- Optimism may surge 340% as it nears a breakout from a bullish ascending triangle.

- On-chain data revealed growing adoption and reduced exchange inflows, fueling bullish momentum.

Optimism [OP] has been trading within a sideways range for the past five months, consistently struggling to break above the $2 resistance.

Despite the consolidation phase, crypto analyst Ali suggested that this movement formed an ascending triangle pattern, a historically bullish setup.

This setup could pave the way for a rally toward the projected Fibonacci target.

Potential for strong gains?

Optimism has previously displayed a similar price movement. The first ascending triangle breakout saw the price rise from around $1.00 to a peak near $3.23, achieving a 220% gain.

A second breakout occurred near $1.06, pushing the price to $4.77, marking a 350% increase.

Now, analysts observe a potential third breakout point around $1.85. If Optimism follows its historical trend, the price could climb toward $7.20, which corresponds to the 1.618 Fibonacci retracement level.

This would represent a 340% gain from the breakout level, mirroring past performance.

Source: X

Current market dynamics and price movement

As of press time, Optimism was trading at $1.81, marking an 11.09% increase in the past 24 hours and a 31.03% increase over the last seven days.

Its 24-hour trading volume was $1 billion at press time, and the market cap was valued at approximately $2.27 billion, with a circulating supply of 1.3 billion OP tokens.

Optimism’s current price was approaching the $1.85 resistance level. Breaking this threshold could confirm the ascending triangle breakout and lead to a sustained bullish rally.

Historical patterns suggested that Optimism has formed similar setups in 2022 and 2023, both leading to rapid price surges.

On-chain data reflects positive sentiment

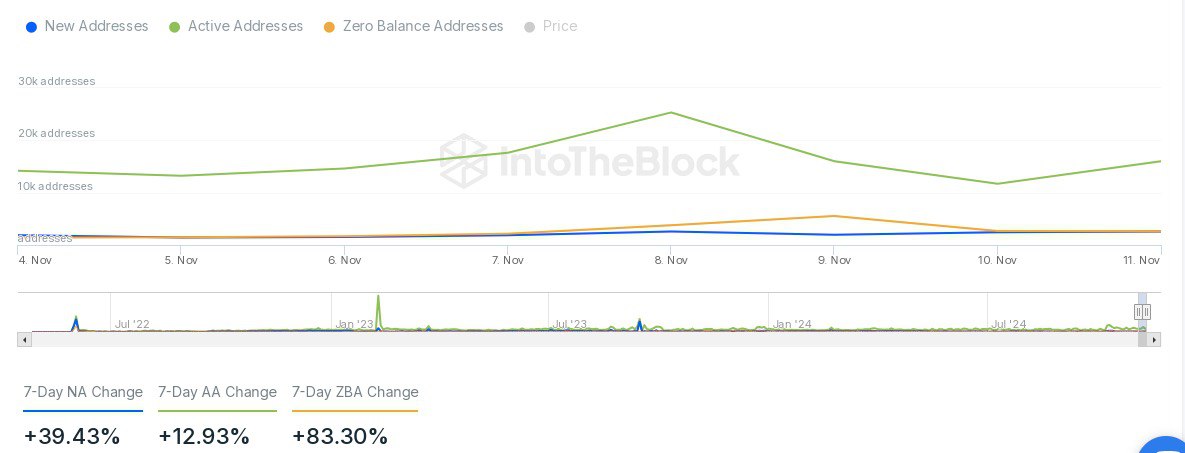

On-chain metrics indicated growing interest in Optimism. A recent spike in new addresses showed a 39.43% increase in the past week, while active addresses rose by 12.93%.

Additionally, zero-balance addresses increased by 83.30%, suggesting that previously inactive wallets are re-engaging with the network. These metrics point to higher user participation and adoption.

