- Data showed a recent SHIB burn of 7.8 million tokens.

- The memecoin was at a crucial support level of $0.0000130 at press time.

Shiba Inu [SHIB] has been in a downtrend, with a notable pivot at $0.000020 in mid-July, trading at $0.0001329 at press time.

The current daily chart resembles pre-March action, which previously pushed SHIB to a resistance of $0.0000380.

With the recent data from Shibburn showing the burn of 7.8M SHIBs, SHIB might rally toward the $0.000020 range before testing $0.00030 level.

If the mentioned trend holds…

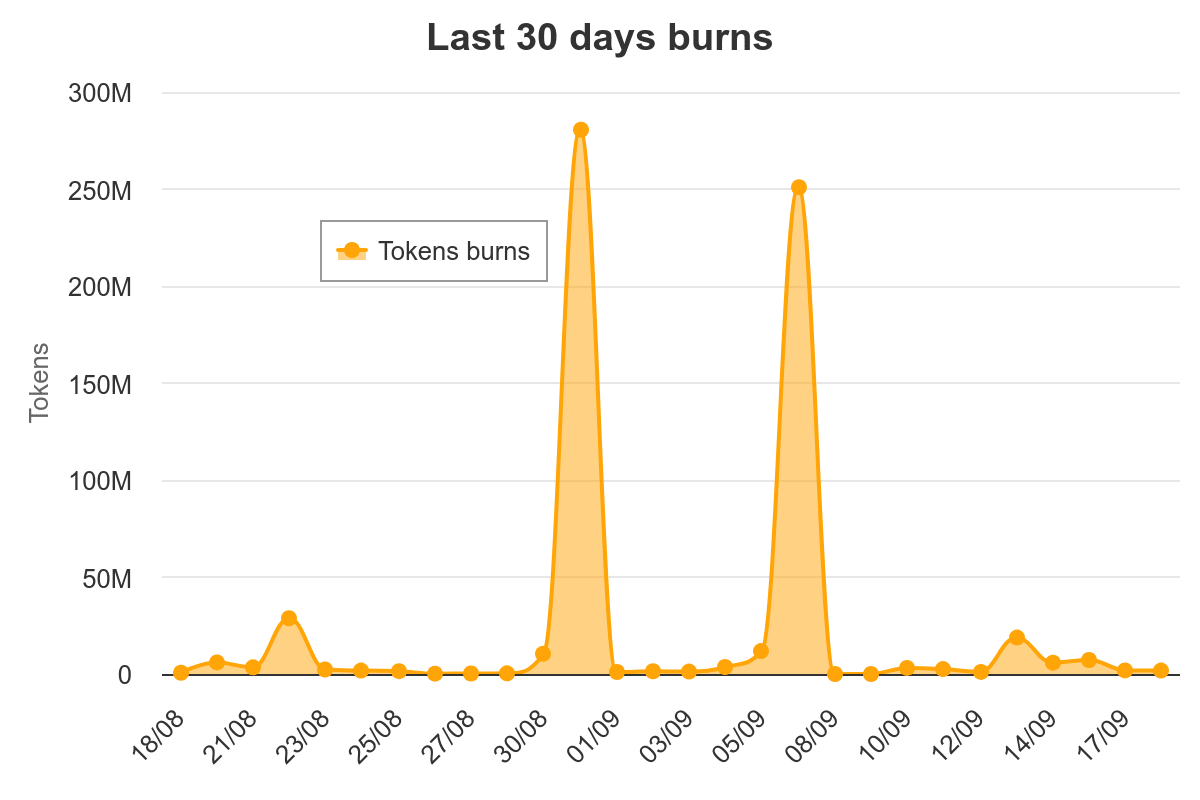

For context, SHIB burns are a strategy to manipulate value by making tokens scarce. Since launch, 41% of the total SHIB supply has been burned from the original 999 billion.

