In a brutal turn, Mantra [OM] plunged over 90% in 24 hours, wiping out $68M in value.

Co-founder JP Mullin blamed “reckless” liquidations, denying any wrongdoing – but investors remain skeptical. With charts in free fall and sentiment crashing, many are calling it a live rug pull.

Whether it’s lost confidence or something worse, the Mantra collapse is the latest cautionary tale in crypto.

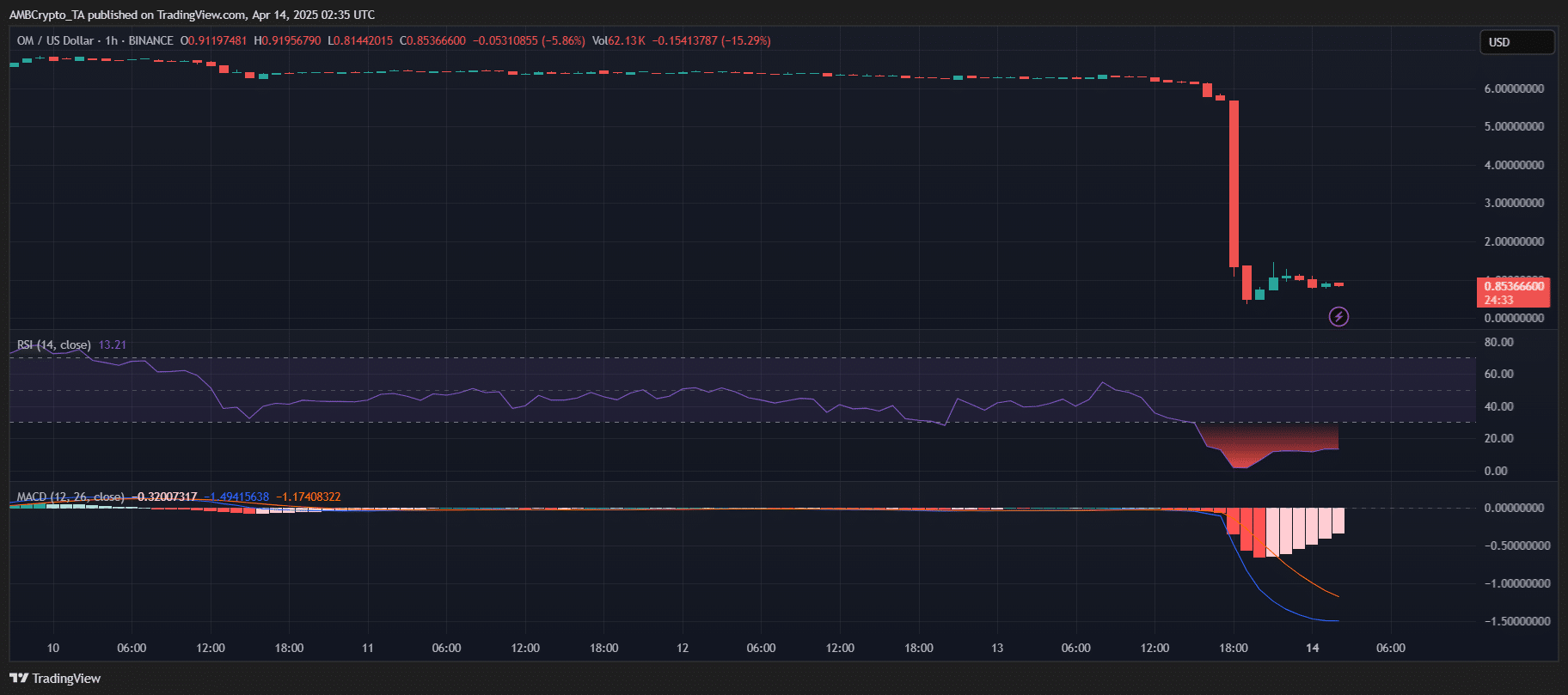

OM is in a death spiral

Source: TradingView

The dramatic crash of Mantra’s OM token — from around $6.30 to as low as $0.50 — has triggered chaos across leverage-heavy crypto markets.

