- Over 800 million XRP coins were transferred within a South Korean exchange in the last trading session.

- The price has increased by over 4% in the last 24 hours.

On the 5th of November, XRP saw a major movement when WhaleAlert flagged an extraordinary transfer of 866,092,944 coins.

These coins were valued at approximately $803.8 million and were moved from Bithumb to multiple wallets.

This sizable withdrawal has drawn considerable interest, prompting a closer look at XRP’s exchange inflows, outflows, and daily active address metrics to understand market sentiment better.

The big question remains — could this substantial withdrawal indicate a shift in market behavior?

Ripple effect on XRP inflow, outflow

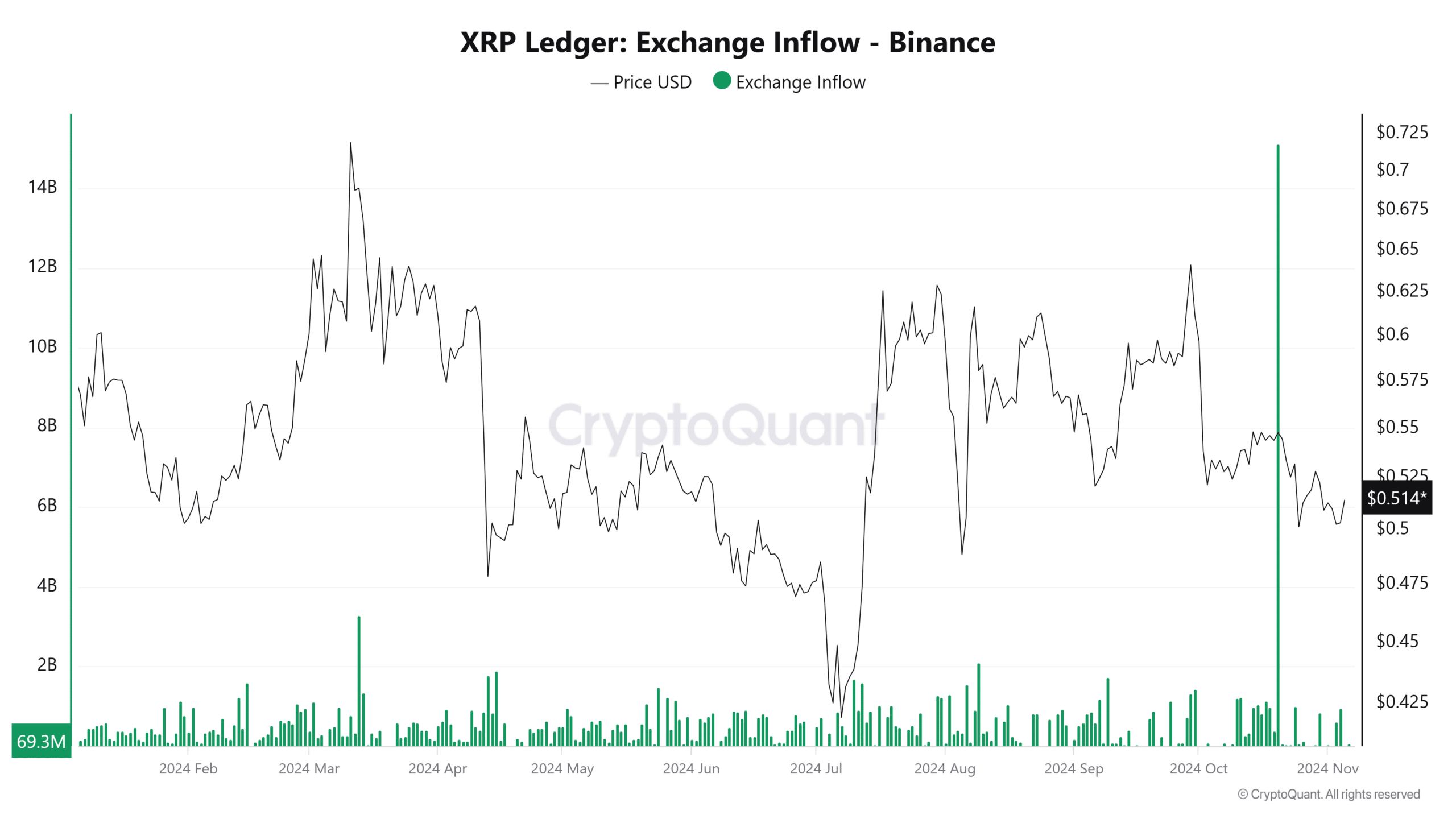

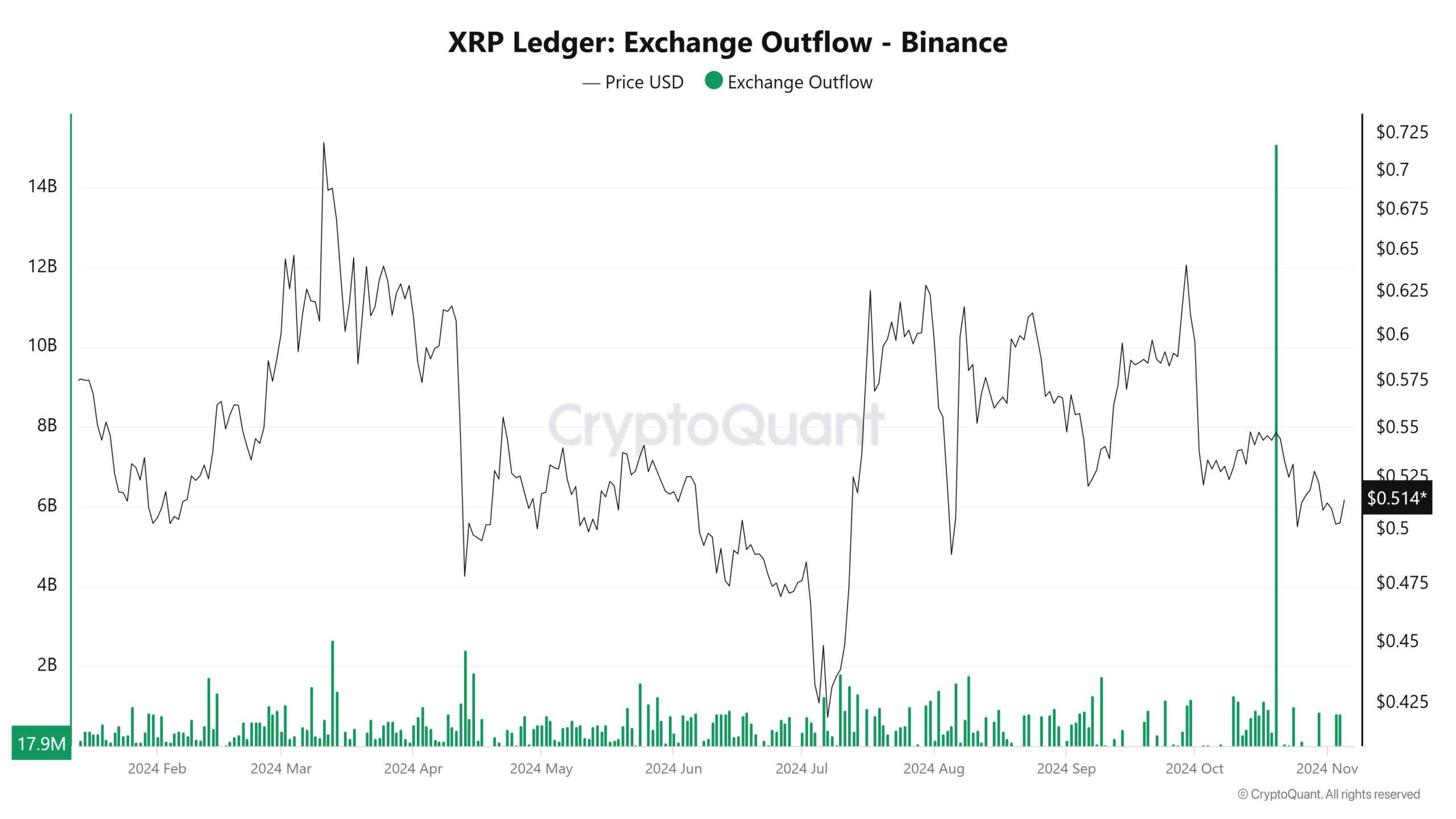

This significant XRP withdrawal has shifted the spotlight onto the inflow and outflow patterns, particularly on Binance.

Outflows, which saw a recent uptick, often indicate that holders are moving their XRP off exchanges. This could be signaling long-term holding intentions or other strategies.

Conversely, inflows typically suggest increased selling pressure as tokens are moved to exchanges for potential trading or liquidation.

Examining Binance’s recent outflow data, the recent transfer corresponds with a period of elevated outflows, possibly showing investor caution amid market uncertainties.

Source: CryptoQuant

However, no major inflow spikes were recorded in the latest trading session, with inflows at around 15.5 million XRP and outflows slightly higher at 16.5 million.

This trend suggests a market in a state of cautious optimism, where participants appear more inclined to hold than sell, hinting at a potential bullish sentiment in the background.

