- Justin Sun downplayed risk USDD fears after withdrawing its 12K BTC collateral.

- Despite the reassurance, an analyst viewed Sun as a likely risk factor in the space.

Tron [TRX] founder Justin Sun hit the headlines this week after withdrawing Bitcoin [BTC], which was initially set as collateral for the Tron-based stablecoin, Decentralized USD [USDD].

He pulled 12K BTC, worth over $700 million based on press time market prices, without any approval from Tron DAO.

This raised liquidation fears as the community fretted over a Terra Luna-like scenario that could be triggered.

Justin Sun defends himself

However, Sun downplayed the fears and defended his unilateral action as “DeFi 101.” Part of his statement posted on X (formerly Twitter) read,

‘When your collateral exceeds the amount specified by the system (usually between 120%-150% depending on the vault), any collateral holder can withdraw any amount freely without anyone’s approval.’

Sun added that a liquidation risk could only be triggered when the collateral drops below 110% as it would need replenishment.

“If the collateral falls below a certain level (typically under 110%), it needs to be topped up; otherwise, the collateral may trigger liquidation. This is part of the basics of DeFi 101.”

As a result, per Sun, given that USDD was over-collateralized at 300%, he didn’t need any approval for his actions, and the move didn’t present any liquidation risk.

Fears still exist

Despite Sun’s reassurance, some users seemed unconvinced. In fact, renowned market commentator Marty Party singled him out as a major risk factor to the crypto industry.

“I also reported Sun and WBTC are the second largest risk in crypto.”

For context, last week, wrapped BTC (WBTC) custody changes also raised fears after Justin Sun was mentioned as being involved in its operations.

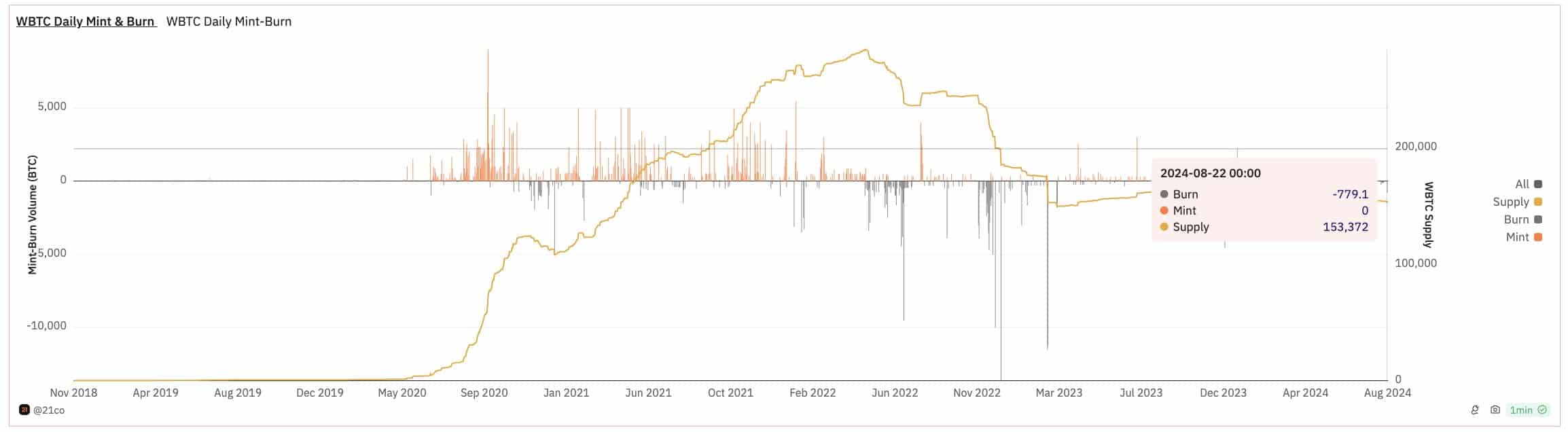

Since the custody changes were unveiled, $90 million has been redeemed from WBTC. Half of that ($45M) was redeemed in the past 24 hours, as an analyst projected that investors might be seeking a ‘reliable alternative.’

“$90M WBTC has been redeemed since Bitgo’s announcement. The community and industry are in search of a more reliable, institutional-grade alternative.”

Source: Dune