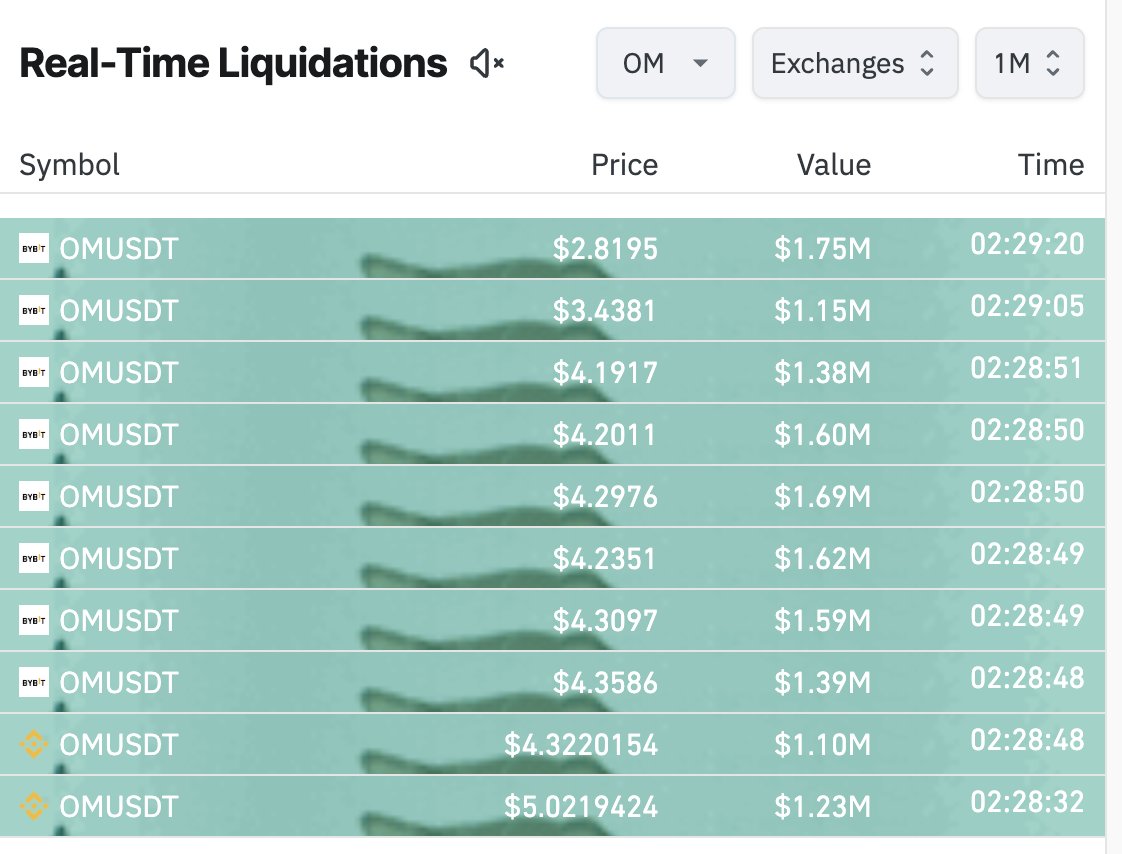

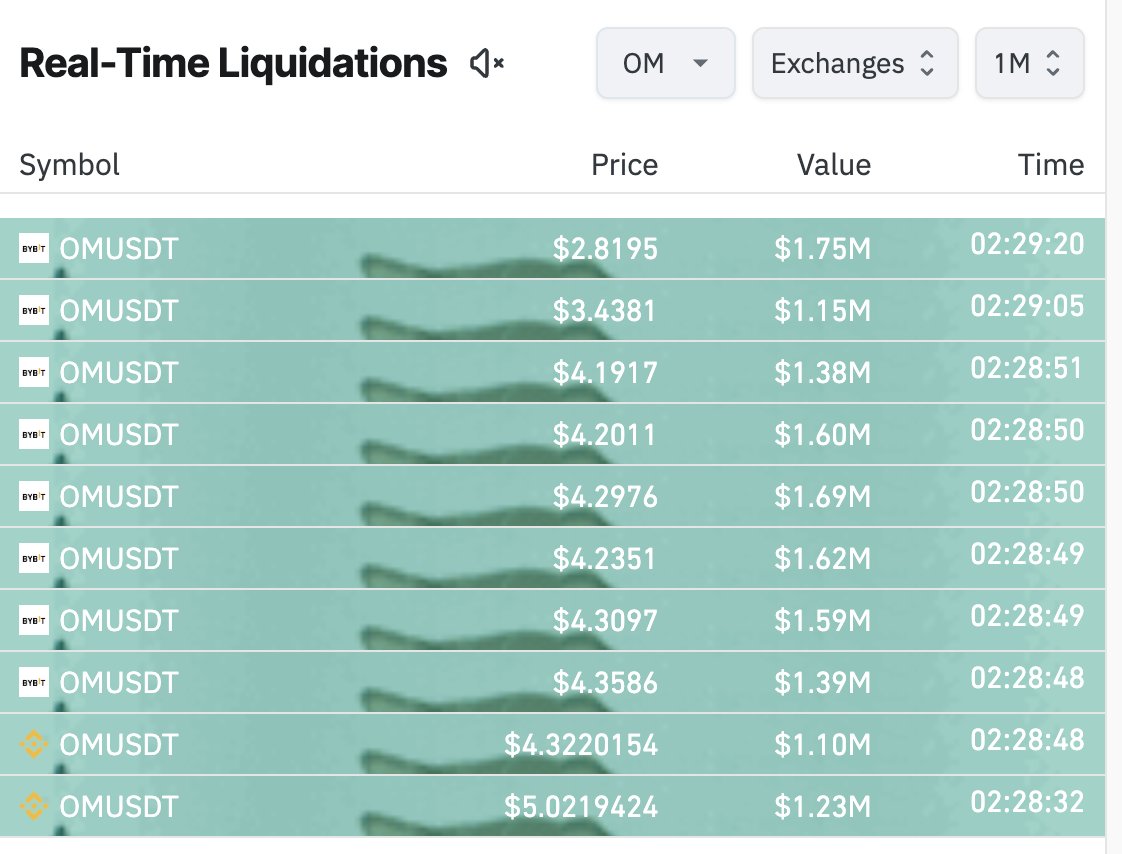

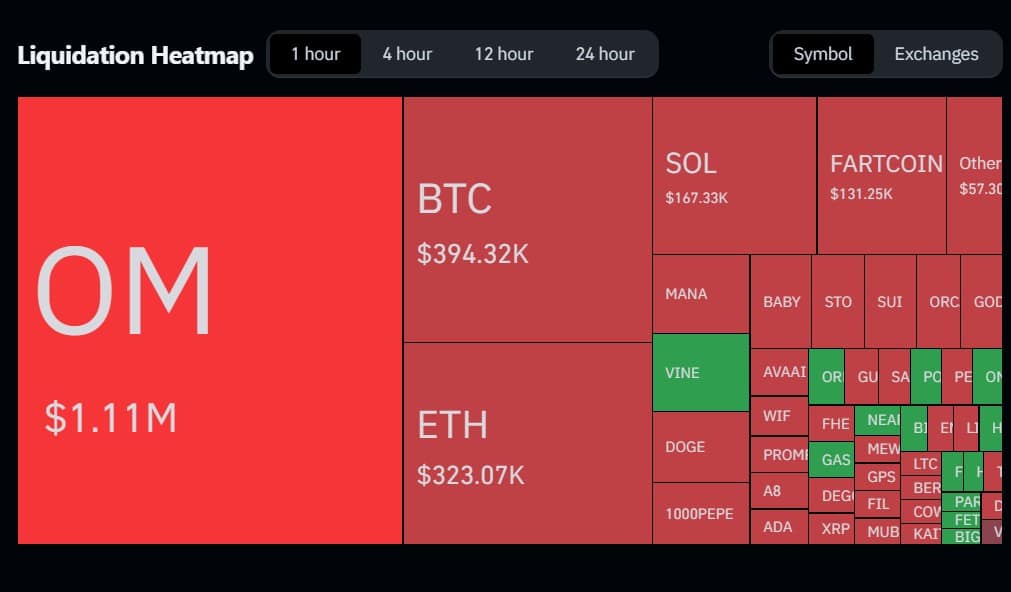

OM not only suffered the largest price drop but also led the liquidation heatmap. Within just 12 hours, traders liquidated over $68 million in long positions, including more than 10 trades exceeding $1 million.

