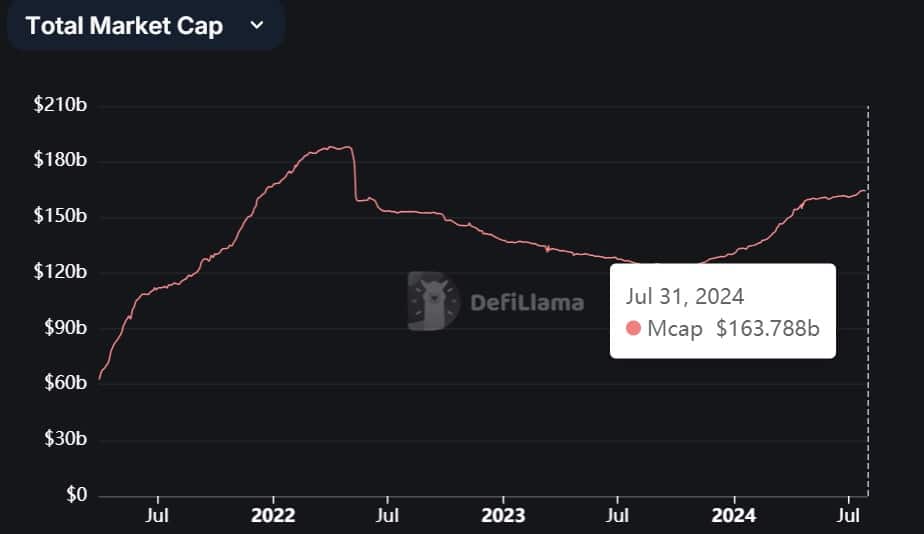

As of press time, Tether hit $114.4B in market capitalization, experiencing exponential growth since the collapse of SVB. Equally, Circle [USDC] will recover in 2024 after becoming the first crypto to fulfill MiCA regulations.

Source: Defillama

USDT outpaces USDC in inflows

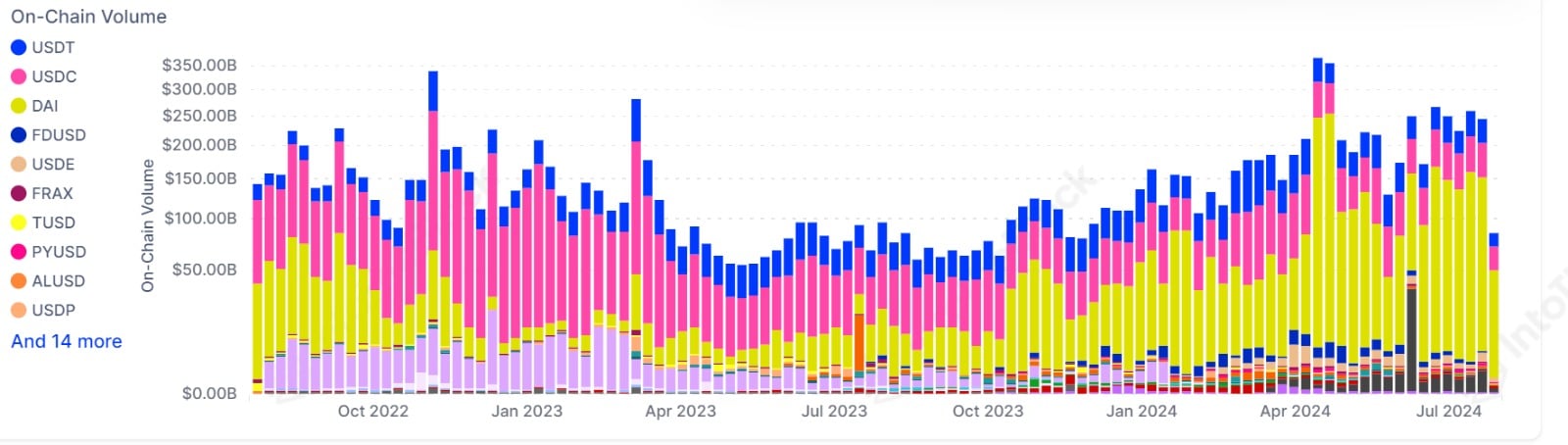

Notably, Tether’s USDT has experienced sustained inflows at press time, according to IntoTheBlock. This showed increasing deposits and adoption by many users, especially institutions and individuals.

Many crypto users have turned to USDT as a store of value to avoid fiat fluctuations, local currency devaluations, and inflation.

In many unstable economies, such as Argentina and Nigeria, USDT has become the last resort.

Source: IntoTheBlock

Data from IntoTheBlock verified that there was a low netflow, indicating that most users were keeping their USDT for future use, thus increasing the coins’ reserves and causing instability.

Additionally, AMBCrypto’s analysis showed a sustained rise in on-chain volume throughout the year. This suggested increased demand and usage for USDT over the period.

Thus, there was widespread adoption of stablecoins by individuals and institutional investors.

USDC recovers with MiCA compliance

As reported earlier by AMBCrypto, USDC has gained ground with a massive surge in trading volume, from $9 billion in 2023 to $23B in 2024. Equally, USDC’s market cap has surged over the past year.

The SVB collapse pushed USDC’s market cap to $24B in 2023 from $48B. However, since then, its market share has recovered, gaining over 12% with the market cap increasing to $34B.

