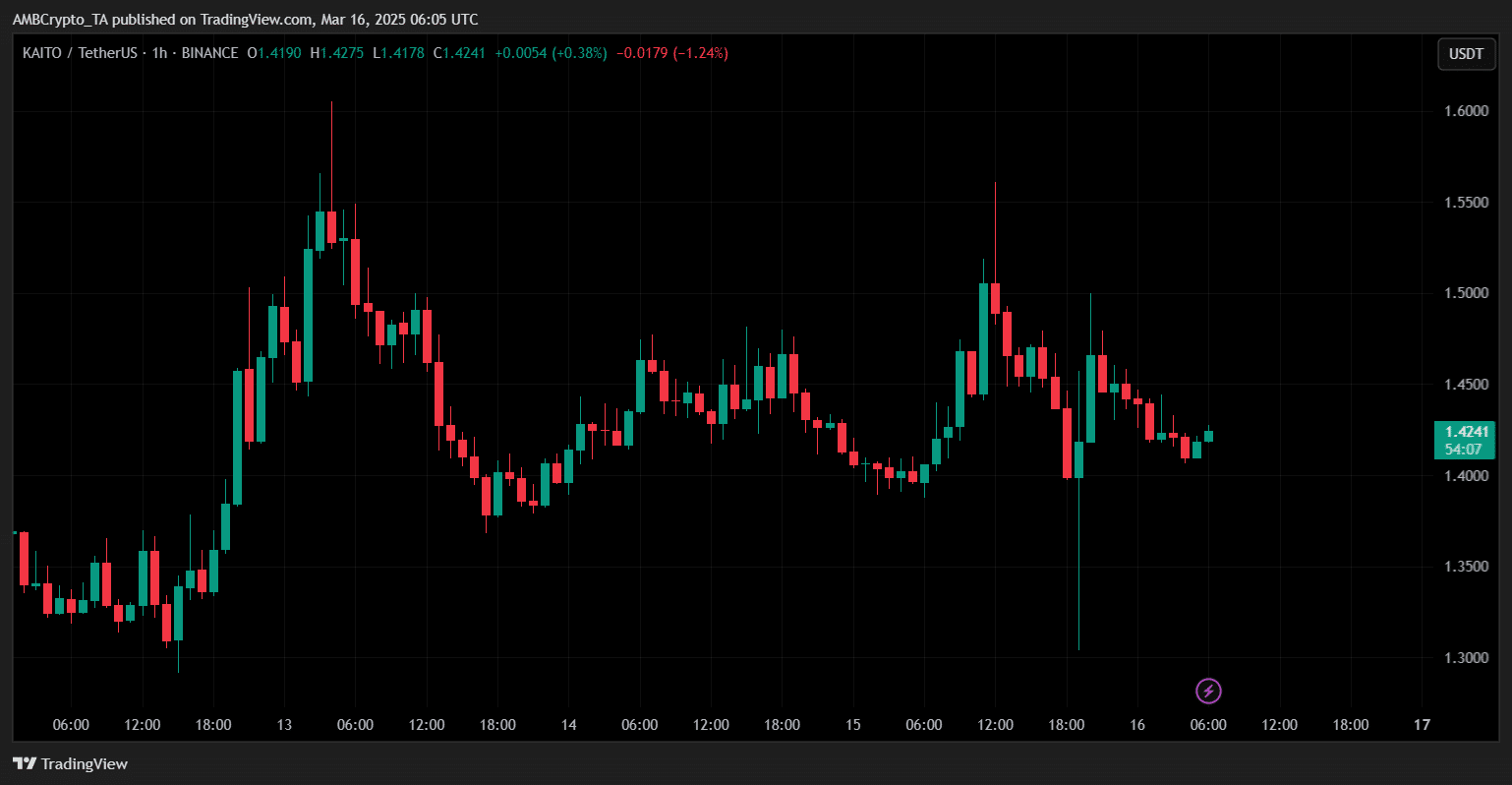

- KAITO dropped to $1.30 before recovering, showing vulnerability to social media-driven manipulation.

- Blockchain analysts linked the attack to previous DB X account hacks and similar schemes.

A targeted cyberattack compromised Kaito AI’s official X (formerly Twitter) account and the personal account of its founder, Yu Hu, in what appears to be a deliberate market manipulation scheme.

The attackers falsely claimed Kaito [KAITO] wallets were compromised, triggering panic among investors.

Source: X

A now-deleted post from Kaito AI’s official X account stated,

“We have identified irregular activity in multiple wallets linked to Kaito AI. Our team is actively investigating to assess the potential impact. Initial reports suggest that a percentage of the token supply may have been compromised.”

The misleading posts caused an immediate drop in KAITO’s price, before the information was corrected.

