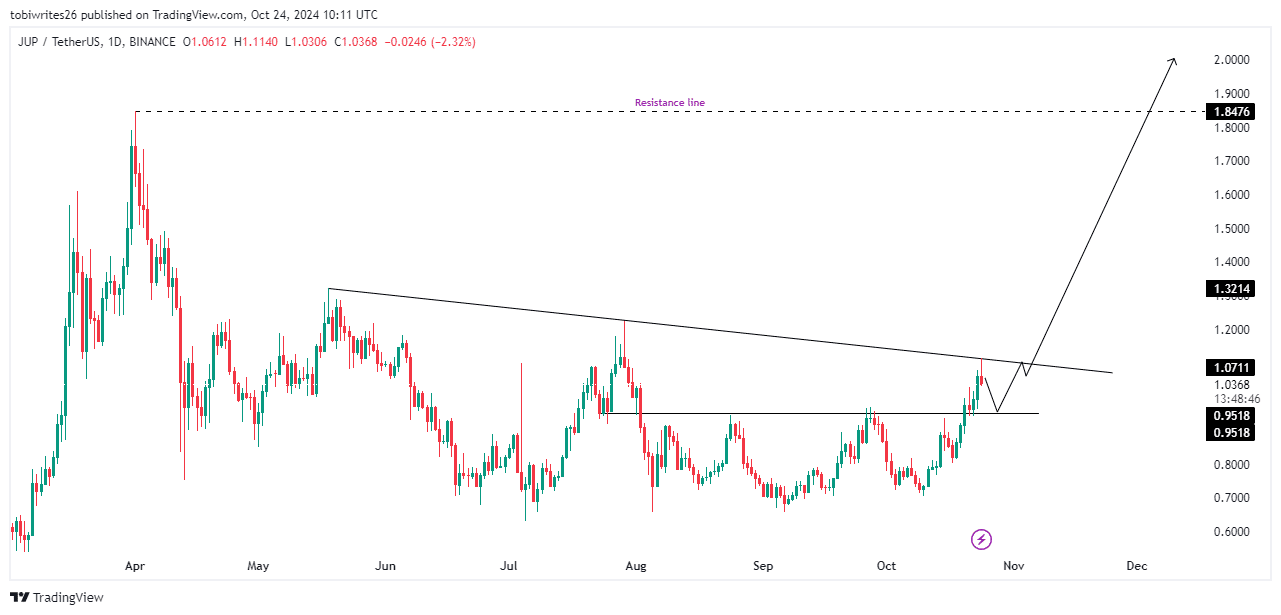

- The primary challenge for JUP is a descending trendline that has triggered three consecutive pullbacks.

- However, after an expected brief dip, JUP could see a 100% surge, targeting the $2 level.

Over the past month, Jupiter [JUP] has gained 31.72%, and its daily chart shows continued strength with an additional 11.30% increase, setting the stage for a potential breakout.

AMBCrypto’s analysis suggests that JUP’s momentum could extend further, provided it holds key support levels and market metrics continue to align favorably with its bullish trend.

JUP market dynamics: Leg down then run up

According to JUP’s daily chart, the asset is well-positioned for a potential rally despite recently encountering resistance during its third unsuccessful attempt to break through, resulting in only a minor decline.

However, this downturn is expected to persist for a while, as increased selling pressure could push JUP further down toward the support level at 0.9158, where large buy orders are likely positioned.

If JUP reaches this support level, it could trigger a rebound, allowing the asset to first overcome the resistance from the descending trendline.

This could be followed by another resistance at 1.847 before making a potential move toward the $2 target.

