- A surge in development activities signals NEAR’s potential to break through existing resistance levels.

- Trading activities in the NEAR market have also played a significant role in fueling its expected growth.

Over the past week, the market dynamics have favored bullish traders, evidenced by a 6.53% rise, which mirrors Near Protocol’s [NEAR] daily performance gains.

NEAR faces a significant resistance at $4.662 currently, which has slightly dampened its 24-hour gains. Nonetheless, NEAR remains well-positioned for an upward trajectory.

Surge in development activity backs anticipated NEAR rally

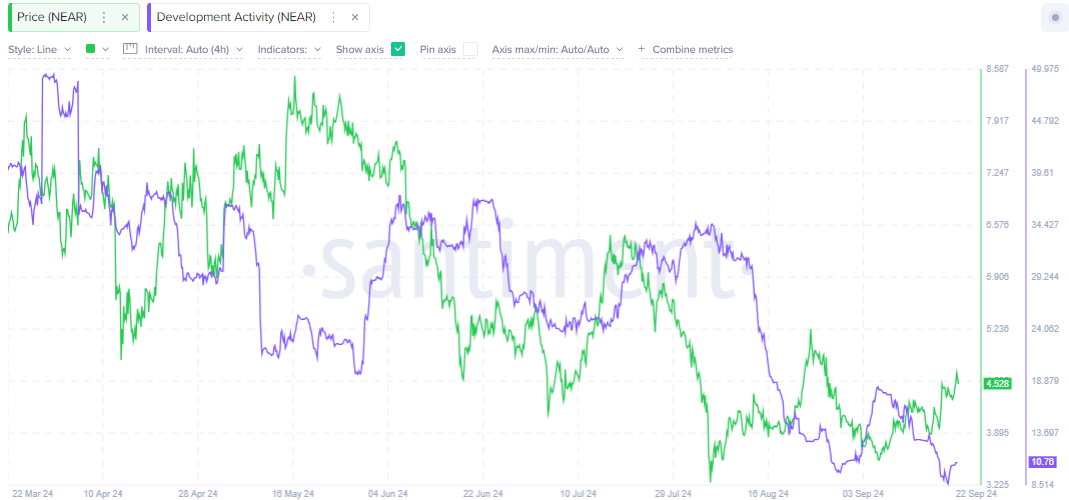

According to Santiment, NEAR has experienced a notable increase in development activities after a period of trending downward. Market trends often mirror movements in development activity.

In this instance, an upward trend in development activities suggests a potential rise in NEAR’s price. Typically, such activity indicates that the NEAR team is addressing issues or implementing new improvements and major advancements in its protocol.

Source: Santiment

While ongoing development activity suggests a bullish outlook for NEAR, other factors may also influence the asset’s rally.

