- An early Maker investor sold $408,000 MKR barely two weeks after the project rebranded to Sky.

- At press time, MKR was trading at an eight-month low, as bearish pressure persisted.

The recent Maker [MKR] rebrand to Sky was meant to boost network usage and ensure regulatory compliance. However, the move appears to have not boded well with some investors.

According to Spot On Chain, an early investor in the project has sold over half of their stash. This holder purchased 451 MKR in 2017 at around $23.

On the 5th of September, they sold 251 tokens for $408,000 and still hold 200 MKR.

Source: Spot On Chain

The recent sale comes as Maker continues to succumb to bearish pressure. On the 27th of August, which is when the rebrand went live, MKR was trading at around $2,175.

Since then, the token has dropped by over 24%, to trade at $1,628 at the time of writing.

Maker drops to an eight-month low

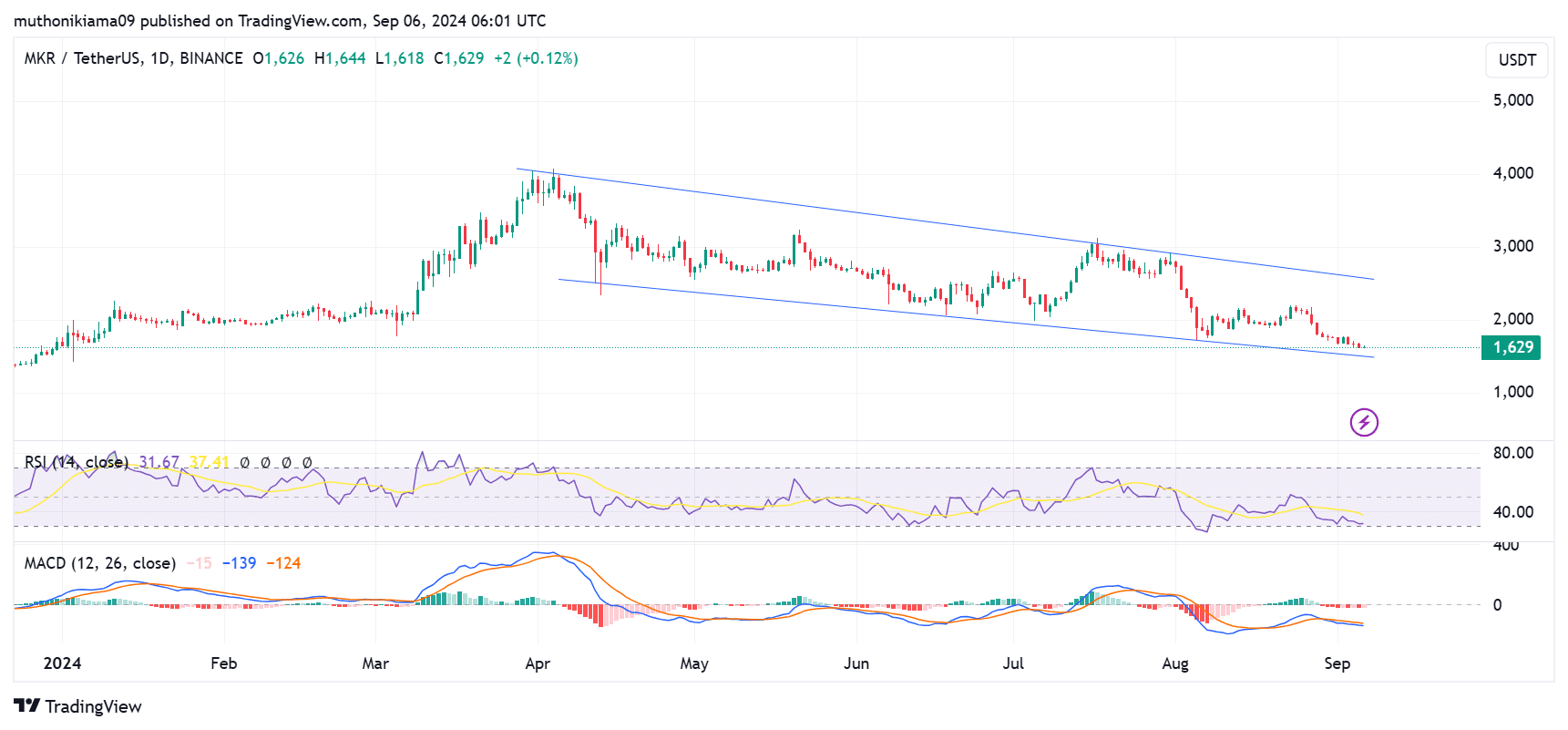

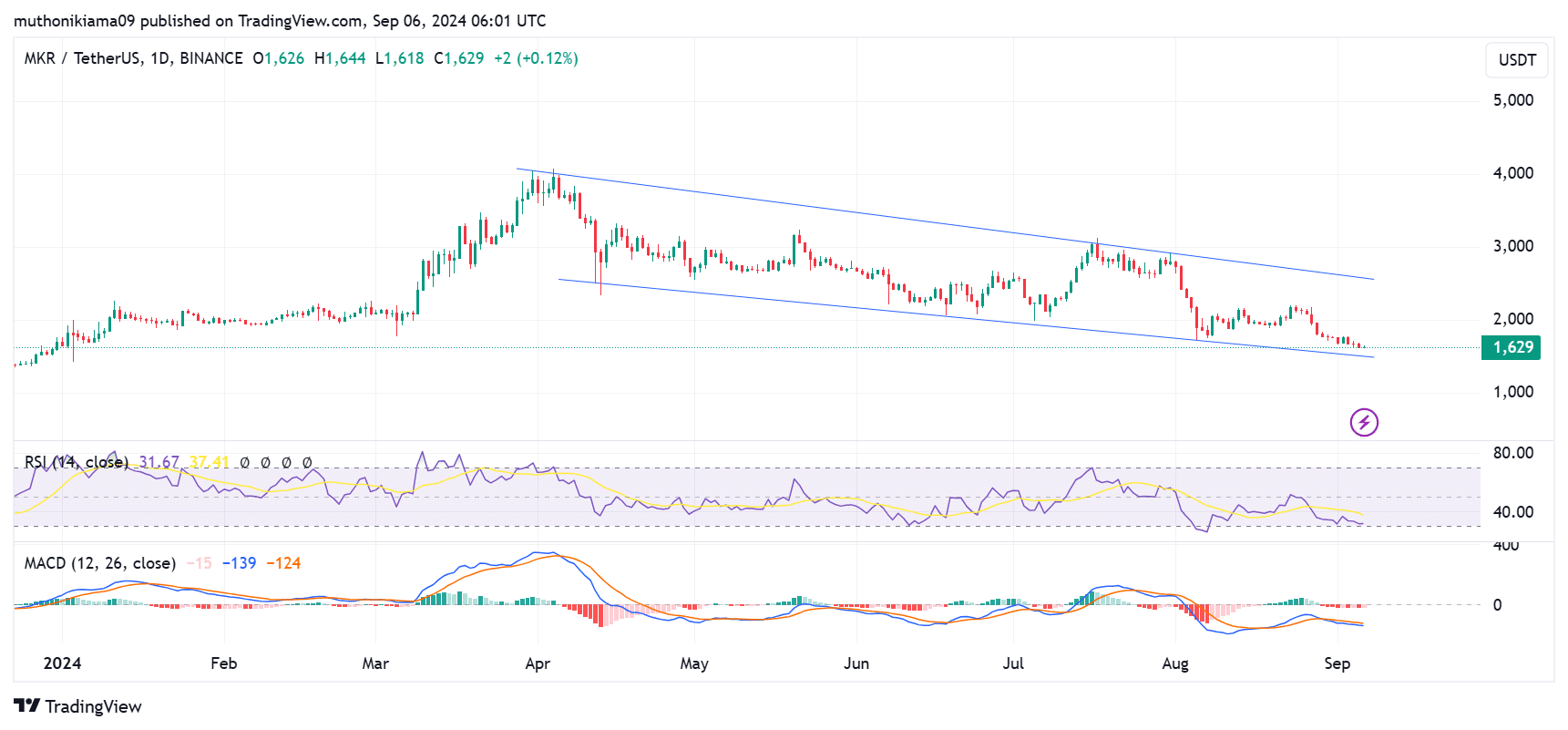

Maker was trading at its lowest price since early January 2024. The token, following a bearish downward channel, was at risk of testing the lower trendline, which could see the bearish trend triggering further price declines.

The Moving Average Convergence Divergence (MACD) further supported this bearish thesis. The MACD was negative and below the signal line, an indication that bearish momentum was in play.

Moreover, the MACD histogram bars have flashed red, which further suggested that traders should brace for more price declines.

Source: TradingView

This bearish trend could persist due to a lack of buyers in the market. The Relative Strength Index (RSI) at 31 showed that sellers are dominating.

Additionally, the RSI line has moved below the signal line and was making lower lows.