Source: TradingView

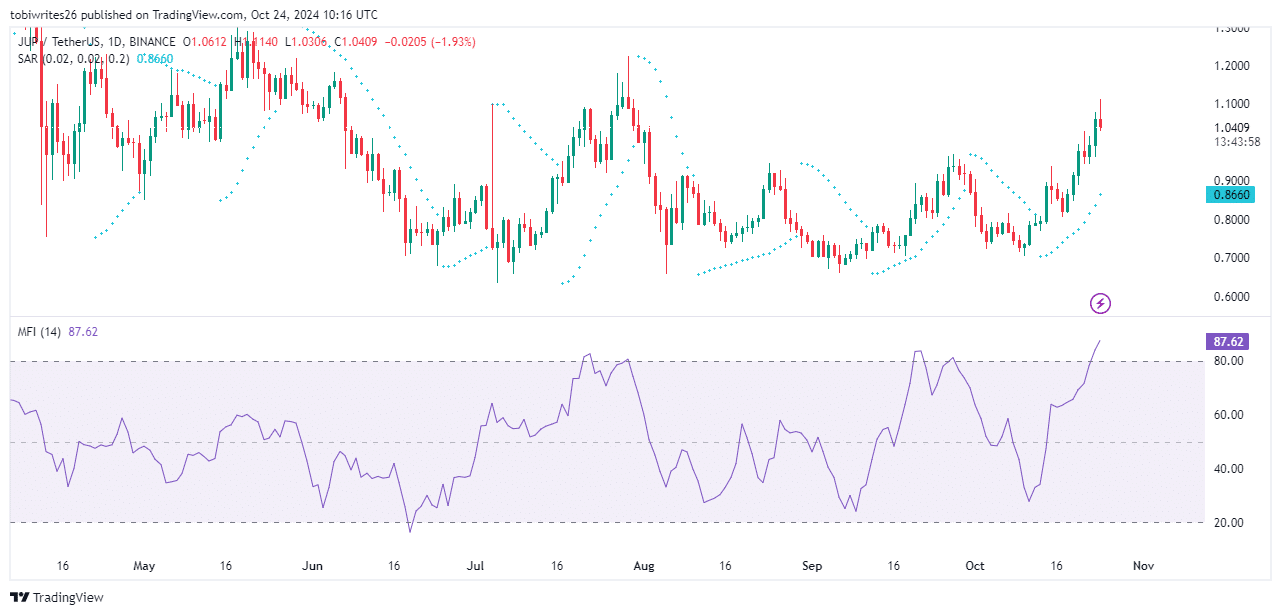

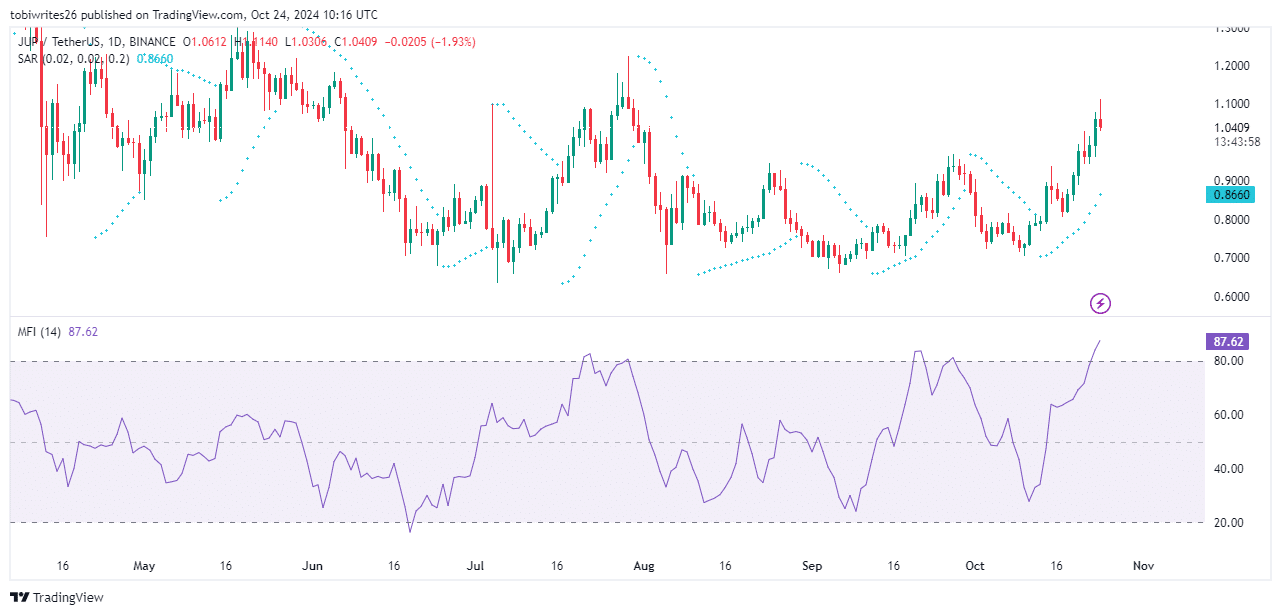

AMBCrypto analyzed technical indicators to determine the likelihood of this projected scenario playing out.

Market greed suggests a potential drop for JUP

According to the Money Flow Index (MFI), which gauges liquidity flow in and out of assets to assess market participant behavior, JUP is likely to experience a short-term drop.

The MFI has crossed into the overbought zone, exceeding the 80 mark, indicating extreme greed in the market. This means that a corrective drop is needed to balance out the price action.

This drop is expected to fade at the previously mentioned support level or lead to some price revaluation before the next upward move.

While this downturn may trigger some panic, the Parabolic SAR (Stop and Reverse) indicator signals that market sentiment remains bullish, with a series of dots forming below JUP’s price.

In summary, the anticipated drop is likely to be short-term before an upward movement resumes.

Source: Trading View

Open interest for JUP continues to rise

Data from Coinglass shows that Open Interest in Jupiter (JUP) has increased by 13.89%, bringing its total value to $126.25 million.

Realistic or not, here’s JUP’s market cap in SOL’s terms

Open Interest reflects the actions of market participants, and in this case, it indicates an increase in long contracts and the maintenance of existing long positions.

This suggests that the market is maintaining its overall bullish sentiment.