- Jupiter, at press time, was trading at a demand zone, but buying pressure was lethargic

- Further losses can be anticipated as the price moves towards the next key liquidity zone

Jupiter [JUP] crypto seems to be in a tough spot in the market. The token’s price has dropped by 26% in two weeks, with the trading volume falling by 18% in the last 24 hours alone – A sign of bearish market sentiment.

The Solana [SOL] liquidity aggregator has not attracted many buyers recently, even though the token was trading at an attractive demand zone. Will the bulls halt the sellers, or should we expect a deeper drop?

The 78.6% retracement level might not hold

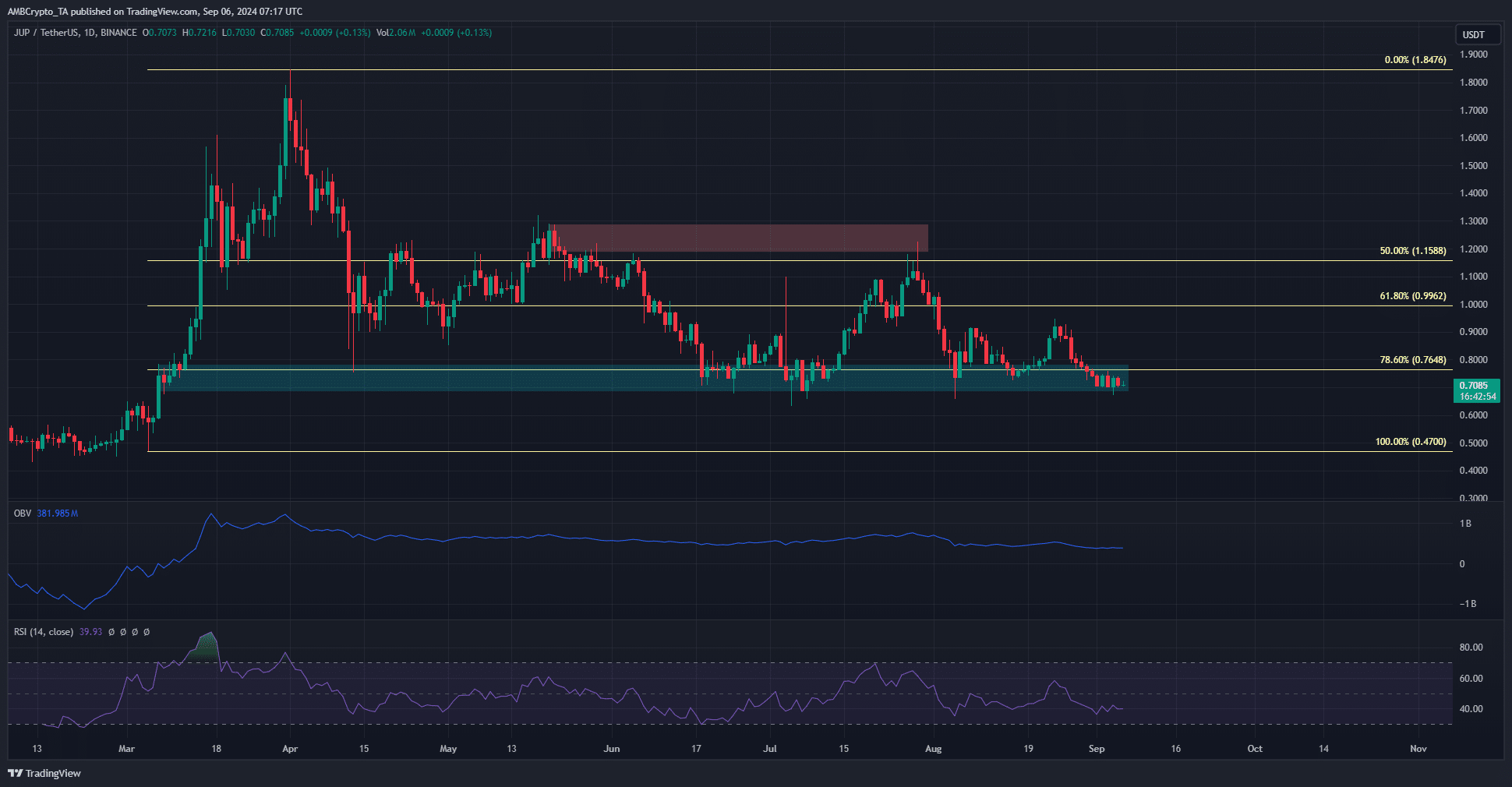

Source: JUP/USDT on TradingView

The market structure on the daily chart was bearish once more. Jupiter appeared to form a range that extended between $0.736 and $0.913, but the last few days of trading have taken it below the lows.