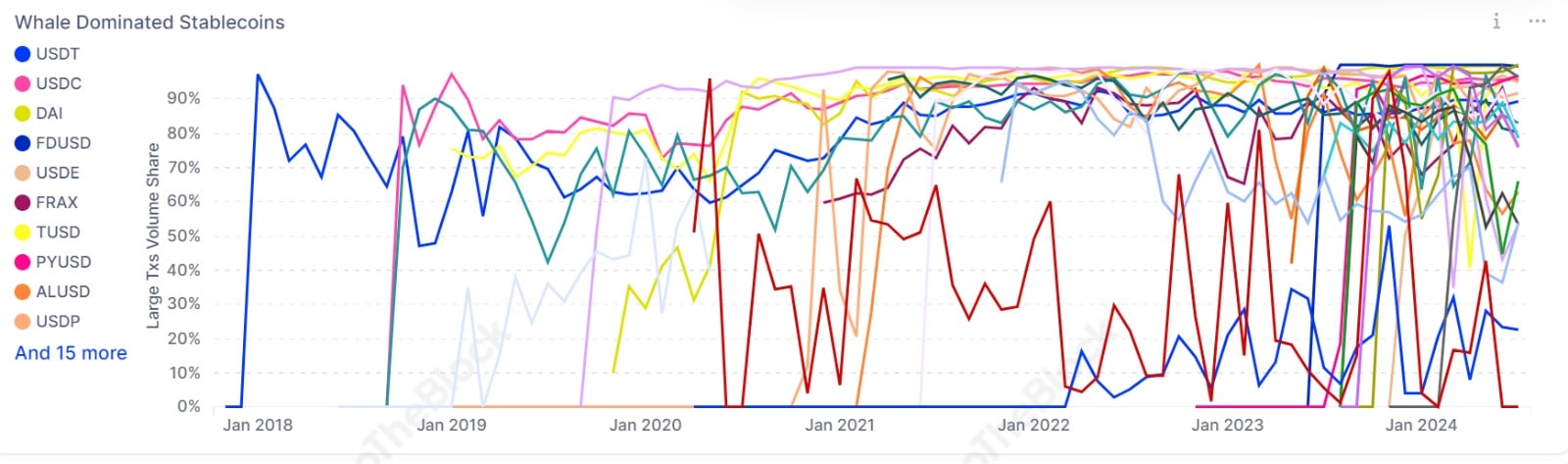

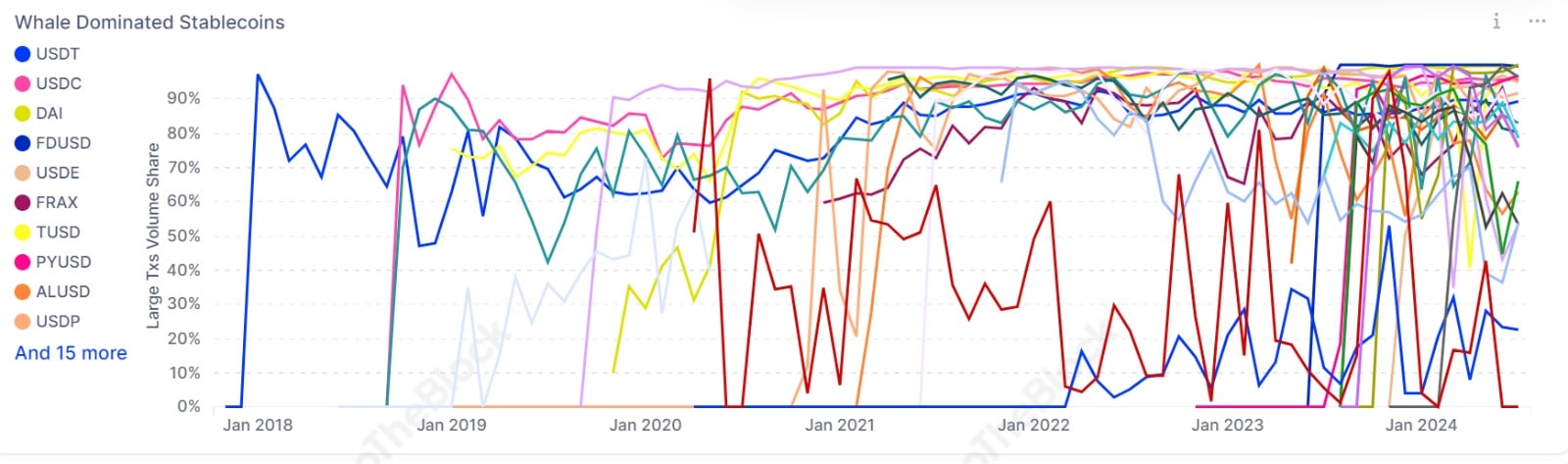

Source: Blockworks

Following its compliance with MiCA regulations, USDC has become a preference for investors looking for regulated stablecoins, which has seen the stablecoin experience a 95% of large transaction volume share.

This shows greater dominance among institutions and whales as institutions turn to regulated stablecoins.

Compliance with MICA has given USDC an advantage over Tether and other stablecoins, thus gaining ground in European markets.

Source: IntoTheBlock

Stablecoins market dominance

Undoubtedly, the surge in USDT and USDC adoption showed increased interest in stablecoins. The crypto market sentiment has shown favorability, with stablecoins showing sustained growth.

According to Defillama, the stablecoins market cap has surged to $160B as of this writing. The data showed a continuous rise from a low of $123B in 2023 to $160 with, USDT enjoying 70%.

Source: Defillama