- On the bullish side, the emergence of a head-and-shoulders pattern points to a potential upside.

- However, caution prevails due to a notable imbalance in long liquidations over the past 24 hours.

Despite a strong 15.65% rally over the past week, market activity around Jupiter [JUP] has slowed. The asset slipped by 0.24% on the daily chart, reflecting weak bearish pressure but also raising concerns about waning momentum.

For now, uncertainty dominates, with no clear indication of where the asset is headed next.

Bullish sentiment builds around JUP

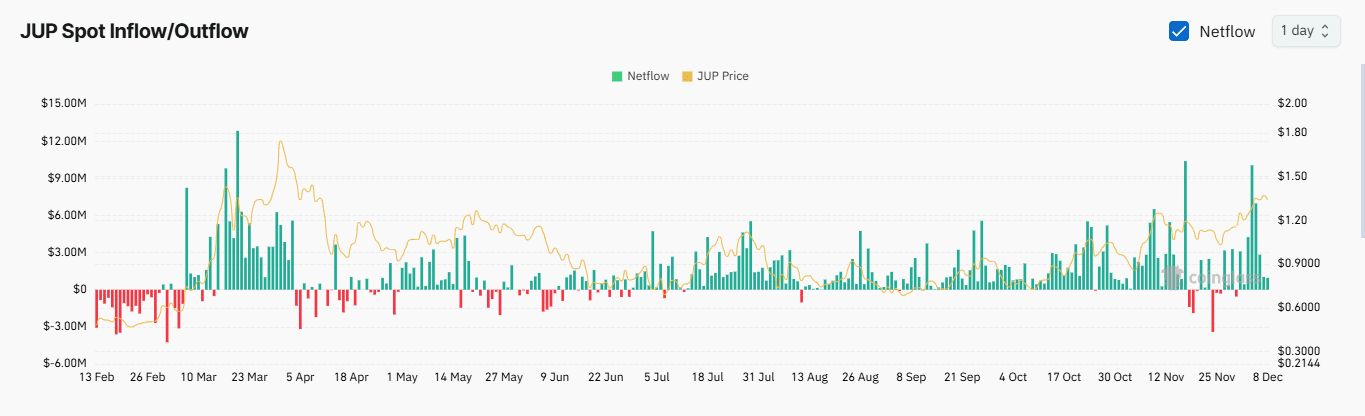

Bullish momentum appears to be forming around JUP, supported by declining Exchange Netflow and a gradual rise in Open Interest over recent days.

Exchange Netflow, which tracks buying and selling activity by measuring assets moved on and off exchanges, offers insight into market sentiment.

Recent data indicates a decrease in JUP deposits on exchanges, suggesting that market participants are opting to hold rather than sell. This behavior strengthens JUP’s position by reducing its available supply on exchanges.

Source: Coinglass

Meanwhile, Open Interest has increased by 2.62% in the past 24 hours, reaching $169.02 million. This rise further bolsters bullish sentiment, as it reflects a growing number of unsettled contracts, predominantly held by long traders.

Together, these factors suggest optimism in the market, although broader trends may still shape JUP’s trajectory.