In a recent move, up to 280 million SHIB tokens were burned just before September, likely as a preemptive measure ahead of expected volatility.

Source: Shiba Burn Tracker

However, despite the burn efforts, SHIB couldn’t shield itself from Bitcoin’s [BTC] downturn; it started September on a bearish note.

This time, though, the timing aligns well with overall market optimism. If the trend holds, it could propel the memecoin towards its previous market highs – What are the odds?

A decisive moment for SHIB

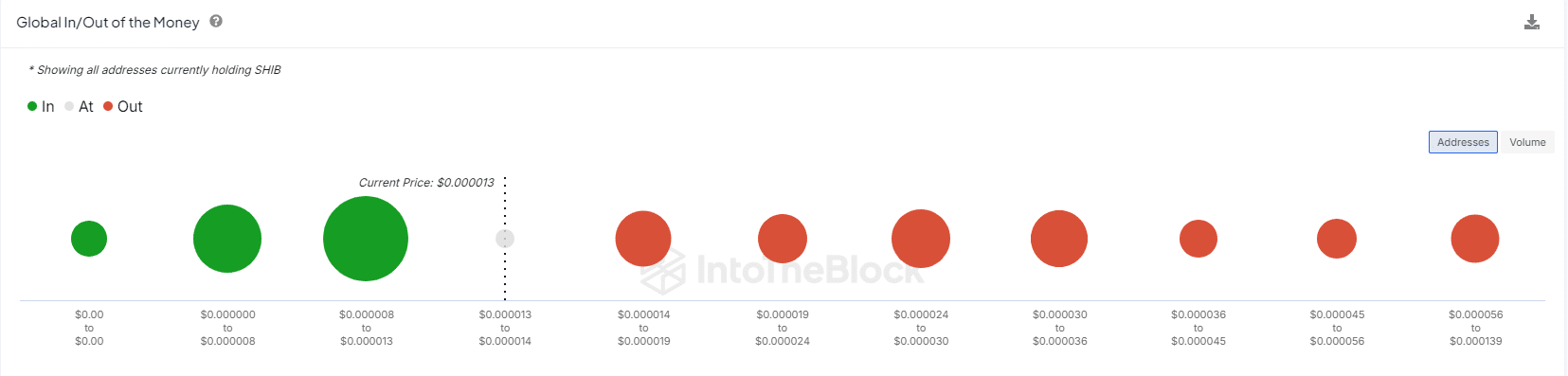

According to AMBCrypto, optimism may fade if SHIB bulls fail to maintain the $0.0000130 support.

A recent market surge led to a nearly 1% rise in SHIB’s value. Interestingly, developers capitalized on this by burning 7.8 million SHIB, increasing the burn rate by 3,348%.

However, this strategy may prove ineffective if the bears drive SHIB below $0.0000130, putting around 350,000 addresses in a loss position.

Source: IntoTheBlock

Conversely, if the strategy succeeds and SHIB nears $0.000014, about 127,000 addresses would become profitable—favorable for bulls.

In short, SHIB is at a critical juncture. While the burn timing was strategic, the outcome hinges on how effectively the bulls capitalize on their positions.