Source: CryptoQuant

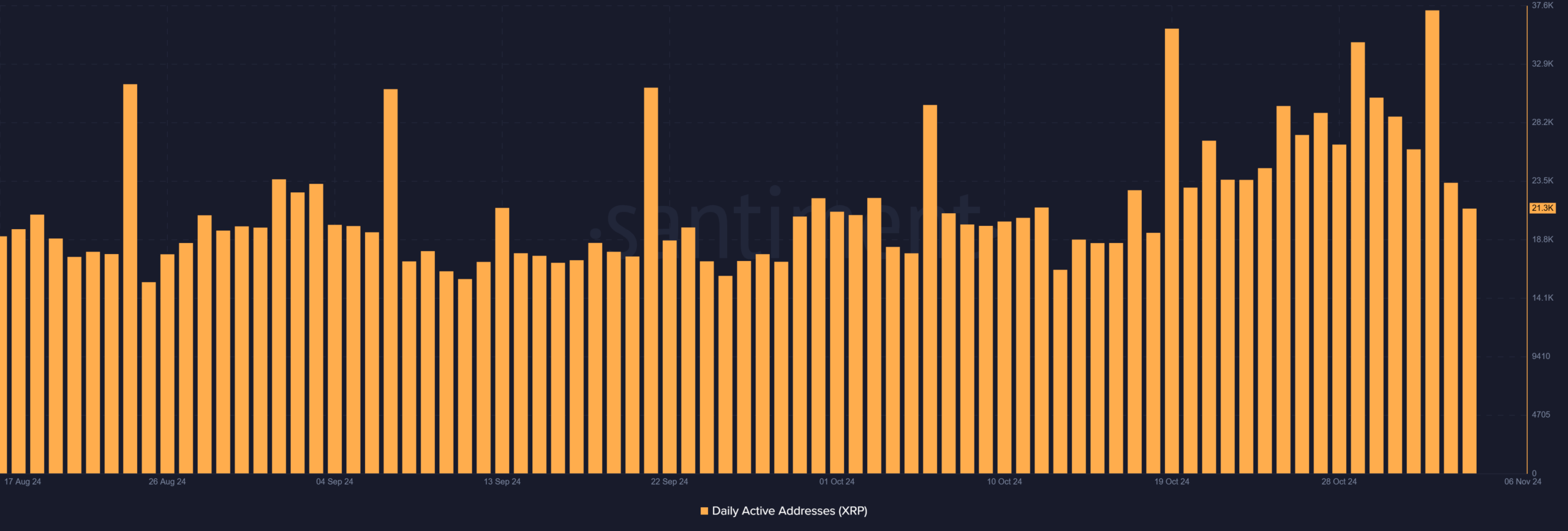

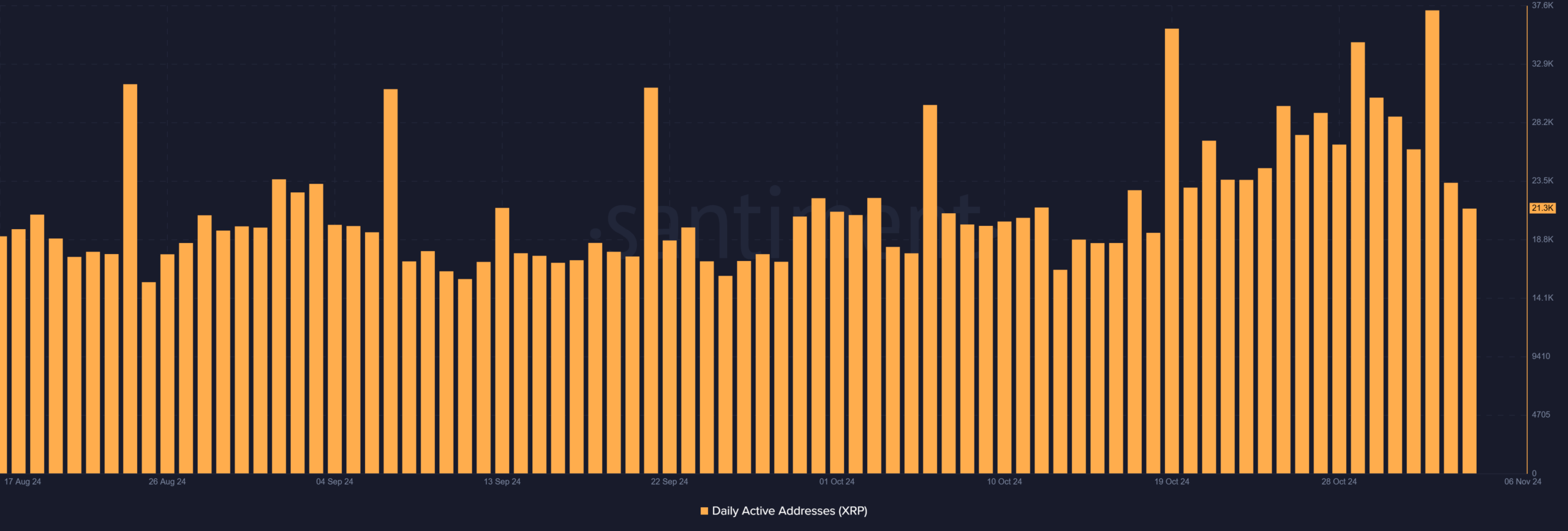

Stable trends in daily active addresses

A review of XRP’s daily active addresses on Santiment revealed a consistent trend, with no significant changes in the most recent trading session.

Aside from a spike on the 2nd of November, where active addresses surged past 37,000, the number has generally stayed between 21,000 and 23,000.

Source: Santiment

This pattern reflected steady engagement within the XRP ecosystem, without any unusual increase in activity.

In the past, spikes in active addresses have often preceded price movements, as increased network activity can signal upcoming volatility.

However, the current stability suggests that, while there is consistent interest, there may not be any immediate, dramatic shifts on the horizon.