Timing is everything—and the hackers knew it

Source: X

The attack occurred while Yu Hu was asleep, indicating a coordinated effort to maximize impact before he could intervene.

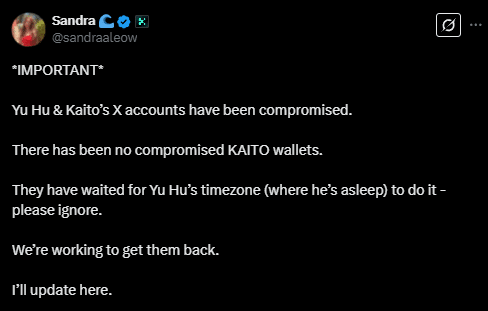

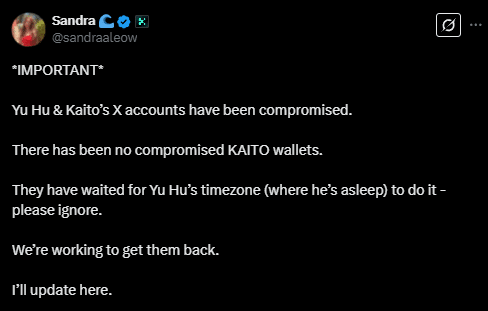

Sandra Leow, a research partner at Kaito AI, confirmed this timing,

“They have waited for Yu Hu’s timezone (where he’s asleep) to do it.”

Source: X

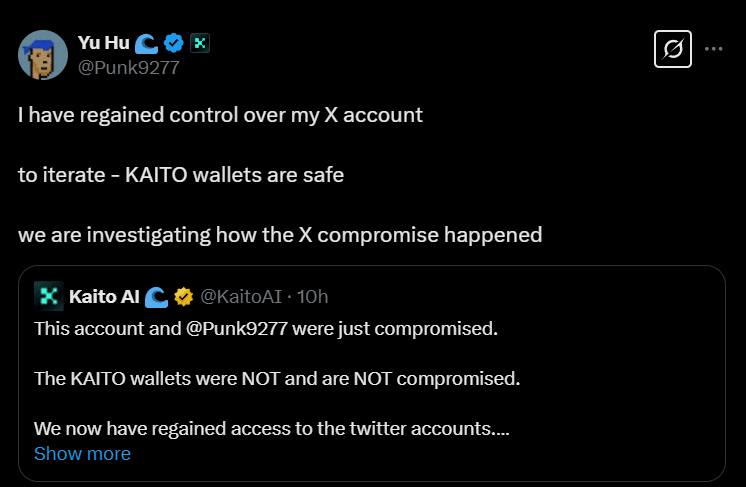

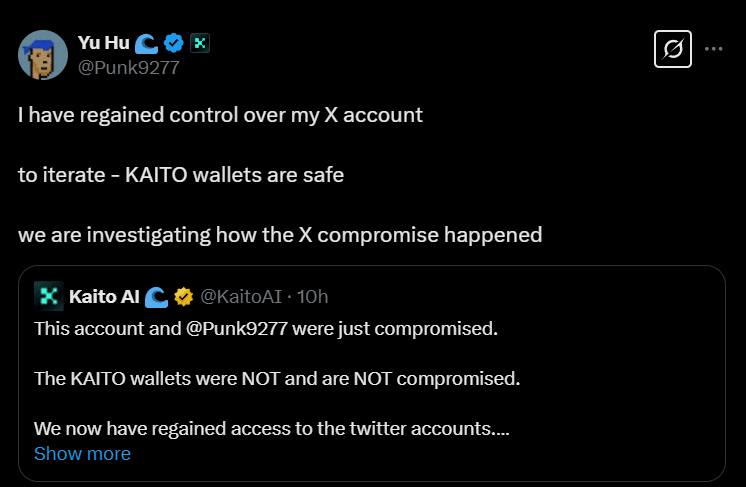

Yu Hu reassured the community that KAITO wallets were never at risk and that an investigation into the security breach is ongoing,

“To [re]iterate – KAITO wallets are safe…we are investigating how the X compromise happened.”

While control over the accounts was restored quickly, the price impact was already felt, with KAITO experiencing significant volatility in a short time frame.

The market reacted swiftly to the misinformation spread by the compromised Kaito AI X account, with KAITO’s price plummeting to $1.30 before rebounding.

A rollercoaster for KAITO’s price

The attack initially triggered panic selling, leading to a sharp decline of 9.07% from its previous level.

Once the false tweets were removed, KAITO’s price began recovering. Clarifications from Yu Hu and the Kaito AI team helped restore investor confidence.

The token then surged to $1.56, a 20% increase from its lowest point.

Source: TradingView

Despite this recovery, KAITO’s price did not remain at its peak for long.