Source: X

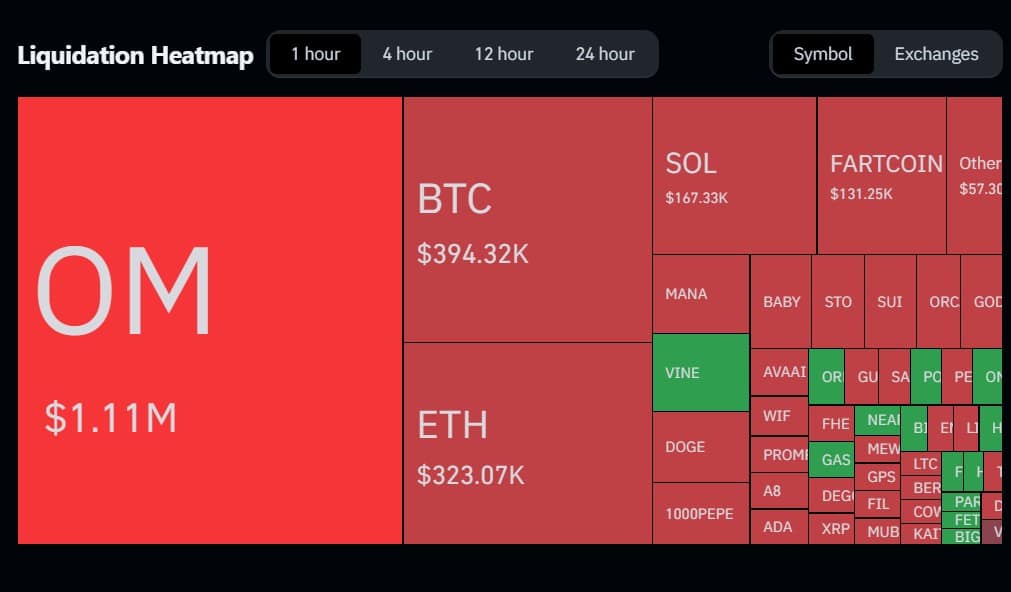

In the past hour alone, $1.11 million worth of OM long positions were forcibly closed, surpassing even Bitcoin [BTC] and Ethereum [ETH] in liquidation volume.

Source: Coinglass

The rapid plunge caught over-leveraged traders off guard, triggering a chain reaction of margin calls as OM nosedived through key support levels.

Other tokens like Solana [SOL] and even the joke coin Fartcoin [FARTCOIN] saw liquidations – but none came close to OM’s scale. It’s a rare sight when BTC and ETH are relegated to supporting roles in the liquidation leaderboard.

The chaos may have started with a 3.9 million OM deposit from a possible team wallet to OKX.

With nearly 90% of the supply allegedly controlled by the team – and a history of market manipulation, delayed airdrops, and discounted OTC deals – panic selling quickly escalated.

As OTC buyers went underwater, a wave of exits may have triggered cascading liquidations.

Mantra blames CEXs, but the market cries rug pull

JP Mullin, co-founder of Mantra Chain, defended the project after OM’s $1.11M liquidation crash, blaming “reckless forced closures” by centralized exchanges during low-liquidity hours. He insisted tokens remain locked under vesting schedules and claimed the team, investors, and advisors didn’t sell.

But traders aren’t buying it.

On X, accusations of manipulation exploded. Prominent market watcher, AltcoinGordon, compared the collapse to previous disasters:

“Biggest rug pull since LUNA/FTX??”

Another user called OM “one of the biggest scams I have ever seen in crypto,” accusing the team of OTC dumping and demanding “the team belongs in prison after this.”

Screenshots online claimed 90% of OM’s supply was dumped, and Mantra deleted its Telegram, fueling exit scam fears. One post went as far as branding the situation: “Welcome to Terra Luna V.2.”

Market commentator Miles Deutscher called the OM crash a textbook case of inflated valuations. He stressed that liquidity matters more than market cap.

“The chart didn’t look normal for some time,” he noted, pointing to a broader issue of prices diverging from fundamentals. As trust in OM fades, he sees potential for capital to rotate into more credible RWA protocols.

Same script, different token

From Terra Luna’s catastrophic $60 billion crash in 2022 to FTX’s criminal downfall, crypto has faced numerous rug pulls.

Now, comparisons to past events are emerging as OM faces a $1.1 million liquidation and allegations of insider dumping.

Whether it’s a deliberate scam or genuine market dislocation, one thing remains clear: the crypto market is unforgiving and swift in its judgment.