- Saylor could announce the buying of $3 billion BTC after the latest hint.

- Will the announcement boost BTC to hit the elusive $100K level?

Michael Saylor, co-founder of MicroStrategy, has hinted at a likely Bitcoin [BTC] scoop from its latest bond sale proceeds.

In his 24th November X post, Saylor indicated that the firm needs to buy more BTC.

“We need more green dots on SaylorTracker.com.”

Source: X

The last time he made a similar post, he announced a 51.78K BTC bid afterward. As a result, the market expected a similar outcome, likely a $3 billion (about 30K BTC) buying spree from the latest bond (convertible notes) sale proceeds.

Will it push BTC to $100K?

As of this writing, the firm held 331,200 BTC, worth over $32 billion. The firm had previously announced a bold plan to acquire $42 billion worth of BTC through a 21/21 strategy.

The first half, $21 billion, would be bought by debt (like convertible notes), while the remaining would be funded by issuing shares. Based on the latest moves, the plan’s execution has picked up momentum.

As a Bitcoin proxy, the firm’s stock, MSTR, has enjoyed massive growth, riding on the cryptocurrency volatility and its vast BTC holding.

According to options analytics firm Amberdata, MSTR’s implied volatility (future expectations) has remained elevated. This suggested that the firm might sell more debt and shares to buy more BTC. The result could boost MSTR and BTC in the short term.

Part of the Amberdata report read,

“The market activity makes me think MSTR can still do something completely, COMPLETELY, insane (like rally to $1,500 by EOY as BTC breaks past $100k and is FOMO bought to $120-$140k)

As of this writing, BTC was valued at $98.3K after a 9% rally last week. However, the much-anticipated $100K target remained elusive in the spot market over the weekend.