Following the price correction, the token settled at $1.44, reflecting an overall 9.12% gain from the initial drop.

This pattern of extreme fluctuation suggests that the attackers may have capitalized on the volatility to execute profitable trades.

Market participants quickly took note of these price swings, with KriptoAlly.eth questioning whether such a sudden movement was purely a reaction to misinformation or a deliberate market manipulation attempt.

“$KAITO price dropped to $1.30. And then it hit $1.45, a fluctuation of nearly 12%. Was that all for this?”

The $1 million question: who profited?

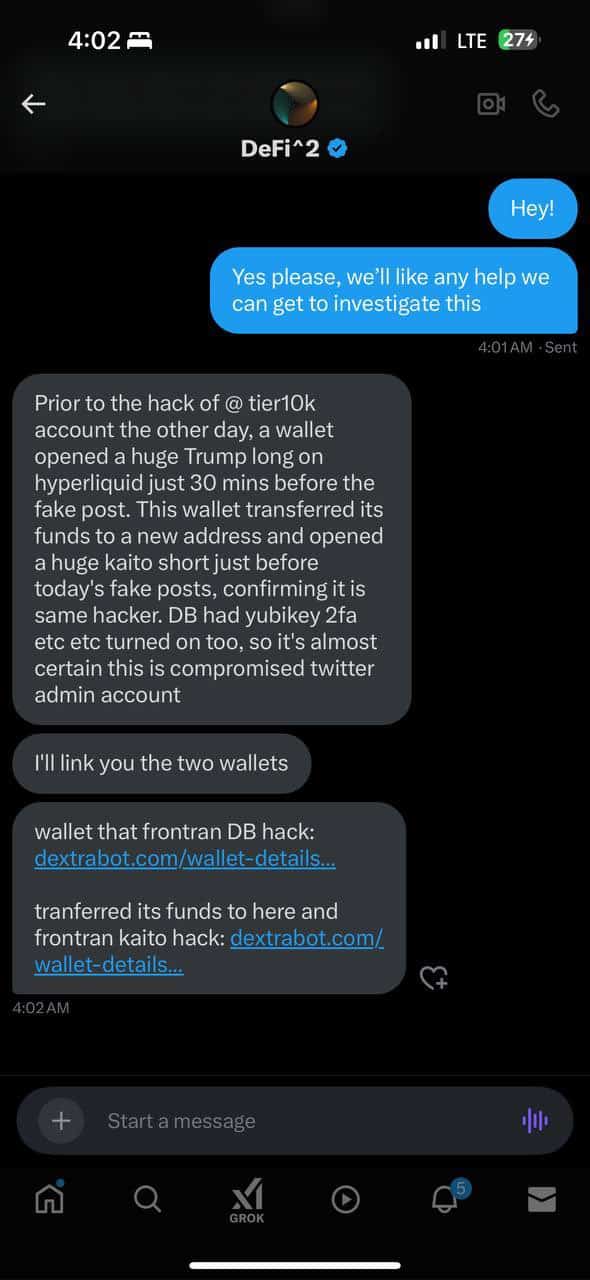

Yu Hu confirmed that the hacker made an estimated $1 million, including $300,000 from KAITO-related trades.

His investigation, alongside DeFiSquared, linked the attack to the same group responsible for hacking DB’s account days earlier.

Source: X

He stated that a wallet opened a large Trump token long position on Hyperliquid [HYPE] just 30 minutes before DB’s X account was hacked.

The compromised account then posted false claims about the token’s utility, triggering a price surge.

After securing profits, the wallet moved funds to another address. It then opened a KAITO short position just before misleading tweets about a Kaito supply issue appeared.

Yu Hu tweeted that KAITO’s X account had two-factor authentication (2FA) enabled through Yubikey hardware. The breach raised concerns about how attackers bypassed such high-level security measures.

“We had high-level security measures on both accounts, including hardware 2FAs. Currently, it seems we might have faced a similar attack to what we saw with other projects recently, like Jupiter.”

Social media is the new weapon in market manipulation

The use of X account breaches to manipulate crypto prices is becoming a pattern. Attackers strategically executing leveraged trades before spreading misinformation.

DeFi Warhol, a crypto market analyst, commented,

“Hackers are getting smarter. Instead of posting blatant scams, they shorted first before spreading a seemingly legit tweet concerning the $KAITO supply.”

The incident highlighted how easily false information can disrupt crypto markets.

A single misleading post led to panic selling and millions in liquidations, demonstrating the risks of relying on social media for financial decisions. The hacker’s $1 million profit from shorting KAITO reinforced these concerns.

Calls for better monitoring of suspicious market activity have intensified.

Until stronger safeguards are in place, traders are advised to verify information across multiple channels and avoid reacting impulsively to unverified social media posts.