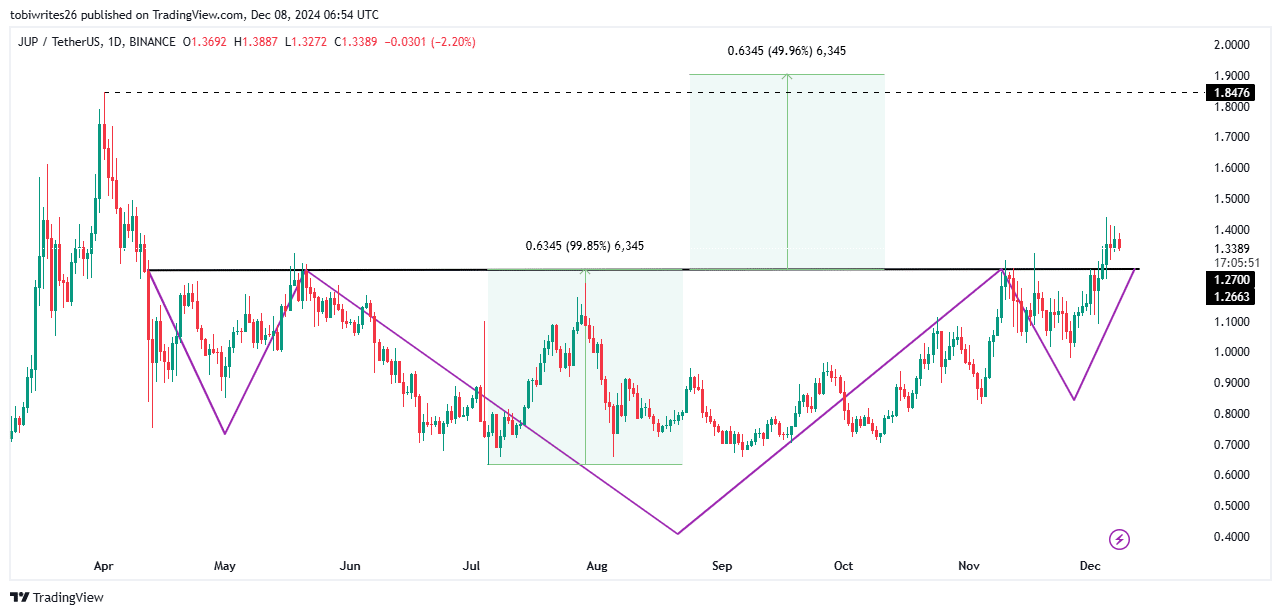

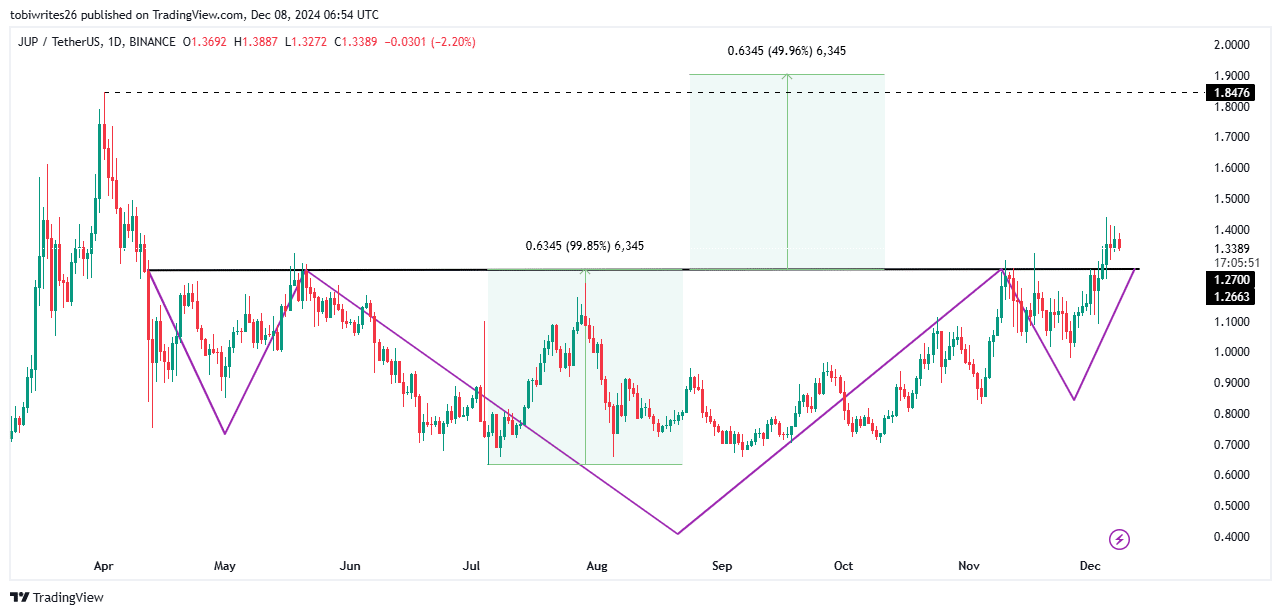

JUP set to establish a new market high

JUP has broken through the neckline of a classic cup-and-shoulders pattern at $1.2663, a significant resistance level that could signal the start of a full-fledged rally.

If this pattern plays out, JUP could climb an additional 49.96%, reaching $1.90—surpassing its previous all-time high of $1.85. This projected move aligns with the strength of the pattern displayed on the chart.

Source: Trading View

However, bearish sentiment persists in the market and could delay JUP’s upward momentum.

Imbalance in market liquidations

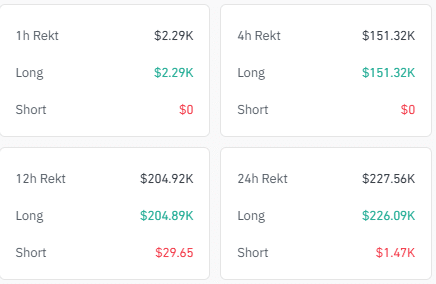

Over the past 24 hours, there has been a notable imbalance in market liquidations. At the time of writing, long liquidations totaled $226,090, while short liquidations were significantly lower, amounting to just $1,470.

Source: Coinglass

Read Jupiter’s [JUP] Price Prediction 2024–2025

Such a disparity, where long and short liquidations show a wide gap, indicates that market sentiment is skewed toward one side. In this case, sentiment favors the bears.

If this trend persists, the market is likely to continue moving downward unless stronger bullish forces emerge to counteract it.