NEAR faces selling pressure at resistance line

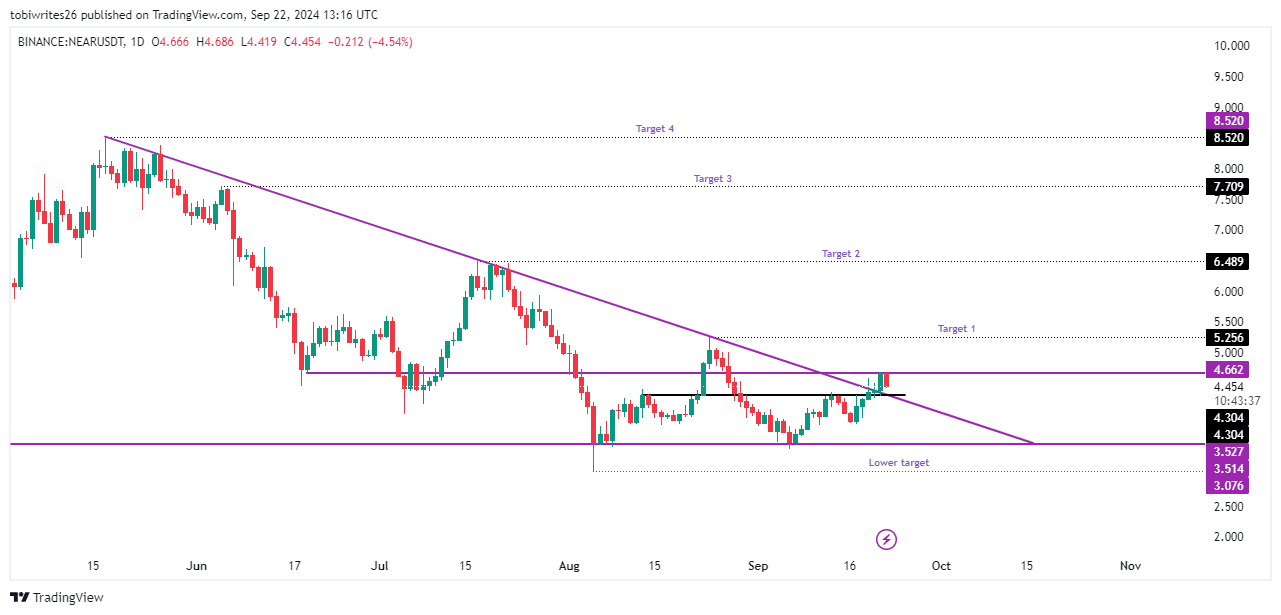

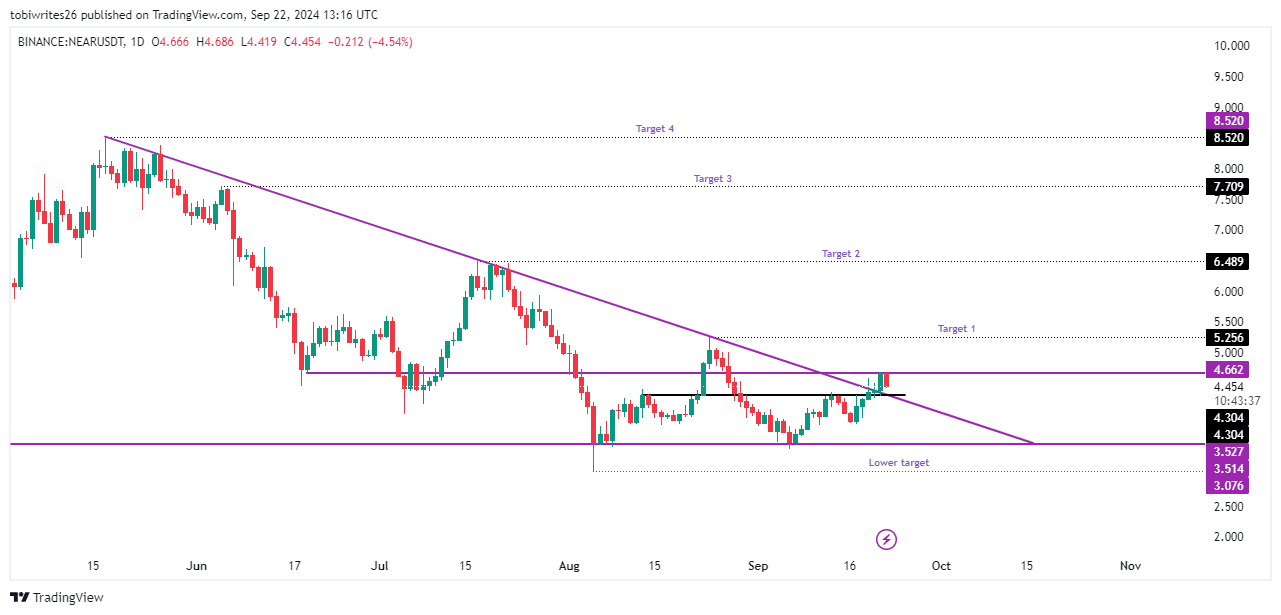

NEAR is currently trading within a bullish triangle pattern, suggesting an imminent upward movement. This pattern is characterized by a diagonal upper line of resistance and a horizontal line of support.

However, at the time of writing, NEAR has broken out of this pattern and encountered another resistance region at $4.662, pushing the price downward.

While this appears to be a retracement move before the price trends higher, it is highly likely that NEAR will regain momentum and target prices at $5.256, $6.489, $7.709, and $8.520.

Source: Trading View

Should this breakout prove to be a fakeout, NEAR may find the next local support at $4.304. Intense selling pressure could drive the price back to the horizontal support line or even lower to $3.076.

Interest in NEAR remains elevated

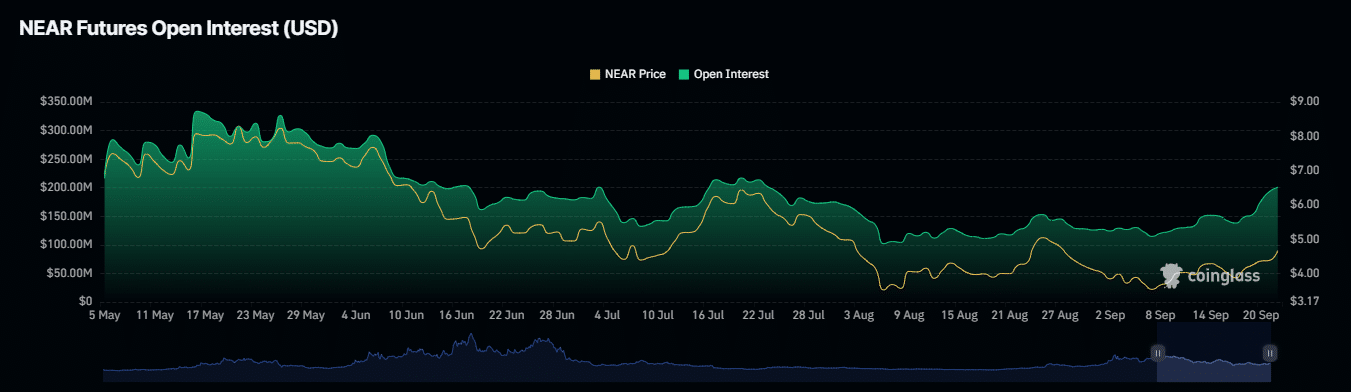

According to the Open Interest metric from Coinglass, NEAR is poised for a further price increase, currently trading at $200.76 million, above its September 17 low of $138.25 million.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

This notable surge suggests that buyers are actively accumulating NEAR in anticipation of a continued upward price movement, aiming for even higher trading levels.

Source: Coinglass

This increase in Open Interest has been matched by a corresponding 56.52% surge in NEAR’s trading volume over the past 24 hours.