Source: IntoTheBlock

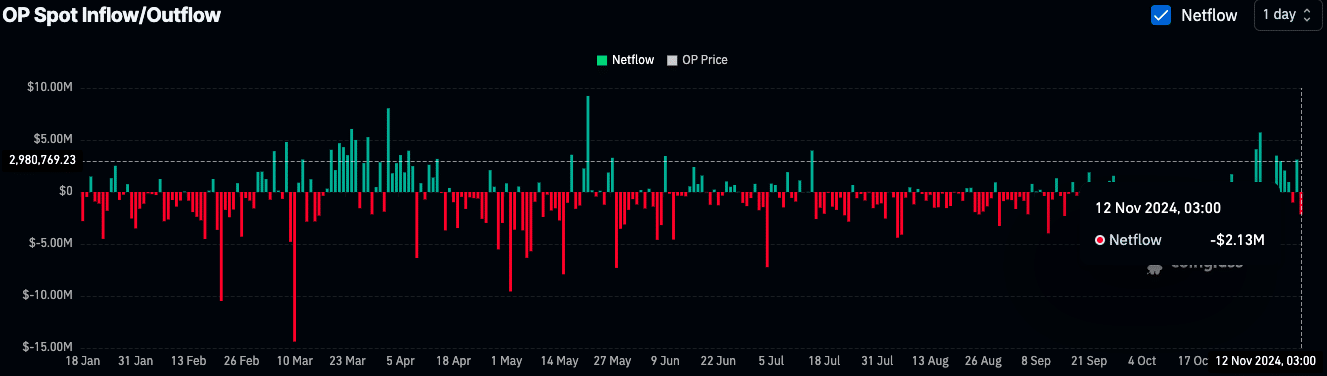

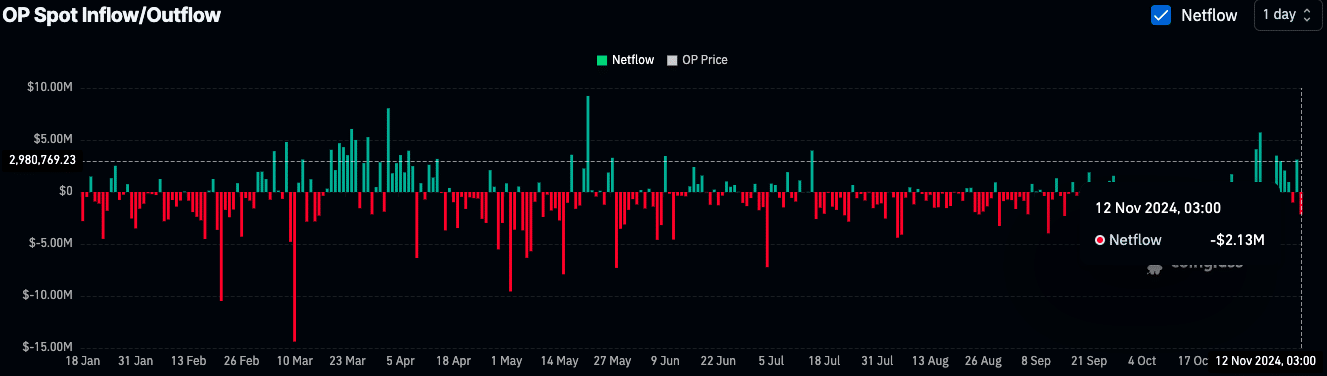

Exchange netflows also painted a bullish picture, according to Coinglass data.

On the 12th of November, OP recorded a net outflow of $2.13 million, indicating that investors are moving tokens off exchanges, potentially for long-term holding.

Historically, such outflows have coincided with price increases, hinting at reduced selling pressure.

Source: Coinglass

Sustained trading activity supports growth

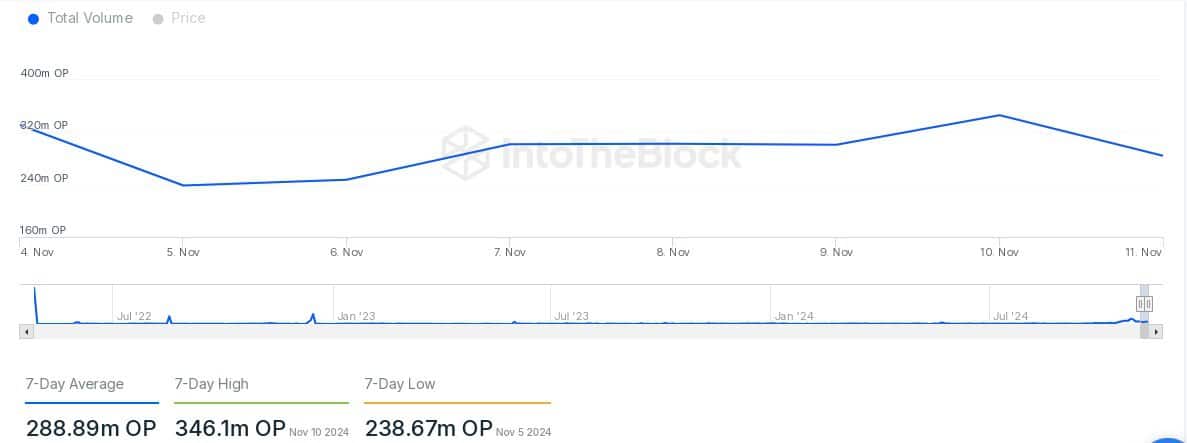

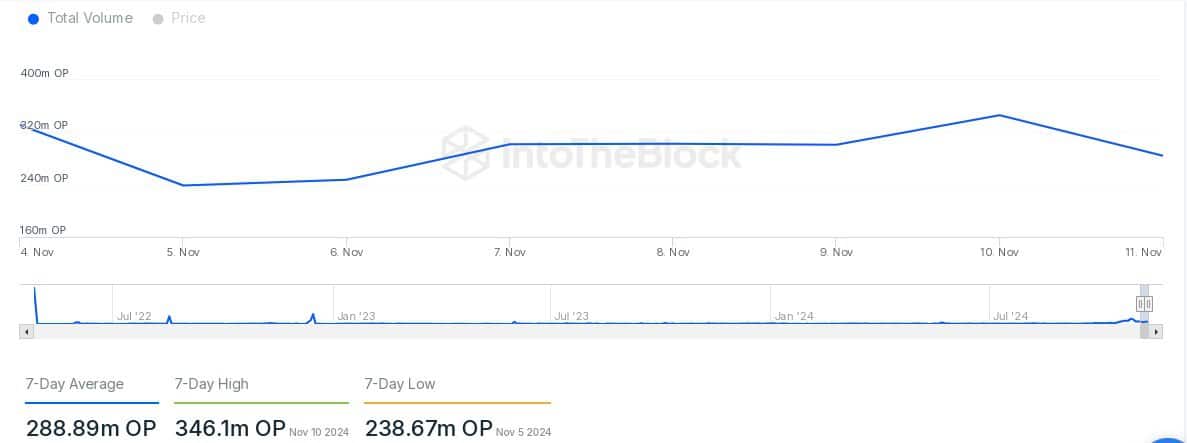

Transaction volume data further supported the bullish outlook. Optimism’s 7-day average transaction volume was 288.89 million OP, with a peak of 346.1 million on the 10th of November.

Read Optimism’s [OP] Price Prediction 2024–2025

The lowest recorded volume was 238.67 million OP on the 5th of November.

Source: IntoTheBlock

This steady trading activity reflected consistent liquidity and network utility, which could provide the foundation for future price growth.