- PEPE surpassed UNI to become the 23rd largest cryptocurrency by market capitalization after a significant rally.

- PEPE saw a new all-time high, with rising Open Interest suggesting potential for continued momentum.

Pepe [PEPE], a rapidly rising memecoin in the cryptocurrency market, has achieved a significant milestone by overtaking Uniswap [UNI] in market capitalization.

According to data from CoinGecko, PEPE now ranks as the 23rd largest cryptocurrency by market cap, pushing UNI down to 25th place.

This shift reflects the increasing momentum of memecoins within the broader crypto ecosystem.

The development also comes amid PEPE’s sustained upward trend, with its market cap and price experiencing notable growth.

Over the past month, PEPE’s value has surged by over 100%, and during the opening of the trading session on the 8th of December, the memecoin reached a new all-time high of $0.00002716.

However, it has since retraced slightly, trading at $0.00002602, reflecting a 4.3% decline from its peak.

Despite the dip, the token’s performance has overshadowed that of UNI, which, while still on an uptrend with a 98% gain in the past month, has suffered a 3.2% decline in the past day, bringing its trading price to $17.69.

UNI remained 60.6% below its all-time high of $44.92 recorded in May 2021.

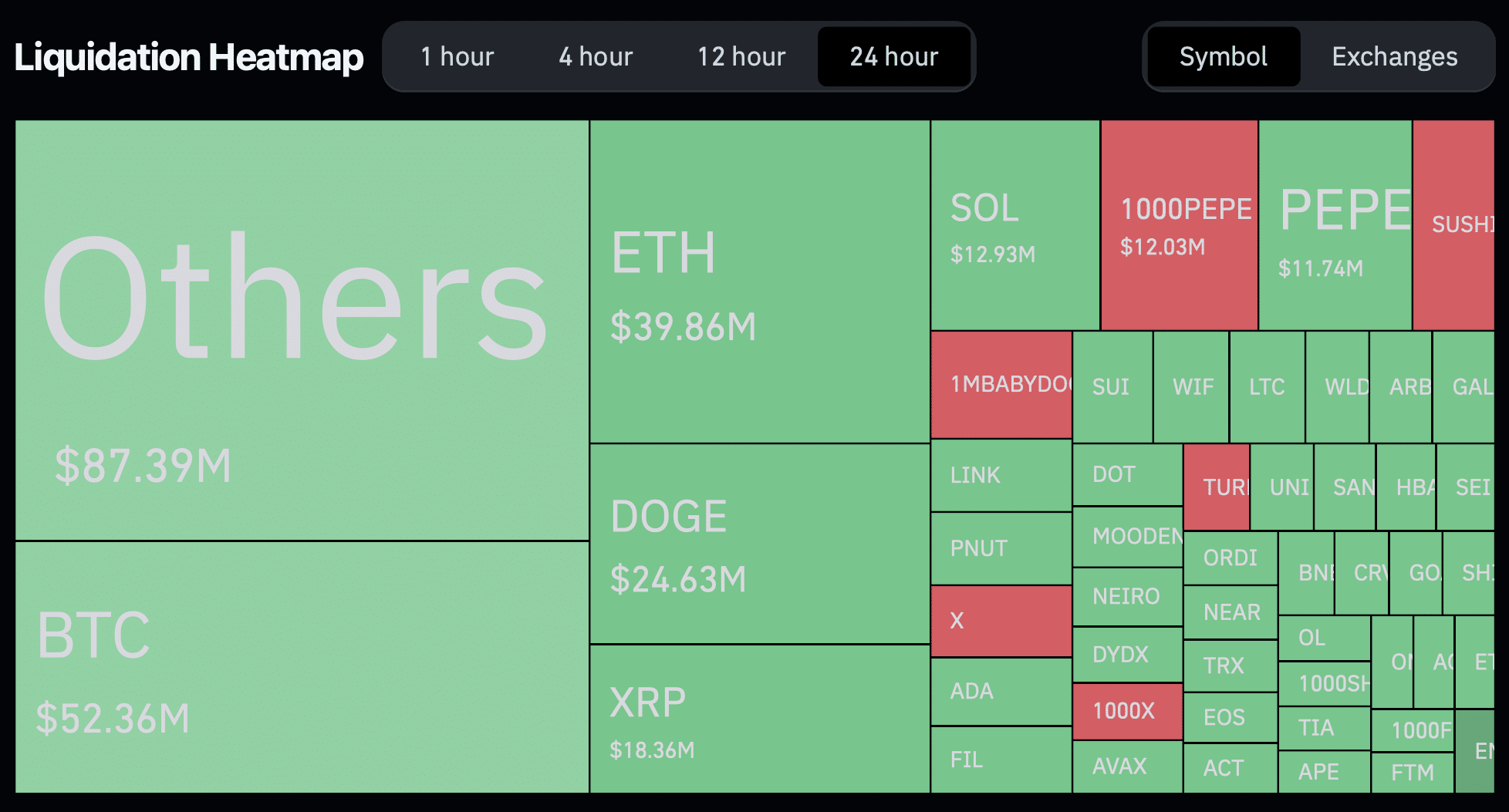

Liquidations highlight market volatility

While PEPE’s price surge has been a boon for some investors, not everyone has benefitted. AMBCrypto’s look at Coinglass data revealed that the past 24 hours saw liquidations totaling $359.99 million across the crypto market.

Source: Coinglass

Of this, PEPE accounted for $11.74 million, with long positions bearing the brunt of the losses. Specifically, $8.19 million in long positions were liquidated, alongside $3.54 million in short positions.

This highlights the significant risk associated with leveraged trading, even amid bullish trends.

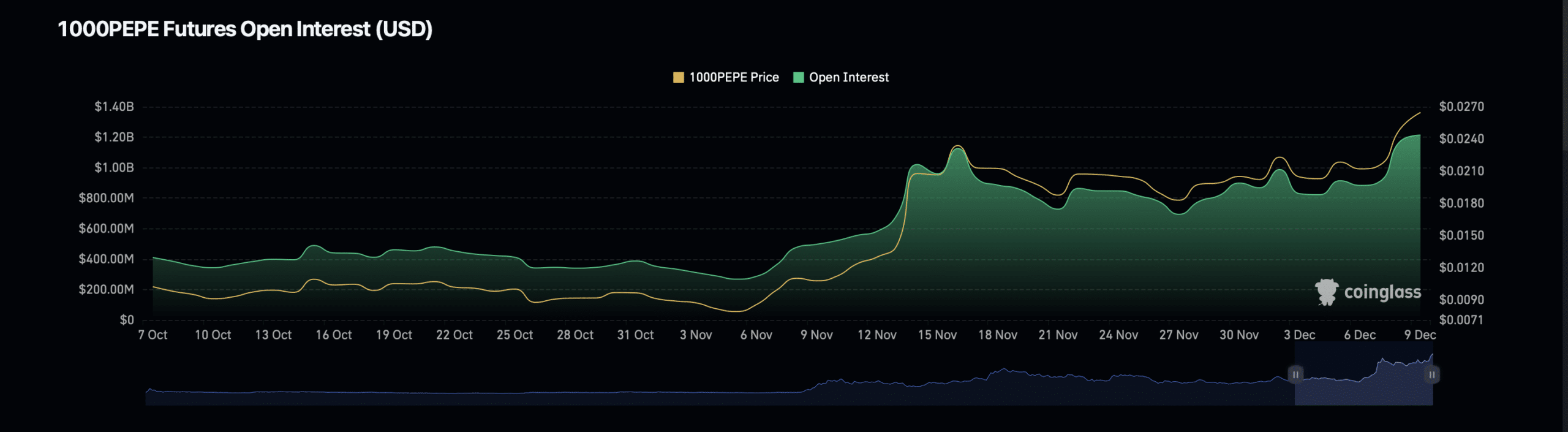

Fundamental metrics suggest that PEPE’s rally may have further momentum. Open Interest, which measures the total number of outstanding derivative contracts, has increased by 4.22% to $1.19 billion.

Source: Coinglass

Additionally, PEPE’s Open Interest volume has surged by 9.34%, reaching $6.16 billion.

Realistic or not, here’s UNI’s market cap in PEPE’s terms

Rising Open Interest often indicates heightened trading activity and investor interest, suggesting continued confidence in the token’s potential for growth.

However, such increases can also signal potential volatility, as heightened speculative activity may lead to sharp price swings.