Impact of SHIB burn on HODLers

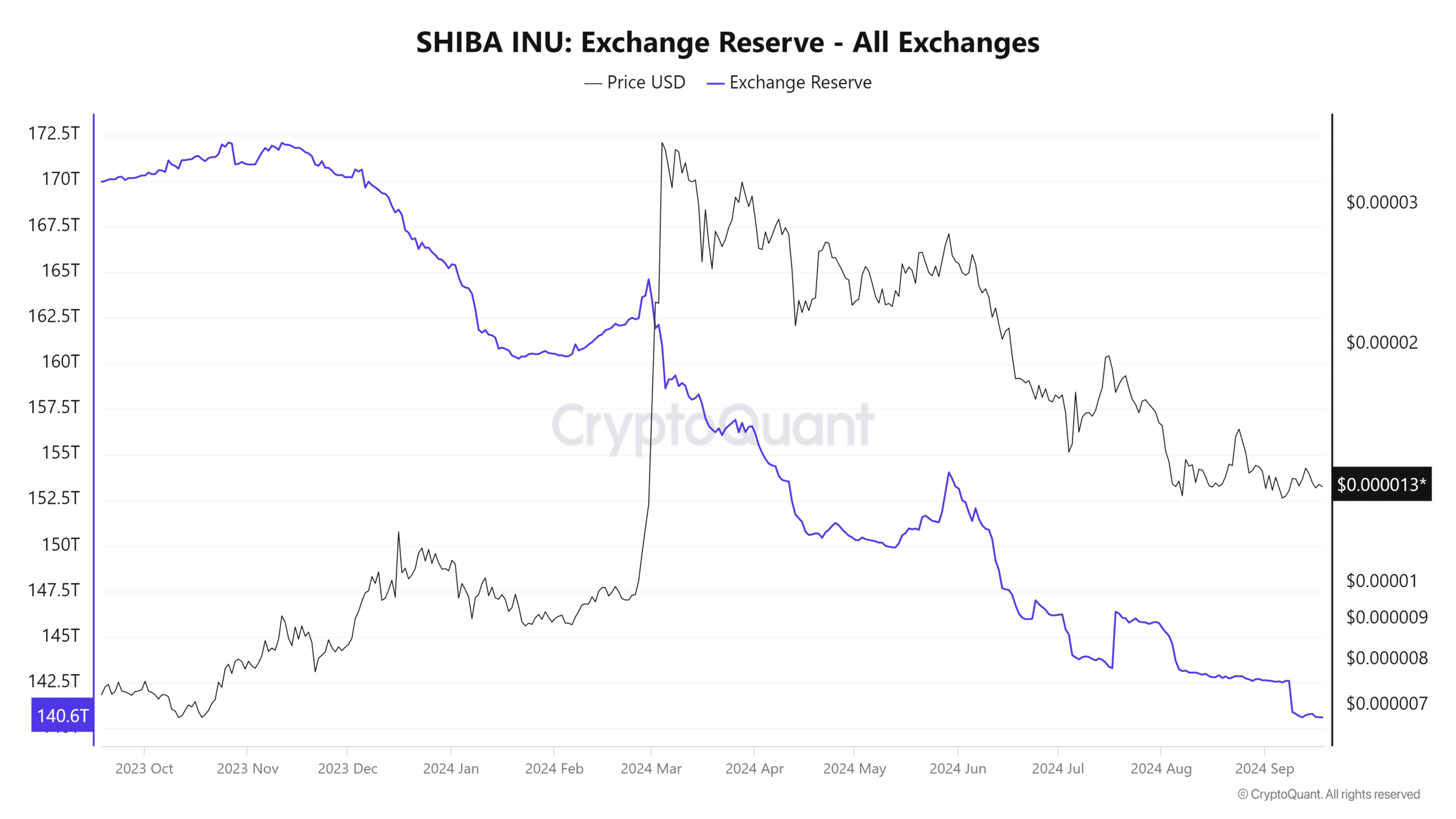

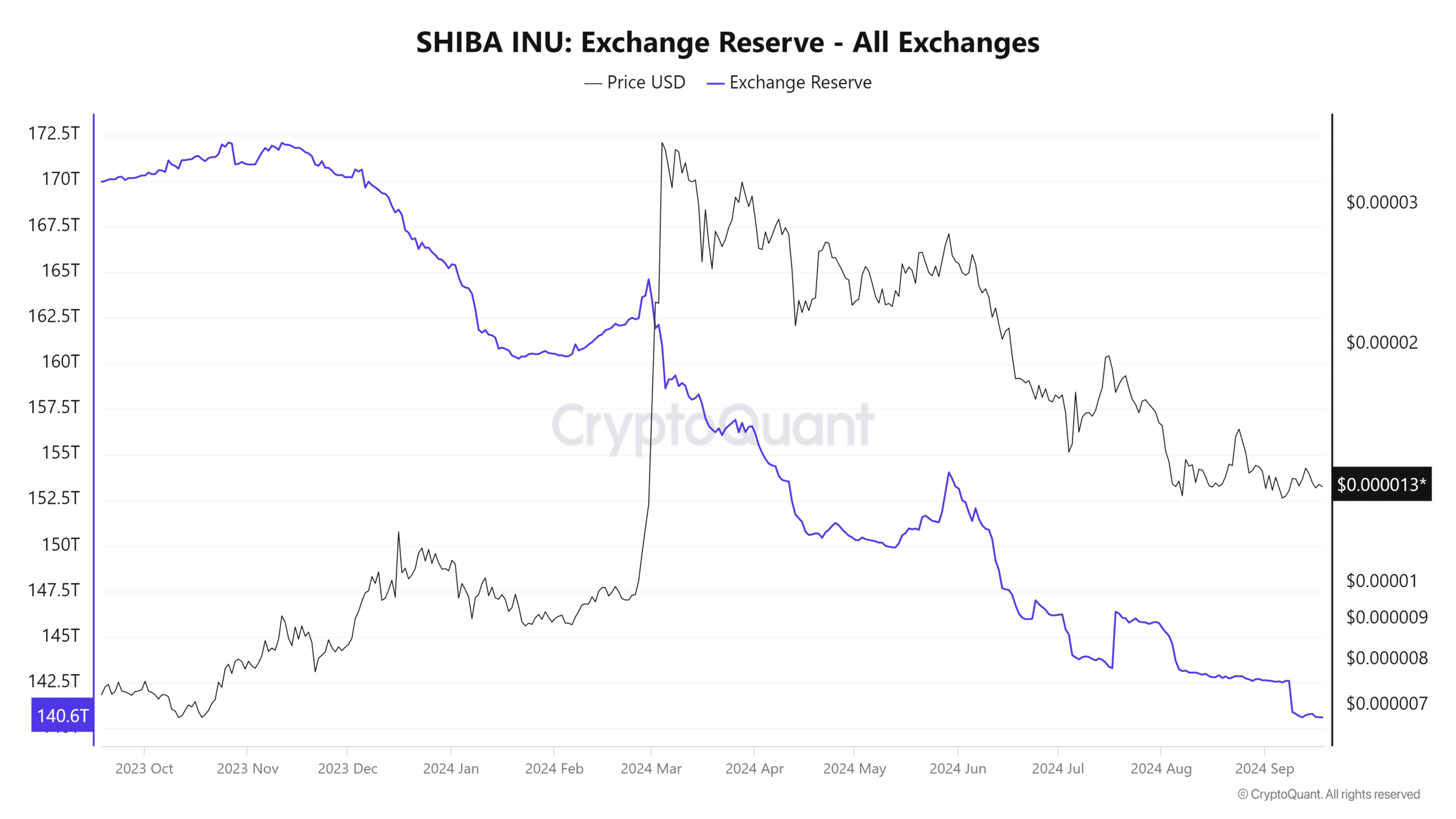

On the one-year lookback chart, the exchange reserves of SHIB have been plummeting significantly, indicating confidence in price recovery among HODLers.

Source : CryptoQuant

In fact, the total coins held on exchanges are at their lowest in the year, marking a staggering 17.8% decline from 171T to 140.6T at press time.

Is your portfolio green? Check out the SHIB Profit Calculator

In summary, strong stakeholder support highlights confidence in SHIB’s long-term prospects. Bulls are positioning for a recovery, but this depends on holding crucial support levels against bearish pressure.

If bears intervene, reaching the $0.000020 resistance might be challenging. While the burn strategy has captured stakeholder attention, maintaining the $0.0000130 support is crucial for a potential market top.