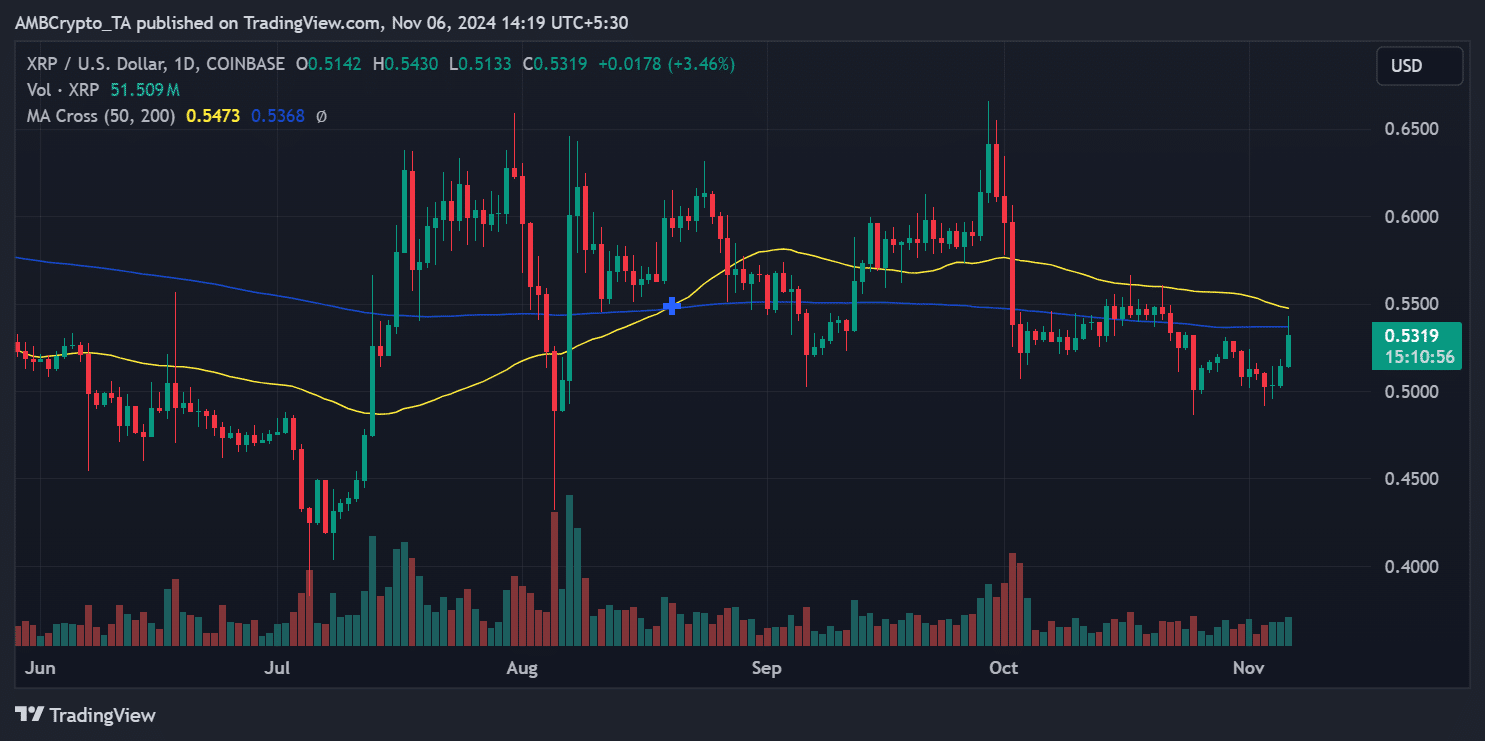

Price dynamics amid withdrawal

Following this large XRP withdrawal, technical analysis shows XRP approaching resistance near the $0.53 mark.

Despite the whale transfer, XRP’s price has remained stable, likely benefiting from the broader market’s upward momentum as Bitcoin reaches new all-time highs.

Source: TradingView

XRP’s 50-day moving average remains below the 200-day moving average, indicating a longer-term bearish trend. However, short-term momentum showed signs of shifting.

The Relative Strength Index (RSI) was holding near neutral, leaving room for either continued consolidation or an upward breakout if buying interest increases.

This large XRP withdrawal appeared to be part of routine exchange fund movements, explaining the absence of notable netflow changes.

Is your portfolio green? Check out the Ripple Profit Calculator

However, this activity still offers valuable insights into market dynamics, highlighting both cautious optimism among investors and stable network engagement.

As market conditions evolve, these trends will be essential to monitor for clues about XRP’s future trajectory.