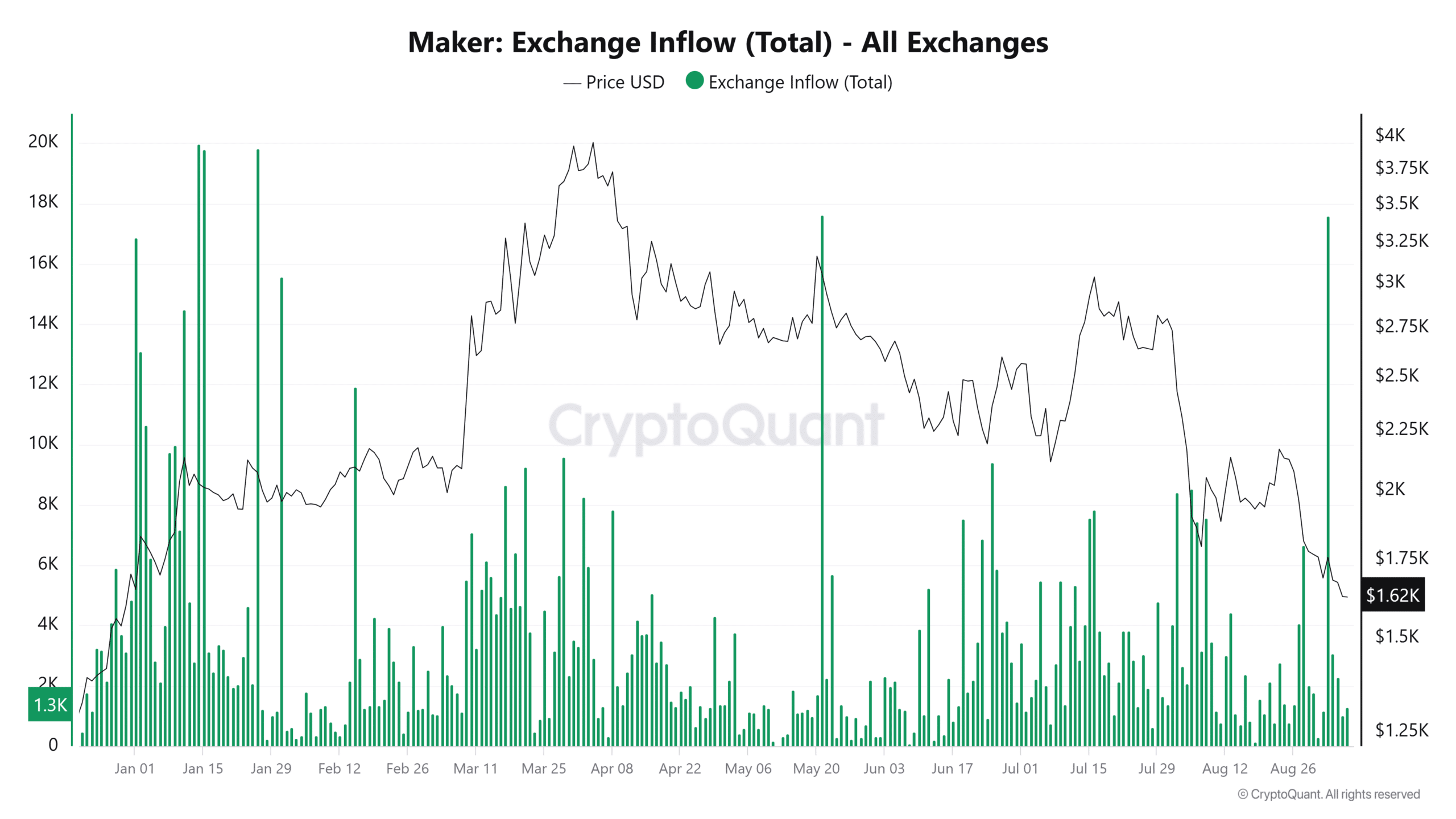

The lack of buyers amid persistent selling pressure could also be seen in the exchange inflows data.

Per CryptoQuant, on the 2nd of September, barely a week after Maker’s rebrand to Sky, MKR exchange inflows reached the highest level since May.

Source: CryptoQuant

AMBCrypto noted that MKR’s supply on exchanges increased amid low demand, as shown by the RSI. This strengthened the bearish case against MKR and the possibility of further dips.

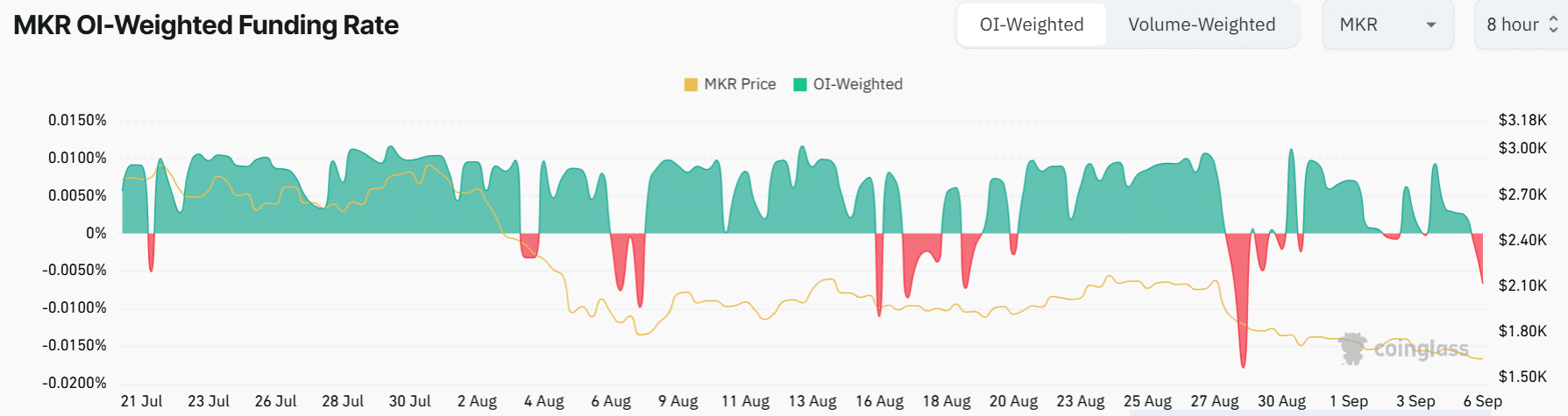

The derivatives market also shows a gloomy outlook. According to Coinglass, Maker’s Open Interest dropped to $82M, the lowest level since July.

This indicated that traders were closing their existing positions because of uncertainty.

Read Maker’s [MKR] Price Prediction 2024–2025

Nevertheless, there could be a glimmer of hope. Funding Rates have turned negative amid the drastic drop in OI.

This could suggest that short traders were exiting positions and taking profits, which showed a weakening downtrend.

Source: Coinglass