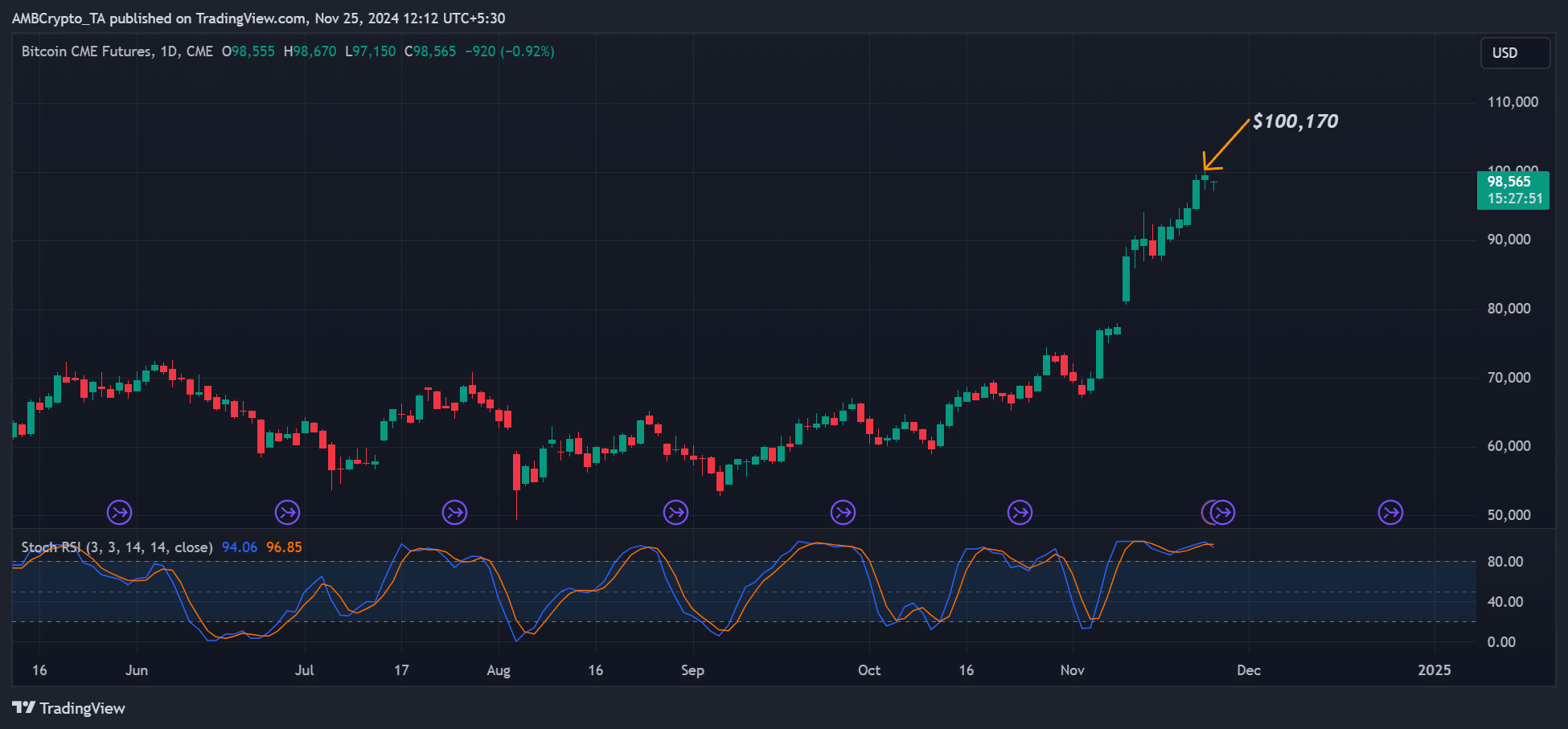

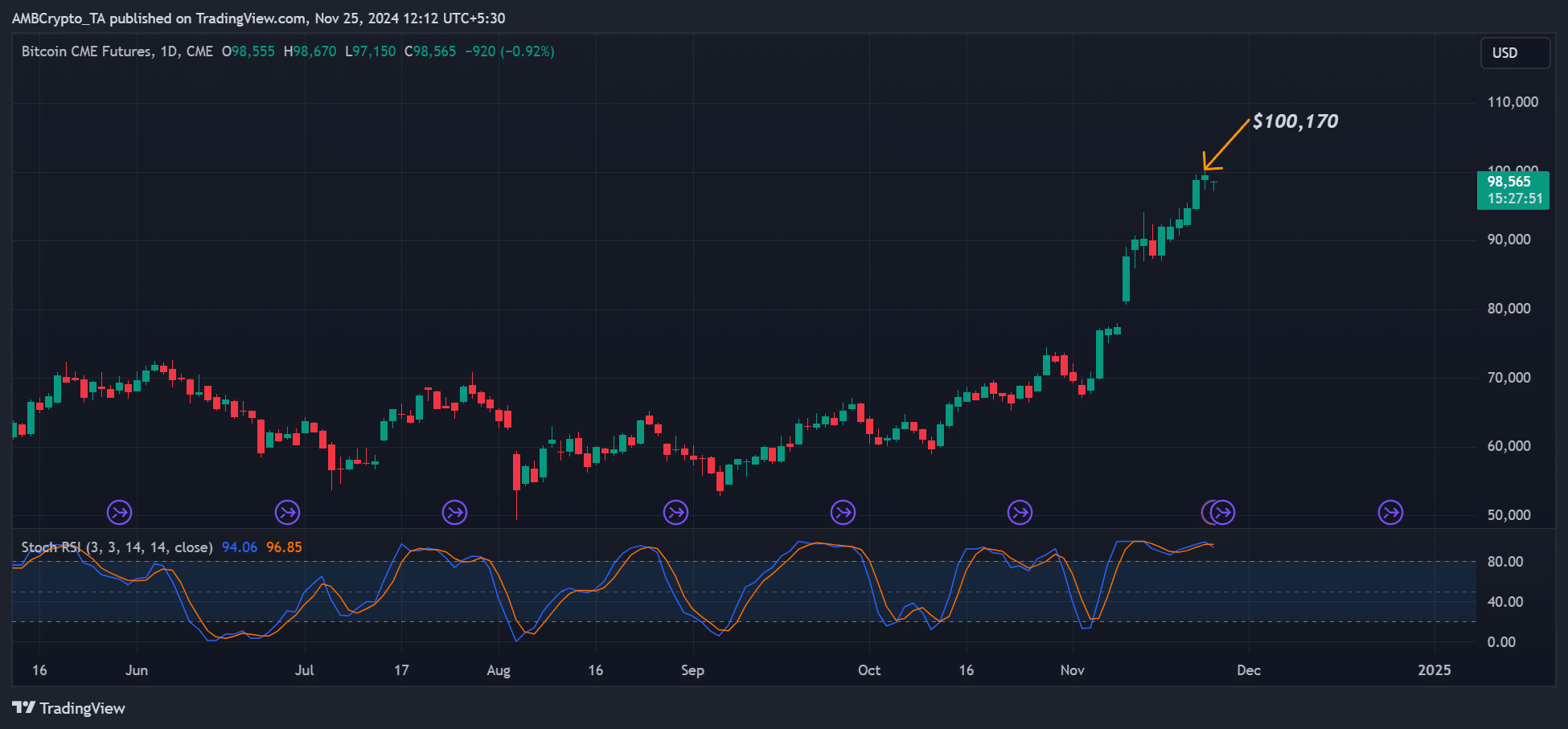

Interestingly, CME Bitcoin Futures hit a new all-time high (ATH) of $100,170, raising hopes that the spot market could soon hit the $100K milestone. Whether Saylor’s announcement of BTC buying will accelerate the target remains to be seen.

Source: Bitcoin CME Futures, TradingView

On the other hand, MSTR was valued at $421 at press time, up 6% before the US market opened on November 25th. Market pundits expected more front-running for the stock ahead of its likely inclusion in the Nasdaq 100 before December 2024.