The $0.69-$0.78 zone was a demand zone since April and has been tested multiple times. A daily session close beneath the 78.6% Fibonacci retracement level at $0.76 has also happened many times.

A drop below the lows of 5 August at $0.658 would be a sign that $0.47 is the next price target. The OBV has also declined slowly over the past six weeks to show a lack of buying pressure. Finally, the daily RSI reflected bearish momentum with a reading of 40.

Bullish reversal potential for Jupiter under the retracement level

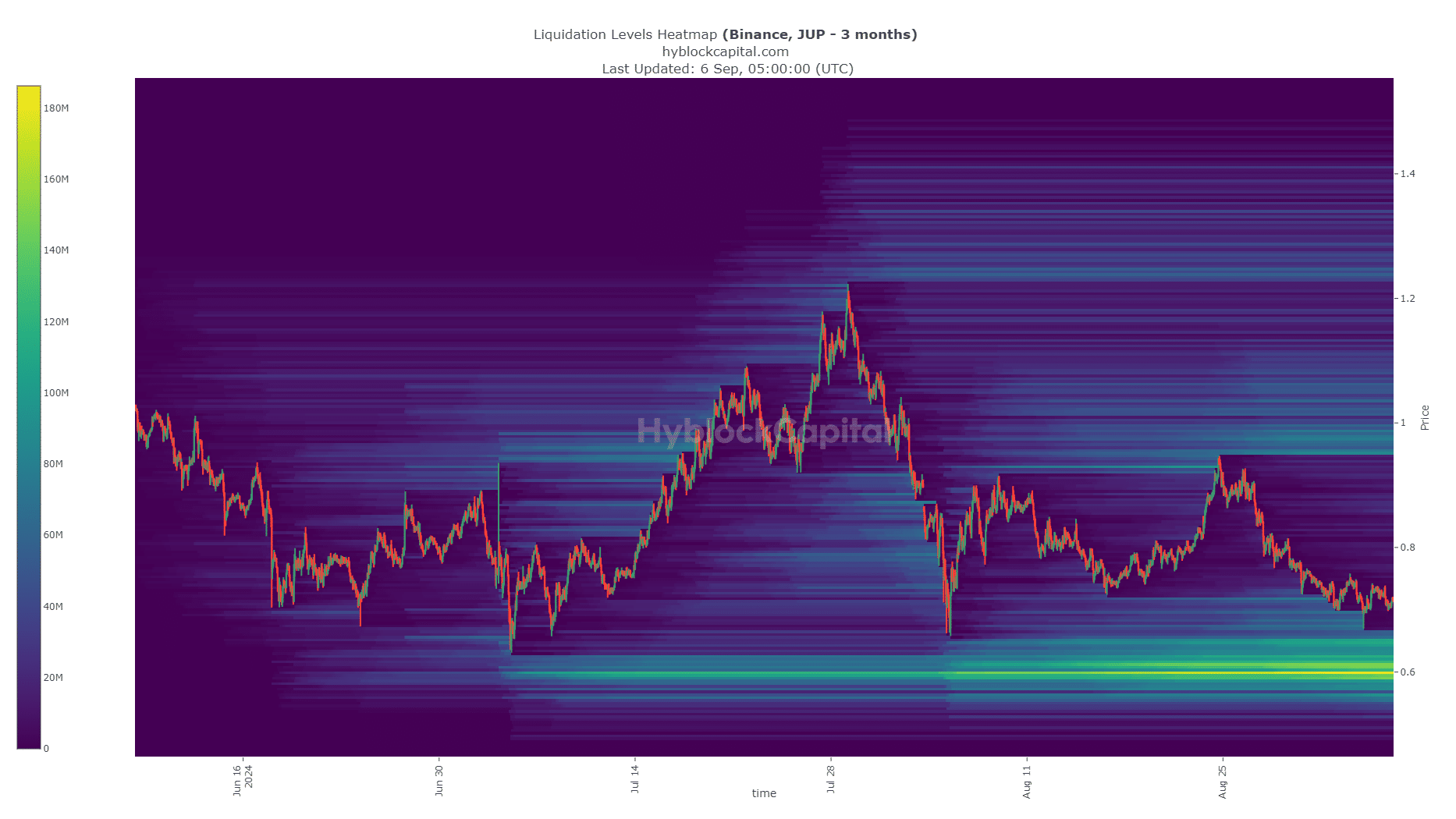

Source: Hyblock

Once the 78.6% level is beaten, the 100% retracement level is usually the next target. AMBCrypto noticed that in Jupiter’s case, it might not play out in this case.

Realistic or not, here’s JUP’s market cap in BTC’s terms

This, because a large pool of liquidity has built up at $0.6 over the past three months. A drop to this zone to collect the liquidity would likely be followed by a swift price rebound for JUP.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion